Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

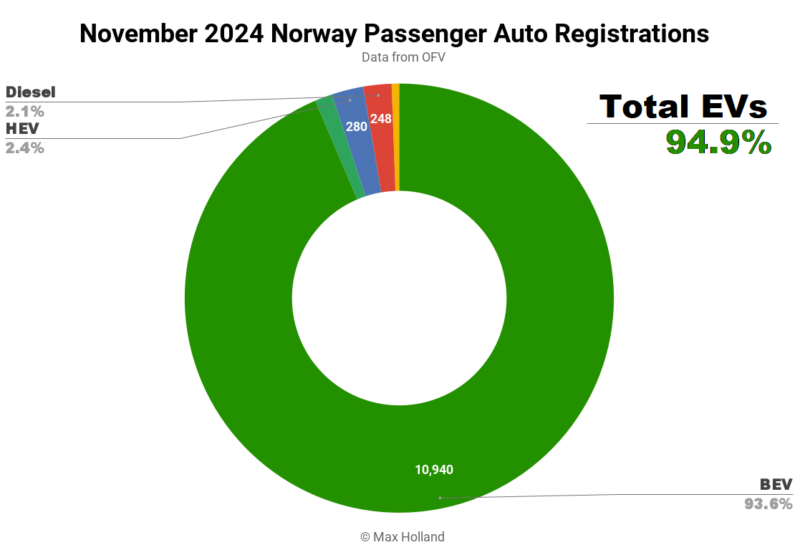

November saw plugin EVs take 94.9% share in Norway, up from 90.6% year on year. BEV sales grew 30% YoY, taking almost 94% share. Overall auto volume was 11,689 units, up 13% YoY. Tesla took the top two spots, with the Model Y and Model 3.

November’s auto sales saw combined EVs take 94.9% share in Norway, comprising 93.6% full electrics (BEVs), and 1.3% plugin hybrids (PHEVs). These compare with YoY figures of 90.6% combined, with 81.6% BEV, and 9.1% PHEV.

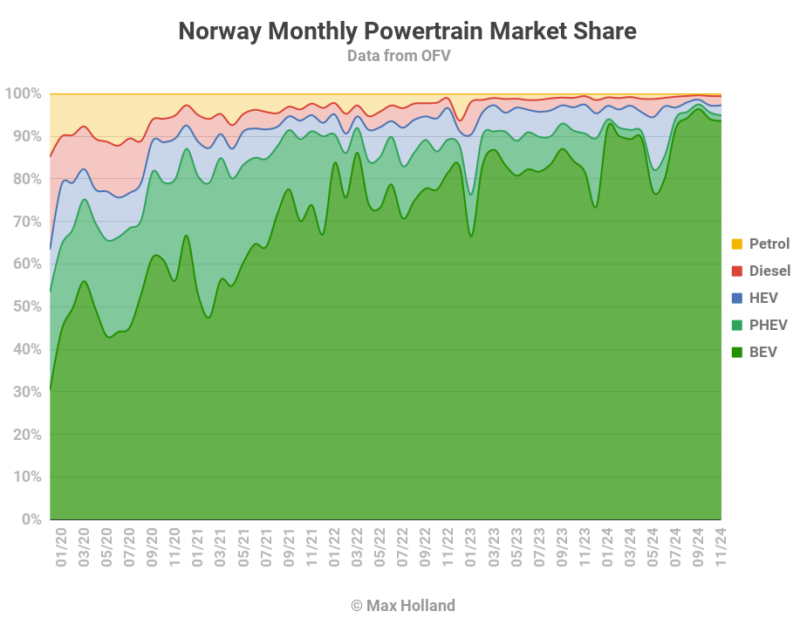

The policy changes that came into effect in January 2024 appear to be bearing fruit. PHEVs were no longer particularly favoured under the new tax rules, and that has meant that BEVs have steadily climbed towards an ever higher proportion of auto sales. All other powertrains are now in trace amounts.

As we discussed last month, there’s still some progress to be made for BEVs to cover fractional edge-cases such as inside the arctic circle, in the deep winter, for remote duty, including for towing. This is why diesel sales, for now, hold on to a tiny but enduring market share. These rare use-cases are where EREVs might play a useful transitional role until battery technology improves still further (which it certainly will in time).

According to one very helpful comment under last month’s report, the Skoda Octavia and Kodiak together account for around 40% of Norway’s diesel car sales in 2024. These platform-sharing VW Group models are currently not offered in a PHEV version in Norway (they are in other markets), which might be an unfortunate side-effect of 2024’s harder taxation regime for PHEVs. The taxation policy might perhaps be making them costlier up-front than diesels. If anyone has insights into this apparent anomaly, please jump in to the comments.

Our same correspondent reported that a good portion of the remaining diesels are working 4WD pickup trucks like the Isuzu D-Max, and Toyota Hilux, which surely sometimes are used for remote work (including towing) in farming fields and forests. This is an area where Maxus have missed a trick by still not offering a 4WD version of their otherwise rugged and competent T90 pickup truck, which has been on sale in Norway for 18 months already.

Perhaps Maxus’ newly announced eTerron 9 — which does have 4WD, as well as a 102 kWh LFP battery — will come to Norway soon? The eTerron 9 is already generating orders on Maxus’ UK website. Working vehicles also represent a segment where BYD could offer a pickup variant of the Shark PHEV (which has 100 km of WLTP range). The Shark is supposed to be coming to Europe in 2025.

Might the Norwegian government consider compromise taxation policy for long-range PHEVs (and EREVs) — those with 100+ km of rated range — in certain (utilitarian) vehicle segments, at least temporarily? If you have other ideas about displacing the residual diesel and HEV sales that are bought for demanding duty in remote areas inside the arctic circle (including for emergency vehicles), please jump into the comments.

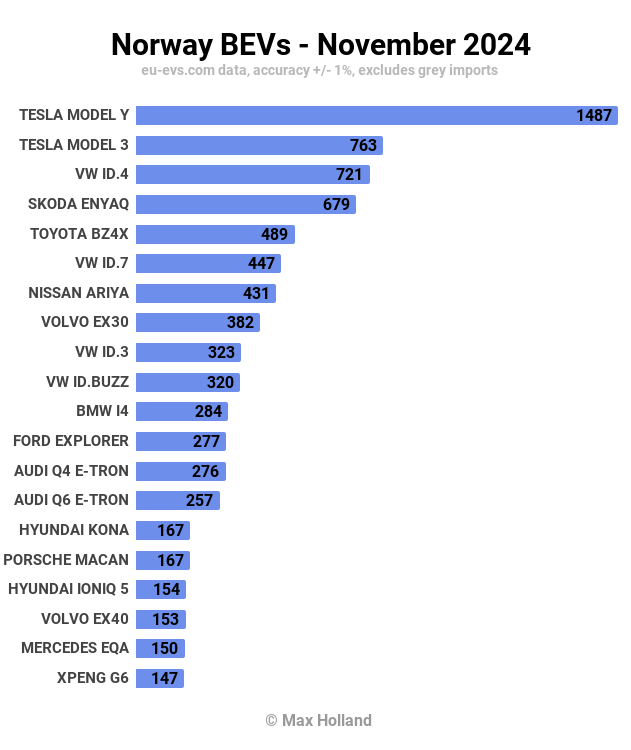

Best Selling BEV Models

After Tesla’s timeout in October, the brand took back the top two best selling model spots in November. The Model Y led, with 1,487 units, and the Model 3 came second, with 763 units.

In third place, not far behind the Model 3, was the Volkswagen ID.4, with 721 units, its highest monthly volume in H2 2024.

Most changes in the rankings were small, and there were no great surprises. We can note that the new Ford Explorer settled back to (a still very respectable) 277 units, from the 407 units in October. Is this volume (and a rank in the top 15) its steady-state going forwards?

The new Audi Q6 and Porsche Macan cousins stayed fairly stable in the second half of the table, in 14th and =15th positions respectively, and likewise may have found their comfort zone.

There were a couple of interesting new debuts in November. The new BYD Sealion SUV made a strong start with 135 units, landing just off the table, in 22nd spot. The BYD Sealion is a mid-large SUV coupe, at 4,830 mm in length, with a starting price of 469,900 NOK (€40,400) for the base version. This version has a 91.3 kWh (usable) battery, with pretty fast DC charging (10% to 805 in 24 minutes), with AWD and plenty of performance (530 PS). This is a great value BEV, and should prove popular in Norway, so let’s see how it gets on.

At almost the same volume, the new Kia EV3 also debuted in November, with 120 units and 24th spot. The EV3 will eventually replace the Kia Niro, which has been a very popular BEV in Europe since launching in 2018. For more info about the new Kia Ev3, see our recent coverage.

The final interesting debutant is the Dongfeng Nammi Box, which landed with 23 units. I covered the Nammi Box back in March, when looking at the Dacia Spring’s peers in the Chinese market. I asked “Will Dacia Spring’s Competitors In China Come To Europe?” and Dongfeng has answered that question in the affirmative. The Nammi Box is a small hatchback, with a length of 4,020 mm, a rated range of 310 km WLTP (from its 42.3 kWh battery), and an affordable price of 199,900 NOK (€17,200).

The Nammi Box is possibly the best value BEV currently available in Europe, and may do well in Norway. Why? It undercuts the (post-tax) price of many of the economy-car ICE and HEV models (which are still selling hundreds of units per quarter in Norway) by around €10,000!

The Nammi Box has just enough range (and okay DC charging) to be a modest all-rounder for some drivers, and to be a second-car for many households. This is exactly the kind of simple, affordable, yet competent BEV that European motorists have been crying out for (and which has powered the Chinese auto market’s stratospheric transition).

The Nammi Box’s success will likely depend less on its inherent capabilities (and value proposition), and more on what kind of dealer network and service support Dongfeng can arrange in Norway. Let’s keep a close eye on this one.

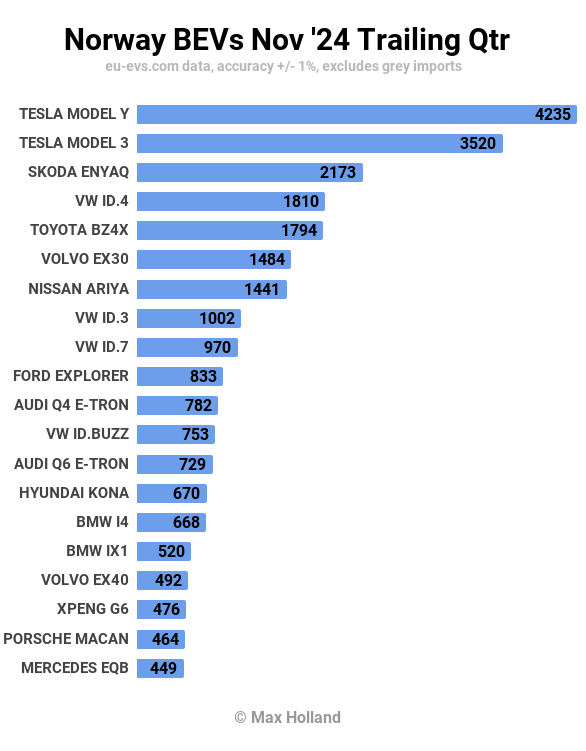

We now turn to the 3-month rankings:

The two Teslas are obviously still dominating by a strong margin in Norway. Year to date, just these two models, with 21,085 combined sales, almost match the combined sales of all of VW Group’s 14 BEV models sold in Norway (22,122 units).

In terms of moves in the top 20, the Ford Explorer has had the most spectacular rise from three months ago. Back then it had just seen 4 units delivered to dealers. Since then it has delivered 833 units and climbed into 10th spot. This is a great result for Ford.

Further down the list, the Audi Q6 (13th), and the Porsche Macan (19th), have also had great results over the past three months. Not to be overlooked, the Xpeng G6 (18th), has also done well, and has been consistent at around 150 monthly units over the past 3 months.

The next models to watch out for are the BYD Sealion and the Kia EV3, which should both climb into the top 20 by early next year, if their debut volumes are indicative.

Outlook

Norway’s broader economy remains erratic – not unusual for a small economy heavily weighted by the export of an erratically priced global commodity. Latest data from 2024 Q3 shows YoY GDP up by 3.5%, thanks to a recent government stimulus, following much of the prior year in negative GDP territory. Inflation is at 2.6%, interest rates remain high at 4.5%, and manufacturing PMI is slightly down, at 50.7 points in November, from 52 points in October.

I’ve previously said that there’s still a need to displace the most affordable remaining plugless cars in Norway with equally (or more) affordable BEV alternatives, and with the Dongfeng Nammi Box now launching, the Citroen e-C3 (which is only 10% more expensive) on the cusp, and the Hyundai Inster (10% more again) collecting reservations, this remaining piece of the puzzle is now solvable.

The other end of the market, that of the hard-conditions edge-case in the far north, with niche working vehicles, will take a bit longer to solve, but with the Maxus eTerron 9, and BYD Shark already promised for Europe, there’s may be light at the end of the tunnel for those segments also. I’ll be watching closely over the coming months.

What are your thoughts on Norway’s final stages of the EV transition? What models (or market niches, or price points) are you looking for to fill the remaining spaces? Please share your perspective in the comments section below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy