Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

After the December EV sales peak in China, the year started with an expected sales slump, but it was smaller than expected.

Year on year (YoY), while the overall market dropped a significant 12%, to close to 1.8 million units, plugins started 2025 with a 11% rise, to some 774,000 passenger new energy vehicle registrations.

This allowed the plugin vehicle (PEV) share to start the year at a high 42% (24% BEV), a full 10% more than a year ago (or an extra 6%, if we count just BEVs). Although this score is below the final 2024 result of 48% PEV share (25% BEV), expect that mark to be achieved sometime in the summer, and the year to end at 55%+ share. A couple of months in the last quarter of the year should even end above 65% share.

Imagine that, the largest automotive market in the world with a 66% plugin share. These kinds of market shares would be considered a pipe dream when I started reporting EV sales back in 2012….

Back to January, there was a surprising development when it comes to powertrain breakdown. Pure electric models rose more than average plugin vehicle growth (they were up 13% YoY), and PHEVs were the fastest growing powertrain (+19% YoY), so then why did plugins only grow by 11%?!?!

The answer lies with EREVs, with the current star of the EV market posting a surprising 24% drop YoY. This technology thus had its share of the plugin market drop to just 9% (PHEVs had 34%, while BEVs owned 57%).

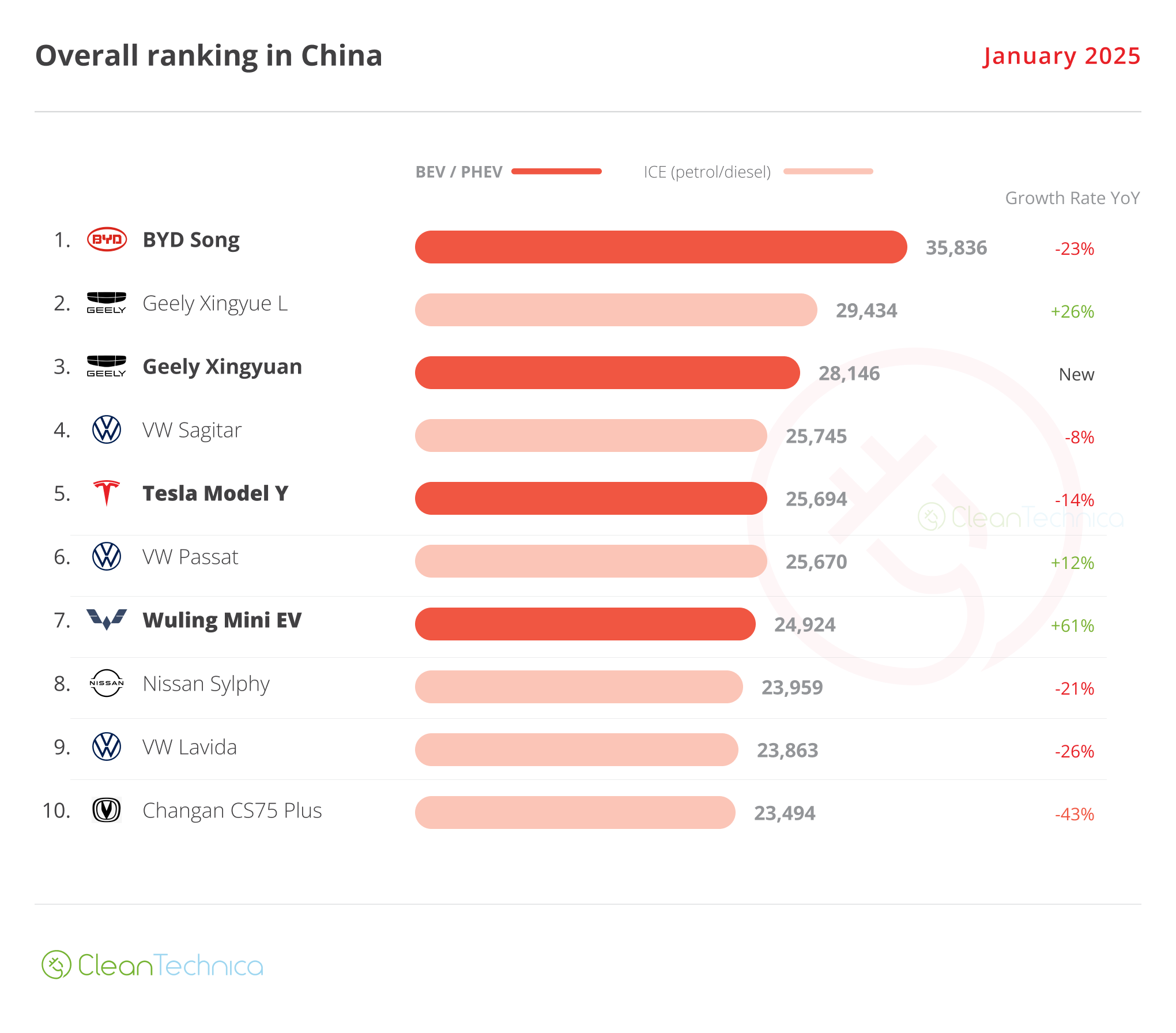

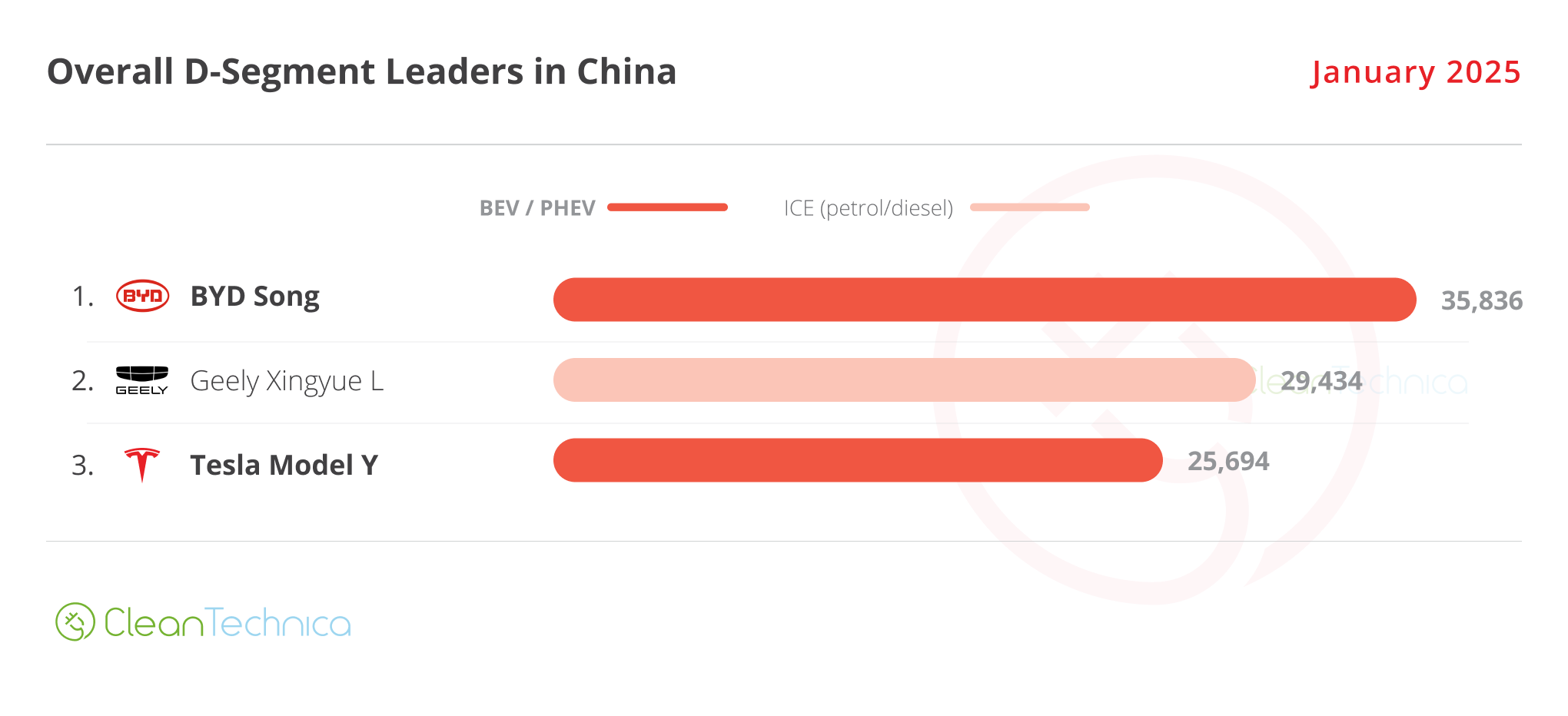

In the overall ranking, as usual, the beginning of the year has ICE models populating the top positions, with six models in the top 10. The BYD Song was the usual best seller, but behind it, there was a small revolution happening. The remaining podium positions went to two Geelys (Geelies? Geely’s?), with the Geely Xingue L ICE midsize SUV (also known as Geely Tugella and Renault Grand Koleos in export markets) winning silver and the recently introduced Geely Xingyuan hatchback winning bronze.

Funny enough, the most represented brand in the top 10 was Volkswagen(!), with three ICE sedans. The Tesla Model Y was the third plugin model, in 5th, while the tiny Wuling Mini EV was the 4th EV representative in the table.

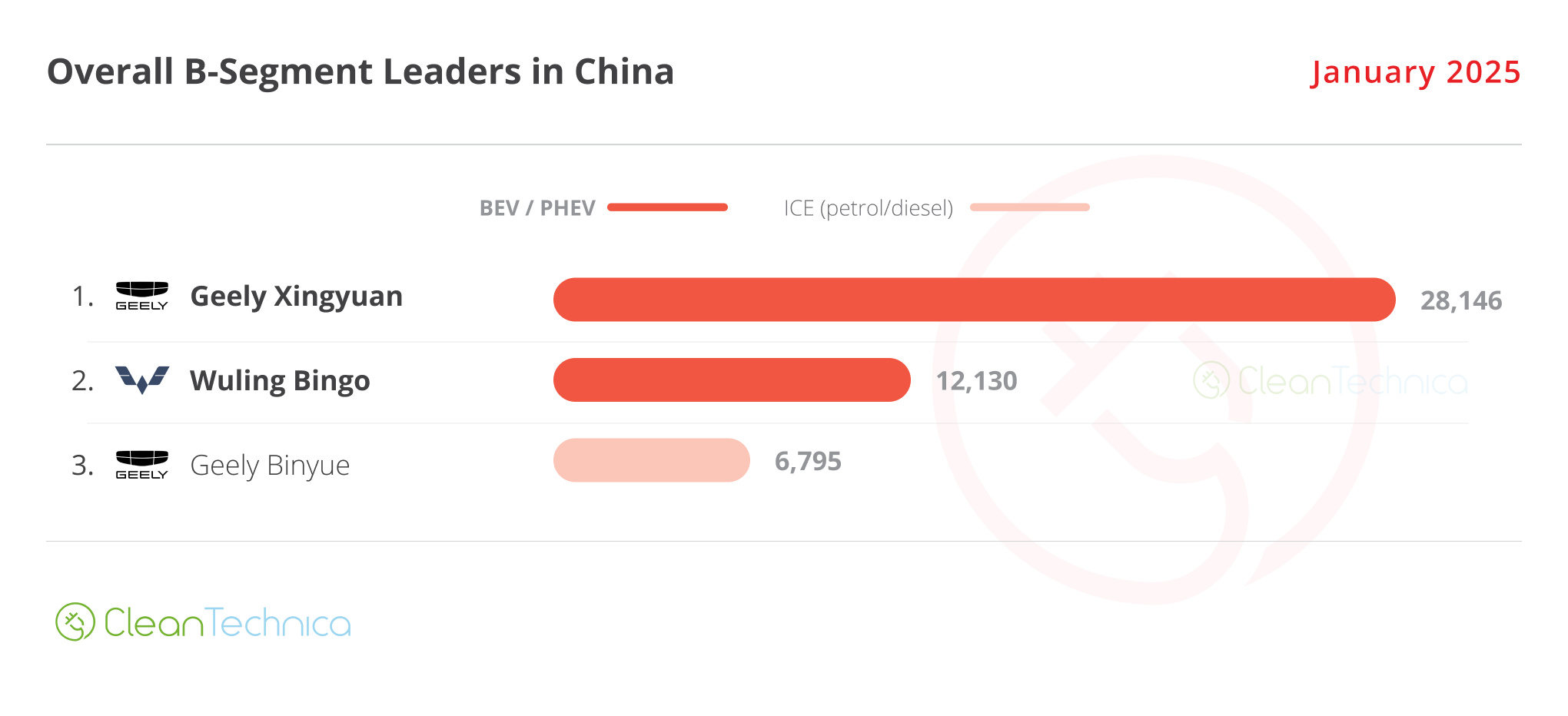

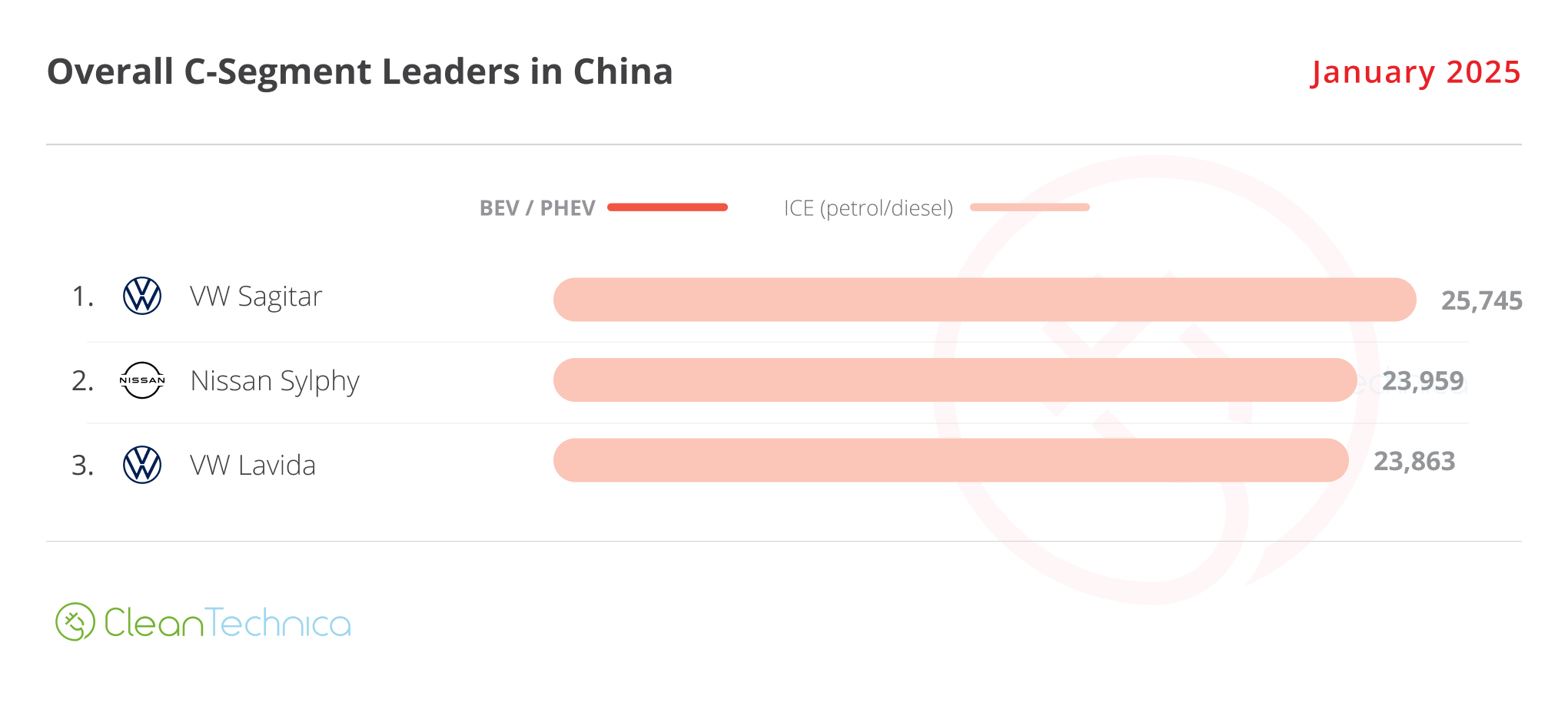

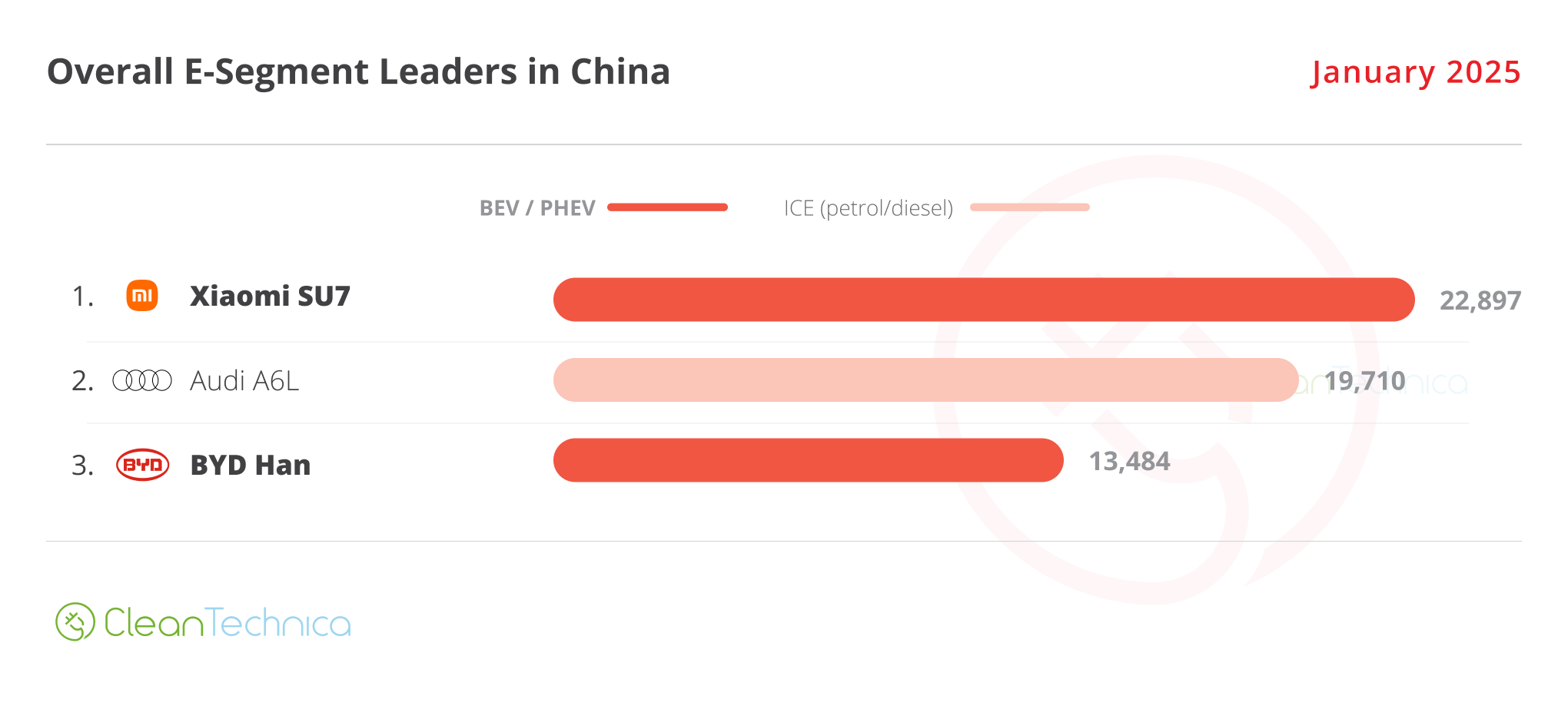

Looking at the best sellers in several size categories, all but the C segment (compact cars) have plugins leading each category. In fact, in the C segment, all top three positions were filled by ICE models. Looking at the bright side of this, it means that models like the Xpeng Mona M03 and Geely Galaxy E5 have plenty of room to grow….

The biggest surprise was the little Geely Xingyuan beating the missing in action BYD competition and the Wuling Bingo to take the win in the B segment/subcompact category, with another Geely joining the category podium. It was a great month for Geely, which placed four representatives on the category podiums, even beating BYD (3 representatives)!

This is a whole letter of intentions by Geely. With Geely’s sprawling lineup, albeit still partly relying on ICE (internal combustion engines), the fact is that if BYD thought it had the Chinese market locked in for the next few years, it might have been wrong and Geely could be the one to spoil BYD’s plans….

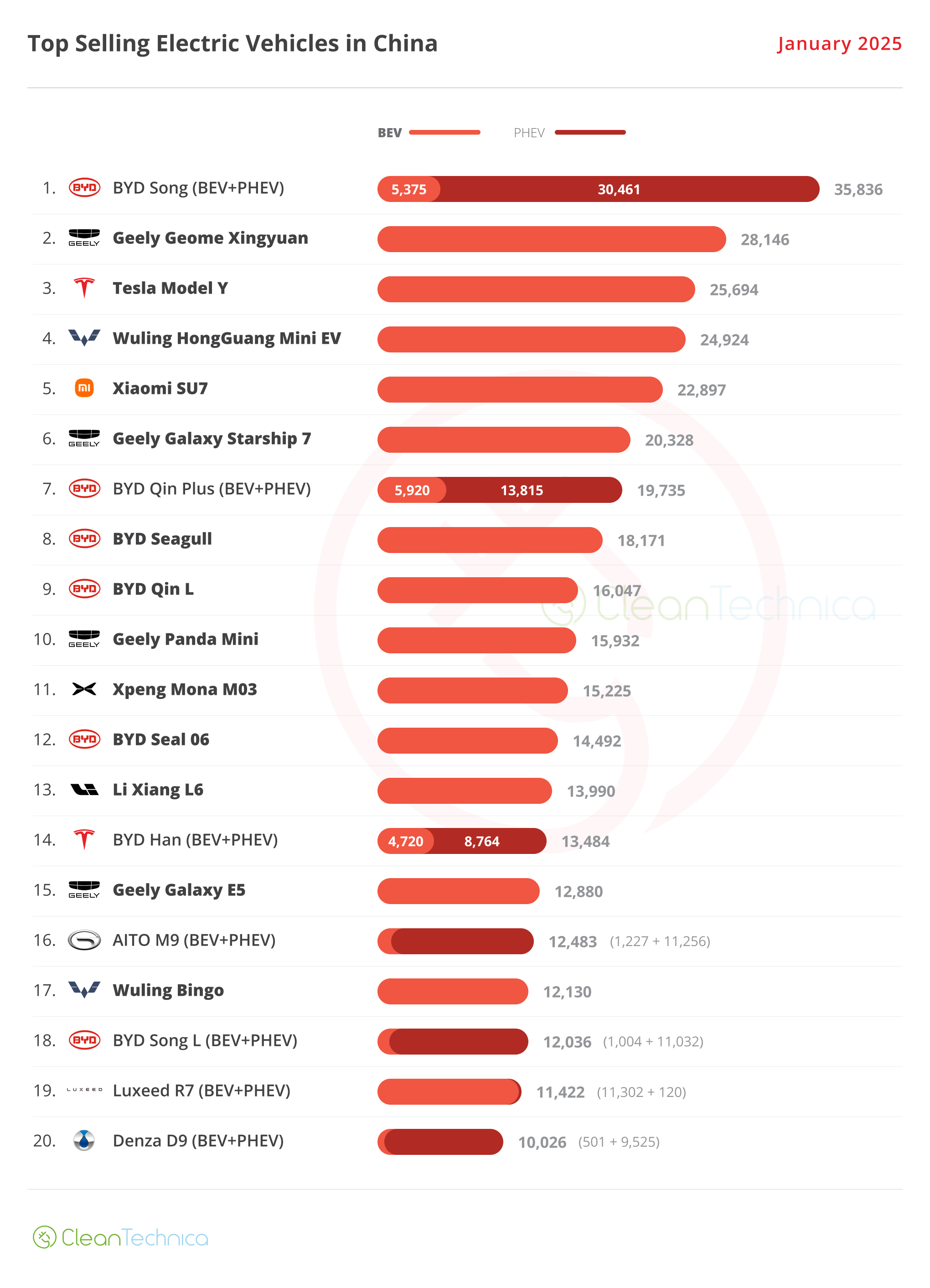

Focusing only on plugins, and illustrating the changing trends of the Chinese EV market, while last year’s top 5 were usually a BYD festival, this time we have only one BYD, the #1 Song, followed by one Geely (Xingyuan), one Tesla (Model Y), one Wuling (Mini EV), and one Xiaomi (SU7). Now that’s what I call (welcome) diversity!

Better yet, there was also diversity in the body types (hatchbacks, sedans, crossovers, SUVs…) and sizes of models in the top 5 — from tiny city cars to full size models.

Here’s a closer look at January’s top 5 best selling models:

#1 — BYD Song (BEV+PHEV)

BYD’s bread and butter model model is currently at cruising speed, floating above everyone else in China thanks to 35,836 registrations. But in a generally slow month for BYD, the midsizer was down 23% YoY. A mere blip? Or is Geely’s latest BYD fighter (the Galaxy Starship 7) already making a dent? One thing is for sure: if it wants to keep the best seller trophy, the Song will need an update this year, or else it could be surprised….

#2 — Geely Geome Xingyuan

A BYD Dolphin for BYD Seagull money. At least, that’s how Geely’s internal memo might have described the Geome Xingyuan when developing its latest hatchback. And with an interesting name, as Xingyuan translates as “wishing upon a star,” is Geely wishing on a star to take BYD’s leadership position? Well, that’s what the Xingyuan did in the B-class category last month. It obliterated BYD’s models as well as the rest of the competition (it doubled the sales of the #2 Wuling Bingo). What does this hatchback have that makes it so special? Besides all the support that comes from a leading OEM like Geely, it has a rounded, sensible design, somewhere between a Wuling Bingo and a Smart #3. Starting with an 80,000 CNY (+/-$11,000) price, the buyer gets a 30 kWh LFP battery from CATL, which is nothing to write home about until you realise that its price places it closer to the BYD Seagull (70,000 CNY for the 30 kWh version) than the BYD Dolphin (100,000 CNY). In January, the Geely model hit a record 28,146 registrations.

#3 — Tesla Model Y

The best selling BEV in the world got 25,694 deliveries in January, a 14% drop YoY. So, yes, the crossover has seen better days, but let’s remember that the refreshed version is set to land soon, which will probably propel it to much better results. The midsizer is expected to peak in March, possibly reaching a 45,000+ result, which would place it on the overall market podium.

#4 — Wuling Mini EV

Thanks to the recent refresh, the tiny hatchback had a second spring in its life, registering 24,924 units in January. And it could see its sales jump even further in the next few months, as a new 5-door version is set to land soon. With its killer prices, expect the model to continue competing for podium positions during the next few months. Will we see it even return to some 35,000+ units/month performances?

#5 — Xiaomi SU7

Veni, Vidi, Vici. “I came; I saw; I conquered.” This could have been the SU7’s motto. Having just landed in April of last year, Xiaomi’s flagship sedan has beaten nearly every demand/production record in the EV game, but I will just mention one: It took only 230 days to deliver its 100,000th unit! And this is no bare-bones, cheap EV, with prices starting at 216,000 CNY, or around $30,000. What you get in return is mind blowing value for money — a RWD full size sedan with a 74 kWh LFP battery from BYD, a 300 hp motor that pushes you from 0–100 km/h in 5.3 seconds, and a nice (if somewhat generic — did anyone say “Taycan”?) design made with the contribution of a certain Chris Bangle. Currently in its 9th month on the market, it won a top 5 presence thanks to 22,897 registrations. It also won the full size category leadership position. With a 60,000-plus waiting list in China alone, expect the sedan to be a serious candidate for the full size category leadership position in 2025, and with export plans now set in motion, expect its success story to be replicated in many markets.

Outside the top 5, we have a few surprises, starting with the Geely Galaxy Starship 7 showing up in 6th with a record 20,328 registrations. Expect this BYD Song fighter to become a regular in the top positions moving forward.

Still in Geely’s stable, they placed a record four representatives in the top 20. The tiny Panda Mini was 10th, with a near record 15,932 registrations, while the Geely Galaxy E5 crossover ended the month in 15th, with 12,880 registrations. With good players in most segments (Panda Mini — A segment; Xingyue — B segment; Galaxy E5 — C segment; Starship 7 — D segment), Geely or its premium brands now need to add top players to the full size category, all while reinforcing the lineup in each segment (like a Yuan Up fighter, a competitive midsize sedan…) in order to go after BYD in 2025.

Elsewhere, Xpeng’s Mona M03 continues to impress, delivering 15,225 units. That put it 11th overall, which added to the good results of the P7+ (8,114 units in January). So, Xpeng continues to ramp up deliveries, confirming its goal of 2025 being its breakout year. And with a certain Xpeng G7 in the wings, the new crossover could be the company’s Third Musketeer in its quest to become the Value for Money King.

Another surprise was the 19th spot of the Luxeed R7, with the HIMA full size crossover model gaining traction in the Chinese market.

Speaking of HIMA, Huawei’s product managers are doing a fine job with what could be a big mess of different brands and associated manufacturers — AITO is for big, comfy SUVs; Luxeed is for stylish sedans and crossovers; Stelato is one step above Luxeed, with a more formal design; Maextro is the Rolls-Royce/Bentley-slaying brand; and whatever they are preparing with SAIC will be more mass market.

Finally, outside the top 20, as usual, there was plenty to talk about, but this time I will focus on three landings, all important for different reasons.

Let’s start with the Lynk & Co Z20, which will be known in export markets as the Lynk & Co 02. The compact crossover landed with a robust 6,368 registrations, which is a good sign of things to come, but its more important role will be to become the star player of the company in the export markets, namely in Europe, but also in places like Israel and Uruguay.

Close to the Lynk & Co model when it comes to volumes (6,397 units) and segment (compact category), but with very different execution, Chery’s iCar V23 is a retro-styled compact SUV with a focus on off-road performance. It kind of reminds me of a Mercedes G-Wagen. (Just me?) The model got off to a flying start, with over 6,000 deliveries, but like in music, we need to see its long-term performance in order to see if it’s just a one hit wonder or not.

Finally, despite having a slow month, BYD landed a new model. The Xia MPV landed with 2,794 sales, so BYD’s take on the Denza D9 started its career with a solid result, if not outstanding. Will the Shenzhen make be able to replicate Denza’s D9 success?

Looking at the overall manufacturer ranking, we have shock and awe — Geely (198,000 units) has beaten BYD (182,000) and won the January trophy!

Still more surprising, Geely surged 43% YoY in a month when everyone else saw falling sales (except… Audi?!?, which was up 2%). So, one wonders if this was just a one-time thing, or if Geely really is going to fight BYD this year in the overall market?

(Well, some competition would be nice….)

Outside this top 10, a mention goes out to Leapmotor, which is continuing to grow fast (+87% YoY, 23,000 registrations). It ended January at #21. A mention is also due for Xpeng (#20, +244%), and for Xiaomi, which is already showing up on the radar (#22) despite having just one model on sale.

On the losers side, Dongfeng had a horrible month, down 65% YoY. It’s no wonder Dongfeng is said to be bought merging with Changan…. After foreign legacy OEMs, apparently, now even Chinese legacy OEMs are starting to feel the walls closing down….

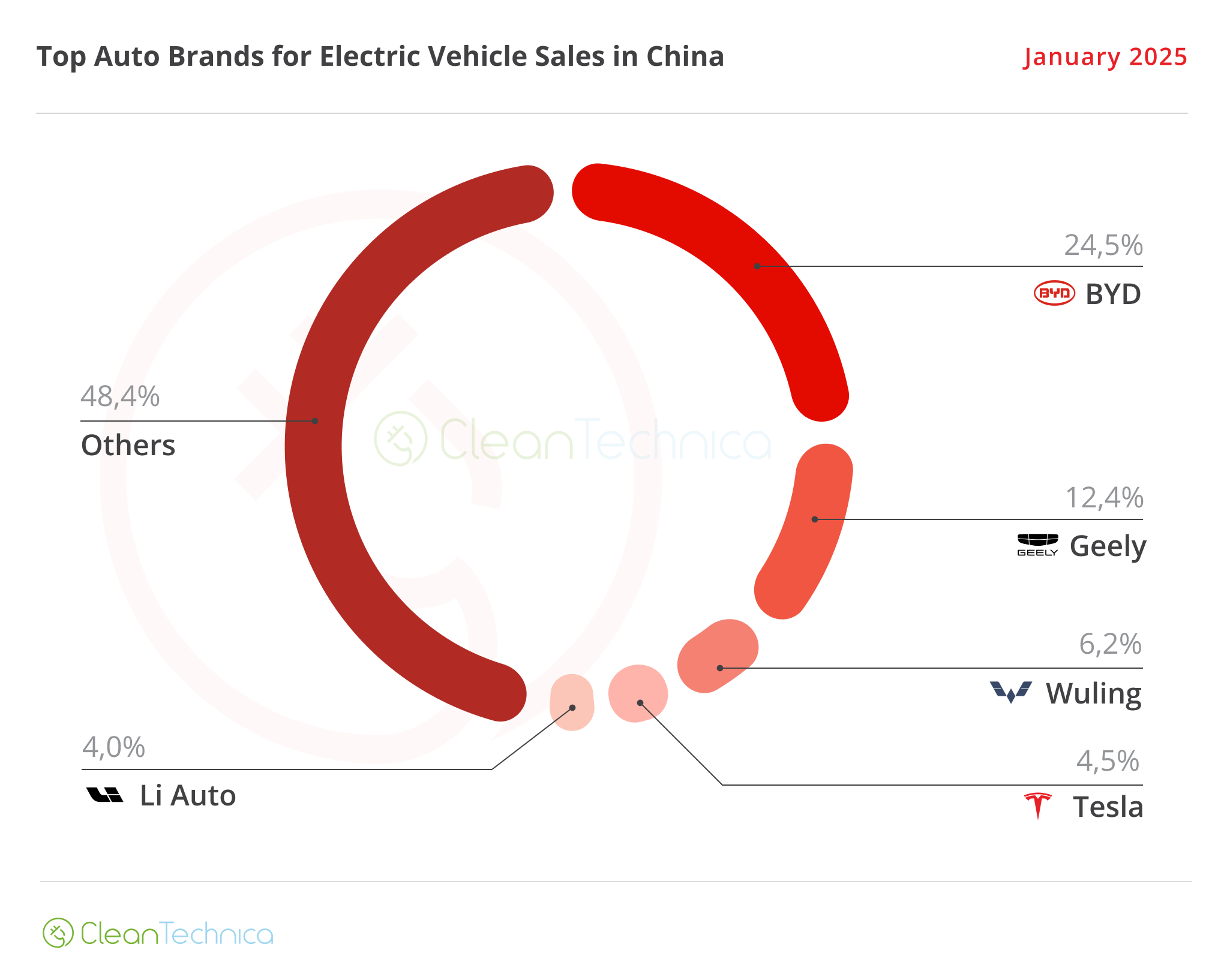

In the EV manufacturer ranking, BYD started the year like it ended the last one, hovering above everyone else with 24.5% share.

BUT. Not only did it lose 4% share YoY, but it also saw Geely start the year with 12.4% share, which is double the share it had in January 2024!

And while it might still be too soon this year for Geely to surpass BYD, in 2026 or 2027 we could see a close race for supremacy in China between these two.

Wuling (6.2%, up 0.3% YoY) took bronze in January, followed by #4 Tesla with 4.5% share (down 1.5% YoY) and then #5 Li Auto with 4%.

Just outside the top 5, we have #6 Xpeng (3.8%), which is hoping to join the table soon.

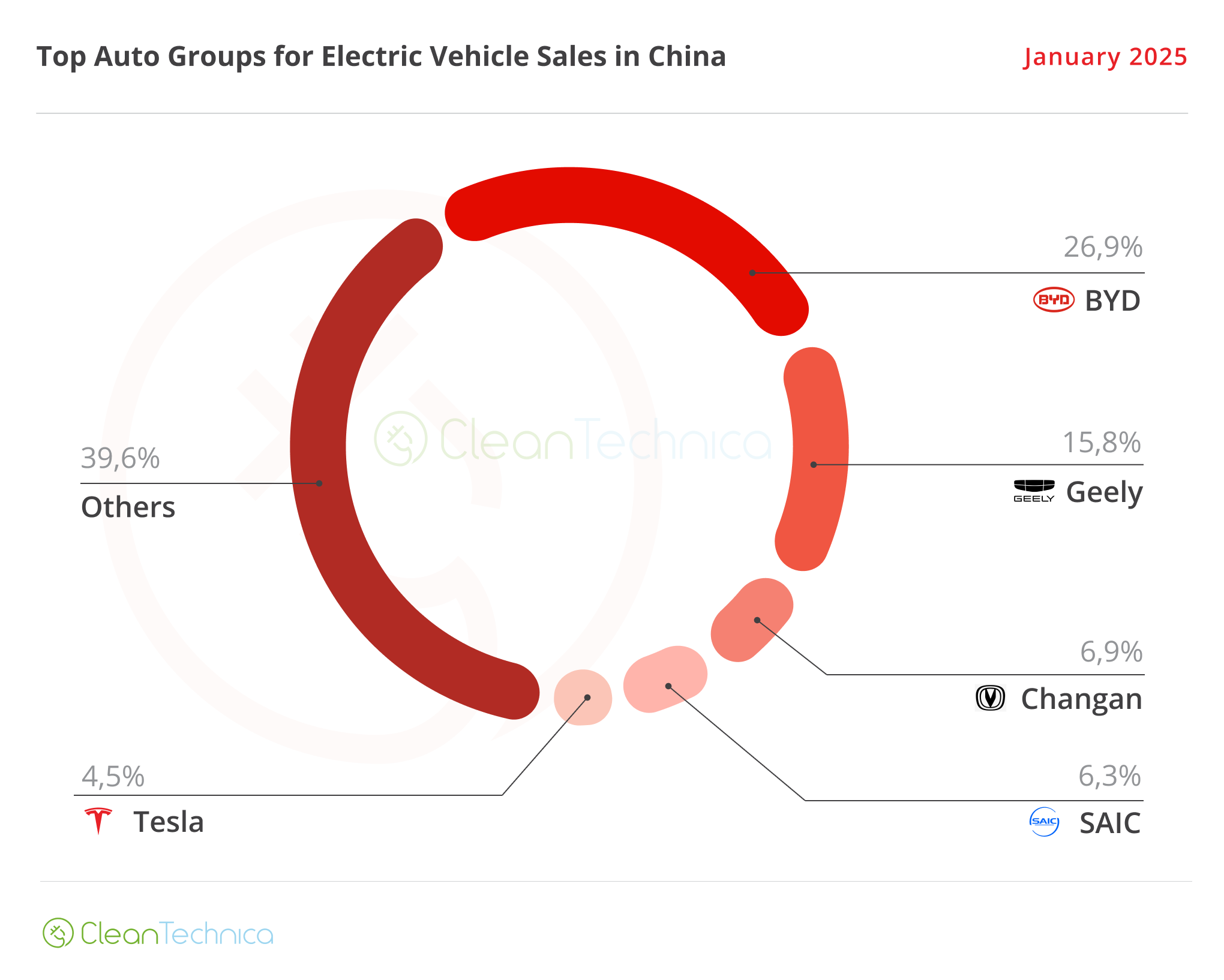

Looking at the OEM level, BYD is comfortable in #1, with 26.9% share, while Geely is a still distant runner-up, with 15.8% share. But with Geely firing on all cylinders, expect the Taizhou-based OEM to consolidate its status as the main alternative to BYD in China, and maybe displace BYD in the future…

… Because while BYD’s leadership is safe for now, time is on Geely’s side, and this is proven by the following stat — BYD had 42% share in January 2023, against its current 27%, while Geely surged from 4.2% in January 2023 to 15.8% now.

Changan is 3rd, with 6.9% share, profiting from the good results of the Qiyuan make and its Deepal premium brand.

SAIC (6.3%) is 4th, mostly thanks to the Wuling brand, while #5 Tesla (4.5%) continues its slow descent into irrelevance, having slipped from 7.8% in January 2023 and 6% a year ago to its current 4.5%.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy