Gold and silver are bullish and ready to be bullish, respectively.

The gold price has pierced our initial target (2450) off of the pattern break above 2030-2070. The larger technical target is, as I’ve been projecting since 2020 (based on the Cup with a Handle that was yet to come), 3000+.

The question now is whether a potentially parabolic move in gold will get there sooner, rather than later. If it does go there sooner, we have reason to believe the gold price (as opposed to the inherent value of gold) will then be quite vulnerable to the broad market’s oncoming bear (in my opinion). Gold has been a leader of the broad rally, after all.

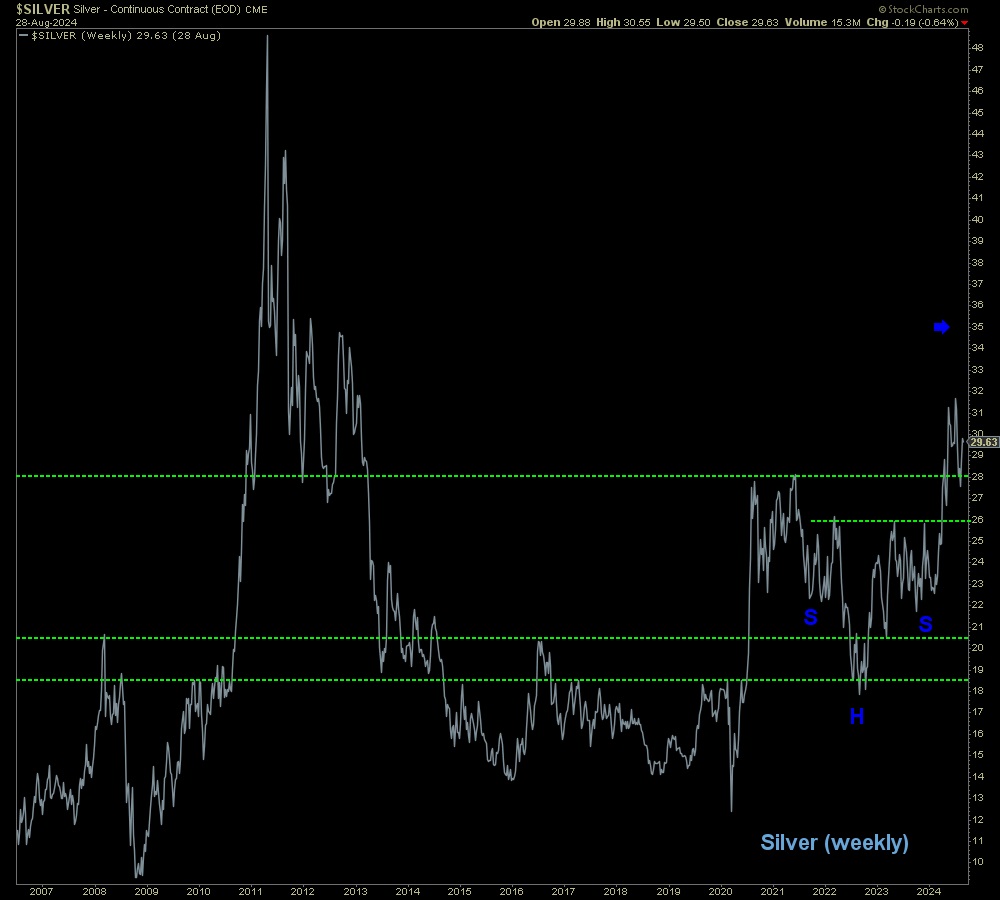

The silver price has a long-held target of 35, based on the noted Inverted H&S pattern from which it broke out earlier this year. I would think, however, that if gold elects the “3000+ blow-off” option, silver might challenge the old Hunt Brothers high and 2011 high of 50, if it takes leadership and does as silver often does during precious metals bull phases.

The bottom line is that it will probably be an end to the current bull phase if we see gold at 3000 and silver at 50, as opposed to an earlier correction (e.g. silver from 35 or so). But it sure would be profitable in the meantime. Which is why I want to pay close attention now for signs of a brewing acceleration and blow-off (longer-term bearish) or signs of a nearer-term correction (longer-term more healthy).

Just some thinking aloud for you. You, of course, may have your own opinions.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

*********