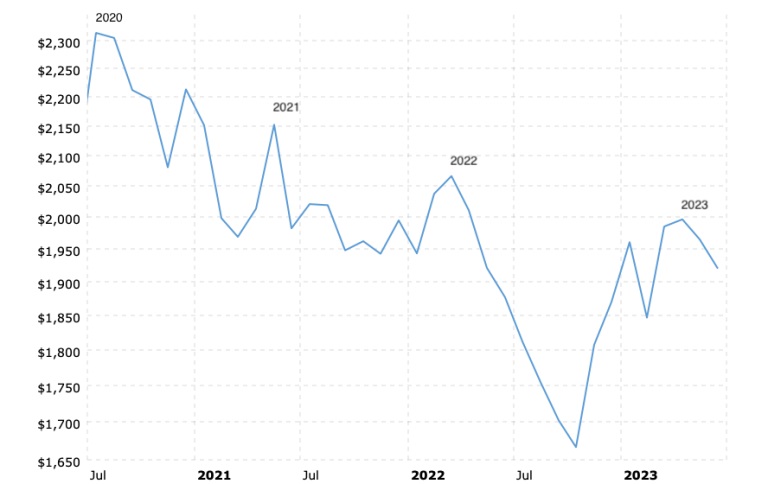

The latest gold analyses have shifted to a more accommodative nature regarding the yellow metal’s failure to extend its gains after breaking above $2000 for the fourth consecutive year. Here is a chart (source) that depicts what most analysts and investors are seeing…

Gold Prices 2020-23

On the surface, it appears that the gold price is working its way higher, even after dropping back from new all-time highs. The chart below gives a different impression…

Gold Prices (inflation-adjusted) 2020-23

In inflation-adjusted terms, the gold price has been declining since its peak in 2020. There is a clear succession of lower peaks and a well-defined downtrend in gold prices.

One might reasonably ask, “Is this an anomaly; or a short-term aberration?” Below is another chart that covers a longer period dating back to the gold peak in 2011….

Gold Prices (inflation-adjusted) 2011-23

In inflation-adjusted terms, the recent ‘new’ highs in the gold price were new highs only on a nominal basis. In inflation-adjusted terms the ‘new’ highs were the lowest in a succession of lower peaks dating back to the summer of 2020.

Additionally, the succession of lower peaks since 2020 are all lower than the peak in 2011.

GOLD- THE BIG PICTURE

Below is one more chart. This one dates back to the gold price peak in 1980 that is referenced so often…

Gold Prices (inflation-adjusted) 1980-2023

Gold’s ‘new’ highs are never that in real terms. Nominally speaking, a higher gold price reflects the actual loss in U.S. dollar purchasing power that has already occurred.

Fundamentally, that is the only thing one can expect. Expectations for a radically higher gold price that is not tied directly to the loss of purchasing power in the U.S. dollar are unrealistic and fundamentally unsound.

In addition, those periods when gold reflects the full extent of the dollar’s loss of purchasing power come infrequently and only in hindsight.

When the gold price peaked in 2020, it was the third major price peak since 1971. Each of those peaks (1980, 2011, 2020) fully reflected the actual loss in U.S, dollar purchasing power that had occurred up to that point.

Any future nominal highs in the gold price will come only after new, additional losses in U.S. dollar purchasing power and will not exceed the previous inflation-adjusted peaks of 1980, 2011, and 2020

Expectations for “new highs” in gold are unrealistic and untimely. Any new highs in the gold price will come only after additional losses in U.S. dollar purchasing power and could be several years away.

(also see Gold Bulls Are Too Price-Dependent)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

********