Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Last Updated on: 24th February 2025, 01:49 am

For years, major organizations like the IEA, IRENA, BNEF, the Hydrogen Council and CSIRO have been projecting future costs for hydrogen electrolysis systems and the future cost of green hydrogen that don’t stand up to scrutiny. As a result, their projections of future costs increase every year, yet real-world data from projects shows that they are still far under realistic costs for today, 2030, and 2050.

The following charts and data are modified and repeated from great work done by Visa Siekkinen, an energy transition researcher now with Häme University of Applied Sciences in Finland and Andrew Fletcher, Adjunct Industry Research Fellow at Griffith University in Australia. I’ve normalized all currencies into US dollars from euros and Australian dollars in what follows. Any errors in transcription and foreign exchange are mine, and I’ll provide links to the original material as well.

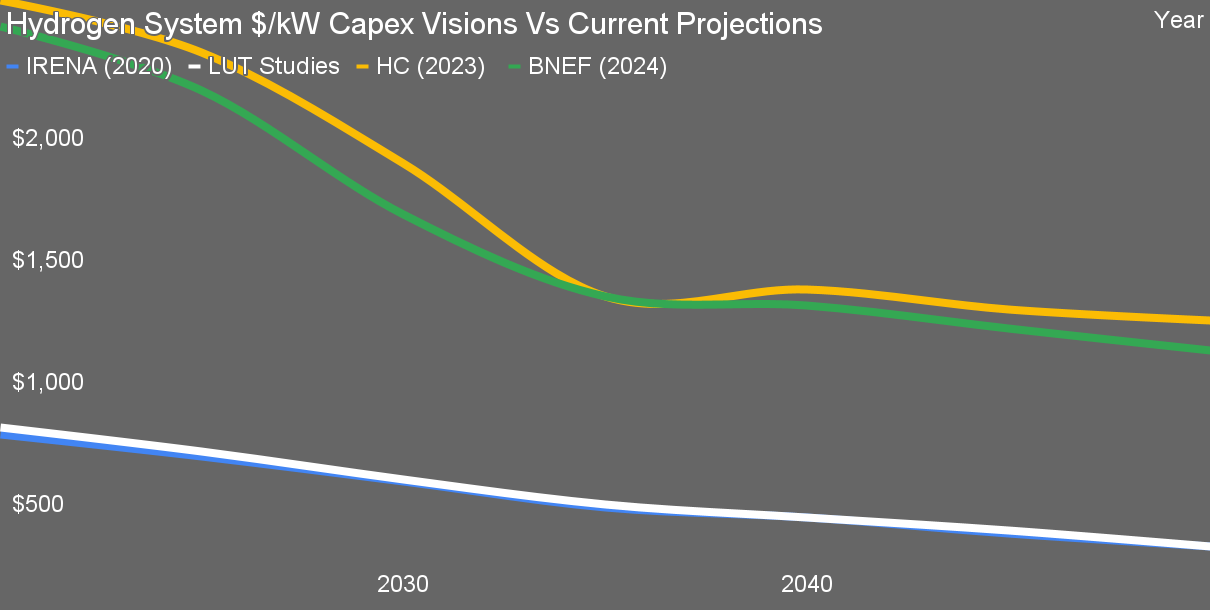

This chart is an adaptation of one by Siekkinen from a LinkedIn article published December of 2024, showing hydrogen vision electrolyzer capex from 2020 and 2021 from the International Renewable Energy Agency (IRENA) and the Lappeenranta-Lahti University of Technology (LUT) in Finland in the two very low-cost lines along the bottom, and from more recent and informed but still unrealistically low projections from Bloomberg New Energy Finance (BNEF) and from the Hydrogen Council (HC), which gives Mckinsey & Company a lot of money to do studies like that every year.

As Siekkinen points out, the EU’s hydrogen ambition increased from 40 GW (Hydrogen Strategy 2020) to 140 GW (RePowerEU 2022), yet the estimated investment cost only rose from €22–42 billion to €50–75 billion by 2030. This implies a system cost of ~€450/kW, aligning with IRENA (2020) projections. However, BNEF (2024) estimates suggest a €300 billion investment need, creating a €225–250 billion funding gap. This shortfall explains why €0.5/kg in public funding over ten years from the EU Hydrogen Bank has not been sufficient to drive the green hydrogen transition.

Enter Andrew Fletcher, who submitted a pair of documents, 2024–2025 GenCost Consultation Submission and Draft 2025 IASR Stage 1 Consultation, to the Commonwealth Scientific and Industrial Research Organisation (CSIRO), Australia’s national science agency to make a series of recommendations on how they could improve their hydrogen electrolysis capex and hence hydrogen cost projections.

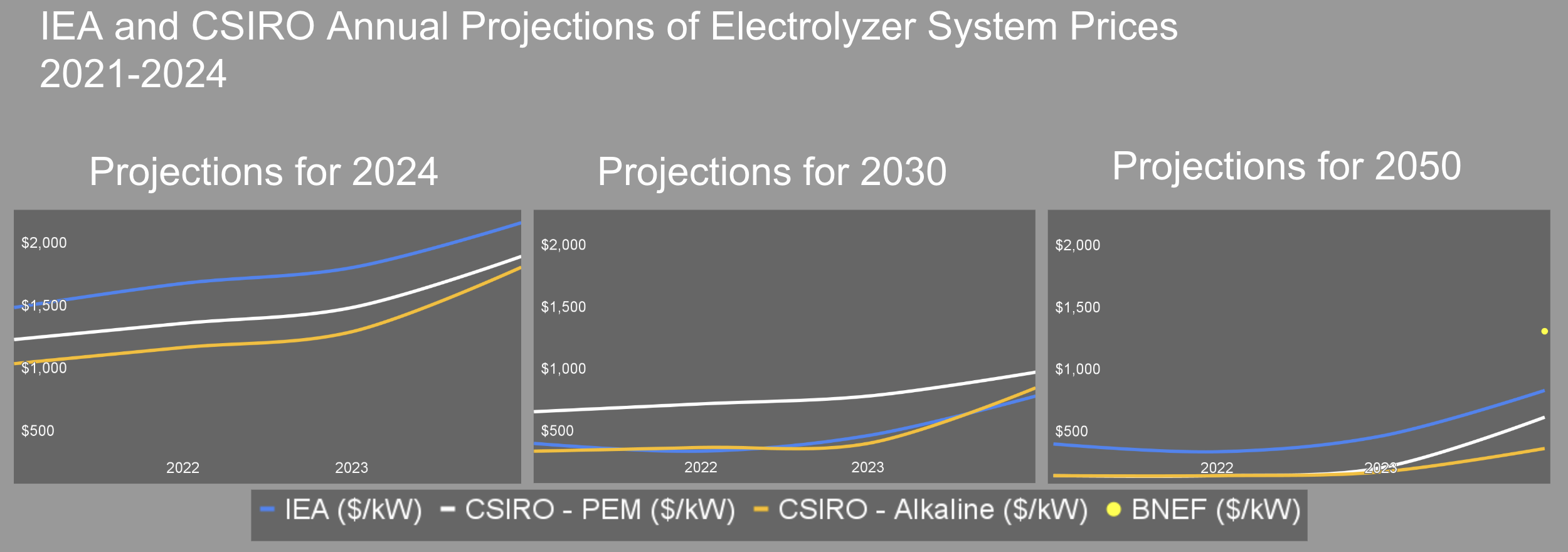

CSIRO and the International Energy Agency (IEA) both share remarkably bullish projections for hydrogen electrolyzer system capital costs, and both are seeing substantial increases every year in their projected costs. Like IRENA and LUT, the two agencies were very optimistic about costs of hydrogen in 2020, and each year they have become less optimistic.

The 2020 and 2021 projections were incredibly influential with policymakers in Europe, Australia, and elsewhere, and they were clearly wrong. The Hydrogen Council and BNEF capex projections from 2024 are far higher. However, there’s very good reason to believe that the Hydrogen Council and BNEF are both still far too optimistic. Why? Because actual 2024 capex for electrolyzer systems were still much higher than their capex projections.

This chart is adapted from Fletcher’s CSIRO submission and converted to US dollars. The Aurecon costs are the ones CSIRO uses for its current estimates for 2024 costs. Fletcher believes Aurecon’s estimates lack accuracy, as they align with Class 5 (rough order of magnitude) estimates from H2Kwinana and Port of Newcastle Hydrogen Hub, which have a wide uncertainty range (-50% to +100%) and low project maturity. He does not consider them based on detailed studies.

The other bars on the chart are costs from real projects and bids for projects from Australia and Europe. The Netherlands Organisation for Applied Scientific Research (TNO) data includes over a dozen European projects, while the bars on the right are from individual projects in Australia. The real projects costs average $3,000 per kW of electrolyzer system, while the Aurecon estimates average $1,800. That’s despite the Aurecon estimates including compression equipment which the project data excludes.

Fletcher’s recommendations for inclusions in estimates emphasize incorporating compression costs, transmission connection, and hydrogen storage capex, as assuming zero cost contradicts Australian Energy Regulator (AER) forecasting principles. Additionally, estimates should account for contingencies, infrastructure upgrades (electricity transmission, hydrogen pipelines, water, and port infrastructure), and other potential costs that impact project feasibility and total build cost.

Fletcher’s documents include a literature review. A key section of that document deals with the experience curve cost reductions expected for electrolysis systems, something that’s been a consistent point of clear inaccuracy in hydrogen electrolysis systems projections.

Fletcher cites a 2020 paper, Accelerating low-carbon innovation by Malhotra & Schmidt, which lays out a learning rates framework for technology projects, and engineering firm Ramboll’s 2023 whitepaper What will it take to reduce CAPEX in green hydrogen production?, which applies the framework to electrolyzers. I’ve synthesized the framework, Ramboll’s material, and Fletcher’s references to other learning rates material into the graphic above. (Any errors in transcription or interpretation are mine.)

As a reminder, learning rates are also referred to as Wright’s Law or the experience curve. They refer to the degree of reduction of costs over time, typically against doubling of manufactured units. They are best thought of as an S-curve or sigmoid, in that they start out with relatively low reductions in cost, then when scaled manufacturing arrives achieve the 20% to 27% Wright’s Law asserts, and then see reduced cost reductions again for fully mature products.

Fletcher points out that electrolyzers only represent 20% of total electrolyzer system cost at present and declining, so the higher learning rate for them will be less and less relevant to future costs of hydrogen electrolyzer systems. Pertinent to CSIRO, Aurecon significantly overstates the electrolyzer as a component of cost within its much lower overall costs, understating balance of plant, construction, permitting, and the like significantly.

What this means for 2030 and 2050 electrolyzer capex is that it will decline a lot less from current cost points than asserted by CSIRO, BNEF, the Hydrogen Council, and IEA have been asserting. That has direct implications on the cost of green hydrogen in 2030 and 2040, in that it will stay high. Visions which assumed dirt cheap electrolyzers, assumed dirt cheap electricity, ignored balance of plant costs, and assumed massive learning rate cost reductions were all wrong.

Fletcher does dip into a key area that becomes pertinent to learning curves, which is the volume of green hydrogen that will be manufactured. He approaches it from two perspectives. The first is the question of source of low-carbon hydrogen to fulfill demand. If blue hydrogen or white hydrogen fulfills substantial amounts of demand, then green hydrogen demand will be lower, lowering the number of electrolyzers manufactured, and hence their doublings that reduce costs. The highest demand cited from CSIRO is 440 million tons annually.

To this point, I’m pretty sure that demand is going to be vastly lower than that. I have a heterodox projection of hydrogen demand mostly because I have never believed that green hydrogen would be cheap, or even that blue hydrogen would be cheap enough to distribute everywhere for heating and transportation fuel. That’s because I kept doing my own technoeconomic workups and reading analyses of chemical plant engineering and costs by experts like Paul Martin. His Distilled Thoughts on Hydrogen are recommended reading.

Having done a lot of estimation of complex systems, I dodged simplistic cost cases that excluded lots of the costs, and knew that already commoditized components would not see significant learning rates in hydrogen electrolysis systems installations. That means that my estimates of end 2024, 2030, and 2050 green hydrogen costs are tracking much more closely to the reality being discovered through actuals found from detailed planning exercises and construction of electrolysis facilities.

I also started from a different perspective than most of the hydrogen projections, where the question wasn’t Will hydrogen be competitive against alternatives? but How much green hydrogen is needed to replace fossil fuels in all of these use cases? That meant that I had a lot of use cases like ground transportation electrifying as well as longer haul aviation and shipping running on biofuels. It meant that ammonia fertilizer demand declined as hydrogen feedstock costs rose because more precision agriculture and agrigenetic nitrogen fixing would be applied because they would be cheaper. It also meant that the biggest current demand area, petroleum refineries, was going to see a massive reduction in demand as refineries declined only to petrochemical manufacturing and took the cheapest, lightest crude closest to water to refine.

The only growth areas for hydrogen in my projection are a potential growth of green steel using hydrogen as a reducing agent, something which is at risk as molten oxide electrolysis and the new Chinese high temperature method may outcompete it, and hydrogen for hydrotreating biofuels.

As a result, my demand projection declines to around 80 million tons from the roughly 120 million tons including syngas consumed today. That’s under a fifth of CSIRO’s demand, and hence fewer doublings again. That’s going to hit the learning rate cost reductions.

A key point to take away from this comparison of real costs is that they are all far above the 2024 cost projections by BNEF, CSIRO, IEA, and the Hydrogen Council, even after those projections had risen sharply over the four preceding years. No major agency is getting its hydrogen cost projections right yet. Further, higher costs for green hydrogen make all use cases for it less competitive against alternatives, including direct electrification, biomass pathways for things like methanol, and biofuels. As we decarbonize, these higher costs will mean that alternatives to hydrogen will outcompete it and things made with cheap hydrogen today won’t be used because they’ll cost more.

As a result, BNEF’s announcement of tripling of 2050 green hydrogen costs to $1.60 and $5.09 per kilogram, with the low end only in China and India, is still far too optimistic. When it was announced, my immediate reaction was that they were going to have to up it again. My range for manufactured green hydrogen costs in 2050, not distributed, but at the electrolysis facility, is $6 to $8 per kg in current currency values. Distribution will remain expensive, so it won’t be distributed. Just as 85% of hydrogen today is manufactured at point of demand as an industrial feedstock, 85% of hydrogen in the future will be electrolyzed where it is needed as an industrial feedstock, in the amounts required, when it is required.

Siekkinen’s and Fletcher’s work, along with Ramboll’s and others, is starting to get close to reality, and is starting to inform major organizations’ projections. But it’s embarrassing and difficult for organizations like BNEF, CSIRO, the Hydrogen Council — which has its own clear biases to deal with on top of this — and the IEA to admit that they were as wrong as they have been and start from scratch on strong estimates. As a result, they are only slowly increasing the cost projections to avoid any given increase making it clear how wrong they were.

That means that policymakers and investors are still using bad data from organizations which they trust to make decisions, and making bad decisions as a result. Everyone remains anchored below realistic cost points and is not pivoting rapidly enough as a result. It also means that the United States’ moonshot goal of $1 per kilogram green hydrogen is a complete fantasy, just as I knew it was when it was announced.

While Fletcher is focused on CSIRO, my call to action is to all organizations with projections in the space: start from a blank slate with real-world data, and live with the results and embarrassment. We are in a climate crisis and accelerated energy transition, and can’t afford to waste time on the dead end of hydrogen for energy just because you are trying to save organizational face.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy