I recently viewed Finding the Money, a video aimed at persuading a popular audience of the putative merits of Modern Monetary Theory (MMT). The video debuted this past May on several streaming platforms and theaters throughout the U.S. Whether it succeeded or not in its purpose, I will leave it for others to judge.

What I found most noteworthy in the 95-minute video was a brief clip of an interview with George Selgin, an economist of some stature in free-market monetary policy circles. When questioned about what MMT proponents get wrong or factually incorrect, Selgin waffles a bit and replies, “it’s a matter of emphasis and rhetoric.” He then goes on to give a more definite answer: “The MM theorists do say there is ultimately a scarcity of resources. But too often, they treat the world as if the norm is one of generally unemployed resources and plenty of ‘em.” Here, Selgin seems to be challenging MMT’s central claim that politicians and bureaucrats can costlessly conjure up real resources to expend on their favorite programs simply by creating and spending fiat money. Selgin then quickly reverses field, adding, “But I must say in the last twenty years, of course, since 2008, there’ve been more times when we haven’t been constrained [by real resource scarcity] than when we have.” Selgin is in effect saying that, since 2008, the Fed has been derelict in failing to administer a bigger dose of monetary expansion to the U.S. economy than it actually did.

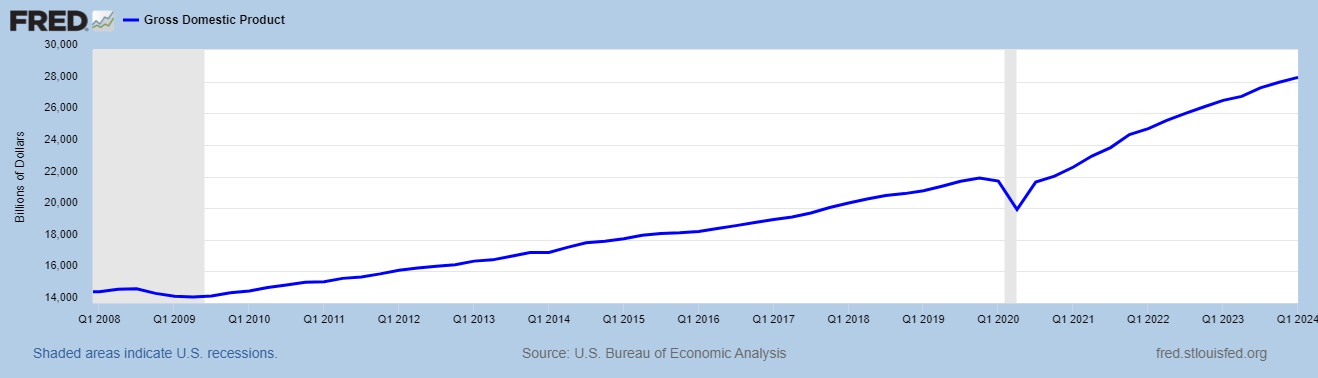

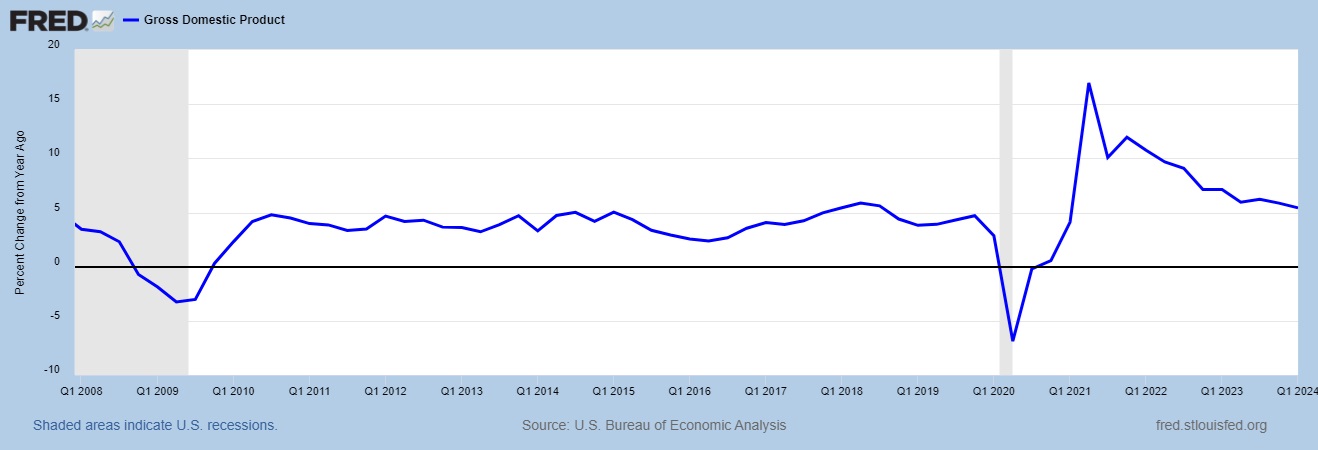

We can readily test Selgin’s claim that since 2008, the U.S. economy has been awash in excess resources more times than not. In previous writings, Selgin has upheld stabilization of total spending or nominal GDP as the ideal monetary policy for preventing recession and inflation and keeping the economy on an even keel. Thus, according to Selgin, unemployed resources emerge, and resource constraints evaporate, whenever the growth rate of nominal GDP turns negative. Let us see if the data support Selgin’s view that for most of the period since the financial crisis, we have been living in an MMT world. In fact, if we take an overall view of the period based on Selgin’s nominal GDP targeting framework, we are forced to characterize it as inflationary. From Q1 2008 to Q1 2024, total spending exploded by $13.6 trillion or 92% from $14.7 to $28.3 trillion. (See Figure 1.) Taking a more granular view, the year-over-year growth rate of nominal GDP was positive for 62 of the 68 quarters composing this period, ranging from 2.5% to 5.0% for most of them. Only six quarters displayed a negative growth rate, which, according to Selgin, would place us in an MMT world of unemployed resources. (See Figure 2.) Thus, even on Selgin’s own terms, we are forced to reject his assertion that the economy was unconstrained by scarcity more often than not during the past 17 years.

FIGURE 1

FIGURE 2

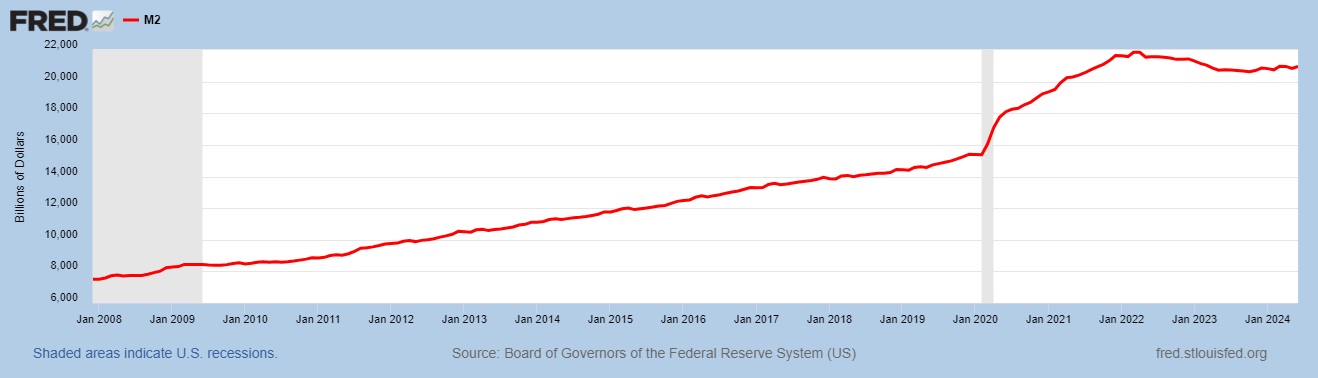

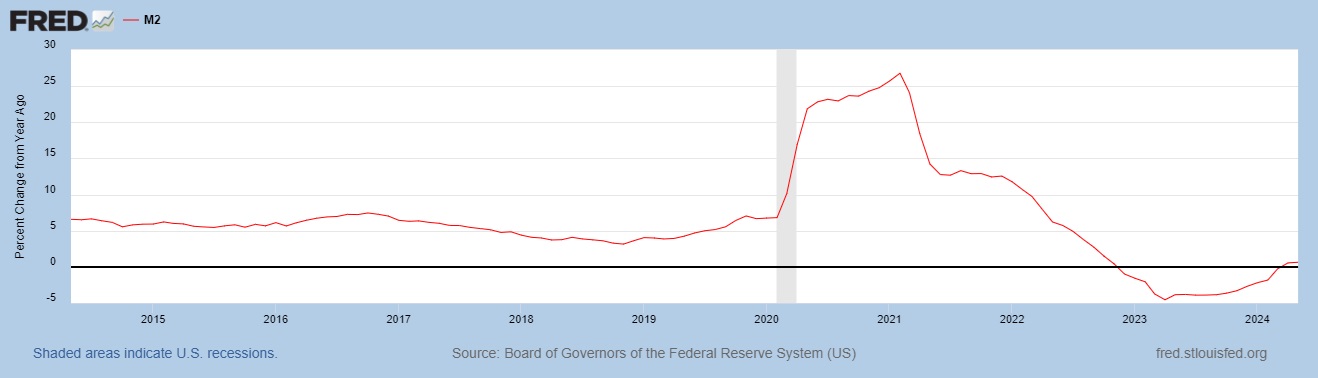

Delving a little deeper into actual Fed monetary policy we find the reason why, contrary to Selgin, inflation rather than recession has prevailed since 2008. From the end of December 2007 to May 2024, Fed policies increased the money supply, as measured by the M2 monetary aggregate, by $13.3 trillion or 178%, from $7.5 trillion to $20.9 trillion. (See Figure 3.) During this period spanning 197 months, the annual growth rate of the money supply on a year-over-year basis exceeded 5.0% for a whopping 153 months. Very recently the growth rate of M2 turned negative for 16 consecutive months ending in March of this year, but this did not put a dent in NGDP growth, which slowed but continued to grow above 5.0% for the entire period. (See Figures 2 and 4.)

FIGURE 3

FIGURE 4

Empirical considerations aside, Selgin’s remarks reveal a deep affinity between MMT and the monetary-disequilibrium theory that he champions. Both theories incorrectly attribute economy-wide unemployment of resources to a deficiency of aggregate spending. In doing so, both divert attention from the crucial insight of Austrian economics: it is the price structure and not spending that drives and coordinates economic activity. Money prices are formed directly by the interaction of the value scales of buyers and sellers on markets. Spending has no causal significance in determining money prices; logically and chronologically the payment of a sum of money, like the handing over of units of the good sold, occurs only after a price has been agreed upon by buyer and seller. The physical transfer of a bundle of monetary assets from buyer to seller and bundle of goods from seller to buyer is the consummation and not the cause of the price event.

This is just as true of aggregate spending as it is of spending involved in an individual transaction. At any given moment, the market process determines a structure of money prices or, inversely, the purchasing power of money. An increase in the money supply would cause a fall in the marginal utility of money relative to goods on the value scales of the recipients of the new money. All other things equal, this would cause a bidding up of the prices of various goods and a decline in the purchasing power of money, which in turn would entail the handing over of more units of money for some goods and, therefore, increased total spending on all goods. Aggregate spending is a passive resultant, not a cause, of the height or scale of money prices. This point has been emphatically stated by William H. Hutt:

[T]he general rate of expenditure . . . is a consequence of the value of the monetary unit and not its cause. . . . Expenditures do not determine prices. Prices determine expenditures. . . . exchanges of products are the results and not the causes of values, values being established by the acceptance of bids and offers to exchange. . . . It is demand and supply expressed in terms of money and not the spending of money which determines prices. [Emphases are in the original.]

What we may call the “spending illusion” is perhaps the gravest error in the history of economic thought and has been deeply embedded in economics since the early twentieth century when Irving Fisher and others formulated the mechanistic quantity theory of money. Indeed, every school of macroeconomics, from Keynesianism to monetarism to New Keynesianism, has been based squarely on the fallacious assumption that spending is a causal factor in determining prices and quantities. Modern monetary theory is just the latest variation of this fallacy. Only the Austrian school of economics, which is based on Menger’s causal-realist analytical method, has been able to pierce through the spending illusion and develop a business cycle theory consistent with the reality of the pricing process.

Courtesy of Mises.org

********