Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Growing Nationwide Trend of States Requiring Flood Disclosure

Hundreds of thousands of Americans already live in homes that have flooded. And a home that has flooded once is likely to flood again. Unfortunately, far too many buyers and renters were never told whether their potential dream home was a flooding nightmare due to nonexistent or weak flood disclosure laws.

However, states are starting to correct that failing. Since 2018, 10 states (Florida, Hawaii, Maine, New Hampshire, New Jersey, New York, North Carolina, South Carolina, Texas, and Vermont) have enacted or improved their flood risk disclosure laws. Five of those states acted just in this year alone, demonstrating a growing demand that home buyers and renters have a right to know their flood risk.

And that demand for flood risk disclosure is broad across the political spectrum. In a nationwide survey, seventy-four percent of respondents were in favor of a national standard that would require potential home buyers to be told if a property had previously flooded.

Yet too many states still do not require a seller or lessor to disclose to a buyer or lessee whether a home has previously flooded. This problem could be solved simply by giving home buyers and renters the right to information, information that the seller or lessor of a home may have and should be required to provide. Similar disclosures have been required for decades for asbestos and lead paint, which have helped people avoid potential exposure to toxic substances in a home or at least know the risks prior to buying or renting. Making sure information is passed from an owner to a buyer or renter about flooding damages and risks should be no different.

Recent legislative action and strong support for disclosure clearly show that people want to know whether their potential home is flood prone. Those states that are failing to act are not only keeping their residents in the dark about flooding, but also are increasingly on the wrong side of a landscape changing in favor stronger flood disclosure.

2024 Flood Disclosure Changes:

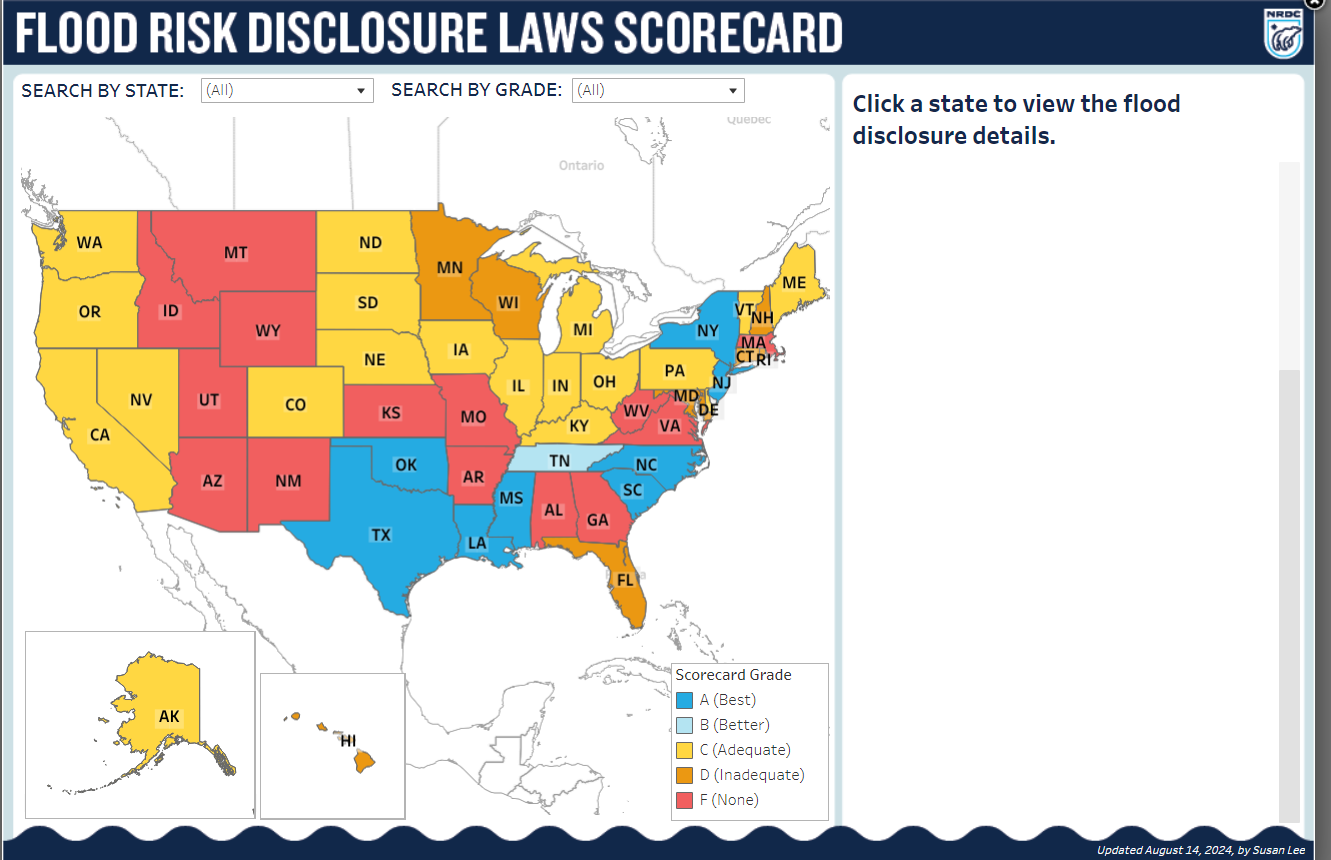

Given the continuing trend of states providing home buyers a right to know their flood risk, NRDC has updated its scorecard of state flood disclosure laws. Since the last update in August 2023, the following states all improved their flood disclosure grades.

Florida (2024 grade D, previous grade: F)

Before 2024, Florida had no statutory nor regulatory requirements for a seller to disclose a property’s flood risks or past flood damages to a potential buyer. As such, Florida home buyers were greatly disadvantaged when it came to learning of a home’s past flood history or potential for future flooding.

This past year the Florida legislature took steps to rectify that problem. Now, home buyers in Florida are told if:

- The seller has filed a claim with an insurance provider relating to flood damage on the property, including but not limited to the NFIP.

- The seller has received federal assistance for flood damage to the property, including but not limited to assistance from FEMA.

While more must be done, such as requiring a home seller to inform a buyer of any past flood damage, not just damage that resulted in an insurance claim, Florida home buyers are better off than they were before this new law.

Maine (2024 grade: C, previous grade: F)

Maine had previously received an “F” on NRDC’s flood disclosure scorecard due the state having no statutory nor regulatory requirements for a seller to disclose a property’s flood risks or past flood damages to a potential buyer. However, Maine took significant action to provide home buyers a right to know their flood risk. As of August, Maine sellers must disclose the following:

- Whether the property is in a FEMA-designated floodplain

- Whether during the time the seller has owned the property

- Any flood events have affected the property

- Any flood-related damage to a structure on the property

- Any flood insurance claims

- If any disaster-related aid was received for flood damage to the property.

New Hampshire (2024 grade: D, previous grade: F)

Like Maine, New Hampshire previously did not require a seller to tell a buyer about a home’s flood risk. While a small change, New Hampshire home buyers will now be told if a property is in a federally designated flood hazard zone. However, New Hampshire still has no statutory nor regulatory requirements that a seller disclose a property’s past flood damages to a potential buyer.

North Carolina (2024 grade: A, previous grade: D)

North Carolina previously received a “D” for flood risk disclosure but now has an “A.” Since July 1st, home buyers in North Carolina are now told if:

- The property located in a federal or other designated flood hazard zone.

- The property has experienced damage due to flooding, water seepage, or pooled water attributable to a natural event such as heavy rainfall, coastal storm surge, tidal inundation, or river overflow.

- A claim for flood damage to the property has been filed with any insurance provider, including the National Flood Insurance Program.

- There is a current flood insurance policy covering the property.

- There is a flood elevation certificate for the property.

- If the seller has received assistance from FEMA, U.S. Small Business Administration, or any other federal disaster flood assistance for flood damage to the property.

Further, the mandatory disclosure form has the following statement: “For properties that have received disaster assistance, the requirement to obtain flood insurance passes down to all future owners. Failure to obtain flood insurance can result in an owner being ineligible for future assistance.”

In February 2023, the North Carolina Real Estate Commission granted a petition for rulemaking filed by Southern Environmental Law Center (SELC) on behalf of NRDC, The North Carolina Justice Center, MDC Inc., The North Carolina Disaster Recovery and Resilience School, Robeson County Church and Community Center, and NC Field, requesting the agency amend the mandatory real estate disclosure form to include detailed questions about a property’s history of flood damages and insurance requirements. In July 2023, the Commission began a public comment period on the revised disclosure form, which contained a version of our proposed questions pertaining to a property’s flood history and risk. The North Carolina Real Estate Commission reviewed more than 700 comments, most submitted by supporters. In March 2024, the state’s Real Estate Commission approved a final real estate disclosure form with detailed questions about flood risk.

Vermont (2024 grade: C, previous grade: F).

Vermont had previously received an “F” on NRDC’s flood disclosure scorecard but has now earned a “C.” The Green Mountain State now requires the following to be disclosed:

- Whether the property is in a FEMA Special Hazard Area or Moderate Flood Hazard Area.

- Whether the property has been subject to flooding or flood damage while the seller possessed it.

- And, whether the seller had flood insurance on the property.

The new law also requires landlords to disclose to renters whether any portion of the premises offered for rent is in a FEMA Special Flood Hazard Area. Given the severe flooding the state has experienced in recent years, this is a great win for home buyers and renters.

Courtesy of NRDC. By Joel Scata.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy