In a monetary economy, the money layer “exists on top of” real economic decisions, actions, and processes.

When the money layer faithfully mirrors the underlying real economy, it maximally serves its purpose; a stable, neutral, non-distortionary money allows us to plan our economic affairs, make economic calculations, engage in financial contracts, and save for the future.

When the monetary layer fails to achieve its role, it makes all those actions harder to navigate, causing a real drag on our economic behavior—with the unfortunate outcome that we’re all poorer for it.

We find it harder to make commerce, engage in mutually beneficial contracts with employers or clients, or save for old age. We must constantly reassess and renegotiate our contracts and wages, even switching jobs every few years to make real headway.

But the most immediate consequence, known to anyone who has ever had a little bit left over from their earnings, is that you cannot save in the “money” used today.

Whether the physical notes in your wallet or the digital bank account representations thereof, over time, they yield a saver fewer goods and services. The outcome for us in the 21st century, and for most of the 20th century, is that we must constantly chase returns on the funds we have already earned.

We become, so to speak, part-time managers of our own finances, having to maximize interest on bank accounts, invest spare funds in the stock market, set savings aside in tax-favored retirement accounts (again consisting mostly of paper stocks), or lend funds to the government against fickle and unreliable promises that we will get back what we put in—tomorrow or in 40 years.

This is the outcome of a very different world than that for most people and nations up until comparatively recently.

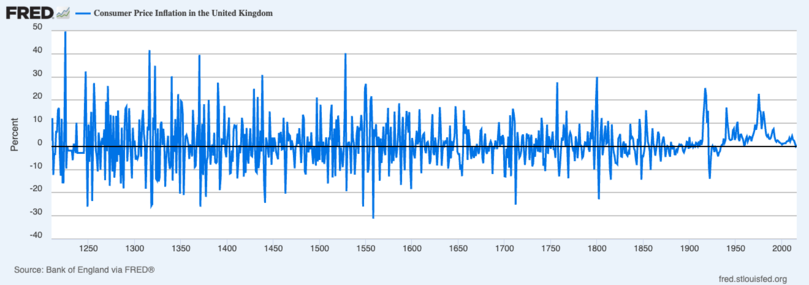

For all of the Bank of England’s 800-year plentiful price history for England/Britain/the U.K., we see aggregate prices bounce up and down greatly—as one would expect from underdeveloped and largely agricultural economies subject to random harvest surpluses and misfalls.

What is astonishing to a modern eye is that from 1210 to around 1934, there is no trendline. There are years where prices explode upward, most likely due to some real economic event (poor harvests or wartime constraints), followed by years of price declines (improved harvests and/or end of wars).

This is precisely what we would expect from a commodity-based monetary system with credible commitment: A gold standard—a monetary order where gold is the base money or the monetary unit is tied directly to a quantity of gold—constrains monetary affairs such that prices over time are mean-reverting.

The exploration and inflow of gold accelerate when prices are low; they slow down when prices are high. Over time, the real value of a unit of money remains flat. Trendless.

Beginning in 1934, British prices never again fell. There’s a concrete regime shift, where prices after this point had an upward trend—forever.

That makes it harder to forecast the value in the future of today’s income, a given sum of money, or a contract, since even small forecasting errors around a stated target (such as the 2% inflation target favored by most central banks) add up over time and push the saver far off course.

The American experience is less clean, but the principle still holds. Prices here gradually fell until the 1860s, when they shot up during the Civil War, came down afterward, and continued their slow, secular, downward trajectory.

They hit a low point in the 1890s, and increased somewhat up until World War I—a price level experience it shared with the rest of the Atlantic world, having much to do with the shared monetary base (gold) and the gold mine discoveries in Western Australia (1885), South Africa (1886), and eventually the Yukon Territory (1896).

After the Great Depression and the first complete detachment of money from gold, America followed Britain and other industrialized nations into the fiat century, where the price level has a consistent but greatly variable and unpredictable trend—and erratic and varying inflation rates punctuated by once-a-decade bursts of money printing.

This is not a natural economic world, and, it is not inevitable either. Our savings behavior and the assets we use to move economic value forward across time are directly related to the monetary regime under which we live.

When the money itself doesn’t work to safeguard future value, people use (“monetize”) everything else that’s liquid enough—paintings, rare wine, houses, stocks. Our houses become ATMs, our mortgages a way to short the currency; these behaviors have distortionary effects, most obviously by using condos and apartments in our largest cities for storing economic value rather than providing shelter for their owners, or a financial sector much larger than it would have been under a harder money.

The perverse conclusion, contrary to all prudent savings advice up and down the centuries, is for individuals to hold the maximum amount of debt they can carry and to never, ever, hold money (i.e., fiat currency)—the very object whose socioeconomic function is to move economic value across time and place.

The backdrop of a broken monetary regime is the underappreciated variable in many current political and social disputes.

Until we pay attention to how today’s monetary regime is different from all that came before it, most current topics of a fiscal or macroeconomic nature won’t make sense.

To paraphrase James Carville, Bill Clinton’s strategist during the 1992 election, only a little: It’s the money, stupid.

********