After moving higher on Friday, the gold price disappoints today. What’s going on? Which move is real?

There was no major news on either day (Friday or today), so the odds are that the price moves were of a technical nature. I wrote about that in my Friday’s extra Alert – I emphasized that since gold stayed below the 61.8% Fibonacci retracement, nothing really changed from the technical point of view, and I emphasized that mining stocks remained in a medium-term downtrend. If you read that analysis, you were prepared for what’s happening today – and you’re prepared for what’s about to happen next.

Normal Corrections in Gold Price

Gold price corrected to the 61.8% Fibonacci retracement level, which is a typical level to which prices move during corrections – there’s nothing special about it. Or actually, the fact that this level tends to work as reliable resistance over and over again is quite special. Other than that, nothing really happened or changed from the technical point of view.

Therefore, what’s happening in the markets today – gold’s decline back below the 50% retracement – is normal. Gold did what was normal for a market to do during corrections, and now it’s moving lower again.

Also, given the fact that 61.8% of the previous move is often the maximum size of the correction, it could be the case that the top in gold is already in.

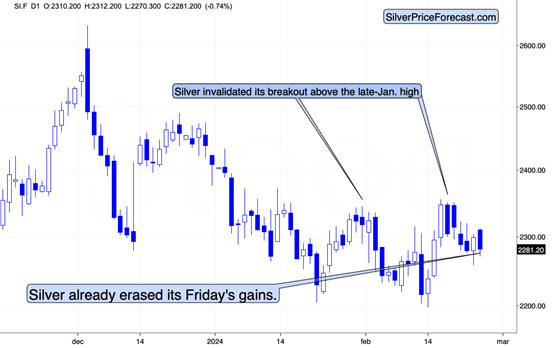

Silver and Junior Miners Follow Suit

Silver pretty much erased it’s Friday’s rally, and junior mining stocks are just did that as well.

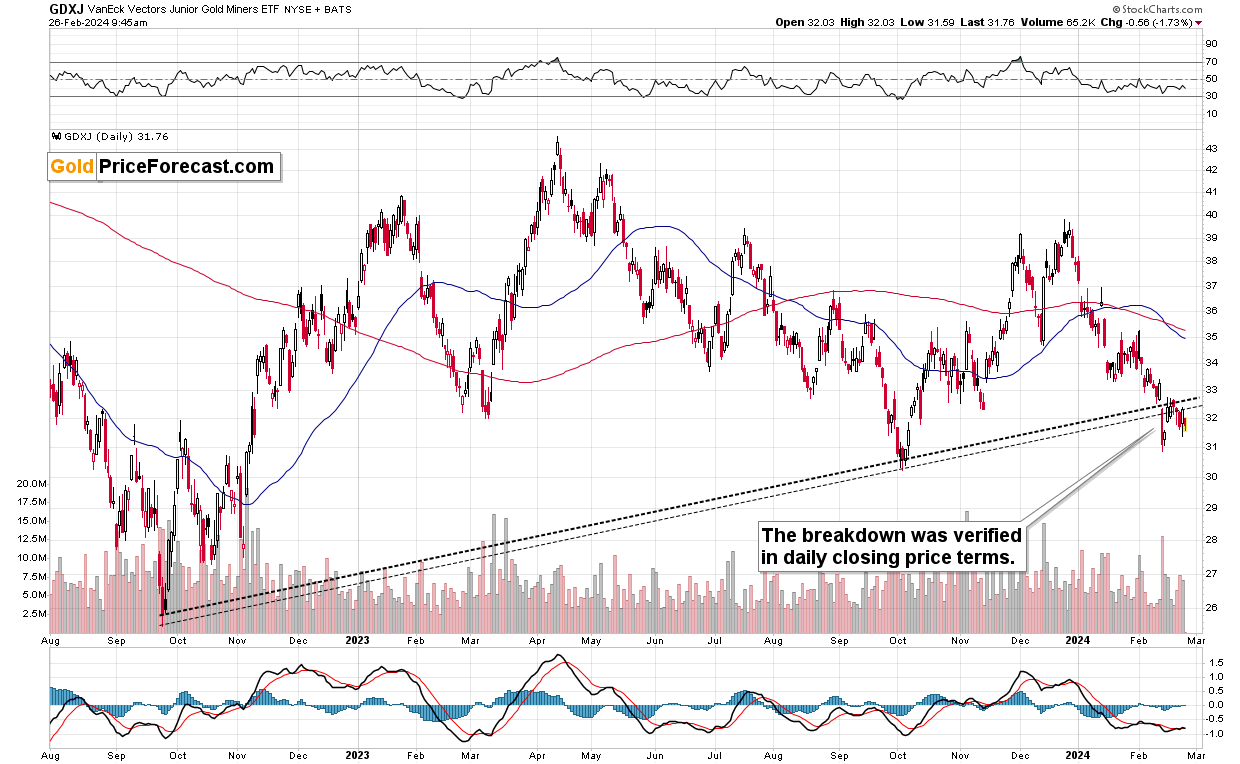

Looking at the above chart makes it clear that what we saw yesterday was just another verification of the breakdown below the rising support / resistance line based on the 2022 and 2023 lows.

After touching this line, the GDXJ declined once again – just like it was likely to.

Also, please note that junior miners didn’t move to their recent mid-Feb high, even though the gold price moved above its mid-Feb. high (the intraday one on the CPI day), which means that miners continue to severely underperform gold, which is a bearish sign for them and for the gold price as well.

The earnings from big companies might impact the movement of the S&P Index, but they are unlikely to cause any big or lasting changes in the prices of junior miners.

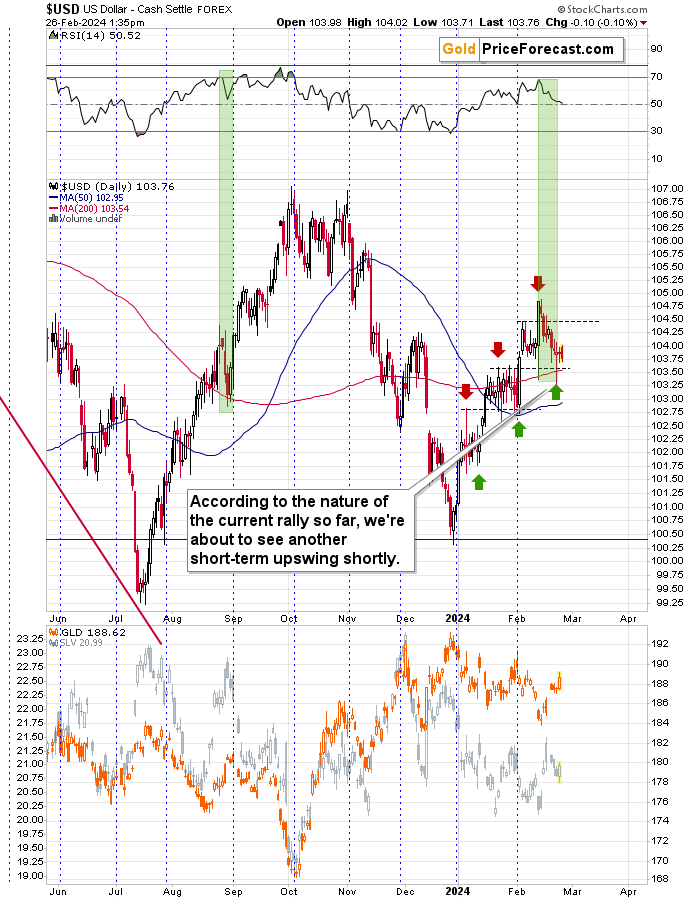

Meanwhile, the USD Index isn’t doing much – it’s taking a breather after the powerful daily bullish reversal.

Based on the analogies to the previous consolidations, it’s about to rally. I marked the similarities with red (intraday volatility in the middle of the consolidation) and green (the final decline) arrows. This situation confirms gold’s move to its 61.8% Fibonacci retracement and the subsequent decline.

How will gold deal with the rallying USD Index? It will most likely fall. The top in gold might be in.

And given the confirmed breakdown in junior miners, it seems that the very short-term top in their prices is in as well. It seems that our profit-take levels can be reached any day now.

*********