Happy days are here again. Fears that the largest economy in the world is entering a recession led to a brief global sell-off, which whipsawed the markets due to weakening US economic indicators. The fear of missing out (FOMO) crowd returned, boosted by the diminished recession fears and a “time has come” interest cut that helped markets achieve all-time highs, in a return of irrational exuberance and a rerun of the Roaring 20s. Global stock markets rebounded from the roller coaster ride. Bull markets are climbing walls of fear, and there are plenty of reasons to be concerned, ranging from political, economic, and domestic uncertainties to the largest inflation shock since the 1970s.

What is more, many are blaming the Fed as part of the problem. Biden blames Trump, Trump blamed Biden and Harris blames big business. All are wrong. The blame is spread over many presidents who were reluctant to restore fiscal discipline, and not the corporate sector. Consequently, without a ready solution, inflation will creep along. Looming tariffs or additional green spending or taxpayer funded tax cuts will only serve to boost inflation. It is not interest rates that is an indicator of monetary policy but macro-indicators such as inflation and GDP and by those measures, monetary policy remains loose. Central to the US economy, consumers which makes up about two-thirds of America’s GDP, shrugged off the recession woes with upbeat retail spending, mainly on imported goods. Simply, the economy is very much alive as too much money chases too few goods.

Consequently, the US economy continues to defy gravity, growing 2.8% in the second quarter that is the envy of the high-income world. A while back, there was no inflation, so central banks literally went on a printing spree, maintaining interest rates close to zero in order to bring inflation back to target—2 percent. Japan even lost a decade of growth trying to boost inflation. Both succeeded when that gargantuan spending caused an economic boom, inflation and higher rates. The Fed then turned its attention to the concern over price increases, even though structural factors could keep inflation “higher for longer.”

Era of Easy Money

Simply, the decades of free money, endless wars, Covid stimulus and Bidenomics fueled not only a worldwide economic boom but helped blow up the “everything bubble,” resulting in trillions of deficits and the highest inflation in four decades. Within this environment of artificially free money, corporate earnings grew, the purchasing managers index remains strong, stock markets spiked, and core consumer prices again hit a record, for the 50th straight month. Simply that deficit spending was financed by the Fed’s purchases of government debt that created the biggest asset bubble in history. As a result, money is too plentiful and the government keeps printing more out of the thinnest of air, devaluing the nation’s currency. Not surprisingly inflation is up 20% when Biden entered office, further eroding purchasing power. Little is said that the profligate spending to green the economy was misplaced as much of the battery and electric car factories are idle today. Similarly some of that largesse was directed to artificial intelligence (AI) which is turning out to be the next bust. So much money, so little results.

Milton Friedman, the renowned economist who won the Nobel Prize, stated that “inflation is always and everywhere a monetary phenomenon.” Inflation is a phenomenon born of excess demand over supply as too many dollars chases too few goods. And in eroding purchasing power, there is an increase in prices for goods and services. To restore the balance, one must either increase supply or reduce demand. Cutting demand though has high social costs (unemployment, bailouts etc.) In fact, it is not inflation that we should be focusing on, it is the erosion of buying power. Money is increasingly losing value, particularly in the US where profligate government spending has resulted in record borrowings, leading to a mountain of debt left for taxpayers to pay, made worse by a knife-edged election where both candidates are vying for power, at any cost.

State of Play

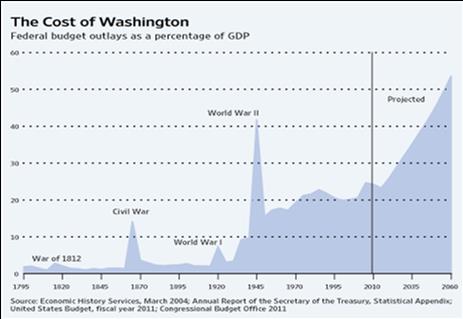

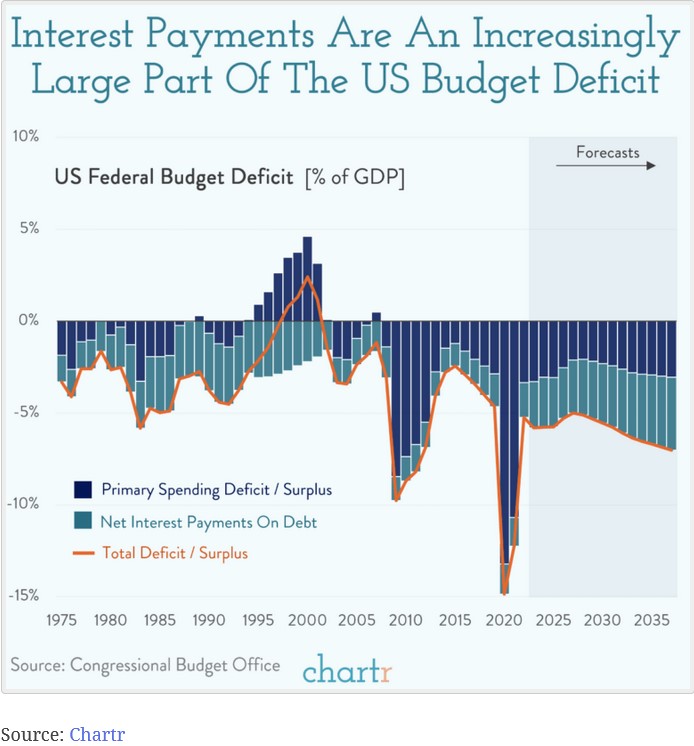

America’s populist isolationism and the end of globalization also boosted inflation as geopolitical events proved inflationary. The disasters in Afghanistan, Iraq, Syria, Libya and recently, new wars blazing in Ukraine and Gaza cost money. The IMF calculated that the Russian “war” economy will grow by 3.2%, more than the US, Germany and France. The US alone spends almost $1 trillion on defense spending. Governments could always raise taxes to pay for this spending, but voters are unlikely to approve. Instead, central banks just print more money and that largesse contributed to the economic boom. With $1.5 trillion in interest payments, the US will spend more on interest than on defense. Inflation to governments is a viable option – a hidden tax, but inflation can get out of hand. The inflation obituaries are premature.

America’s social and growing movement towards populism and isolationism has led to a reluctance to engage globally. America’s adversaries are probing for weaknesses believing that the internal turmoil makes the country distracted and vulnerable. A good example is the Iran-backed Houthis rebels in Yemen which have fired on US naval destroyers in the Red Sea. Those disruptions and strikes in Canada, US and India have stretched supply chains pushing up costs. To date the world’s greatest navy’s response has not stopped the drones, missiles nor the attacks. To protect American interests, the weapon of choice has been sanctions and tariffs as substitutes for putting boots on the ground such that America has sanctions on almost one third of all nations. The results are questionable as sanctions have not stopped Iran, Russia, Cuba or the Houthis. Of concern is that the conflict in the Middle East looks set to take a dangerous and unpredictable form that threatens to directly involve America.

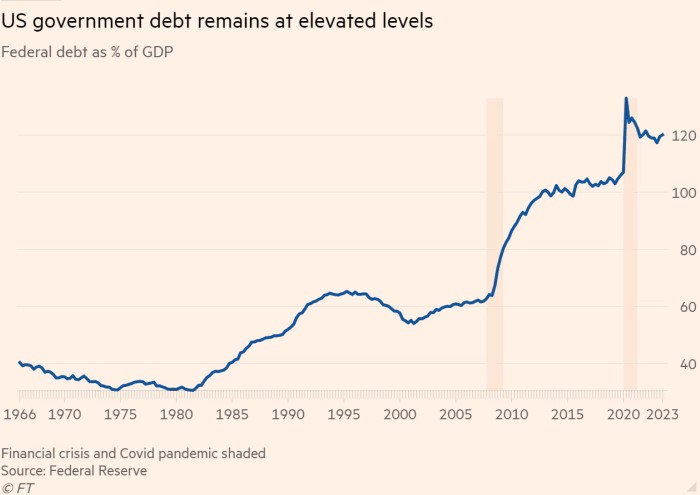

Forever Deficits

The deeper problem though is that the Western governments fight against climate change through EVs and renewables has backfired with inflationary implications. Although delays have hit about 40% of Mr. Biden’s taxpayer-funded $400 billion Inflation Reduction Act (IRA) bet to boost the output of EVs, semiconductors and critical minerals, this high spending protectionism has yielded little economic bang for the taxpayers’ buck or done little to reduce the country’s dependence on China or, reduce inflation, or reduce carbon emissions. Despite Biden’s environmental aspirations, the United States has emerged as the global leader in oil production.

It is a whole new world. America’s deficit is greater than most other countries and there appears to be little appetite, particularly in an election year for both parties to tighten the country’s fiscal stance. There are few places to hide. The reality looks gloomier. US debt today stands at $35 trillion with debt to GDP at almost 130 percent and deficits of $2 trillion a year or 8% of GDP. The immediate cause is profligate spending. Bidenomics’ IRA stimulus and separate Chip Act allowed the highly indebted government to vastly expand its powers and spending, which didn’t reduce inflation, but caused it. Mr. Biden’s green revolution broke the bank. At the same time, America’s tax burden remains relatively low with former President Trump pledging even lower rates and an extension of his tax cuts at a cost of $5 trillion.

In 2006, the Fed’s balance sheet was $800 billion or 6% of GDP. Today after record government spending, the Fed’s balance sheet exploded to a whopping $7.3 billion or 26% of GDP. Also, the monetary base is up 60% and year-over-year change in M2 is up 23%. With America’s already strained public finances, the other problem is that fiscal policy remains too loose to control inflation. Debt is not a problem until it is. Given that a dollar bought four years ago is now only worth about 80 cents, all of this is fuel for further inflation. It is a fiscal accident ready to happen.

Weird

With less than 90 days to go until the November presidential election, voters must choose in a highly contested race that cuts across generations, gender and race. Although almost eight years as a senator and an unpopular Vice President, Kamala Harris has overnight electrified the election. She, however, has only offered glimpses of her policies and no doubt will borrow heavily from Biden’s playbook, including an economic record that left Americans worse off than four years ago. Her key people are also refugees from the Biden/Obama camp and although transforming the 2024 election campaign, she has done little to distance herself from Biden’s spendthrift ways or leftwing populism.

The GOP idolized Mr. Trump. His party is governed by what it hates. Other countries and democracies have judiciaries for appeal but the legitimacy and independence of the Supreme Court was undermined when it ruled against Roe v Wade, a right to abortion that most Americans supported. The Court has been politicized with its approval rating lower than President Biden’s lowest. The United States has become a country where everything has become politicized and institutions such as its courts, FBI and media have been weaponized. Equal treatment under the law? Depends on who makes the laws. Ms. Harris was once an officer of the law as a prosecutor and state attorney general. Amid a sharply split citizenry and party specific application of the rule of law, support of an independent legal system and enforcement is important. Yet today nearly half of the country no longer believes in equality under the law and a right to order. Abraham Lincoln said democracy is, “for the people, by the people.” These days that depends upon which party is in power. American democracy is at risk.

Ahead Ms. Harris lies potential traps from China, the economy, the culture wars and Mr. Trump. Much of what she proposes will require Congressional approval, which is far from assured in the current political environment. To be sure, whatever the outcome in November, polarization will continue to exist, undermining domestic, world trade and order. Inflation is another problem and she has not repudiated Bidenomics which helped fuel it. Investors can only hope that Harris is a better alternative, just don’t expect better results. Her main appeal is that she is neither Trump nor Biden. …and that is weird.

Make Money Great Again

One of the root causes of inflation was Trump’s tariffs which Biden retained and other forms of protectionism which did not restore America’s export competitiveness nor solve its climate change problem. Ironically, in his initial term, the US experienced low inflation, economic growth and strong wage gains, spurred by tax cuts that added $8 trillion to the nation’s debt. Tariffs however raised prices and slowed economic growth with American farmers caught in the middle. As Trump’s first term showed, they also invited retaliation, inhibited trade and proved inflationary. The former president’s tariffs did not even generate sufficient revenues and instead was an inflationary cost to consumers and businesses. Trump’s proposed tax cuts for businesses and a damaging 10% across-the-board tariffs on other imports from allies and friendly trading partners will also be inflationary.

Globalization ended when Trump first took office and should he prevail, he is expected to continue an isolationist role with strict immigration laws, a protectionist trade policy and course lower taxes. Wall Street’s fintech stocks gained on a “Trump trade” on hopes that a GOP win would provide a pro-business environment and lighten the energy, labour and environmental regulatory load. What is more, Trump’s tactical mindset of “let’s make a deal” is more transactional, in place of the interventionist “take or leave it” attitude by the Democrats. A Donald Trump win would also dismantle the very expensive Bidenomics, but climate change will still need funding. Instead he is expected to push a “Buy America” policy, which would cause shortages, drive up demand for imports which would again prove inflationary. Business, in particular the Silicon Valley types, like Trump and unlike his first term, he will place loyal acolytes in his administration, promising a presidency of polarization and retribution.

Although his NATO threat encouraging Russia “to do whatever it wants” to those members who do not spend enough on defense, is of concern to both allies and enemies, a re-elected Mr. Trump would pose huge questions over the future of America’s global leadership, undermining the security arrangements in three of the most strategic regions in the world: Europe, Asia and the Persian Gulf where America faces challenges.

China: The Sky Is Falling

Further boosting inflation is the cold war raging between America and China. America’s huge industrial complex is working overtime with the Pentagon its main customer. Russia’s invasion of Ukraine resulted in a US-led NATO buildup and need to replace spent munitions and equipment. With the peace dividend gone, the US needed an adversary and China was conveniently turned from a competitor to that of an adversary.

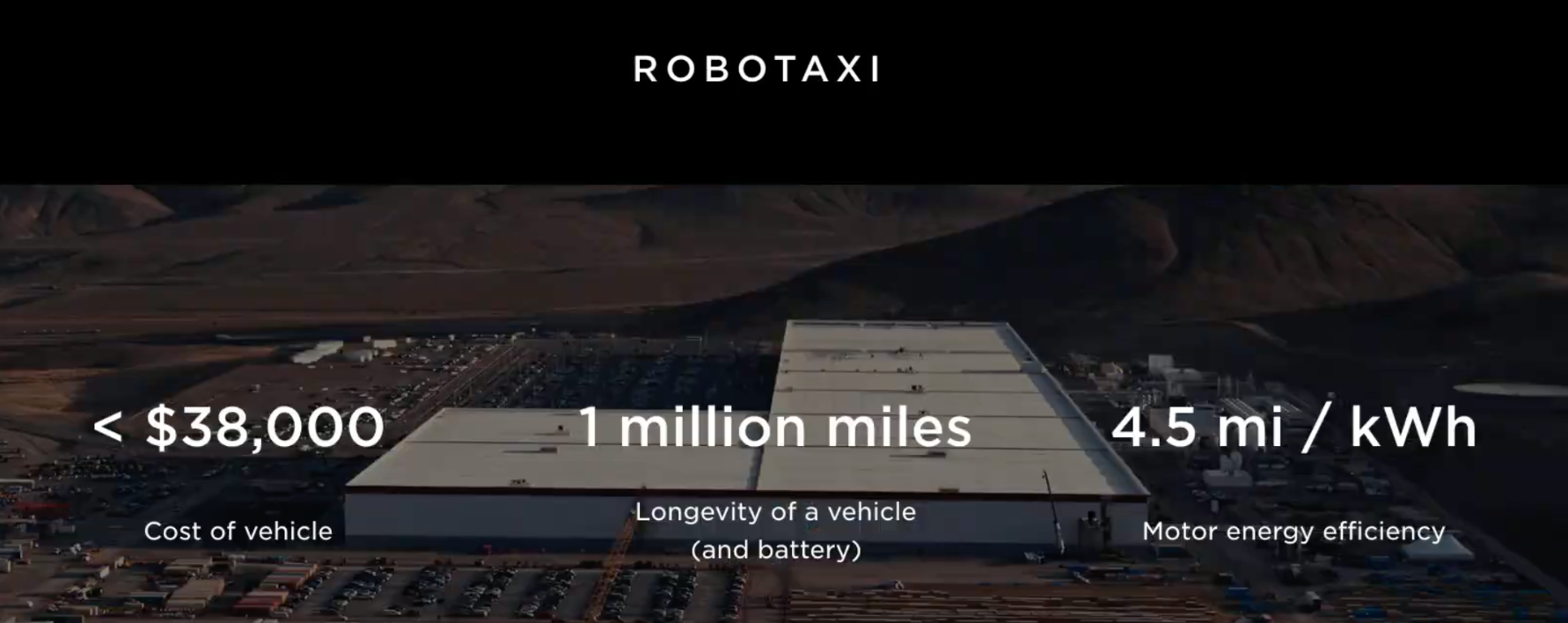

Although China accounts for one third of the world’s annual growth, it is also the world’s largest player in critical minerals, dominant in EVs, solar and wind technology and has done more than any other country to drive down the cost of green tech. As a result China’s carbon emissions peaked last year due to its dominance in renewables, where EVs and hybrids exceeded 50% of Chinese car sales in July. However, America’s heavy reliance on Chinese manufacturers has raised security concerns. The escalation of tensions and tariffs has inadvertently bolstered China’s resilience, lessening their dependence on American technology, localizing chips and supply chains hurting American and European revenues. As a matter of fact, Huawei’s HiSilicon recently introduced a sophisticated AI chip, and today is larger than in 2019, the year when the US imposed a ban on national security grounds. China’s response was to simply carve out new markets and products, shifting away from America. Apple’s iPhone has suffered a setback as a result of the conflict between the two giants, falling out of the top five phones sold in China. China’s critical role and inroads in global supply chains is unlikely to change, notwithstanding the political rhetoric of the day. Shanghai is home to Tesla’s first gigafactory abroad. Instead, we think that in order to find common ground and resolve their problems amicably, both nations should put an end to their geostrategic rivalry and instead work toward communication and cooperation on matters like trade and climate change. Too much is at stake to be used as a political football.

China too has turned inward but dominates its backyard, taking advantage of America’s inconsistent policies and isolationist stance. Vice President designate Walz spent a year teaching in China in 1989 and visited China 30 times which might help improve ties. Needed because after China’s quinquennial third plenary session, China is set to grow even faster with a supply-centric growth model designed ironically to reduce its technological dependence on the US. The country’s GDP will grow 4% plus due to strong exports, infrastructure spending to offset weaker household spending.

The Chinese are gradually bringing the renminbi global; they are purchasing oil in the Middle East with its money and developing a competing financial settlement system (CIPS) to the Western SWIFT system. China is a major player in BRICS+, a group that now includes all of Latin America. Together, these countries account for over half of the world’s population, which increases their economic clout and further isolates the United States. In contrast, just 11% of the world’s population lives in the US and western Europe. China is willing to support its partners if the solitary US is not. The Chinese spoke with both Gaza players and hosted the foreign minister of Ukraine to discuss possible peace negotiations with Russia in just one week.

American Exceptionalism

Another problem with Trump’s exceptionalism is his belief that the president should have a say on interest rates and monetary policy and thus job one might be reshaping the “independent” Federal Reserve, running the risk of destabilizing the nation’s monetary and fiscal credibility. Trump promises to reduce interest rates, but he can’t control rates. The Fed sets rates. The Fed is the overseer of the economy and with Bidenomics adding to the inflationary pressure by boosting demand, the Fed is under constant pressure to lower rates.

Although Fed Chair Jay Powell was appointed by Trump in 2017, Mr. Powell might not be so lucky when his term expires in 2026. After all, inflation reared on his watch and first believing inflation was transitory, now believes it is here and higher for longer. Further, after refashioning the Supreme Court in his first term, Mr. Trump has unfinished business in remaking the Federal Reserve and Mr. Powell’s reappointment is not a sure thing. Yet pressuring the Fed is not without precedent. In the 70s, President Richard Nixon pressured Fed Chairman Arthur Burns to keep monetary policy easy to boost his re-election chances. Inflationary pressure consequently surged to double digit levels and of course it was left for Fed Chairman Paul Volcker to clean up the damage with double digit rates and the worst recession in modern times.

And after transforming the Grand Old Party (GOP) in his own image, should Mr. Trump return, he promises on remaking America great again but unlike his first term, he will hold virtually all the levers of power, from the courts, to the military, threatening democratic norms. He also promises to refashion the civil service with thousands less and on his retribution hit list are the regulatory bodies from the FBI to the SEC. The office of the president will be used to settle scores and after the “Big Lie,” is there a Big Lie 2.0 in the offing, should he lose?

Be Careful What You Wish For

At some point policy or prices will need to adjust. Unfortunately not all adjustments are created equal. We believe that America’s goal to inflate their way out of their problems will steepen the yield curve. That’s happened recently. Price controls, handouts to Türkiye’s voters, and years of extremely low interest rates contributed to hyperinflation, which in 2022 caused inflation to reach 85%. The experiment came to an abrupt end last month when inflation dropped to 70% due to a subsequent increase in interest rates. Today the role of an independent Federal Reserve is all-important as political polarization and budget deficits “as far as the eye can see” has resulted in the Treasury financing US debt in the short-term market rather than 10 or 30-year bonds which exposes the Treasury to interest rate risk. Divergence is also evident with the Japanese yen, renminbi and lira falling against the dollar. As the dollar’s role as the world’s reserve currency allows America to finance their debt, the demand for dollar-denominated debt remains. America’s “exorbitant privilege” and the credibility of the Federal Reserve would be at stake if the fiscal trap was to be tested by Mr. Trump causing a perfect storm that would undermine both America’s economic and financial stability.

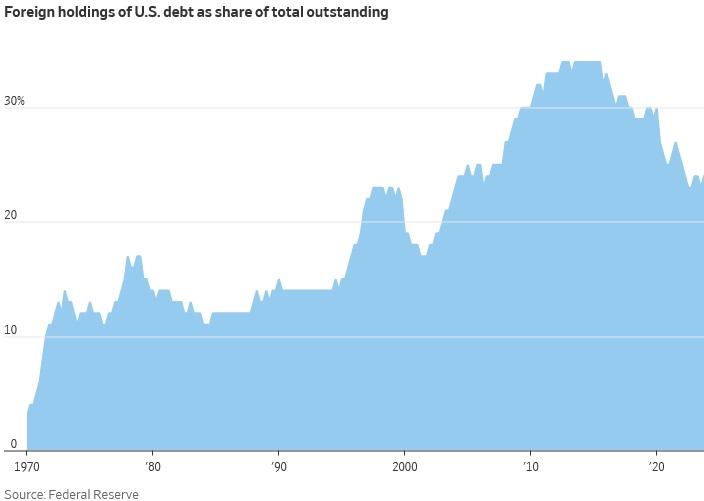

As such any changes in the dollar echoes around the world. Mr. Trump would like to devalue the dollar to help domestic exports and lower the trade deficit of $750 million dollars. Yet the world’s reserve currency has been strong and overvalued whilst other currencies have been weak, due to higher rates in the United States. However, both candidates’ embrace of protectionism and spending ensures the continuation of inflation which paradoxically boosts the dollar. However increased tariffs discourages foreign capital flows needed to finance America’s twin deficits and while foreign borrowings peaked two years ago, the Fed is forced to keep printing dollars to fill the financing gap. This environment creates risk of a currency war. America’s hegemony looks more vulnerable than ever, particularly since dueling tariffs would see trading partners retaliate, hurting US exports which ironically could cause the dollar to crash as it did in the 1970s. The dollar is not forever.

Given that both candidates have chosen to ignore the debt crisis, it is important to look at history which shows that increases in federal debt to fund a government’s spending bonanza can only be financed in three ways. One, the Fed could borrow from domestic sources, or two, borrow from foreigners or, the printing of money. While asset purchases under quantitative easing ended two years ago, the Fed owns $6 trillion of Treasury notes or 20% of issuances. Worse, the mark to market unrealized loss is $1 trillion against the Fed’s paltry $43 million of capital which imposes unique risks to the Treasury and taxpayers. Since the US abandoned the gold standard over a half century ago, the printing press has been working overtime, creating more money than in any other period in history. That money creation debases the country’s currency. History does repeat. Today foreign holdings of US Treasuries make up almost a third, according to the Treasury Department, but the biggest holders are reducing their stakes. Japan’s holdings fell to $1,128 billion and China, No. 2 fell to $780 billion. America depends on foreigners to finance its consumption – that is their Achilles heel.

There have been many failures in the history of money. Every fiat currency from the Romans to the Turkish Lira where governments spent more than they brought in ended in collapse and hyperinflation. But is America really on the brink of hyperinflation? Not now, but the experience of the 1930s is a useful guide. First, we are concerned that tariffs and the beggar-thy-neighbour policies of today raises parallels to the Weimar Germany hyperinflation when tariffs on agriculture skyrocketed in 1930, helping trigger hyperinflation. Second, America’s finances are in disarray, needing outside help. Third, democracy is under siege. Fourth, America’s debt today surpasses that of Weimar Germany and dollar usage has declined to 58% of the world central bank reserves this year, or a drop of 14% since 2002. In our view, the experiences of the 1930s with a cycle of competitive devaluations and tariff increases are lessons and as the situation worsens, nations are uniting into competing economic blocs to challenge US hegemony.

Political upheaval, massive post-war debt, and deficit spending that culminated in the Great Depression plagued the Weimar Republic. After the First World War, the central bank produced billions of marks to pay its bills, causing uncontrollably high inflation that eventually led to the Weimar hyperinflation. The dollar was worth four marks and twenty pfennigs on August 1, 1914. Just nine years later, in November 1923, the dollar was valued at 4.2 trillion marks. The mark was worth so little by then that labourers received five paychecks a week, and spouses rushed to buy anything before the marks became worthless. Although the current state of inflation in America is far from the hyperinflation that plagued Weimar Germany, there are concerning similarities dating back more than a century, beginning with the conditions reminiscent of the Roaring 20s. And today as before, despite economists’ obituaries on inflation, voters’ main concerns are rising grocery bills, rising restaurant and gas prices which is largely excluded from the index. It is not so different this time.

Gold’s Hedge Against Uncertainties

Gold was always held as a protector of wealth due to its record of long-term price stability. Gold is up 22% so far this year, breaching a 10-year base to new all-time highs at $2,500/oz. Having met our interim target, we continue to believe it will top $3,000/oz. As part of a de-dollarization push, central banks led by China have increased their holdings over the past three years, buying nearly a third of the world’s annual output of gold, increasing their share of reserves at the expense of the dollar, reflecting heightened concern over the US government’s failure to control its profligate spending (notwithstanding the debt ceiling charade) and the subsequent monetary explosion. At the upcoming October BRICS summit there is talk of a BRICS currency basket backed by gold.

Hyperinflation? It can’t happen here. Yet history shows that it can happen to any nation that creates inflation as an acceptable price for growth or debt management. The more America’s debt trap is ignored, the higher the risks of competitive devaluation and currency wars. Simply, the system today is a series of ad hoc arrangements of floating exchange rates with no discipline as reserve creation and inflation show. American economist Milton Friedman once said, “There is only one way to cure inflation, for the Fed and government to spend less and create less money.” Neither candidate is advocating that.

As a result, we think that demand for gold is rising again as worries about the state of the world economy and the increasingly unstable geopolitical situation from the Middle East to Asia to the US intensifies. Central bank purchases coincidently picked up after America froze Russia’s foreign exchange reserves. And in fact, central banks were net buyers since the financial crisis of 2008. And, at long last there have been net inflows of 90 tonnes into gold backed ETFs reflecting surging retail demand. The World Gold Council reported that gold demand increased 4% in the second quarter as part of the longest period of gold accumulation since 1950-1965 when they acquired 7,000 tonnes of gold following the Second World War. Meantime the Shanghai Gold Exchange has developed into the largest physical gold player in the world, aided in part because China has become the world’s largest producer and consumer of gold. By purchasing gold, they understand the fragility of the system, and the US dollar. To them gold is an alternate currency to the dollar and, store of value. For the first time in history, a standard 400 troy ounce gold bar is worth more than $1 million.

Recommendations

In the latest quarter the big gold miners recorded huge free cash flow, allowing for bumper returns to shareholders from the reduction of debts, buybacks and the boosting of dividends. Gold is supply constrained. Mining companies face many challenges, including the replacement of depleting reserves. Also countries in Africa and elsewhere are attempting to capitalize on the rising gold price, extracting higher royalties, or in some cases outright nationalization. In Canada, the Yukon government used the courts to takeover gold producer Victoria Gold as compensation for a cyanide spill. Major discoveries are rare, as the low hanging fruit has been plucked and for those fortunate to discover new deposits, it could take hundreds of millions of dollars and up to 10 years before the first gold pour. Consequently to shorten the long-cycle, the M&A takeover game of musical chairs is expected to continue, but with fewer free chairs available, it is still cheaper to buy ounces on Bay Street than to explore. Gold Fields for example is buying the other half of Osisko’s Windfall for $2.1 billion at a whopping 55% premium, reflecting the scarcity of development situations.

Yet not all development projects are equal. First there are the projects that have recently come on stream when the gold price was lower and economics at the time factored in a price of $1,200/oz such as Lundin Gold’s Fruta del Norte which went into production last year. And the margins are so good that they were able to purchase a streaming obligation, further enhancing shareholder returns. Today development projects are using higher price decks and the need for higher IRRs potentially dims future projects. Then there are the overbudget development projects that appear profitable but longer-term returns are abysmal. IAMGOLD’s Côte comes to mind or Kinross’ Tasiast. Then there are jurisdictional differences with some projects good on paper but unrealistic in reality. Mexico for example has proposed a ban on open pit mining, precluding many good-looking projects.

As such we continue to emphasize the growth oriented senior producers such as Barrick and Agnico Eagle as well as developers like B2Gold, McEwen Mining, Eldorado and Endeavour Mining which are bringing on new mines within the current gold bull cycle and will benefit from the expected rotation from the seniors into the development plays.

Agnico-Eagle Mines Ltd.

Agnico Eagle had a barn burner quarter producing 896,000 ounces generating free cash flow of more than $500 million or $1.12 per share allowing for the reduction of $250 million of debt and the allocation of another $50 million for exploration at Detour, Malartic and Hope Bay. Cash cost was a low $870/oz, guiding at $1,250/oz for the year. Agnico also increased liquidity to $2.9 billion and possesses a stellar balance sheet of $900 million of cash and debt under $1 billion. Canadian Malartic and Nunavut mines, Meadowbank and Meliadine performed well in the quarter benefiting from the wider margins. Agnico’s Odyssey is developing as the largest underground mine in Canada with ramp development ahead of schedule and 23 rigs turning. At Upper Beaver about $50 million will be spent as plans unfold for a separate mill. An update outlined plans for Detour underground to become a one-million-ounce producer annually over the next 14 years, beginning 2030. Agnico is a low-cost producer with a growing project pipeline and is the largest Canadian producer in Canada with mines in Finland, Mexico and Australia. We like the shares for its stable production, growth pipeline and execution capabilities.

Barrick Gold Corp.

Barrick had a strong quarter producing 950,000 ounces of gold at an all in cost of $1,500/oz. Barrick also produced 95 million pounds of copper, and the company generated $340 million in free cash flow. Barrick maintained its guidance of 4.1 million ounces this year at all in cost of $1,400/oz. The company restarted production at New Porgera in PNG. Meantime the plant expansion at Pueblo Viejo in the DR will enable potential 800,000 ounce annual production for 20 plus years. Similarly, Nevada Gold joint venture’s Goldrush continues to ramp up and will produce 400,000 ounces annually in a couple years. Barrick also expanded Fourmile, a likely extension of Goldrush and close to infrastructure with a 2.5 km strike length. Barrick has 10 rigs turning on expectations that it will be a major contributor. Nevada JV already hosts three Tier 1 mines with Fourmile a potential fourth. Meanwhile Reko Diq in Pakistan and the Lumwana copper superpit feasibility studies will be tabled before yearend which could significantly boost Barrick’s copper output in a couple years. Barrick is the world’s second largest gold producer and the company has the largest array of Tier 1 assets with an expanding organic growth profile. We like the shares here.

B2Gold Corp.

B2Gold’s quarter was a miss because B2Gold’s flagship Fekola mine had equipment issues. Also Masbate’s results were lower. B2Gold produced 213,000 ounces at an all in cost of $1,267/oz but the company lowered guidance by about 50,000 ounces. It is expected that the equipment issues will be resolved and B2Gold’s main mines should produce about 650,000 ounces this year. Otjikoto performs well. Management is negotiating with the Mali government over clarity of the 2023 mining code, which potentially could have an impact on the receipt of the exploitation permit for the expansion of Fekola Regional. Importantly B2Gold is also preparing for the final construction at Goose in Back River Nunavut. The open pit and underground mine is dependent and a company builder upon winter access. The project is expected to be in production Q2 2025. Also a revamped Gramalote feasibility study is expected next year. B2Gold has $500 million in cash and a $700 million line sufficient to build out Goose. We like the shares here.

Centamin PLC

Centamin had a strong quarter at its Sukari mine in Egypt. Cash cost was below $850/oz and all in at $1,350/oz. Sukari’s underground operations are ramping up and costs trended down on a unit basis. Centamin’s balance sheet improved with cash and cash equivalents of $110 million. In the first half, Centamin produced 225,000 ounces. The company has a policy of distributing 30 percent of cash flow and is a consistent dividend performer paying out over 11 years. Centamin maintained guidance between 470,000 ounces and 500,000 ounces for the year and the balance sheet has $350 million in liquidity, including a $150 million undrawn facility. Costs were lower due to changeover from contract to owner mining. In addition, the company has an aggressive drilling programe at their large Eastern Desert (EDX) concession which has yielded two targets, Little Sukari and Umm Majal, only 20 or so kilometers from their existing mill. Buy.

Centerra Gold Inc.

Centerra had a decent quarter producing 90,000 ounces of gold from Mount Milligan and Öksüt in Türkiye at AISC of $1,200/oz. Mount Milligan generated $2 million in cash and $14 million in free cash flow despite lower recoveries. Centerra sold almost 3 million pds of moly and the Thomson Creek Mine feasibility is expected in the fall which to date has been a money loser. Centerra has no debt and almost $600 million of cash allowing for the repurchase of 1.78 million shares under its NCIB. Operations at Öksüt were in line with guidance and the company should produce about 370,000 to 410,000 ounces this year. Centerra has a great balance sheet but lacks a flagship asset. Sell.

Eldorado Gold Corp.

Eldorado produced 122,000 ounces in the second quarter, in line with expectations. Grades were better at Lamaque in Québec, Efemçukuru and Kışladağ in Türkiye. In the second half, Eldorado is on track to produce between 500,000-550,000 ounces at all in cost of $1,331/oz. Eldorado is building out the Skouries copper/gold project in Greece which is a company builder and about 76 percent complete. Commercial production is expected at the end of 2025. Detailed engineering is now 72 percent complete, and Eldorado expects to spend around $375 million to complete the project. At Eldorado’s second mine Olympia in Greece, second-quarter production was 13,000 ounces in line with expectations. At heap leacher Kışladağ in Türkiye, second-quarter production was almost 30,000 ounces. Eldorado’s balance sheet has $810 million of liquidity, including almost $600 million of cash and $215 million of available credit. We are bullish on Eldorado because of a solid production base of Kışladağ, Lamaque and potential flagship Skouries. Buy.

IAMGOLD Corp.

IAMGOLD repurchased the 10 percent stake in Côté Gold from Sumitomo as commercial production was achieved in August. Nonetheless about $250 million remains to be spent on the overbudget and overdue Côté (capex $3 billion plus) manageable since they have $511 million of cash following a 72 million share issuance that yielded $300 million. IAMGOLD is a mid-tier producer with Côté, Westwood mine and Essakane gold mine in Burkina Faso. IAMGOLD produced 166,000ounces in the quarter, but at an all in cost of $1,600/oz. In our view IAMGOLD’s big bet on Côté is a potential company destroyer with significant downside risk from a risk/reward point of view given expectations of bottlenecks, continuity and ramp-up problem. Low grade Essakane is expected to produce 400,000 ounces this year, but at AISC of $1,700/oz. We do not share the Street’s optimism and thus suggest sell.

Kinross Gold Corp.

Kinross had a strong quarter with $174 million of free cash flow from 535,000 ounces produced at AISC $1,400/oz from Round Mountain and Tasiast. Kinross’ big bet is on Great Bear in Ontario and they will finally release next month the long-awaited PEA concerning an open-pit and underground operation. The miner spent $1.8 billion to acquire Great Bear yet shareholders still do not know how big or the cost or feasibility of the project. Although Kinross has released some results, Great Bear is still too far off to influence the stock. On the other hand, 70% owned Manh Choh project was on time and Fort Knox in Alaska modifications should be complete by the end of quarter. Kinross’ Tasiast produced 162,000 ounces and after 10 years is finally running at nameplate capacity. Paracatu produced 130,000 ounces and La Coipa 62,000 ounces. With the big Great Bear build ahead and possession of largely mature mines, Kinross shares will be non-performing. We prefer B2Gold here.

Lundin Gold Inc.

High-grade Lundin Gold had a strong quarter producing almost 133,000 ounces, processing 4,700 tpd at 11 g/t and confirmed guidance at 490,000 ounces or so with all in cost of under $900 an ounce. Fruta del Norte (FDN) in Ecuador is one of the richest mines in the world allowing Lundin to buy out the 100% Newmont Stream Facility offtake agreement, a legacy of the past. Lundin has spent $30 million dollars to boost plant output and has initiated an aggressive exploration with 10 rigs turning. Bonza Sur’s epithermal gold mineralization now extends 1.6 kilometers while FDN East yielded high-grade results. Given the robust cash flow, Lundin doubled its dividend to a healthy 5% yield and its balance sheet has $258 million of cash. We like this low-cost operator for its total return possibilities. Buy.

New Gold Inc.

New Gold had a disappointing quarter, but the company had positive free cash flow producing 69,000 ounces of gold and 13.6 million pds of copper. New Afton in BC produced 18,300 ounces and Rainy River in Ontario produced approximately 50,000 ounces. New Afton’s all in cost was almost $1,400/oz due to 14% increased copper production. With the amended Ontario Teachers agreement, the accounting liability was partially extinguished, allowing for the posting of additional revenues. At Rainy River waste stripping was again the focus as this low-grade operation needed to access better grade ore in the pit. The lower grade Main Zone accounted for the disappointing output. Nonetheless New Gold maintained its guidance. We prefer Eldorado here.

Newmont Corp.

The world’s largest gold producer, Newmont produced 1.6 million ounces of gold generating $1.4 billion of cash flow from operations or almost $600 million in free cash flow in the second quarter which allowed for the retirement of $250 million in debt. Cerro Negro in Argentina is up and running while operations at Telfer and Cerro Negro were temporary shutdown contributing to higher costs. Newmont is getting close to divesting six non-core assets by year-end that were part of the Goldcorp and Newcrest acquisitions. We believe the estimated $2 billion of asset sales (Porcupine, Musselwhite, Éléonore, CC&V, Akyem and Telfer) will be disappointing because most are modest second-tier assets with about 1.2 million ounces of total production. Porcupine in Ontario for example has a healthy reclamation liability. Newmont maintained its production guidance at 6.9 million ounces at AISC of $1,400/oz with expectations of temporary declines in output from Lihir (maintenance) and Cadia (block sequence). Newmont continued $1 billion of buybacks, useful since their recent acquisitions were accomplished with paper. We prefer Barrick here with a lower cost structure, larger collection of Tier 1 mines and superior growth profile.

John R. Ing

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/research-reports/

********