Below, we consider just how far America has fallen from its founding vision (and something we can do about it).

Union Matters—Poor Ol’ Jefferson

When sitting down to “channel the people’s will” through his own pen, the author of the American Declaration of Independence, Virginian Thomas Jefferson, had one key principle and theme in mind, namely: Union.

According to University of Virginia scholars, Garry Gallagher and John Nau, this concept of Union was premised upon the ideals (and “experiment”) of: 1) equality (despite, of course, can-kicking the slavery issue…); 2) compromise and 3) a fundamental disdain for any form of coercion (or “capture”) by a centralized body (or bodies) within an otherwise fragile republic based upon a federalist structure.

Here, of course, is not the place to unpack or debate the myriad concepts of a republic, federalism, or even constitutional democracy.

However, one issue of economic relevance worth raising today is the core and defining fear shared by America’s founding fathers, namely the fear that critical notions of equality and our three branches of government could one day be captured/coerced by bad actors and hence destroy the experiment of striving/evolving toward equality and union, however imperfect its growing pains.

Captured by a Private Bank

Which brings us to our central bank, whose power over the price (interest rate controls) and supply (balance sheet size) of the world reserve currency, has effectively and constructively become a fourth branch of government.

This centralizing central bank has not only been the direct and empirical cause of historical wealth inequality in America, but has now fully “captured” (i.e., taken centralized control of) the American economy in general and the price control of global bond and currency markets in particular.

The entire world, most of which is directly or indirectly pegged to the price and supply of the USD, literally sits on the edge of its seat to see what the FOMC will (or will not do) with the price and supply of a now weaponized and entirely “captured” USD.

In other words, Jefferson, whose admirable memorial stands just a few blocks from the Treasury Department and an easy walk from the impressive Eccles Building, would be shaking his head in despair if he were alive today.

Or stated more simply, America has sunken, irrevocably it seems, from its original and enlightened ideals of equality.

After all, when a post-08 central bank creates a zero-rate-driven and QE 1-4+ equity bubble, 90% of whose riches were enjoyed by only the top 10% of its population, we see just how “unequal” such coercive institutions can be…

Needless to say, no one in DC, and certainly not Powell, will confess that such centralization of power (and “free” markets) by unelected private bankers is a mark of feudalism rather than capitalism, and a carefully veiled symbol of authoritarianism hiding in “Federal” clothing.

[The Federal Reserve, I’ll remind again, is neither federal nor a reserve, nor even constitutional, despite its address on Constitution Ave…]

No Profiles in Courage

Nor are our lobbied politicians, who collectively know less about history, economics or basic math than just about any college freshman, asking themselves “what they can do for their country” …

Instead, they have been doing a heck of a lot of thinking about how to brand themselves for re-election and maintaining their power.

Toward this end, these “profiles in zero courage” (although Santos will likely claim he also has a PhD in applied math from MIT) have been making promises their budgets can’t pay for.

Thereafter, they blindly fill this deficit “gap” with trillions of annual IOUs (i.e., USTs) per year which are then paid for with inflationary money clicked out of thin air by the IT wizards at the Fed.

Farce After Farce After Farce

Of course, it is such magical money, and not COVID, Putin, global warming or little green men from Mars, which explains our farcically under-reported (i.e., openly dishonest) inflation rate, which if measured by the same CPI scale Volcker used, would place US inflation at well above 11% today, and not the open lie of headline 3.7%.

Such actual rather than “official” inflation means that every single IOU issued by Uncle Sam is a negative-yielding bond, and hence by definition, puts them technically and already in default.

Others Are Catching On

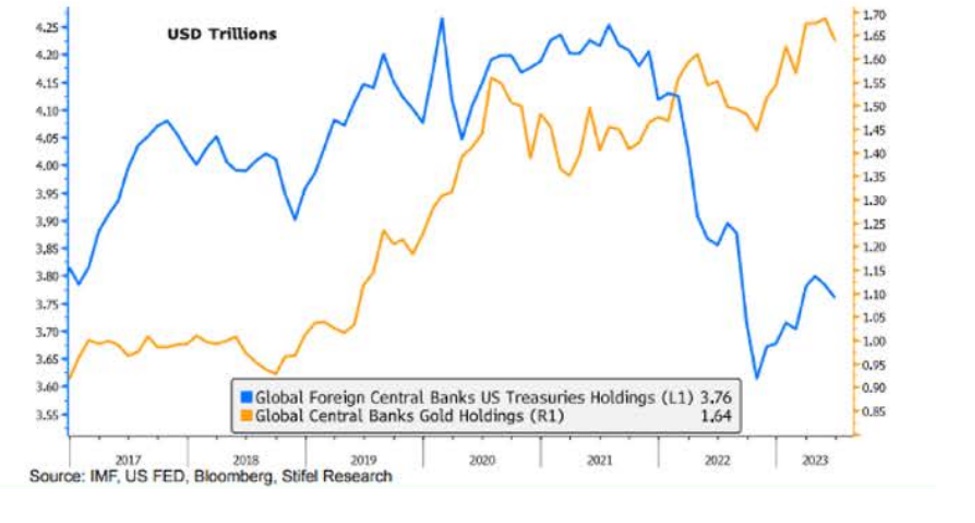

The rest of the world, including the growing BRICS+ nations, knows this, which explains why central banks have been net-sellers of USTs since 2014 and why de-dollarization is not just a concept but a steady reality today.

In short, demand for, as well as trust in, the great “risk free return” of the most important sovereign bond in the world (which is now mathematically “return free risk”) has been tanking while central bank gold-purchasing has been breaking records.

But as the graph immediately below confirms, this lack of love for US Treasuries has not stopped Uncle Sam from issuing trillions and trillions worth of more such IOUs, creating a perfect disaster (i.e., mismatch) of over-supply and under-demand.

This mismatch, as even a high-school econ student knows (but our politicians do not), creates massive downward pressure on the price of those bonds.

And given the fact that bond prices move inversely to bond yields, those yields are now screaming north, which means interest rates, and the cost of debt (for individuals, corporations and even Uncle Sam), are now at record-breaking, bank-breaking and economy-breaking levels.

Meanwhile, the pundits and politico’s will still have you/us debating about hard-landings or soft-landings, despite the open evidence that our economic plane has already crashed…

Just Follow the Debt

Thus, and with simple candor, it’s high time we stop arguing over desert choices on the Titanic’s A-lounge menu and start considering the implications of the debt iceberg off our bow.

Our mental midgets in DC, for example, have placed American public debt at a 120% ratio to its GDP, which mathematically makes growth impossible rather debatable, as such debt ratios are the equivalent of swimming with a cannon ball chained to each foot.

Ultimately, however, the bond market in the USA, which is the key to our nationalized equity markets (which live or die based on bond yields and debt pricing) need to be understood plain and simply.

And I just can’t say this enough: Everything hinges on bonds in general and yields in particular.

When rates/yields are low, things work; when they are high, things break.

This is because cheap debt has been the core of America’s debt-based “growth” model for years, and this alone explains the survival of our respirator-economy and its otherwise bankrupt pension system.

When Too Big to Fail = A Desperate Rescue

Given this plain fact, the US sovereign bond market is indeed, and literally, “too big to fail.”

But given that tax receipts, GDP and foreign interest in Uncle Sam’s IOUs are not nearly enough to “accommodate” this sovereign debt market/bubble, the money needed to “save” it will have to come from somewhere.

And that “somewhere,” in my view, is going to be a money printer, which in turn means an eventual expansion of the money supply and thus an eventual end-game of currency destruction.

Such currency destruction means greater rather than less inflation ahead, with a likely dis-inflationary market crash in the interim.

Again, the rest of the world knows this, which explains why central banks are dumping USTs and stacking physical gold at record levels.

Alternative Views?

The milk-shake theory, however, makes credible counter-arguments to my current view of the US bond and currency forces.

It holds that when and as the world sinks deeper into recession, even that wart-covered USD and unloved UST will become the ironic and superior safe-havens of last resort.

After all, the USD is not about to be replaced by the Rubel, CNY, peso, yen, franc or euro any time soon, or frankly, perhaps any time ever…

I actually agree.

Furthermore, given that “great straw sucking sound” from global derivative and euro-dollar markets which survive off collateralized USTs, the embedded and systemic demand for the USD may very well maintain its relative supremacy for a long while, right?

Nor should we forget the embedded demand for the USD in the form of that oh-so important petro-dollar, which Kissinger made his swan song in the 1970’s.

In sum, there are many sound reasons why one could argue that the USD, in cohorts with the UST, is, and always will be, the best horse in the global glue factory.

But What About History, Math & Tomorrow?

But… and as I’ve argued and written elsewhere, such hubris and faith in the relative superiority of the USD assumes that history doesn’t matter, that math is optional and that tomorrow always looks like yesterday.

The petro-dollar, for example, is no longer a sure thing, as I and others have argued at length elsewhere.

And the belief that the world will just “flow” into USTs when the next storm hits is a belief which ignores the dumping rather than buying of USTs in the most recent market disaster of 2020.

In short, maybe that “flow” has already come and gone?

Other Bad Scenarios

Equally worth considering, of course, is the possibility that DC can save its bond market by just cutting entitlement and military spending by say, 70%, but I wouldn’t hold my breath for that…

Or perhaps America can just look forward to a massive crash in the stock market on the tailwind of rising rates to “scare” bloodied investors back into the UST market and thereby “save” Uncle Sam’s IOUs by killing its stock market (as well as capital gain tax income?).

Hmmm.

Or Just Kill the Currency

More likely, and more politically expedient yet more disastrous to the people, will be the destruction of the currency to save the credit markets, a monetary cancer which now defines our debt-soaked “democracy.”

I’ll say this again and again and again: History confirms that every debt-soaked nation kills its currency to save its @$$ by inflating away their debt with debased money.

Thereafter, those same “wizards” then resort to controlling their inflation-exhausted (i.e., angry) citizenry with more centralized controls.

Jefferson & Gold?

In short, and returning to our sad, old friend Jefferson, America is already “captured” by a financial system and an unelected fourth branch of government which has coerced its nation into a corner with no exit.

At least no exit other than a currency trap whose Dollar’s inherent purchasing power, when measured against that barbarous relic, gold, has lost greater than 95% of its relative strength since Nixon welched on America’s golden chaperone back in 71.

Gold, of course, can not prevent the usurpation (i.e., nefarious “capture”) of power which Jefferson so feared would one day destroy the American “union.”

Sadly, and as wise individuals have known and warned for centuries, debt destroys nations. Not just sometimes, but every time.

Nor can gold act as a Talisman against branded rather than visionary politicos, left or right, American or global, from the dark shadows of Davos to the open comedy of DC.

This is why history-wise, math-competent and financially informed investors, burdened by critical-thinking rather than the partisan or “koo-koo,” have always (and will always) protect their own sanity, their own wealth and even their own private “union” of family (which Jefferson defined as the foundation of freedom) with a healthy allocation of that barbarous relic, that so-called “pet rock.”

In other words, just because political opportunists may have taken away the gold standard to buy votes while slowly destroying nations (and national unity) in all too familiar patterns of debt and centralization, this does not prevent us gold “stackers” from being far smarter than our so-called “leaders.”

It’s time, in sum, that we back our own currencies with gold rather than wait for others to do it for us.

Courtesy of Gold Switzerland

**********