London, 02 August, 2023, (Oilandgaspress) : Fitch on Tuesday downgraded the U.S. government’s credit rating over concerns about “growing debt burden” and “an erosion of governance.” Fitch, lowered the U.S. credit rating from the top-notch AAA to AA+.

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance” relative to peers, Fitch said in a statement.

“In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025,” the ratings agency said.

US Treasury Secretary, Janet Yellen said she “strongly” disagreed with the downgrade, calling it “arbitrary and based on outdated data.”

C-Kore Systems has successfully completed a decommissioning campaign offshore Australia, using C-Kore Sensor Monitor units to interrogate the wellhead pressure and temperature sensors on the subsea oilfield. With their automated test routine, the C-Kore Sensor Monitor units quickly and repeatedly tested and data-logged the information allowing the Operator to complete their offshore campaign swiftly and safely.

C-Kore Systems has a range of subsea testing tools used globally by operators and contractors on decommissioning, fault-finding, and new installation campaigns. The tools are easy to deploy and are operated without the need for C-Kore personnel being present, providing rapid and accurate feedback. This combination of simplicity, accuracy and reliability introduces significant operational savings to testing campaigns.

The Subsea Engineer on the campaign commented, “It was straightforward to plug directly into the trees to read sensors with the C-Kore units and negated the requirement to operate valves. C-Kore’s Sensor Monitor gave us the ability to quickly and safely measure the pressure at a location that would not have been easily possible with other methods”. Read More

What is carbon capture? How the UK government plans to slash the amount of CO2 being released into the atmosphere by catching it and storing it under the North Sea. Carbon capture and storage (CCS) is a relatively new technology that could greatly reduce carbon emissions and in turn combat global warming.

The technology is designed to capture carbon dioxide (CO2) emissions and store them permanently underground, as a greener alternative to releasing them into the atmosphere.

According to the government, a CSS plant could potentially store a total of 78 billion tonnes of carbon – the same weight as 15 billion elephants. Different options to try to reduce overall CO2 emissions are being investigated, but CCS is the main way to reduce CO2 emissions from large industrial sources. Read More

According to the Hydrogen Fuel Cell Partnership’s data, during the second quarter of 2023, 1,076 new hydrogen fuel cell cars were sold in the US, which is 34 percent more than a year ago.It’s the third time in history that sales exceeded 1,000 units in a quarter and the highest result ever (the previous best was: 1,034 in Q1 2021 and 1,033 in Q1 2022). That’s not a groundbreaking change, but an interesting outcome.

Not only that. The record result was achieved with basically only one model – the Toyota Mirai, https://www.toyota.co.uk/new-cars/mirai?- according to Toyota (a different data source) – noted 1,054 sales in Q2 (a new record and the first four-digit result). For reference, Hyundai reports only 40 Nexo sales. Read More

Honda announced that Honda eVTOL was named a 2023 Red Dot winner in the Design Concept discipline of the Red Dot Design Award,*1 one of the world’s most respected design awards. Moreover, two promotional videos Honda created for its motorcycle products, namely ADV160 and CBR250RR, were named Red Dot winners in the Brand & Communication Design discipline of the award. The Honda eVTOL is an electric vertical take-off and landing aircraft that Honda is developing by leveraging a variety of core Honda technologies, including electrification, combustion, aerodynamics and control technologies. Striving to realize long-range, user-friendly inter-city (city-to-city) transportation, Honda is developing an eVTOL which will be powered by a gas turbine hybrid power unit. Honda is envisioning the creation of new value through the establishment of a new “mobility ecosystem” featuring Honda eVTOL at its core, combining with mobility products on the ground. Read More

Diesel performance parts manufacturer Sinister Mfg. Company, Inc. – doing business as “Sinister Diesel” – pleaded guilty to criminal charges today in federal court in Sacramento, California, and agreed to pay a total of $1 million in criminal fines and civil penalties. The company also agreed to implement a compliance program and to not manufacture, sell or install any device that defeats a vehicle’s emissions controls.

Sinister Diesel pleaded guilty to a two-count Information, charging it with conspiracy to violate the Clean Air Act (CAA) and defraud the United States, and with violating the CAA by tampering with the monitoring device of an emissions control system of a diesel truck. Under the plea agreement, the defendant agrees to pay a $500,000 criminal fine.

Sinister must pay an additional $500,000 under the civil consent decree which the United States filed simultaneously with its civil complaint against Sinister, alleging violations of the CAA’s prohibition against the sale or manufacture of devices that bypass, defeat or render inoperative emissions controls. The civil consent decree prohibits the company from making, selling or offering to sell defeat products, including delete tuners, and prevents Sinister Diesel from transferring intellectual property that would allow others to make such products. To ensure compliance with these requirements, Sinister Diesel will implement a robust internal training program and notify its distributors and former customers about the settlement. Read More

U.S. Environmental Protection Agency (EPA) announced it has issued an order responding to two petitions objecting to the renewal of the Colorado Department of Public Health and Environment’s (CDPHE) Clean Air Act Title V operating permit for Plant 2 at the Suncor refinery in Commerce City, Colorado.

One petition was filed by Earthjustice on behalf of the Elyria and Swansea Neighborhood Association, Cultivando, Colorado Latino Forum, GreenLatinos, Center for Biological Diversity and Sierra Club. The second petition was filed by 350 Colorado. EPA’s action denies 350 Colorado’s petition and partially grants and partially denies Earthjustice’s petition, requiring CDPHE to resolve EPA’s objections before issuing a revised permit. The action does not invalidate Suncor’s permit or prevent Plant 2 from continuing to operate while CDPHE addresses the order. “Improving air quality for the underserved communities affected by harmful air emissions from the Suncor refinery is a shared priority for EPA and CDPHE,” said EPA Regional Administrator KC Becker. “EPA will continue to work with Colorado to secure the refinery’s compliance with laws and regulations and protect the health of nearby residents.” In its order, EPA provides specific direction to CDPHE regarding certain aspects of the permit. For example, the order directs CDPHE to evaluate whether additional operational requirements are needed to assure compliance with carbon monoxide and opacity limits at the plant’s fluid catalytic cracking unit. It also directs CDPHE to determine whether previous plant modifications were analyzed properly and, if necessary, to incorporate additional applicable requirements into the permit. As the permitting authority for Suncor, CDPHE has the responsibility to revise the permit and permit record as may be necessary to resolve the issues identified in EPA’s objection.

EPA detailed its own objections to the proposed Suncor Title V renewal permit submitted by CDPHE in March 2022. EPA also provided CDPHE with comments and recommendations related to environmental justice concerns involving the permit, the community surrounding the Suncor facility and the state’s air permitting program. These recommendations included improvements to public participation, permit records and demonstrations of attainment with air quality standards. Read More

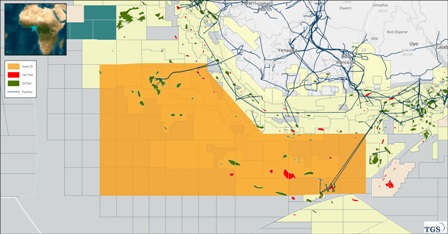

TGS-Petrodata, having secured a Petroleum Exploration License (PEL) with support from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), announced the commencement of the Awele South 3D multi-client survey offshore Nigeria.

This project was previously announced at the TGS Capital Markets Day on 7 March 2023.

Will Ashby, Executive Vice President for the Eastern Hemisphere at TGS, commented, “TGS-Petrodata has an extensive multi-client data library in Nigeria, including reprocessed 2D seismic and our regional multibeam and seafloor sampling study. We are delighted to expand our footprint with the Awele South 3D survey. Since this project was announced in March 2023, the TGS-Petrodata team has worked diligently alongside the NUPRC, NCDMB, COSL and other stakeholders to ensure successful commencement of the survey. As one of Africa’s largest and oldest hydrocarbon producers, unlocking this prospectivity and de-risking drilling operations will further bolster Nigeria’s energy production capacity. Having insight into the petroleum system of the Niger Delta basin will enhance our understanding of the country’s potential energy resources.” Read More

TGS, CGG and PGS, industry leaders of multi-client geoscience data, today announced the launch of new tiered offerings for Versal, the groundbreaking multi-client data ecosystem. This update gives the entire industry free access to Versal, representing the world’s most comprehensive multi-client data coverage – all in one centralized location. Industry professionals can also benefit from a more personalized solution with a focus on enhanced accessibility, flexibility and value.

The latest updates to the Versal platform are designed to offer even more convenience and scalability for exploration & production, data management and procurement team members through the introduction of Versal Pro and Premium tiers. Versal users now gain unlimited access to the essential data from TGS, CGG and PGS, representing the majority of the world’s marine multi-client data available within a single platform. This consolidation eliminates the need to visit multiple vendor websites, streamlining workflows and saving valuable time.

The new tiered access model offered by Versal brings unprecedented flexibility to clients. With the free Versal version, users can view data coverage, download coverage shapefiles and import their map layers and shapefiles. By upgrading to Versal Pro, clients unlock additional benefits, including viewing entitlements, accessing vendor contracts, and downloading acquisition and processing documents. By selecting Versal Premium, clients gain access to enhanced data management capabilities such as seismic visualization and downloading entitled traces. Read More

On 1 August, BP p.l.c. (A2 positive) became the last major European integrated oil and gas company to report results for the first half of 2023. Adjusted EBITDA fell 24% to $22.8 billion compared with the first half of 2022 as oil and gas market prices fell back to an average $79.7 per barrel of Brent crude and $13.3 per million British thermal units, respectively, from $102.9 and $29.1 in H1 2022, and refining margins normalised following Russia’s invasion of Ukraine. BP’s results correspond to the performance of other European integrated oil and gas companies for the period, such as TotalEnergies SE (A1 stable) and Eni S.p.A. (Baa1 negative), which experienced declines of around 20%-30% compared with the same period last year. Shell Plc’s (Aa2 stable) EBITDA for the same period fell at a somewhat lower rate of 15%. Despite meaningfully lower earnings, however, sector credit quality remains strong, reflecting improved credit ratios and net debt levels over the past five years. Sound operating performance, combined with conservative balance sheets, is allowing companies to continue to buy back shares and raise dividends without dampening credit quality. (Moody’s Investors Service, Inc.) Read More

During the period from July 24 to July 28, 2023, Eni acquired on the Euronext Milan no. 3,450,513 shares, at a weighted average price per share equal to 13.6903 euro, for a total consideration of 47,238,406.41 euro within the authorization to purchase treasury shares approved by the Shareholders’ Meeting on 10 May 2023, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, here below a synthesis of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $80.91 | Down |

| Crude Oil (Brent) | USD/bbl | $84.53 | Down |

| Bonny Light | USD/bbl | $86.73 | Down |

| Saharan Blend | USD/bbl | $85.16 | Down |

| Natural Gas | USD/MMBtu | $2.50 | Down |

| OPEC basket 01/08/23 | USD/bbl | $86.60 | Up |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication [email protected]

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,