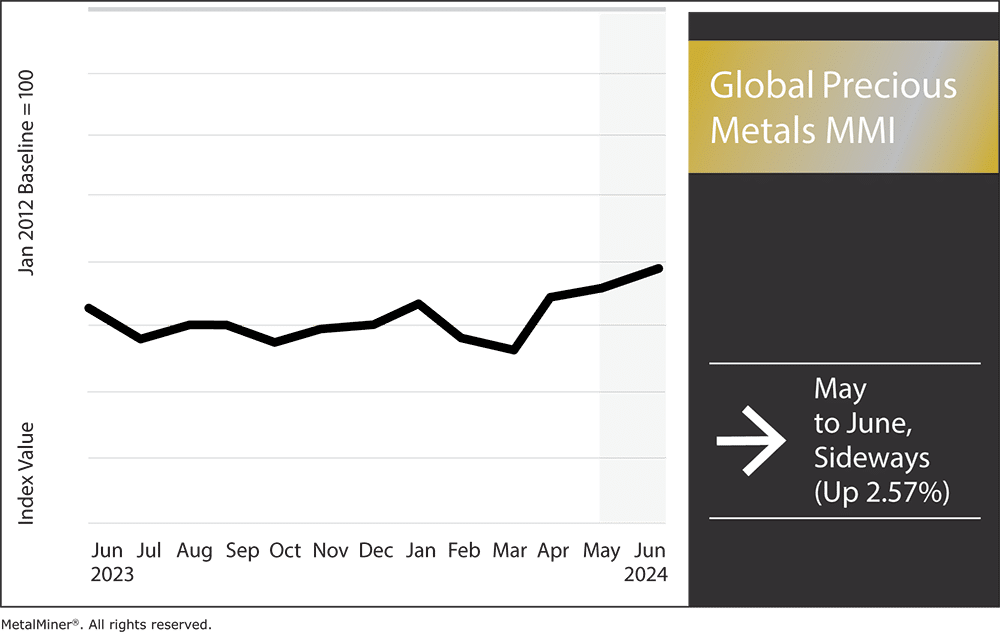

The Global Precious Metals MMI (Monthly Metals Index) showed slight upward price action month-over-month, rising by 2.57%. Despite this, the overall trend of the index held sideways. In terms of specific precious metal prices, platinum and silver experienced upward price action through May before retreating back into range at the beginning of June. This served to pull the index down. Meanwhile, gold and palladium remained sideways. All of this together held the index firmly horizontal.

At the moment, uncertainty remains within many precious metal markets as to long-term trends.

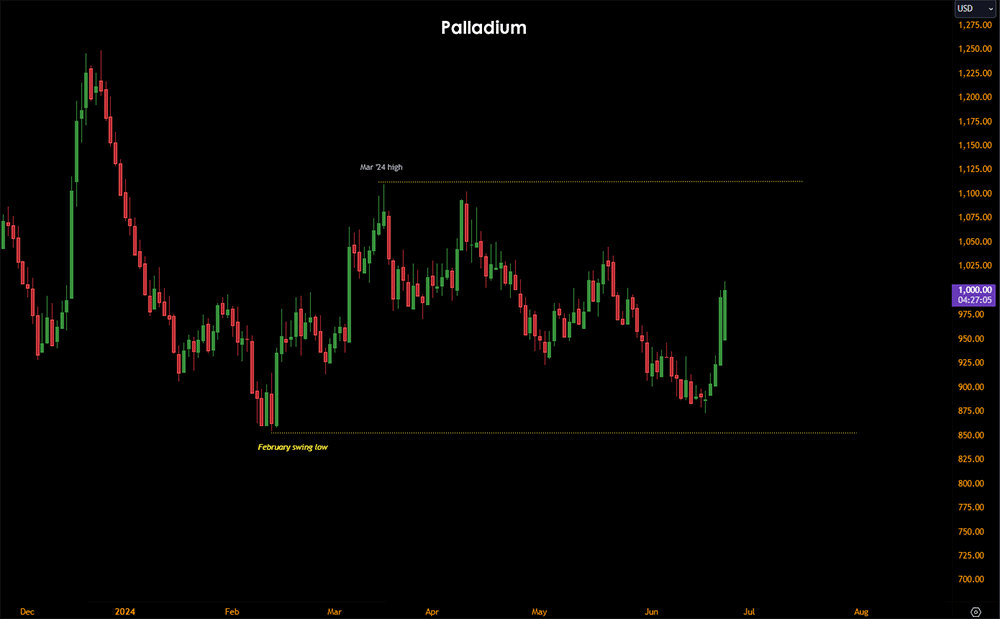

Palladium Prices Remain Sideways

Palladium prices have traded in a sideways range since the start of Q2. After prices failed to breach their March 2024 high, the trend quickly reversed and declined back toward February 2024 levels. Price would need to break above the March high to establish an uptrend. Should prices continue to trade sideways, palladium markets will remain uncertain.

Empower your precious metal investments with the latest market analysis and strategic advice during times of uncertain price directions. Sign up for MetalMiner’s free weekly newsletter here.

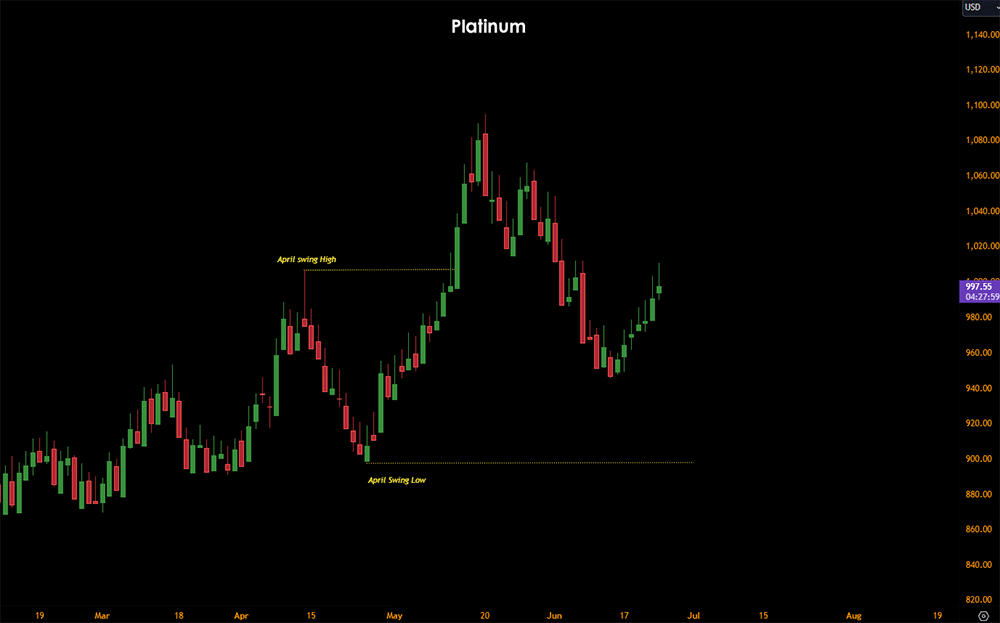

Precious Metal Prices: Platinum

Like other precious metals, platinum prices declined back into range after breaking out to the upside in late May. After breaking through the April swing high, prices quickly reversed and declined back to Spring 2024 levels. Meanwhile, recent price action shows a short-term uptrend, which could signal a potential reversal to the upside. Should prices continue in this direction, it would confirm a higher low and push prices back to the upside.

Silver Prices Lack Bullish Price Action

Silver markets edged lower after reaching a peak in late May. As prices continue to form lower highs in the short term, price action will expectedly decline, as there is no real bullish momentum driving prices into an upside reversal pattern. Uncertainty remains in this market as the current trend does not indicate either bullish or bearish sentiment.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights.

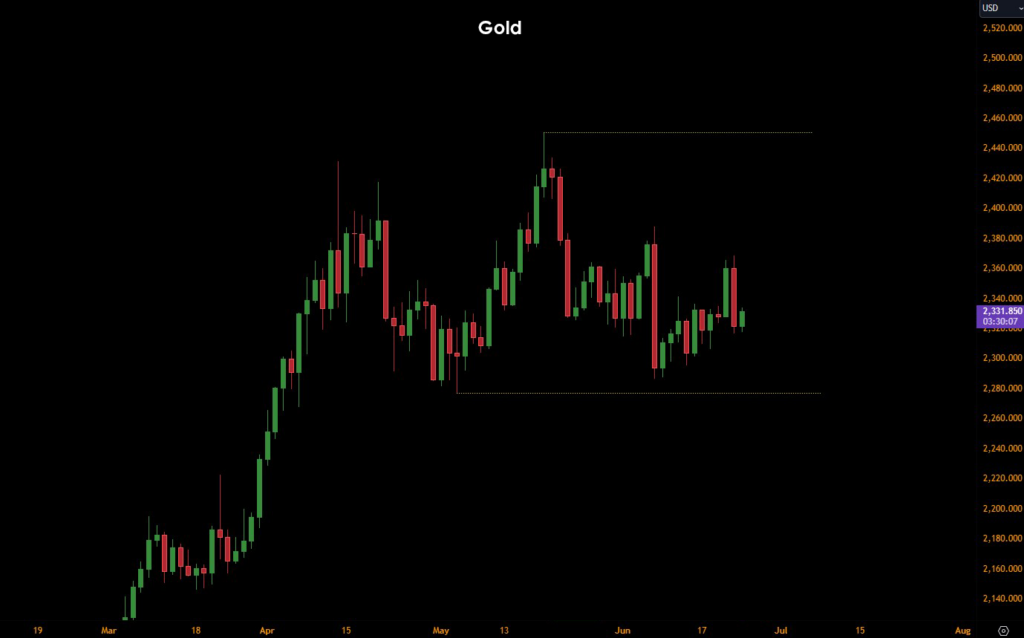

Precious Metal Prices: Gold

As gold prices begin to come off their all-time high peak, price action has now formed lower highs, which could indicate potential downside reversals for gold in this upcoming quarter. The current trend will likely trade within its range until bullish or bearish momentum drives gold markets into new highs or causes them to break new lows.

Global Precious Metals MMI: Noteworthy Moves in Precious Metal Prices

MetalMiner Insights is your key to risk-mitigating strategies, view our full catalog of covered metals.

- Palladium bars moved sideways, only rising by 0.22%. This brought prices to $931 per ounce.

- Platinum bars rose by 10.29% to $1,029 per ounce. Despite this, prices began falling from that rally at the beginning of June.

- Silver ingot prices also rose considerably month-over-month. In total, they shot up 18.12% before retreating at the beginning of June. Prices at month’s start sat at $31.23 per ounce.

- Finally, gold bullion prices moved sideways, rising by 2.34%. This left prices at $2,341.80 per ounce.