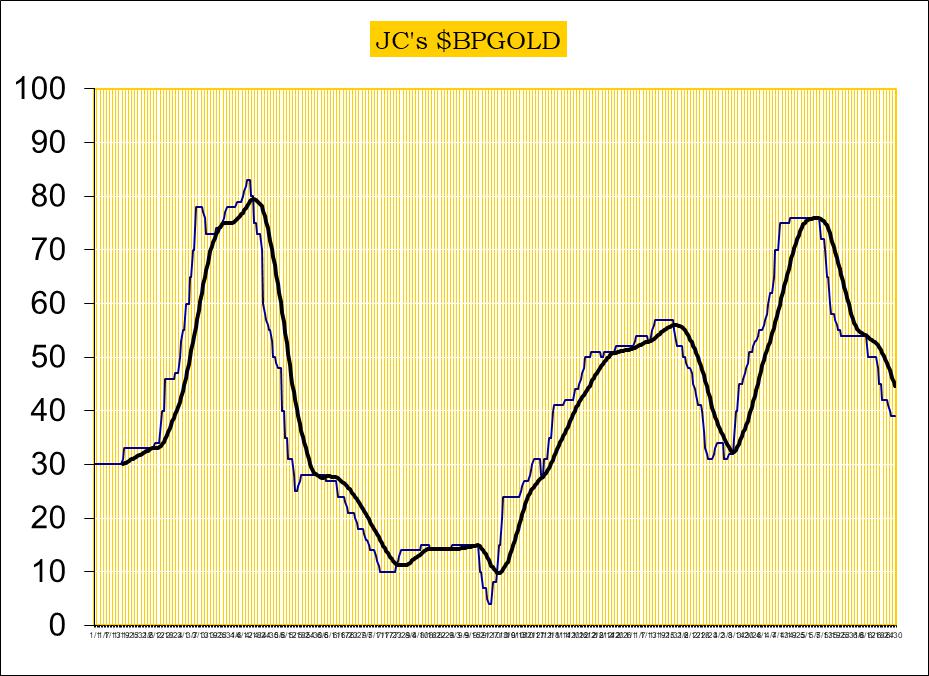

Our proprietary cycle indicator is DOWN.

To public readers of our updates, our cycle indicator is one of the most effective timing tool for traders and investors. It is not perfect, because periodically the market can be more volatile and can result in short term whipsaws. But overall, the cycle indicator provides us with a clear direction how we should be speculating.

Investors

Accumulate positions during an up cycle and hold for the long term.

Traders

Enter the market at cycle bottoms and exit at cycle tops for short term profits.

GLD is on short term sell signal.

GDX is on short term sell signal.

XGD.to is on short term buy signal.

GDXJ is on short term sell signal.

Analysis

Current data supports overall higher gold prices.

Our ratio is on a new buy signal.

Trend is DOWN for USD.

Trend is now DOWN for gold stocks.

Trend is now down for gold.

In a bull market, the 200ema acts as support where corrections end.

This week, prices tested support and bounced.

Summary

Gold sector cycle is down.

Trends are down.

COT data supports overall higher gold prices.

A correction is in progress but may be ending.

$$$ We are holding core positions and hedged.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.

*********