August saw plugin EVs take over 60% share in Sweden, significantly up from 46% year on year. Full electrics alone took over 40% of the market, with plugin hybrids almost 20%. Overall auto volume was 23,871 units, up some 16% YoY, but still well below pre-2020 seasonal norms (typically close to 30,000). The Tesla Model Y was August’s best selling vehicle.

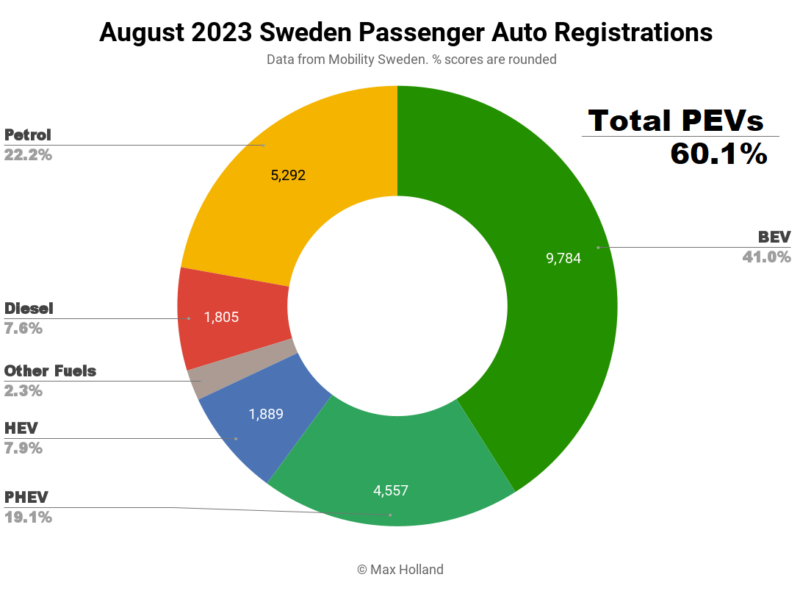

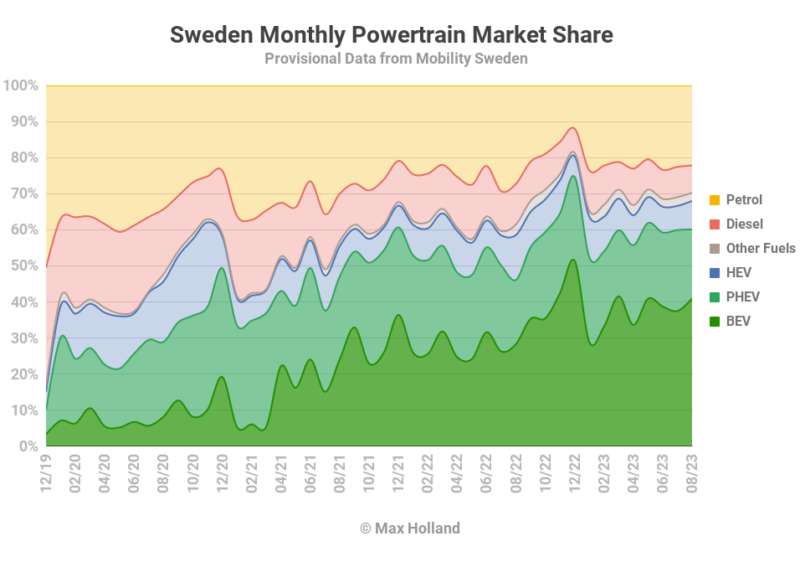

August’s results saw EVs take 60.1% combined share, with 41.0% full electrics (BEVs), and 19.1% plugin hybrids (PHEVs). These compare with like figures from August 2022 of 46.1%, 28.3%, and 17.8%. We can see that BEV share has grown well over the past 12 months, and appears on track to regularly exceed 50% of the market within the next year or so.

Looking at unit volumes, PHEVs grew by 25% YoY to 4,557 units, while BEVs grew a strong 68% to 9,784 units. Every other powertrain lost volume YoY, with diesels declining by some 22%, and plugless hybrids seeing a 26% volume drop.

Combined combustion-only powertrain share was well under a third of the market, at 29.7%. Their share will likely fall below a quarter, consistently, by the end of this year.

The trailing 3 months’ plugin share now stands at 59.7% (from 50.9% YoY). Expect that to reach close to 70% by the end of December.

August’s Bestsellers

The Tesla Model Y has climbed back to the top of the sales charts in August, with 1,506 units, after a logistics lull in July. It was just ahead of the Volkswagen ID.4, while the Skoda Enyaq was some way further back, taking 3rd.

The Volkswagen ID.4 saw its best month of 2023, and the first time since December that over 1,000 units were delivered.

The Volkswagen ID.4 saw its best month of 2023, and the first time since December that over 1,000 units were delivered.

The only other outsized performance in the top 10 was the MG4, in 8th spot, which saw a record volume of 345 units, almost 50% higher than its recent averages.

After having seen a strong delivery month in July, taking the lead, it was the BYD Atto 3’s turn to have a low ebb of shipments in August, and it fell back to 10th spot.

There were three new BEV models making their sales debut in the Swedish market in August. Most significant was Stellantis’ new Jeep Avenger, a diminutive B-segment crossover, with competent range (400 km WLTP), priced from 470,00 SEK (€39,000). This has already shipped over 3,000 units within Europe, already on the streets of Germany, France, Italy, Norway, and elsewhere — lets see how popular it proves to be in Sweden. August saw an initial 16 units, but we can expect that to quickly increase to over 100 units per month.

The next newcomer in Sweden was the Xpeng P7, with 25 units sold in August. The P7 is a D-segment sedan, earlier iterations of which have been on sale in China since mid-2020, though it has rapidly evolved and improved since then. Its pricing starts from 600,000 SEK (around €50,000).

The final newcomer is the Honda e:Ny1, with just 12 units delivered. This is a smallish crossover (4,387 mm length) costing SEK 530,000+ (€44,500+). It has okay range (412 km WLTP), but — like Honda’s previous BEV effort, the “Honda-e” — I don’t think it will be a big seller, due to “DC fast-charging capability that can go from 10 to 80% in just 45 minutes” as Honda themselves put it.

Let’s be clear — 45 minutes charging is not accurately described as “just” for a BEV at this price point, launched in mid-2023. It is about the slowest charging of any new BEV launched over the past few years. Most competitor BEVs launched since 2020 can recharge 10% to 80% in around 30 minutes or faster. The Hyundai Ioniq 5, Ioniq 6, and Kia EV6 — larger, with more range, and only a bit more expensive — take 18 minutes, about the same duration as a normal comfort break on a long journey. The Ioniq 5 launched over 2 years ago.

The more affordable Jeep Avenger, above, needs only 26 minutes to recharge 10% to 80%.

It appears to me that Honda is still foot dragging the transition to BEVs, just like most of the other Japanese automakers, they are stuck in their recurring dream of hydrogen fuel cell cars. We will have to see what the Swedish market thinks of this lacklustre effort.

Let’s now turn to the trailing 3 month performance:

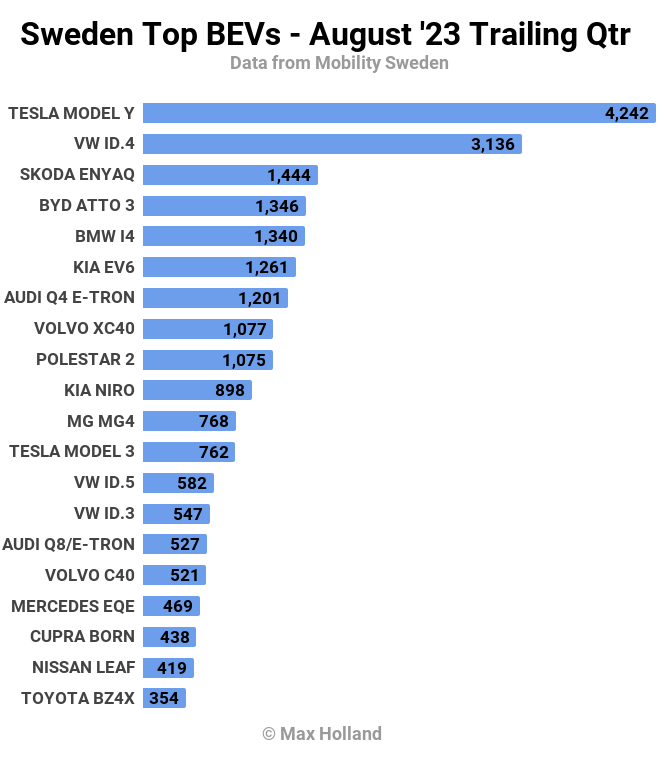

Yet again, the Tesla Model Y is in the top spot, with a decent margin over the 2nd place Volkswagen ID.4. The others are all a long way back from the two leaders.

The biggest climb is from the BYD Atto 3, which was in 29th spot at the end of May. It has now shot up to 4th spot. Much of this is due to uneven delivery logistics, but it certainly appears that BYD are now trying to have a more consistent shipment pattern.

The BMW i4 has also seen a good improvement, now in 5th spot, from 10th in the previous period.

Likewise, the MG4 improved, climbing from 18th to 11th. As perhaps Europe’s best value BEV, it may still have further to climb.

Outlook

The 16% YoY growth in auto sales — all thanks to plugin EVs — is a rare point of good news in a broader Swedish economy that remains in recession. Swedish financial group, SEB, has recently forecast that “In Sweden, GDP will fall by 1.2 per cent this year due to weak households and a deep decline in housing construction, followed by essentially zero growth in 2024.”

Inflation remains very high at 9.3%, unchanged from last month. Interest rates are also at a 5 year high (3.75%).

All of this points to a strong squeeze on household spending, evidenced by 7 out of 10 new EV sales coming from business customers, rather than private consumers, according to Mobility Sweden. They state that this is “driven by the companies’ willingness to reposition their vehicle fleets. New sales on the private side are still ice cold.”

Whilst the outlook for auto sales overall is gloomy, along with the wider economy, the EV transition — the share of new sales converting over to plugins — looks likely to continue at a decent pace. The long term total cost savings of plugins is still advantageous, with gasoline prices still high at $1.90 per litre, something that company fleet managers are surely aware of.

What are your thoughts on Sweden’s EV transition? Please jump in to the comments and join the discussion.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …