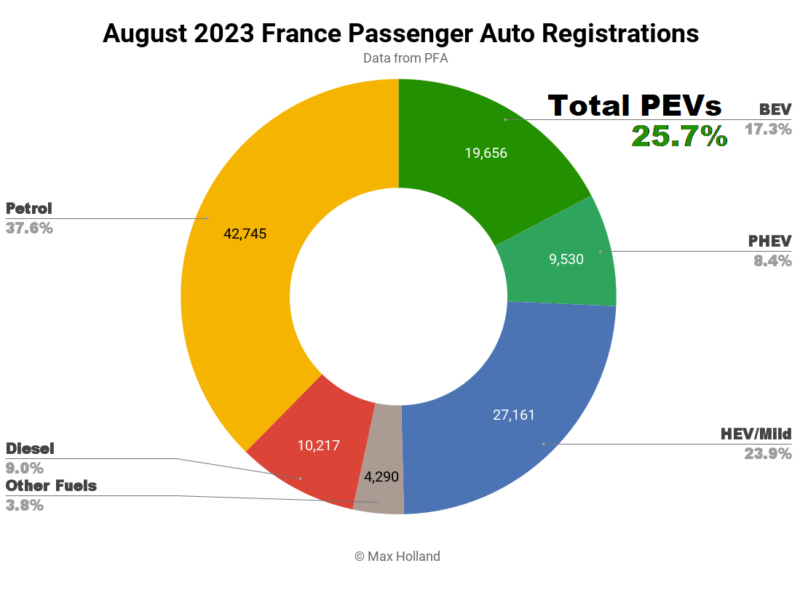

August saw plugin EVs take 25.7% share of the auto market in France, up from 21.0% year on year. The volume of full electric sales grew by almost 60% YoY. Overall auto volume was 113,599 units, up 24% YoY, though still far below pre-2020 seasonal norms. August’s best selling full electric was the Tesla Model Y.

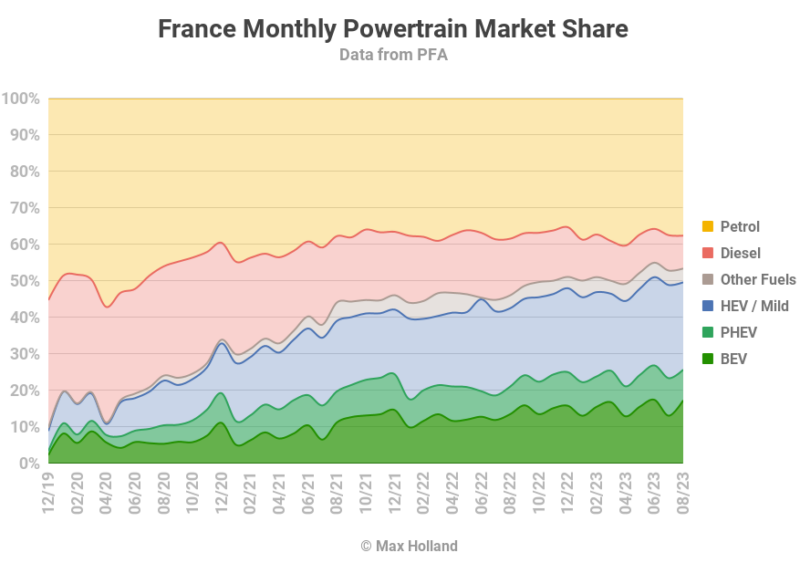

The month saw combined plugin EVs take 25.7% share, comprising 17.3% full battery electrics (BEVs), and 8.4% plugin hybrids. These compare with YoY respective shares of 21.0%, 13.5% BEV, and 7.5% PHEV. We can see that BEVs have grown share at nearly 1.3x over the past 12 months, whilst PHEVs have only grown marginally.

In terms of unit volumes, BEVs grew by 59.5% YoY, to 19,656 sales. PHEVs grew 38.1% to 9,530 sales. Both classes of plugin thus outperformed the overall market’s volume growth of 24.3%.

Diesel share continued to fall, hitting a new record low in August with 9.0% share, from 15.5% year on year. Alongside growth in plugins, some growth in mild hybrids is occurring to fill the void left by diesel, but these are a temporary solution to continuously tightening pollution and emissions restrictions. In the longer term, plugins will take over from these also.

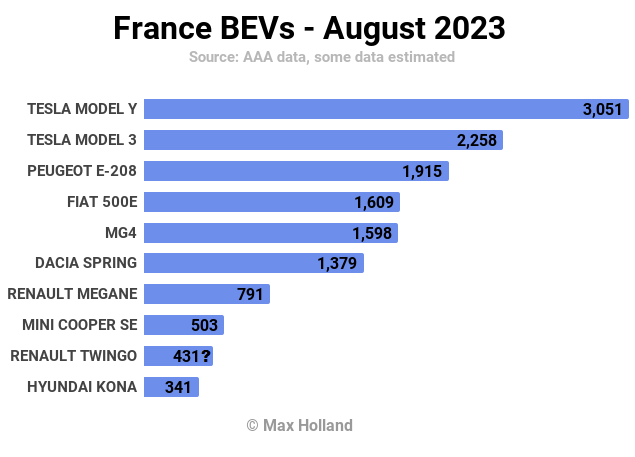

France’s Best Selling BEVs

The Tesla Model Y was back to the top of the BEV charts with 3,051 units registered in August, and its sibling the Tesla Model 3 came in second with 2,258 units.

The Peugeot 208 took third spot with 1,609 units.

Note that — due to low source data resolution this month — some model totals are estimated, but the ranking should be accurate.

If you’ve seen the Germany report, you will know that some brands (notably Opel) prioritised allocations to Germany in August, ahead of the looming incentive cut there. Thus French deliveries for Opel, and a few other brands, saw lower than normal volumes.

There was one notable new model debut in August, the Lotus Eletre. Priced from €97,890 the new Lotus performance SUV will not change the volume landscape in France, but it is good to see these upper segments of the auto market now accelerating their transition over to BEV. These halo auto segments do have a “trend” influence on the higher volume affordable segments.

Let’s check the 3 month picture (again, some totals are estimated):

Tesla is clearly dominant, taking the top 2 spots, and by a decent margin.

Tesla’s strength in France continues to be remarkable given the local market’s long standing penchant for mostly small and affordable models.

Speaking of which, the good value MG4 has continued to climb, from 7th previously, to now take the 5th spot.

There will be several new BEV launches from Stellantis and Renault to look for over the coming months.

The Peugeot 308 has already arrived in Germany, so should be imminent in its home market also. It shares its underlying platform and technology with the Opel Astra, with a WLTP range of over 400 km. Both are C-Segment hatchback vehicles, around 4,367 mm in length, and will also be offered in touring-wagon variants.

Next week, Peugeot will unveil their upcoming SUV the e-3008, taller than the e-308 hatchback (by almost 200 mm), and almost 100 mm longer (4,445 mm). It will use the new e-VMP Stellantis platform (designed primarily for mid sized vehicles), which enables more powerful motors and larger battery sizes.

The new platform will accept up to 98 kWh of battery. Whether this much battery will be available (or needed) for the C-segment e-3008, or only come later with the larger Peugeot e-5008 (around 4650+ mm), we will learn next week. The 3008 will probably not launch before early-to-mid 2024. Opel will launch its own near-twin of the 3008, called the Grandland, sometime in H2 2024.

The Fiat 600e, which will share much of the Jeep Avenger’s specs (over 400km WLTP), in more rounded retro packaging, and should arrive in December 2023, or Q1 2024. Like the Opel Astra and Peugeot e-308 mentioned above, this is based on Stellantis’ existing BEV platform, though this platform has steadily improved in efficiency since launching 4 years ago.

The Renault Scenic, a higher roofline sibling of the Renault Megane, with similar technical specs and pricing, will arrive in February 2024. Around this time, Renault will also show off the final production version of the electric Renault 5, based on the new CMF-B EV platform. Customer deliveries of the Renault 5 should start in Autumn 2024.

We will keep an eye out for all of these upcoming BEVs, and more, and track their growth in the French market.

Outlook

France’s 24% YoY auto sales growth in August helped to prop up the broader economy. GDP growth was at 1% YoY in July, up from 0.8% YoY in June. Although lacklustre, this is much healthier than Germany, Poland, Netherlands, Sweden, Austria (amongst others), which are currently seeing shrinking economies.

Inflation in France is also better than most, though did increase from 4.3% to 4.8% from July to August. Interest rates are flat at 4.25%. Manufacturing PMI was 46 in August, up slightly from 45.1 in July.

These economic figures suggest that — although the auto market is currently seeing YoY growth due to backlog-rebound off the back of the previous period of supply chain problems — it won’t be booming anytime soon.

On the other hand, oil prices are climbing, and electricity rates have come back closer to normal levels compared to the extremes of 2022. This energy pricing pattern will obviously continue to strongly favour the long term economic advantage of BEVs, and most car buyers are now aware of this. Whatever the overall auto market volumes, we can expect EV share to continue to steadily increase over the coming months.

What are your thoughts on France’s transition to EVs? Please jump into the discussion below.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …