With the action seen in recent weeks, Gold is in a confirmed downtrend with our 72-day cycle, a move which is anticipated to end up as countertrend – though it looks to have further to run. Stepping back, the bigger picture view for Gold is projected to remain bullish into the late-2025 to early-2026 window.

Gold, Short-Term

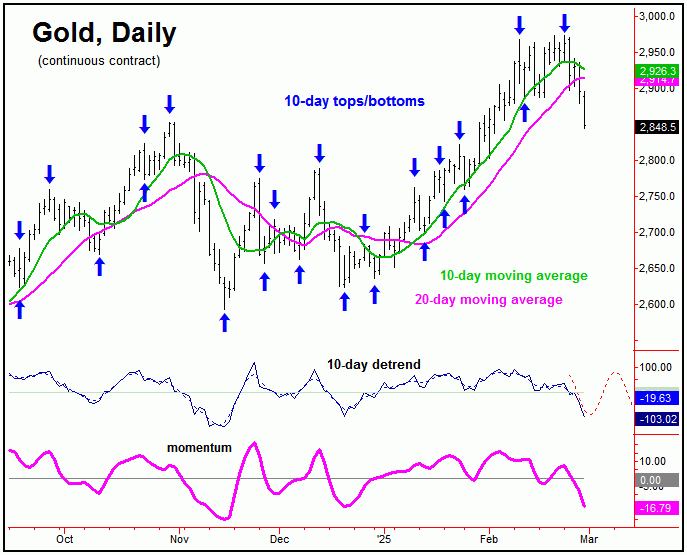

For the very short-term, the 10 and 20-day cycles are seen as heading lower for Gold, with the next smaller-degree trough expected to come from these waves – which are into bottoming range. Once this low is in place, we would expect to see a quick rally back to the 10 and 20-day moving averages:

Adding to the notes above, the next upward phase of the 10 and 20-day cycles could set up the right shoulder of a ‘head & shoulder’ pattern on the daily chart, before giving way to lower lows with our larger 72-day wave into the late-March to mid-April timeframe.

The 72-Day Cycle

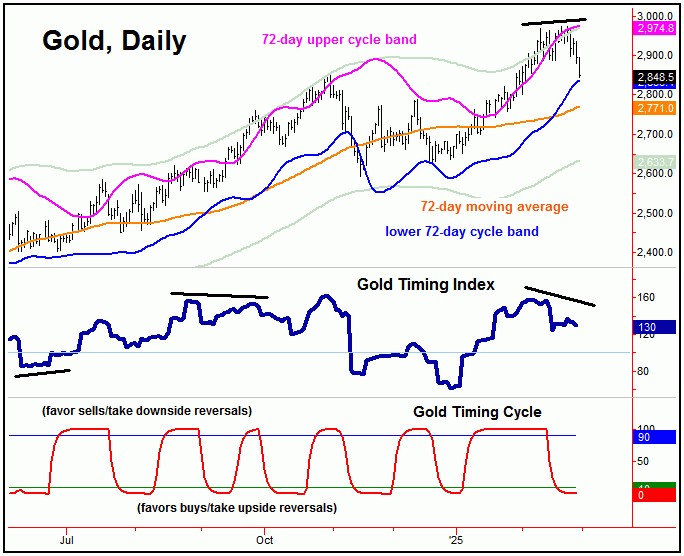

As mentioned in my last article, the next peak of significance was due to materialize for Gold, coming from our bigger 72-day cycle, which is shown on the chart below:

The downward phase of this 72-day cycle was recently confirmed to be in force, and with that is seen as pushing south into the late-March to mid-April timeframe – as projected by the detrend that tracks this wave.

In terms of price, we noted in our Gold Wave Trader report that the ideal path was looking for a minimum drop back to the lower 72-day cycle band – which we came within earshot of hitting in Friday’s session. Having said that, the more ideal path favors a drop back to the 72-day moving average or lower before this cycle bottoms, then to be on the lookout for its next trough to form.

In terms of patterns, the current correction phase of this 72-day cycle is favored to end up as countertrend, holding above its prior trough – which is the November, 2024 low of 2592.70 (April, 2025 contract). Once this wave bottoms out, its average rallies – when coming off a ‘higher-low’ – have been some 13-14%, thus giving us some idea of how its next upward phase could resolve.

The 310-Day Cycle

With the downward phase of our 72-day wave now in force, there is the potential for an extended peak to have formed with our bigger 310-day component, which is shown again on the chart below:

Supporting evidence for a potential extended 310-day cycle top in place is the recent divergence in our 310-day detrend indicator. If this cycle were to have peaked, then an eventual drop back to the 310-day moving average would be expected in the coming months.

Otherwise, the alternate path would favor a 72-day cycle low into the aforementioned late-March to early-April window, followed by a push back to new highs into May – before turning hard south again into mid-to-late June, where the 310-day detrend has readjusted its next projection for a bottom.

For the bigger picture, I still think the next mid-term buy for Gold will still come from a late-Spring, 2025 price trough. In terms of patterns, this correction is favored to end up as countertrend – either with the 72-day cycle, or the combination of 72 and 310-day cycles – before giving way to another sharp (13-20%) rally in the months to follow.

Gold Technical Signals

In terms of technical action, of key note comes from an indicator we track, called the Gold Timing Index, and which is shown on the following chart:

Of note is that, at the most recent new price high, our Gold Timing Index managed to form a decent divergence – a signal which has not been seen since the October, 2024 top for Gold. This is key, as a divergence between this indicator and price is a pattern normally seen near 72-day cycle (and/or 310-day) price peaks.

Going further with the above, a divergence between our Gold Timing Index and price can also appear at key lows, as it did last June – at the 72-day trough that formed there. This divergence is something that we will be watching closely in the coming weeks, should it develop, as it would be a strong signal that our next key bottom is forming. Stay tuned.

Jim Curry

The Gold Wave Trader

Market Turns Advisory

http://goldwavetrader.com/

http://cyclewave.homestead.com/

*******