Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

EVs Now 22% of World Auto Sales

Global plugin vehicle registrations were up 15% in June 2024 compared to June 2023. There were 1.5 million registrations. BEVs were up by just 4% YoY, but plugin hybrids jumped 41% YoY, selling over 500,000 units, a new record.

In the end, plugins represented 22% share of the overall auto market (14% BEV share alone). This means that the global automotive market remains in the Electric Disruption Zone.

Year to date, plugin electric vehicle market share was up to 18% (12% BEV).

Full electric vehicles (BEVs) represented 63% of plugin registrations in June, keeping the year-to-date tally at 64% share.

If we add plugless hybrids to the June tally, all 1.1 million of them, we get a total of 2.6 million registrations, or 38% of total global sales. That means that over a third of global sales already have some form of electrification.

20 Best Selling EV Models in the World in June

Back to June’s best sellers, while the Tesla Model Y is in the lead (as usual) with some 119,000 registrations, it was down 10% YoY. Below it we have the Tesla Model 3, which profited from Tesla’s usual end-of-quarter peak to jump into the runner-up position with 65,000 registrations. But despite this good result, the sedan dropped 5% YoY.

As for BYD, the Shenzhen make placed 7 representatives between the 3rd and 10th position! BYD’s 2024 War on ICE (aka price cut war) is indeed paying dividends.

The only intruder in a top 10 filled with the Tesla and BYD fleets was the new Li Xiang L6, with the midsize SUV registering close to 24,000 units in only its 3rd month on the market, allowing it to be 7th in June. Will the startup model be able to break into the top 5?

In BYD’s looong lineup, the highlight was the brand new Qin L, which immediately joined the top 10 in its landing month, with 18,021 registrations. This new model could be connected to the Qin Plus’s somewhat slow month in June, as both occupy a similar place in the OEM lineup.

Zeekr saw its flagship 001 model end in 16th, with 14,600 sales, its third record result in a row thanks to the recent refresh of the veteran model (because a model that’s three years old can be considered as such in the Chinese EV industry…).

Elsewhere, Xiaomi’s star EV, the SU7, a Model S-sized car that somehow resembles a Porsche and yet costs Model 3 money, joined the top 20! With the striking sedan now in #17, expect it to continue climbing positions throughout the year, with a top 10 position likely to come before year end.

Still on the top 20, a final mention goes out to Volkswagen’s ID.3 and GAC’s Aion Y, which scored their best results this year. The German hatchback reached #14 with some 17,000 registrations, while the Chinese crossover-MPV did even better, ending in #13 with 17,300 registrations.

Off the table, the highlight comes from the Volvo stable, with the recently introduced EX30 hitting a record 11,711 registrations. With deliveries stabilizing in Europe, the small crossover is now being launched in China, so expect the growth trajectory to continue. We might even see it in the top 20 soon.

Another model shining was the Hyundai Ioniq 5, with 10,048 sales, its best result since last August. Similarly, both the Audi Q4 e-tron (10,825 units) and MG4/Mulan (12,410) hit year-best scores.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Finally, a reference goes out to the fact that both Wuling best sellers, the tiny Mini EV and the Bingo, were left out of the top 20, this being the first time in years that the Liuzhou-based make does not have any representative there. A coincidence? Or is there something running deeper here?

Top 20 EV Models YTD

In the year-to-date (YTD) table, the Tesla Model Y and BYD Song continue firm in the top positions, while the Tesla Model 3 profited from its end-of-quarter peak to surpass the BYD Qin Plus in June and end the first half of the year in 3rd.

Interestingly, the podium positions at the end of the first half of 2024 exactly replicate the 2023 and 2022 final standings, with the Tesla Model Y on top, followed by the BYD Song and Tesla Model 3. And it doesn’t seem like there will be more changes to the podium by the end of the year, so 2024 will be the 3rd year in a row with the same podium standings. Boooring….

The next position change happened in 7th, with the BYD Destroyer 05 continuing to rise and now switching with the Aito M7, which is now in 8th.

Elsewhere, GAC’s Aion Y recovered some positions in June, with the crossover-MPV climbing to 13th. Thanks to a strong month, the VW ID.3 climbed two positions, to 16th.

Finally, due to a slow month from the Changan Lumin, both the BYD Tang and AITO M9 climbed one position each, which is somewhat on trend with what is happening — small city cars losing relevance while full size models continue to rise.

Right now, there are as many A/B segment models (five) as there are E/F segment models in the top 20. And with the little Changan Lumin at #20, and the full size Zeekr 001 at #21, we might even see 6 full-size models in July, versus 4 of the little ones….

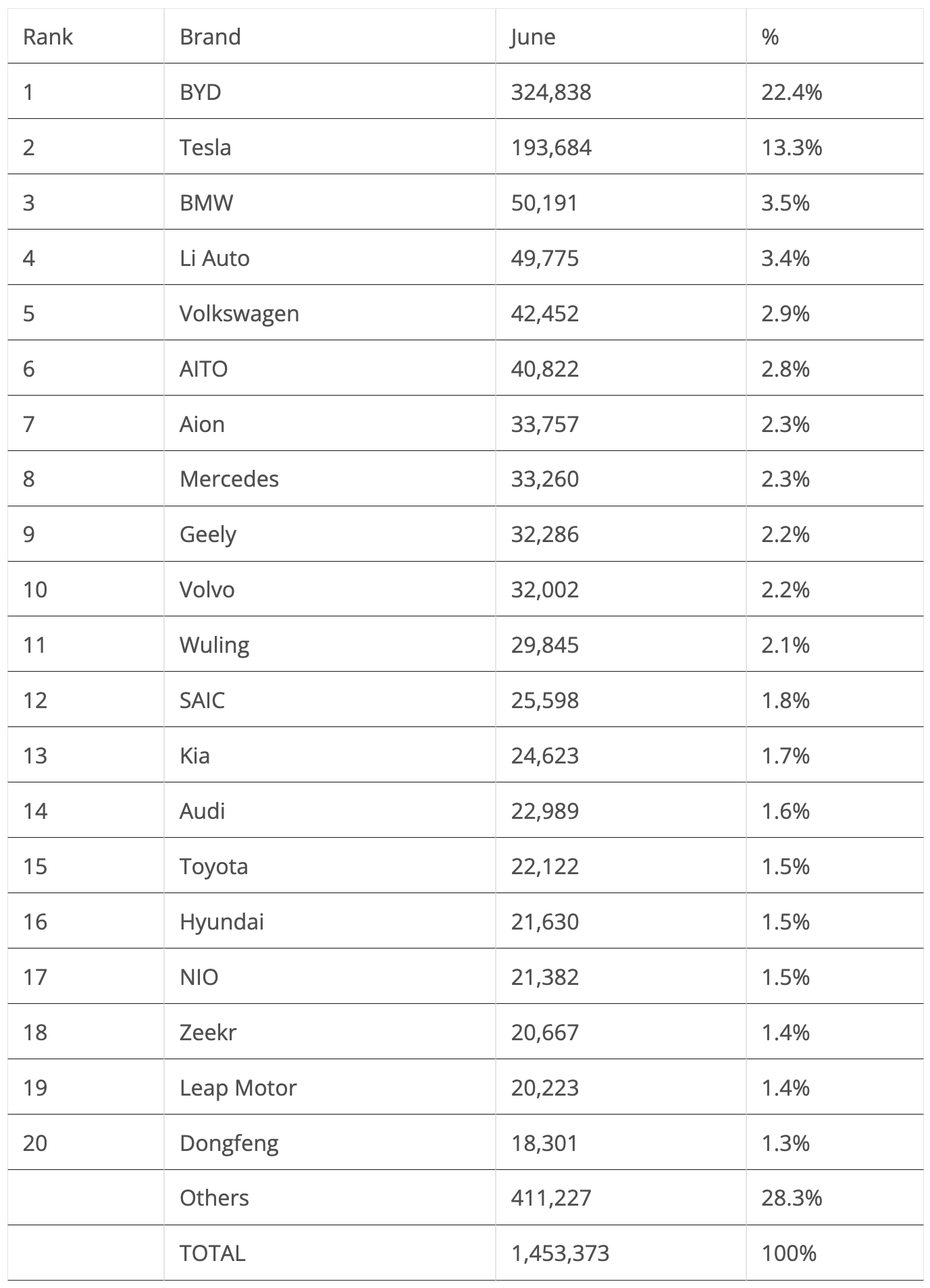

Top Selling Brands

In June, #1 BYD, now deep into pricing out the ICE competition (and quite a few other EVs on the way — ahem Wuling, ahem…) didn’t disappoint. It scored some 324,000 registrations, its second best result ever, only behind last December’s score. With sales at this level already, one starts to wonder how high the Shenzhen make’s sales could go. Ain’t no mountain high enough for BYD?

As for Tesla, after encouraging growth(ish) in May, the company was back to losses in June. The 193,000 registrations represent a 8% drop compared to the same month last year. So, in the first 6 months of 2024, there were two growth months (January and May) and four months in the red (February, March, April, and June). YTD, sales are down by 7% YoY. The second half of the year will be crucial to know if 2024 could be the first year of dropping sales for the US make.

Below the top two galactics, BMW again won the last position on the podium, and with a year-best score (50,000 units) to go along with it. It seems that the German make is set to repeat last year’s 3rd place finish, in what would be a repeat in 2024 of the 2023 podium (#1 BYD, #2 Tesla, #3 BMW). Once again: Boooring!…

Volkswagen, now looking to recover lost time, ended in 5th with 42,000 registrations, a new year best — much thanks to good results from its star players, the ID.4 and ID.3.

Li Auto is back on track, with the startup benefitting from the L6 success to score a new year best performance of 49,775 sales, and the same could be said about GAC’s Aion brand, which was up to 7th thanks to 33,757 sales, its highest score this year.

The second half of the table saw NIO perform a record result, 21,382 registrations, much thanks to the good results of the ES6 SUV and the ET5 sedan/station wagon (I wish all the luck to NIO’s ET5 wagon — we need more load luggers like these to help people get out of crossovers and SUVs).

A final mention goes out to Leap Motor, which joined the best sellers table in #19 with 20,223 registrations, a new year best.

In June, known brands like Ford, Peugeot, and Jeep were left out of the top 20, being replaced by more Chinese brands. Overall, China had 11 brands in the top 20.

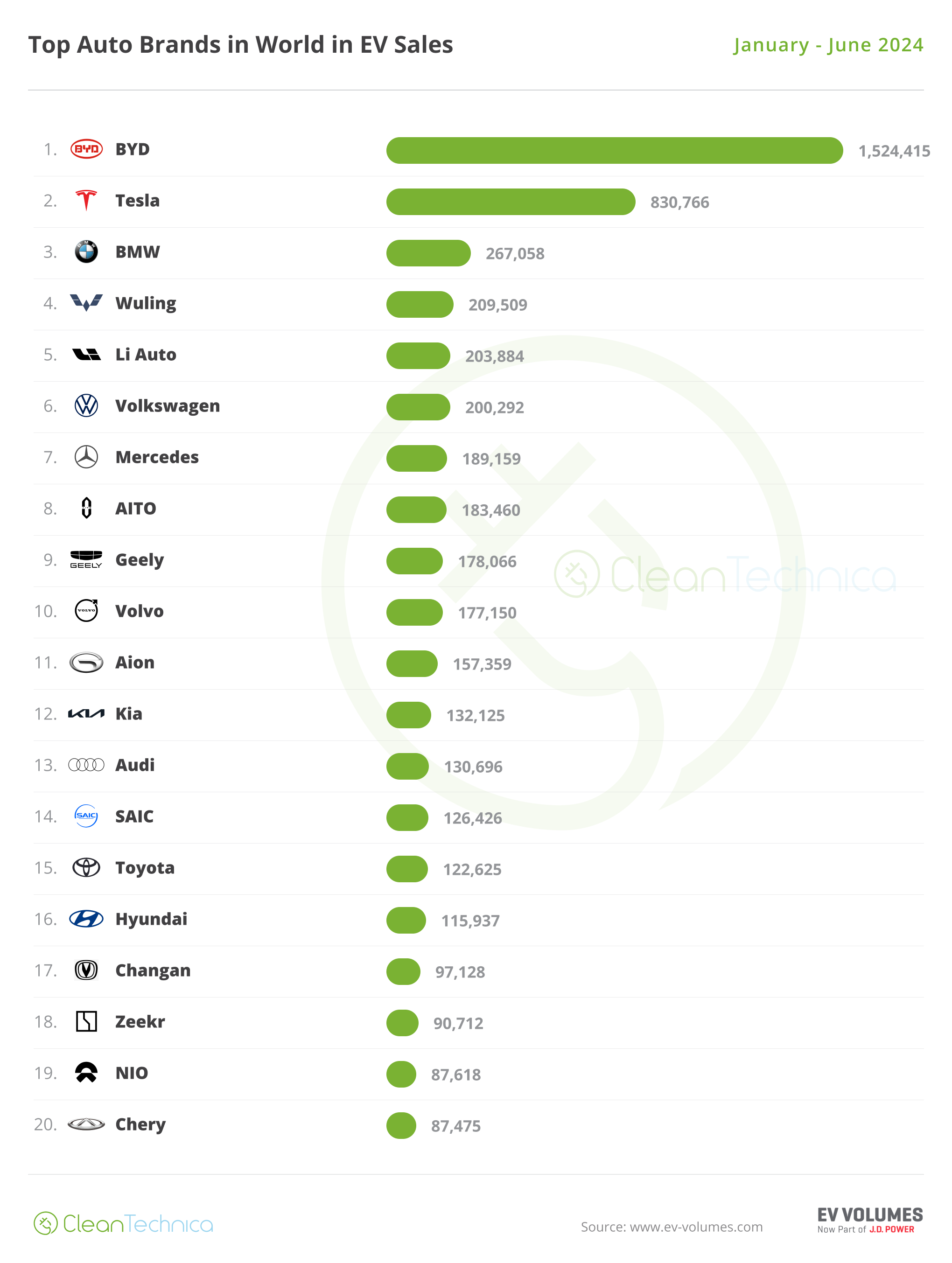

In the YTD table, there wasn’t much to report at the top. BYD is well ahead of Tesla, and the US brand has three times as many registrations as #3 BMW. But while BYD continues to grow by double digits, Tesla’s sales are down 7% in 2024….

Far below these two, which are really in a league of their own, BMW and Wuling stayed in their positions, while Li Auto benefitted from a strong month of June to jump another position, this time to 5th.

With the startup brand surfing the wave of the L6’s success and #4 Wuling suffering from the current price war in China, it wouldn’t be surprising to see Li Auto climbing another position in July.

Li Auto’s rival AITO also gained one position in June, with the Huawei-backed brand climbing to #8. A major factor helping Li Auto to beat AITO on the global stage is that while AITO is basically selling only in China, Li Auto has set up a successful business in Russia, with the startup brand selling an average of over 2,000 units per month in the Eurasian country, satisfying that market’s thirst for big SUVs. The fact that they are plugin hybrids is just a secondary effect….

With Li Auto landing soon in the Middle East, expect the startup brand to be another Chinese EV producer leaving China’s home base and winning relevance in overseas markets.

In the second half of the table, Kia benefitted from a good month in June and climbed to 12th. The remaining highlight came from SAIC, which was up to 14th thanks to the good month of the MG4.

Ford and Jeep were kicked out of the table, as NIO and Chery jumped into #19 and #20, respectively, and with #21 Leap Motor fewer than 1,000 units behind these two, it looks like the score of 11 Chinese representatives won’t go anywhere — because if one falls, there will be two or three ready to replace it.

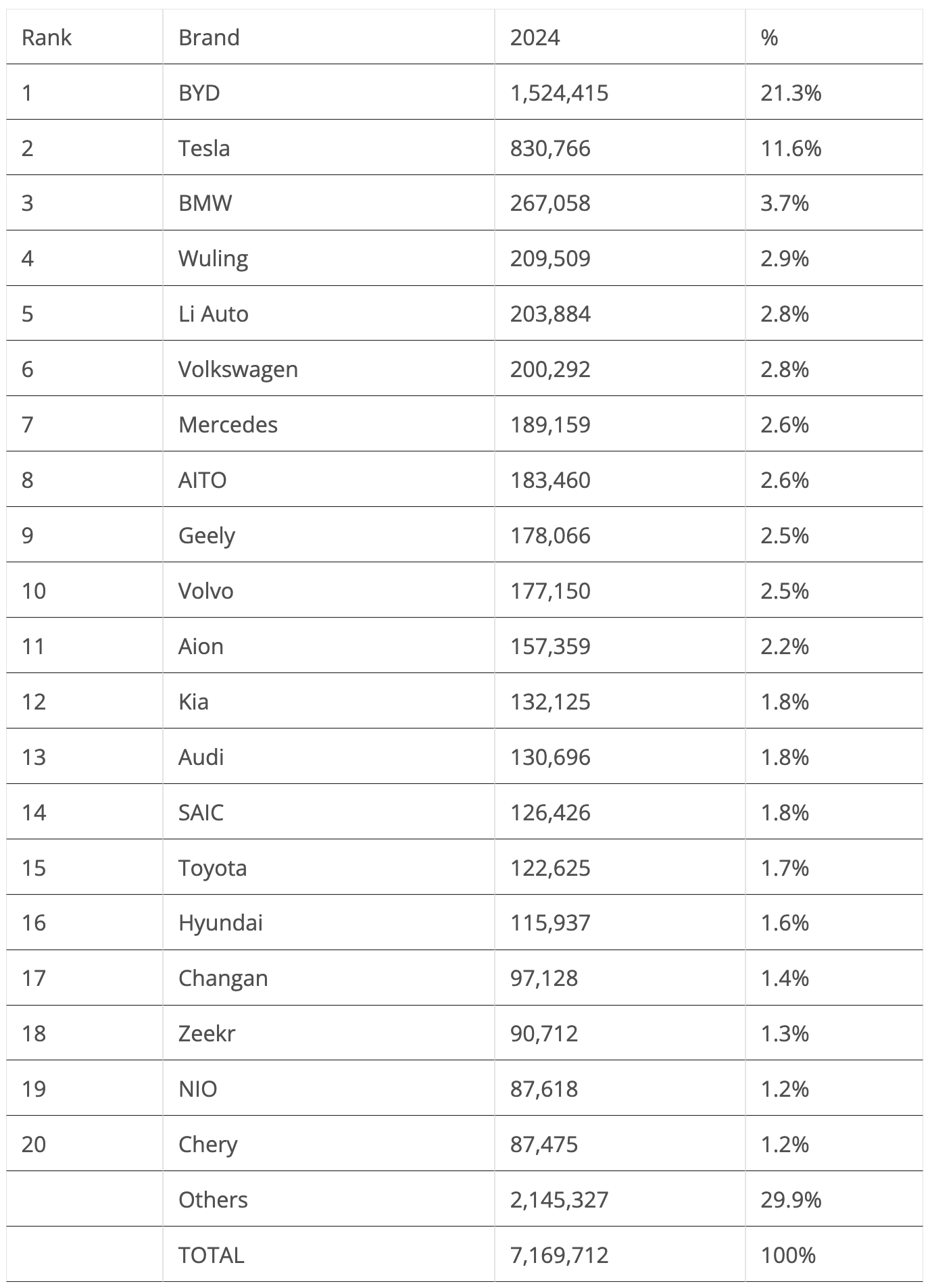

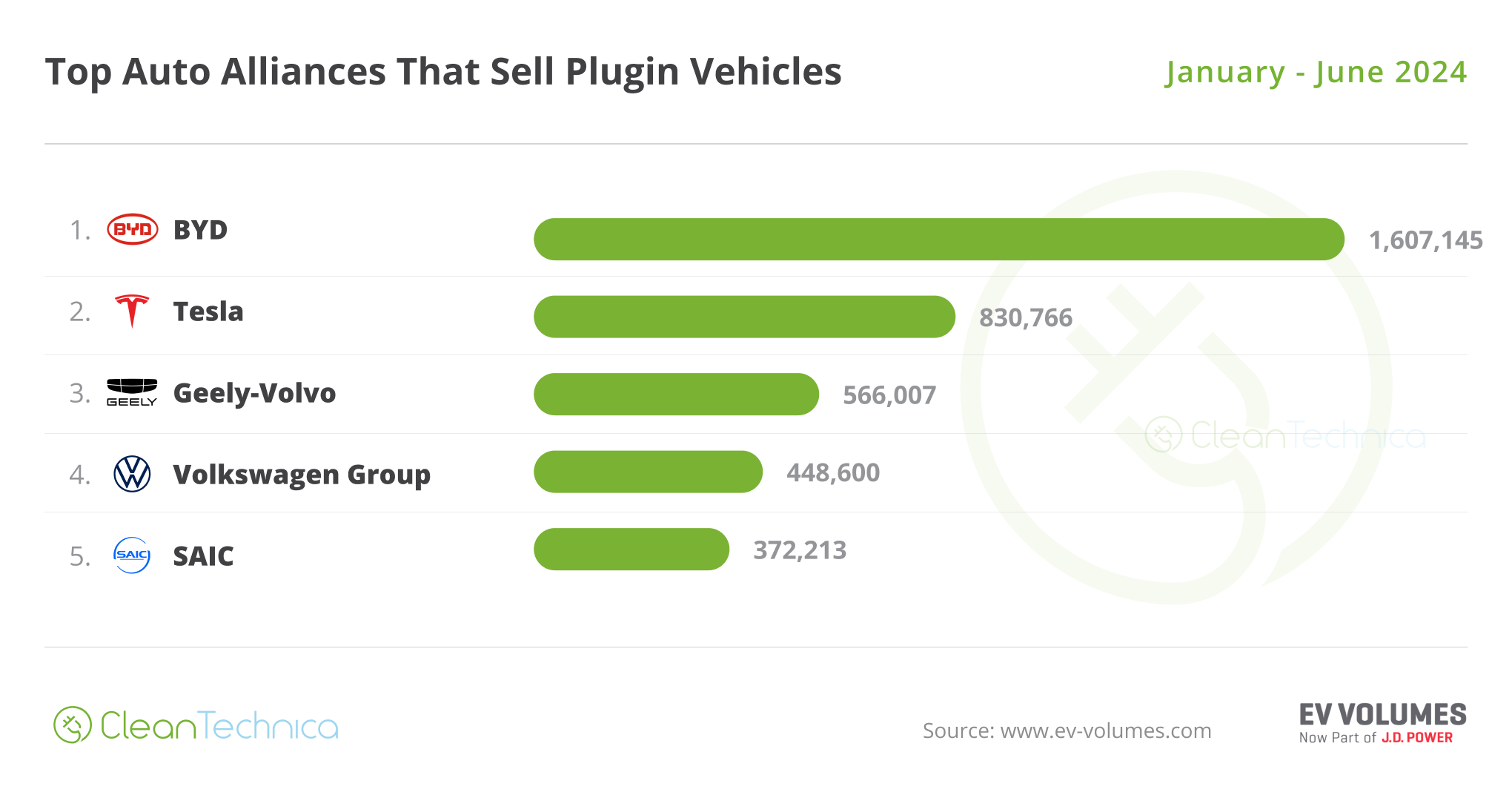

Top Selling OEMs for EV Sales

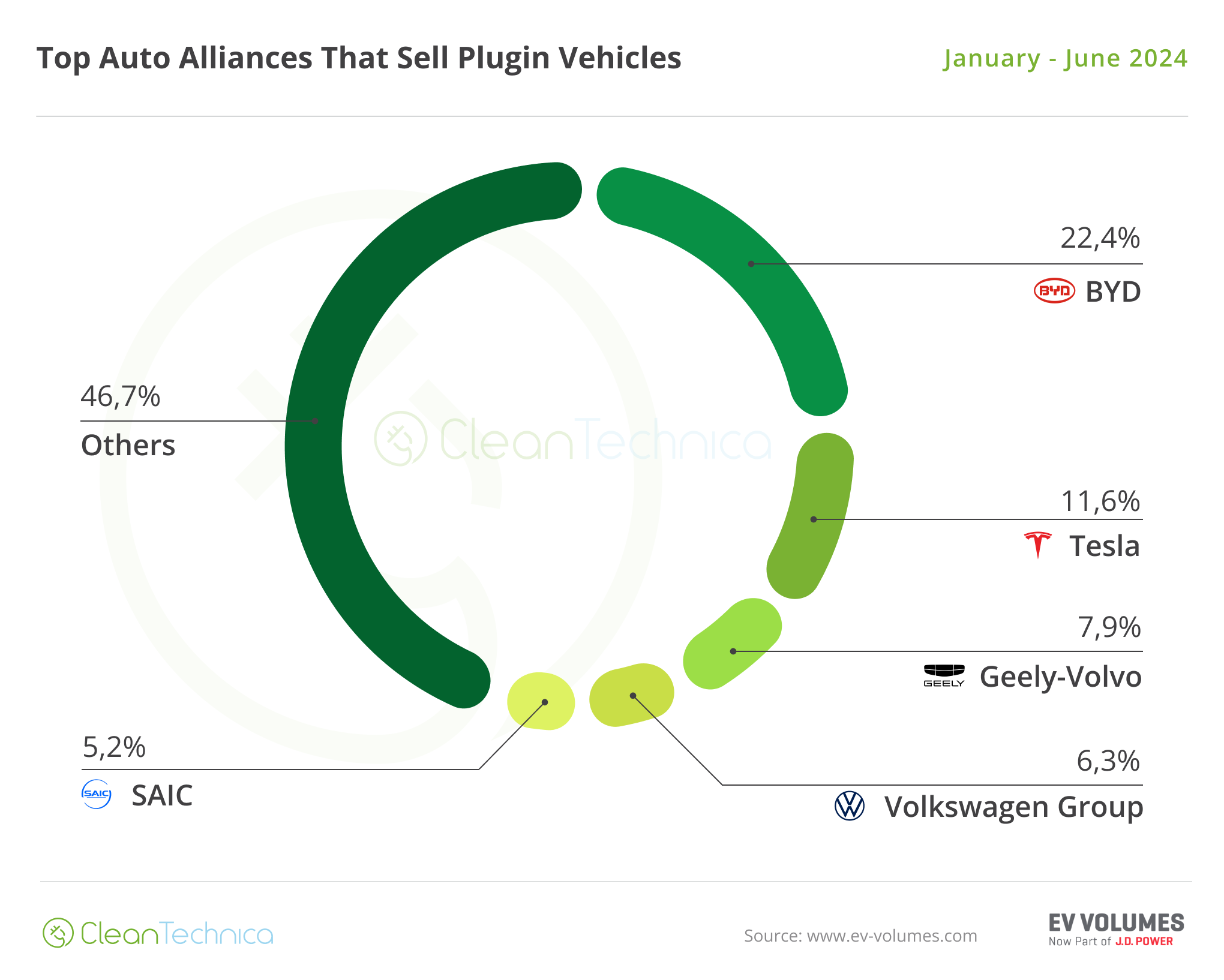

Looking at registrations by OEM, #1 BYD gained share thanks to its recent price cuts, going from 22.1% to its current 22.4% (it had 21.9% a year ago), while Tesla ended June with 11.6% share (it had 14.8% in the same period of 2023).

3rd place is in the hands of Geely–Volvo, with the OEM steady at 7.9%. The Chinese OEM is the one that most progressed in the top 5, going from 6.2% in June 2023 to its current 7.9%.

Considering Tesla’s recent share drop and Geely’s significant growth, will we see the Chinese juggernaut threaten Tesla’s silver medal by year end?

Answer: No, it’s still too early. In 2025, however … it will all depend on the US make. The Model Y refresh needs to be successful, and the future, cheaper model(s) need to make an impact. On its side, Geely will probably have some 33 new model launches, just to keep the lineup fresh.

Meanwhile, #4 Volkswagen Group (6.3%) remained stable, gaining some distance over #5 SAIC (5.2%, down from 5.4%). Will SAIC be able to recover ground on the German OEM?

Answer: Unlikely. Volkswagen Group had a weak Q1, but the second quarter saw it recover ground, and if June is any indication, we could see the German OEM actually recover some share. SAIC, on the other hand, is suffering from weak performances from most of its brands, and particularly that of Wuling, which seems especially affected by the BYD-led price war.

Below SAIC, #6 BMW Group (4%, up from 3.9% in May) gained ground over the competition, with #7 Changan (3.8%, down from 3.9%) and #8 Stellantis (3.7%, vs. 3.9% in May) both losing share. This last case is particularly worrying, because the multinational conglomerate has lost significant share compared to June 2023, when it had 4.3%.

The multinational conglomerate needs to react fast — its cheap EVs (Citroen e-C3 EV, e-C3 Airscross EV, Opel Frontera EV, Fiat Grande Panda EV, etc.) need to land as soon as possible and in significant volumes (a refresh on the Fiat 500e wouldn’t hurt either…). This year, Stellantis not only lost touch with the top 5 OEMs, but it is at risk of being swallowed by the competition.

Looking at the remainder of the year, expect #6 BMW to continue increasing its lead over the competition. Meanwhile, Stellantis is in serious risk of losing yet another position, as #9 Hyundai–Kia (3.5% share) has been gaining share lately, contrasting with Stellantis.

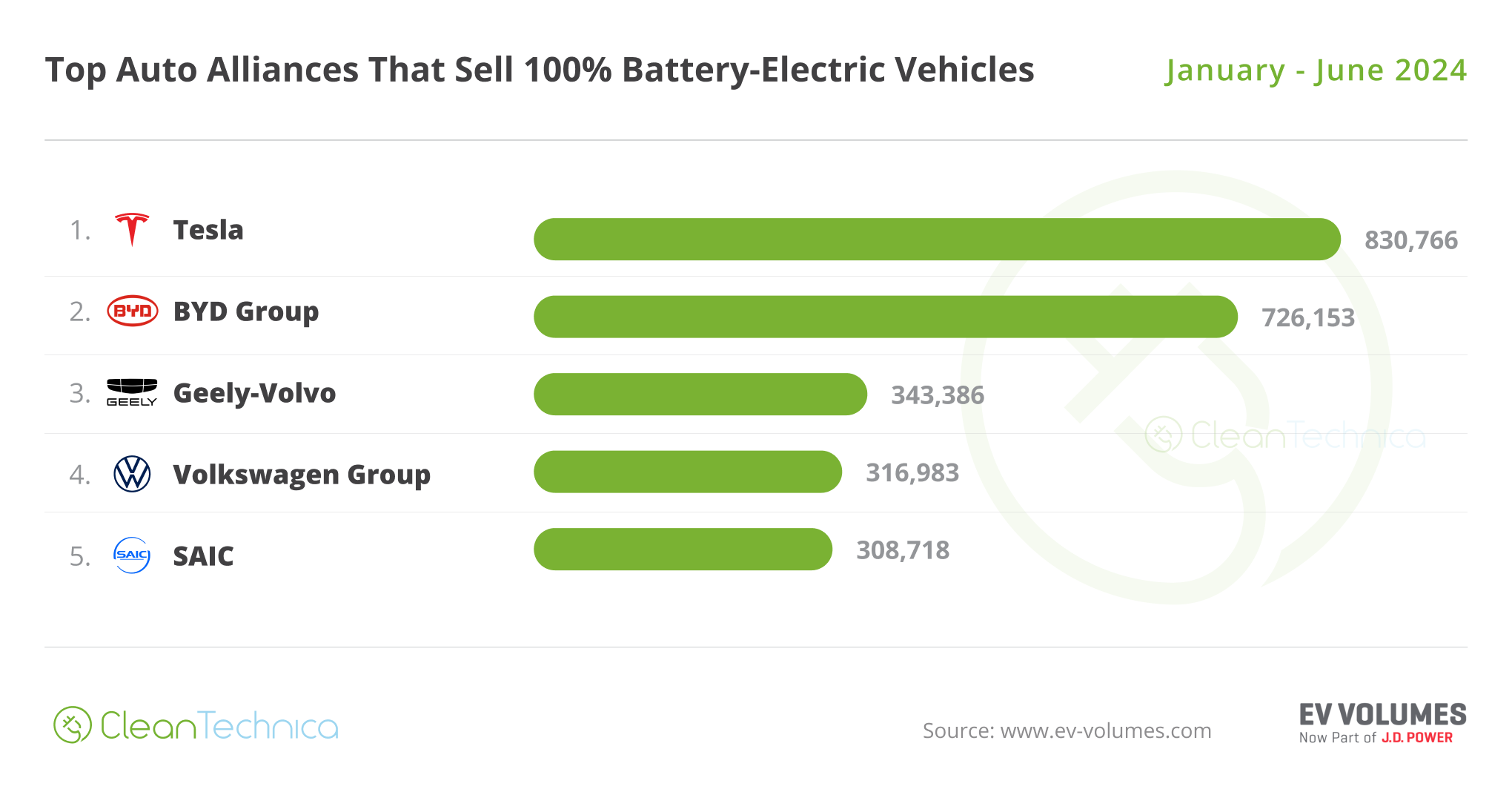

Looking just at BEVs, Tesla remained in the lead with 18.1%, but it has lost 3.8% share compared to the same period last year. In second is BYD (15.8%, down 0.2%). With Tesla losing share at a rapid pace, though, we might see BYD surpass it in Q4.

Geely–Volvo (7.5%) remained stable, thanks to good results across its long lineup of brands.

In 4th we have a position change. Volkswagen Group (6.9%) benefitted from a slow month from SAIC (6.7%, down from 7% in May) and climbed to 4th.

With the German OEM slowly gaining share, and SAIC in a downward trend, the Shanghai-based OEM shouldn’t pose problems to Volkswagen Group. Having said that, do not expect the German group to go after #4 Geely, as both are in the same trend of slow market increases.

Below the top 5, #6 BMW Group (4.5%, up from 4.3% in May) is on the rise, followed by #7 Hyundai–Kia (4.3%), and while both shouldn’t be able to reach the rear of #5 SAIC this year, in 2025, the Chinese OEM will have a hard time keeping these two behind it.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy