Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

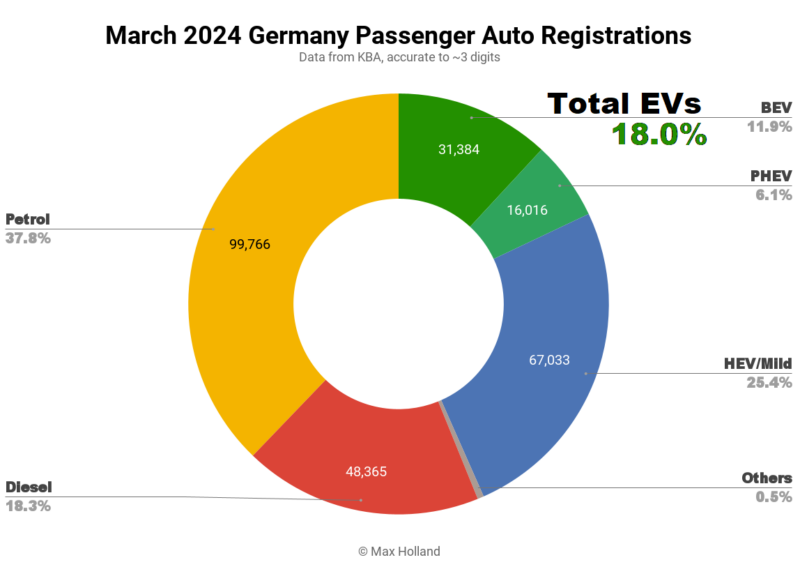

March saw plugin EVs take 18.0% share in Germany, down year on year, remaining stuck in a hangover from sudden incentive abandonment in late December. BEVs were down some 29% in YoY volume, while PHEVs were down 4.5%. Overall auto volume was 263,844 units, down 6% YoY, and down 25% from 2017-2019 seasonal norms (~350,000 units). The best selling BEV was the Tesla Model Y.

The market data saw combined EVs at 18.0% share, with full electrics (BEVs) at 11.9% and plugin hybrids (PHEVs) at 6.1% share. These compare with 21.6% combined, with 15.7% BEV, and 6.0% PHEV, year on year.

BEV sales are in bad shape, following on from the abrupt abandonment of incentives in mid December. How bad is the BEV result? The monthly volume — at 31,384 units — is down 29% compared to the same month in 2023, and down 9% from March 2022. Even March 2021 had almost as many BEV sales, at 30,101 units. This is the worst year on year drop in volume for the past 4 years, excepting December 2023 (which was against a baseline of a record high “pull-forward”).

Over those previous three years (and longer), there were incentives in place for all BEVs priced below €65,000. The main purchase incentive stood at €3,000 for BEVs priced above €40,000, and €4,500 for BEVs priced below €40,000. From December 2023, not only are incentives completely gone, but gone abruptly (they were supposed to continue at a reduced rate throughout 2024). This has caused a major hangover in the perceived value of BEVs, relative to before the cut.

Beyond the incentive cut, there’s another possible influence on March’s low BEV performance. Some minor elements of the BEVs result may be due to temporary logistics ebbs. Tesla was some 4,500 units down compared to March 2023, (down 2,500 for Model Y and 2,000 for Model 3). In the case of the Model Y the recent pause at the nearby Gigafactory may have weighed on volumes. For the Model 3, Tesla has said that shipping challenges through the Red Sea region caused delays to European deliveries. Note that, even after the incentive cut, due to MSRP reductions, the end price for the Model Y is roughly the same or slightly lower than it was a year ago.

The last major influence (and likely the most weighty) on March’s low BEV result, is undoubtedly the weak state of the German economy, combined with the high sticker price of mid-segment BEVs compared to ICE counterparts. Germany’s economy has been in recession since Q3 2023.

As I have discussed in my other recent reports, regular folks with a median financial situation (or under the median) tend to quickly cut back spending on expensive items during recessions. While BEVs in price segments above €40,000 or €50,000 are now competitively priced relative to ICE alternatives, most BEVs listing below roughly €40,000 remain priced as “luxury items” relative to their ICE counterparts.

The Fiat 500 BEV, for example, has an MSRP (€34,990) twice that of the mild hybrid / ICE variant (€17,490), which is positioned and priced as an economy car in Germany. To choose the BEV variant (over the mild hybrid) is of course perceived as a relatively expensive choice — exactly the kind of choice which gets quickly trimmed in a recession by regular (median) consumers.

That’s a double hit on the mid and lower priced BEVs, since, as mentioned above – the eco-bonus was €4,500 for BEV priced under €40,000 (compared to a lesser €3,000 for more expensive BEVs,up to the 65k cap). So the cancellation of the incentive falls more heavily on mid and lower priced BEVs than higher priced ones.

Both these factors together – the heavy blow of the incentive cut on lower and mid priced BEVs, and the tighter economic squeeze on still not price-competitive lower and mid priced BEVs – create an ideal recipe for huge falls in sales of these lower and mid priced BEVs. I will go into more detail on this pattern, and we will confirm it in the data, in the BEV models section below.

Combined combustion-only powertrains strongly outperformed BEVs, only falling in volume by 2.5% YoY, compared to BEV’s 29% fall. Their combined share therefore grew YoY, from 54.0% to 56.1%.

To add insult to injury for BEVs, even the volume of HEVs was almost flat YoY, with the resulting share growing from 23.9% to 25.4%.

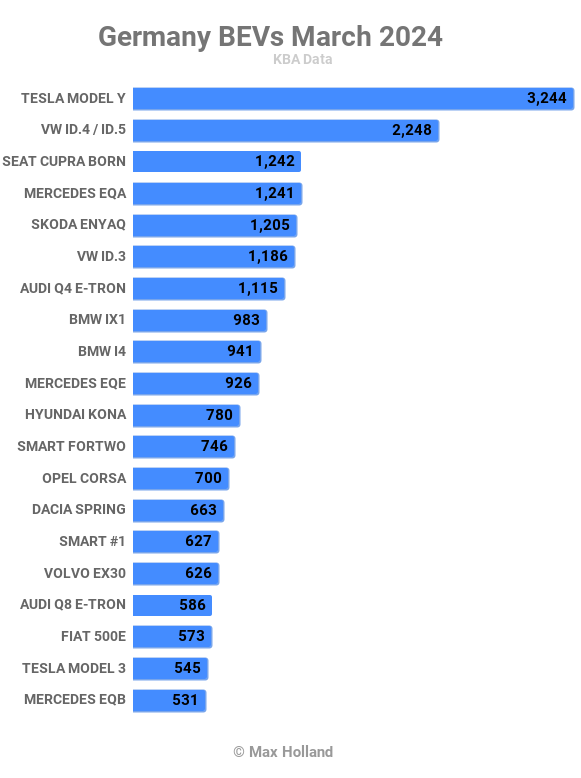

Best Selling BEV Models

The Tesla Model Y was the best selling BEV model in March, for the third consecutive month, with 3,244 units registered.

The Volkswagen ID.4/ID.5 was in second spot, and its group cousin, the Cupra Born, took third.

The Tesla Model Y has taken the top spot in 6 out of the past 12 months (and second spot twice, third spot twice).

The Volkswagen ID.4/ID.5 is the closest competitor to the Model Y, having taken the top spot four times in the past 12 months (and second spot four times, no thirds).

March was the highest result yet for the (SEAT) Cupra Born, taking third spot for the first time ever. Over the past year, group cousin the Skoda Enyaq has been the overall third most popular BEV, but was pipped by its smaller relative this month.

There were no great surprises in the top 20, relative to recent months.

There was one new BEV debutant in March, the Renault Scenic. This is built on the same CMF-EV platform as its older sibling, the Renault Megane. As well as sharing the Megane’s most popular 60 kWh (usable) battery option, the Scenic adds the option of a larger battery (87 kWh usable).

The two recently released BEVs, the BMW iX2, and Audi Q6 e-tron continued to ramp up. After its customer debut in January (18 units), the iX2 saw 37 units in February, and 132 units in March. We can expect it to eventually achieve volumes close to the BMW iX1 (over 1200 units per month recent average). The Q6 e-tron debuted in January with 22 units, saw 50 units in February, and has now sold 120 units in March. Its bigger sibling Q8 e-tron averages 750 units per month, and smaller sibling Q4 e-tron, 1,500 units per month. The Q6 will likely split the difference, and therefore compete on volumes with the iX2.

The Volvo Ex30 also continued to grow, reaching a record 626 sales in March, and 16th spot. It likely still has some room to grow from here.

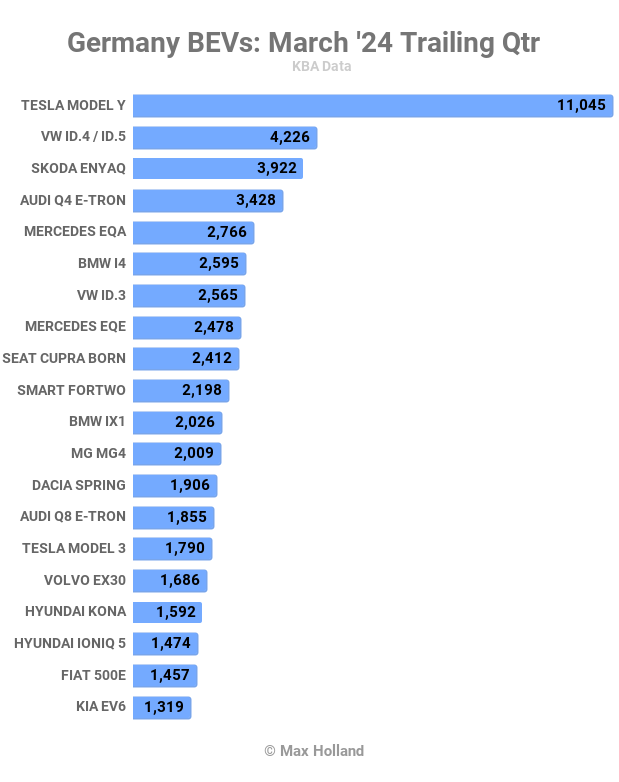

Let’s now look at the trailing 3 month performance:

Here, the long term favourites are still holding their ranks, although the Model Y’s gap has grown since Q4 2023, which was a much closer race.

With just one or two minor exceptions, unit volumes were down compared to Q4.

In the powertrain market share section above, I stated that we are in the perfect economic and policy conditions for huge year on year falls of sales in the mid to lower end of the BEV market

This is confirmed by the data. The popular BEVs whose sales have more than halved year on year include: the Mini Cooper (down 91%), Peugeot 2008 (down 88%), MG4 (down 82%), Tesla Model 3 (down 79%, though see logistics note earlier), Renault Megane (down 78%), Citroen C4 (down 76%), Peugeot 208 (down 75%), Nissan Leaf (down 71%), Renault Twingo (down 69%), Fiat 500e (down 63%), VW ID.3 (down 54%).

There are notably few BEV models priced in the mid, premium, or upper segments with YoY volume crashes of the same magnitude. The few exceptions are due to other factors (e.g. Porsche Taycan about to be replaced, Nio models with erratic shipping)

For example, let’s look at the YoY performance of BEV models from premium domestic brands, models which are already priced competitively with their ICE peers, even without incentives. Most of these models have grown in YoY volume, or at least outperformed the overall market. The Mercedes EQE is up 87%, BMW i4 (up 52%), Mercedes EQA (up 15%), BMW iX3 (up 7%), BMW iX1 (up 1%), and BMW i7 (down 1% outperforming the market).

In contrast to median consumers, the buyers of premium brands like Mercedes and BMW tend to have above-median financial conditions, and are typically less affected by recessions.

Overall, although there are a few models which have middling fates, when you take the time to check the typical relationship between price segment, and YoY volume, there is a very strong correlation between cost competitiveness with ICE peers, and YoY volume.

All of this points to an obvious conclusion. If BEVs were more competitively priced in Europe relative to ICE peers in the higher volume and economy segments, they would not be underperforming the overall market, and the overall BEV volume in Germany would not be falling year on year.

The reducing costs of batteries and electric powertrains make price competitiveness with ICE entirely possible today for most vehicle segments. The world’s largest car market is already seeing BEVs at price parity with ICE peers in even the affordable price segments. The legacy auto makers in Europe are instead choosing to increase their vehicle prices and make record profits, whilst dragging their feet on the BEV transition.

Please jump into the comments below and have your say about this.

Meanwhile — here are the manufacturing group performances for March:

Volkswagen Group still maintains a strong lead over Tesla in its home market, though both have seen volume fall in Q1, compared to a year ago (along with Stellantis in 6th and Renault-Nissan in 8th).

Conversely, in third and fourth spots, Mercedes and BMW groups have seen their volumes increase compared to a year ago, both significantly outperforming the overall auto market.

Outlook

As noted above, the German economy is in recession, with Q3 and Q4 2023 (latest data) recording YoY GDP results of -0.3% and -0.2%. Inflation cooled to 2.2% in March, from 2.5% in February. Interest rates remained at 4.5%, flat since September. Manufacturing PMI weakened to 41.9 points in March, from 42.5 points in February. Consumer confidence remained very negative at -27.4 points.

The data shows that heavily overpriced BEVs in the lower to mid price segments, combined with a broader recession, and cancelled incentives, are causing overall BEV sales volume to shrink YoY in Germany, and for BEV share of the auto market to shrink. European auto makers meanwhile are making record profits.

What do you think about Germany’s EV transition going into reverse? Please join the conversation below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.