Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

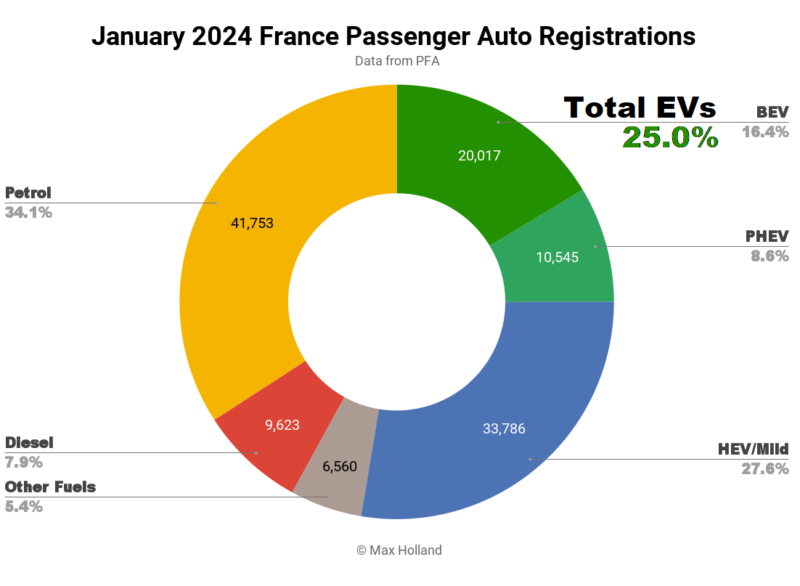

January saw plugin EVs take 25.0% share of the French auto market, an increase from 22.3% share, year on year. Full electric sales volume grew some 1.4x YoY, while plugin hybrid volume was flat. December’s overall auto volume was 122,284 units, up 9% YoY, but still far below 2017–2019 norms (~155,000). France’s best selling full electric in January was the Peugeot e-208.

January saw combined plugin EVs take 25.0% share, consisting of 16.4% full battery electrics (BEVs), and 8.6% plugin hybrids (PHEVs). These compare with YoY figures of 22.3%, with 13.1% BEV, and 9.2% PHEV.

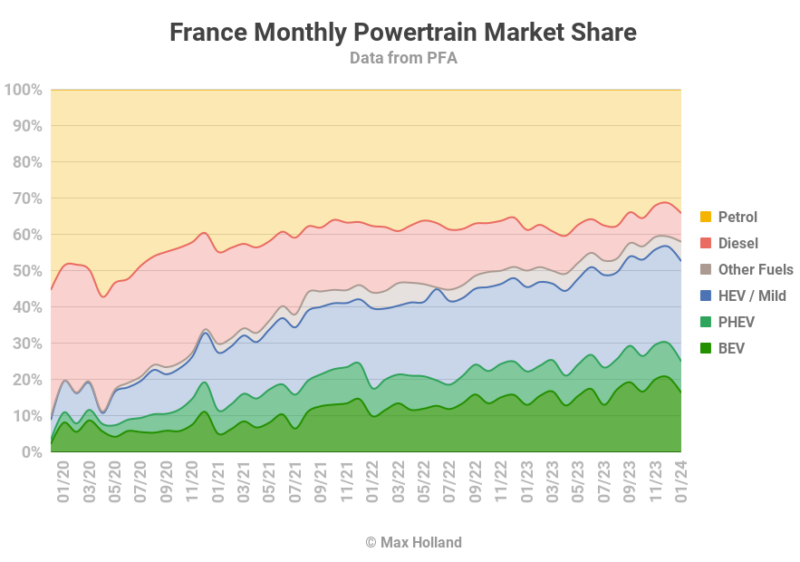

An annual addition to BEV market share of 3.3%, climbing to 16.4% share, looks fairly modest, but represents a 1.25x increase in share from January 2023’s 13.1%. BEV sales volume was up a more impressive 37% YoY, even though this was partly hidden by an overall market volume recovery. That overall volume recovery, however, was only enabled by BEV growth and mild/HEV growth, since PHEVs were flat, and combustion-only powertrains were down in volume.

Diesel-only sales were down to a new record low of 9,623 units, from 12,558 YoY, and just 7.9% market share. This is the 8th consecutive month of diesel-only falling under 10% market share, and the powertrain is trending to fall below 5% sometime in Q3 2024.

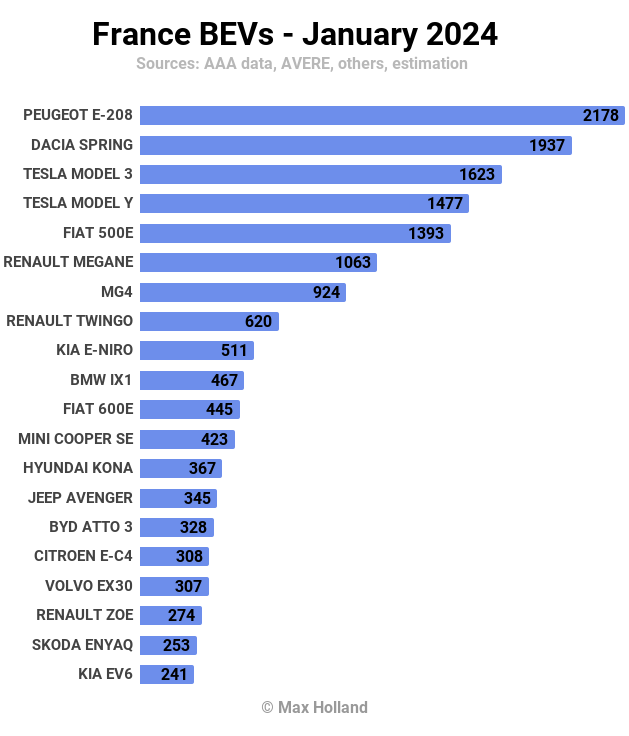

Best Selling BEVs

The best selling BEV model in January was the Peugeot e-208, with 2,178 units. The Dacia Spring, and Tesla Model 3, were in second and third.

Recall that the French policy on eco-bonus eligibility is in the process of tightening, and the Dacia Spring and Tesla Model 3 are amongst the most popular of those models which will lose the bonus. As March 15th is the final cut off date, we can expect them to pull-forward deliveries before then.

Other models in the January rankings which may be seeing a pull-forward ahead of their (certain) loss of incentives include the Kia Niro, and Kia EV6, the BYD Atto 3, and the Volvo EX30. The MG4 is near its normal ranking, not yet showing signs of a pull-froward.

Other popular models which will see the bonus cancelled are the other MG models (ZS, MG5, Marvel R), along with many other more modest sellers, such as the Ford Mustang Mach-e, Fisker Ocean, Nissan Ariya, and Toyota BZ4X (amongst several others). Put in over-simple terms, if it’s not made in Europe, it’s no longer getting any of the €4,000-€6,000 bonus (not even a reduced portion of the bonus).

While the overall goal of monitoring and reducing BEV manufacturing CO2 footprint is a good idea, it would be better achieved by tiered bonus scaling (and tightening over time), encouraging all global auto manufacturers selling in France to buy-in to the process, improve measurement, get a handle on process improvements, and make steady progress. The all-or-nothing “cold turkey” approach ends up being exclusionary and thus counter-productive to the ostensible goals of decarbonising the auto industry, and — who could have guessed? — appears effectively protectionist. Like all protectionism, attempts at insulating the French/European auto industry from outside competition are ultimately condemning it to being uncompetitive globally.

Furthermore, protectionism, or even the perception of protectionism, is a slippery slope for the broader economy. For example, the crucial exports of large French economic sectors such as luxury products, including cosmetics, fashion brands, food-and-wine, (amongst others), as well as the aerospace sector (Airbus), might potentially find themselves subject to retaliatory action. At the limit, an escalating game of protectionism for a middle-weight economy like France — duelling with all economies outside Europe — could conceivably terminate these large export-dependent sectors of the French economy.

In short, I believe a more nuanced bonus-scaling in line with CO2 manufacturing footprint would have been much wiser.

The performance of the French BEV market over the next several months will be strongly shaped by the pull-forward and hangover around this policy change. Those models which are experiencing a pull-forward now, and a hangover in April — may only be clearly discernible in hindsight, around the end of Q2. As I mentioned in last month’s report, the water is muddied further by the prospect of some import brands lowering their prices to try to maintain some sales, even without access to the bonus.

Let’s look at the 3 month rankings:

Overturning the pattern of almost all of the past 14 months, the older Tesla sibling, the Model 3, has recently pulled back ahead of the Model Y in sales volume — due entirely to its upcoming bonus cut (being made outside Europe).

Each of the past three months has seen the Model 3 outsell the Model Y. The Model 3’s rise to number 1 spot is a big step up from sitting in 7th in the prior period (August to October). We can expect the Model 3 to again head the chart in February and in March, due to the pull-forward.

We may also see climbs from the Dacia Spring, MG4, and those other popular BEVs (we noted above) which are due to lose the bonus from mid-March. Let’s keep an eye on the ranks in the next two months.

Outlook

The recent volume recovery of the French auto market is outperforming the broader economy. GDP growth was weak across 2023, with consecutive quarterly YoY scores of 0.9%, 1.2%, 0.6%, and 0.7%. Inflation stabilised to 3.1% in January, the lowest in almost 2 years. Interest rates have remained at 4.5% since October. Manufacturing PMI increased to 43.1 points in January, from 42.1 points in December, but that’s still negative (below 50 points).

With loss of the eco-bonus for many popular BEVs in the near future, we should anticipate that BEV sales will not see strong volume growth this year. The only escape from this would be if the incoming affordable BEVs like the Citroen e-C3, and Renault 5, can quickly scale to very large volumes (top 5 volumes) and effectively replace the diminished sales of the Dacia Spring, Tesla Model 3, MG4, Kia Niro and the others. This seems unlikely, but we will keep an eye on it.

What are your thoughts on the French EV transition? Please jump into the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.