Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

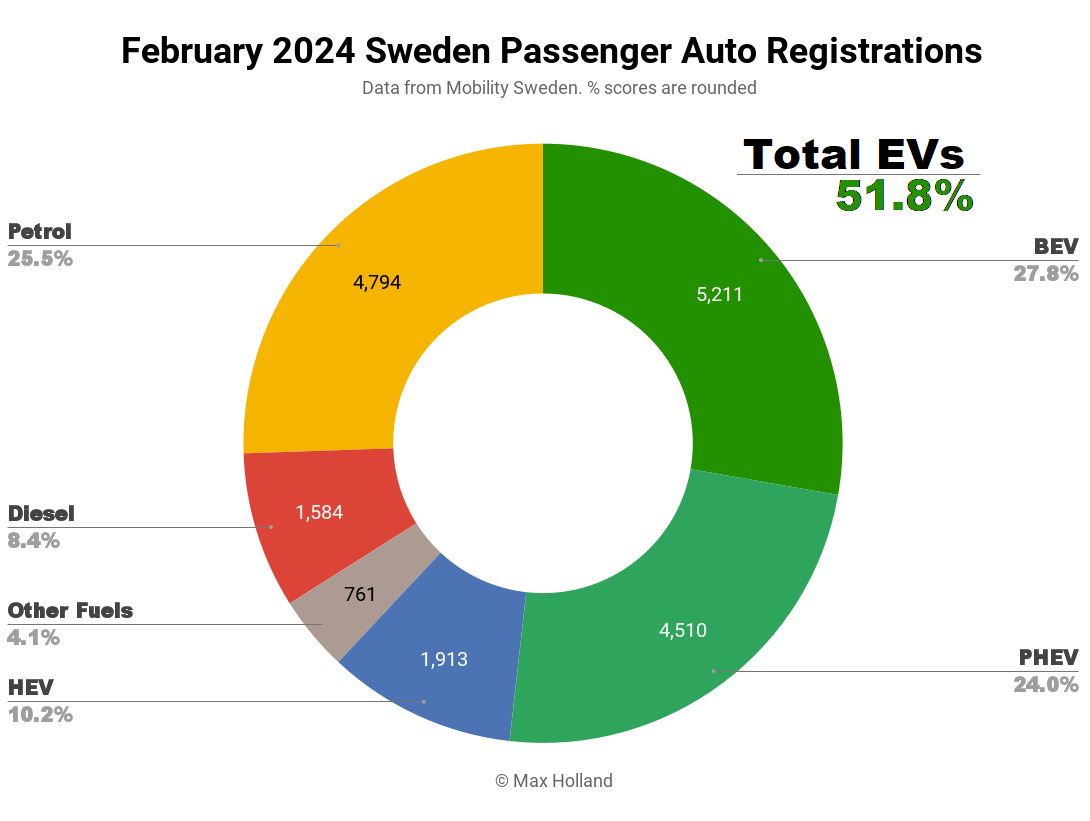

February’s market saw plugin EVs take 51.8% share in Sweden, down YoY from 54.0%. Plugin volumes were down YoY for BEVs, but up for PHEVs. February’s overall auto volume was 18,773 units, up some 2% YoY. The Tesla Model Y was the month’s bestselling BEV.

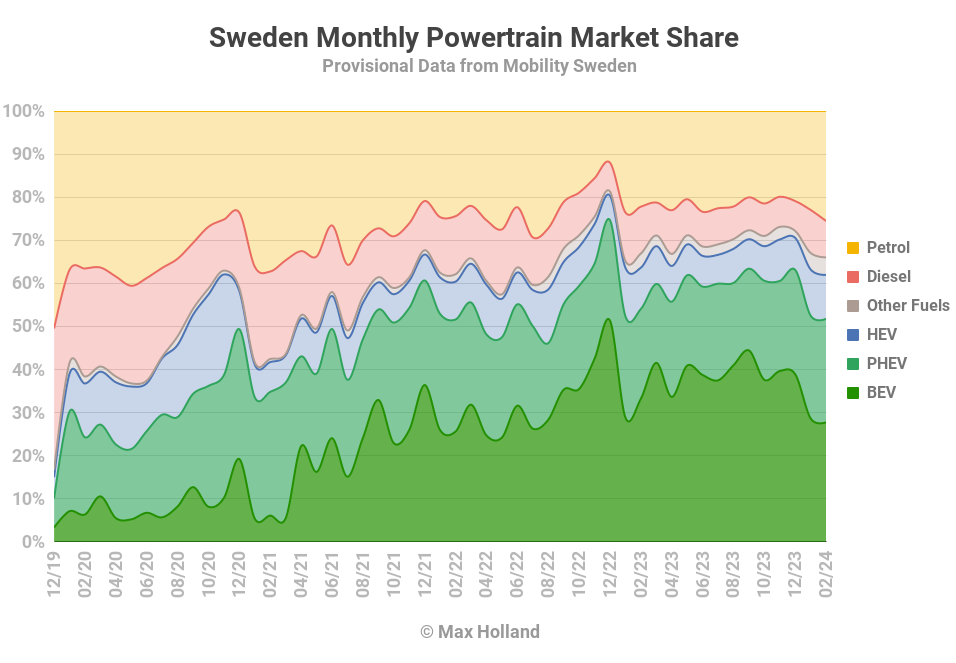

February saw combined EVs take 51.8% share in Sweden, with full battery electrics (BEVs) at 27.8% and plugin hybrids (PHEVs) at 24.0%. These figures compare with 54.0% combined in February 2023, 33.2% BEV and 20.8% PHEV.

In terms of volumes, BEVs were down some 15% YoY, to 5,211 units, some 900 units short YoY.

Contributing most to the volume shortfall, Volkswagen Group brands were down by some 39% in volume YoY, leaving the market some 650 units short. Stellantis brands were almost entirely absent, down some 90% (and 310 units). These two European heavyweights together accounted for the YoY volume drop.

But others were failing to pull their (lighter) weight also. BMW Group was also down by around 39%, and 200 units short. MG Motor was far down (-80%) and some 360 units short. Hyundai Motor Group was moderately down (~30%) and some 250 units short. Mercedes Group was only slightly down (~12%, 25 units short).

With all these manufacturers substantially down in YoY BEV volumes, which brands were up? Tesla was up by over 100% YoY (+ 1030 units), and Volvo/Polestar was up by around 25% (and up some 300 units). Toyota Group was up by almost 400% (though, given the low baseline, still only some 80 units up).

Are Volkswagen Group and Stellantis brands more subsidy-dependent than others? Perhaps, but how about BMW? Are we looking at temporary allocation/logistics shortfalls? Please discuss. No doubt we will get a clearer picture in the months ahead.

Meanwhile, diesel share continued to slide, from 10.9% a year ago to just 8.4% (and 1584 units).

Best Sellers

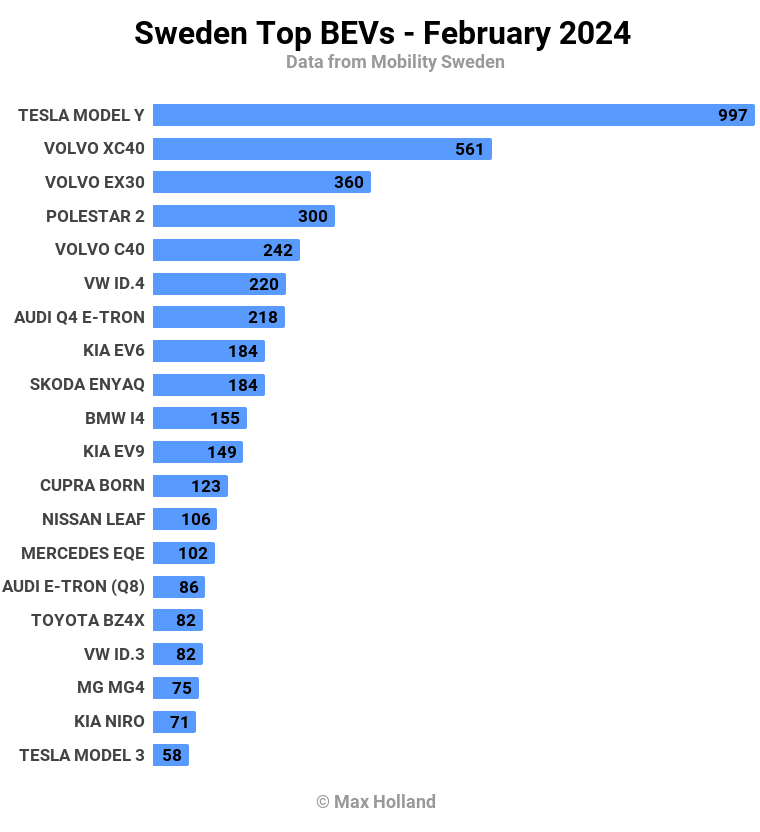

The Tesla Model Y was once again the best selling BEV in February, with 997 units registered. The Volvo XC40 was the runner up, with 561 units, and the new Volvo EX30 rose to third, with 360 units.

Third is a great result for the new Volvo EX30, which only debuted in December! The compact SUV is considered to be one of the better value BEVs currently available in Sweden.

Realistically, a starting price of €38,400 can’t accurately be called inexpensive on an absolute scale, when you can buy, for example, a Dacia Sandero (albeit 3% smaller) for €16,000 in Sweden. Even an entry MG4 can be bought for €33,000. But, relative to most other BEV prices in Europe, the EX30 is “more affordable.” Potentially, it could top Sweden’s charts sometime soon, at least in Tesla’s low-ebb months, assuming that Volvo can build enough units.

Notice also that the home-grown Volvo and Polestar models took every rank from #2 to #5, an impressive feat.

There were few notable changes in the top 20 ranks in February. There were, however, two new BEV models introduced onto the Swedish market.

The most interesting newcomer, with a 52 unit debut, was the Zeekr 001. This is a large, 4955 mm length sedan/coupe with 620 km WLTP range from its 94 kWh (usable) battery. It’s capable of 31 minute 10–80% charging. The starting price for these specs is SEK 677,000 (€60,200), but other variants are available with AWD and more power for more money.

Then there’s the Peugeot e-308, which arrived with 7 units. If you want more detail on this compact hatchback with 410 km WLTP range, priced from SEK 479,900 (€43,000), take a look at Zach’s overview from last year. Stellantis has not been selling much volume in Sweden recently, as discussed earlier, so we can’t expect much market impact from this model for now (nor perhaps much demand, at least at this “ambitious” price point).

Now let’s turn to the trailing quarter rankings:

As usual, the Tesla Model Y is dominant, a significant step ahead of the Volvo XC40 and Volkswagen ID.4.

These same three models have been the long-term leaders in Sweden, sometimes shuffling places, since mid-2022. Already, the Volvo EX30 has joined the top 10 in the 3-month chart, following its December debut. Can the EX30 challenge the stasis of the top 3 ranks? It seems likely to do so, given its evident popularity.

Further back in the 11th spot, the new Kia EV9 is doing well, especially given the high starting price (SEK 807,900, €72,000). Its nearest competitor, the Volkswagen ID. Buzz, is languishing down in the 30th spot, where it has been for a while.

Let’s keep an eye on the Volvo EX30’s ascent in the coming few months.

Fleet Evolution

The statistics agency publishes fleet updates once a year, so let’s take a look at Sweden’s progress:

The rate of change over the past 4 years seems frustratingly slow. At the end of 2019, combined plugin share was 1.98% (with 0.62% BEV). Four years later, at the end of 2023, plugin share was 11.33% (5.86% BEV). PEV fleet increase actually slowed from 2022’s 2.77% to just 2.55% in 2023.

At the rate seen in 2023, it would take another 35 years (till 2059) to achieve a fully plugin fleet. This underscores why we need more affordable BEVs to be made available for sale in Europe. A recent JATO report found that European carmakers have actually increased their BEV prices and their profits, are trying to cash in on high-end models, and are refusing to offer affordable BEVs.

They are doing this even whilst LFP cell prices have recently achieved record lows of 340 RMB (€44, $48) per kWh. This would put the cost of a 45 kWh pack in an efficient small car (for 320+ km range) at around €2,500. So, why are most European OEM’s BEVs still priced at least €10,000 more than an ICE equivalent? The JATO report points to legacy OEM profiteering. Is price collusion going on also? I wouldn’t bet against it.

Outlook

Sweden’s economy is still weak, with latest data (Q4 2023) showing YoY growth of -0.2% GDP, the third consecutive negative quarter. Inflation has worsened, to 5.4% in January (latest data) from 4.4% in December. Interest rates are flat at 4%. The manufacturing PMI score, however, did improve in February to 49 points, from 47.1 in January.

Sweden’s auto industry body, Mobility Sweden, had this to say: “It is clear that the private market for passenger cars in general and electric cars in particular is still weak. To reverse this negative trend, targeted efforts from the government are required to stimulate demand for electric cars among private individuals. It is crucial that electrification does not go backwards.”

What are your thoughts on Sweden’s EV transition? Please join in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.