Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

An interesting development is underway in developing countries, and it’s most visible right now in Latin America.

Latin American nations, by and large, lack the means and resources to promote EVs like the US, Europe, and China have done. At best, we have some benefits regarding transit in restricted times (regular restrictions for ICE vehicles are the norm in all large Latin American cities), lower taxes and tariffs … and that’s pretty much it. Because of this, the competition occurs under more natural market conditions and the results serve as a barometer on how competitive EVs really are.

Mexico is perhaps one of the best examples. An odd bird, the country has an impressively competitive ICEV industry, being the seventh largest producer and fourth largest exporter in the world vehicle market while lacking any local/national brand. Instead, it acts as a hub bringing in investment and production from other regions. A portal between the “two Americas” (the Anglo and the Latin), Mexico’s position is privileged, as it can serve both the markets north of the Rio Bravo and south of Yucatan with ease.

For years, Mexico was a laggard in the EV transition, but things started to change in late 2021. Three years of impressive growth later, Mexico is turning into one of the most interesting countries in the region, attracting significant Chinese investment to build EVs locally and rapidly ramping up sales as prices fall and more competitive options arrive.

Mexico’s EV Sales

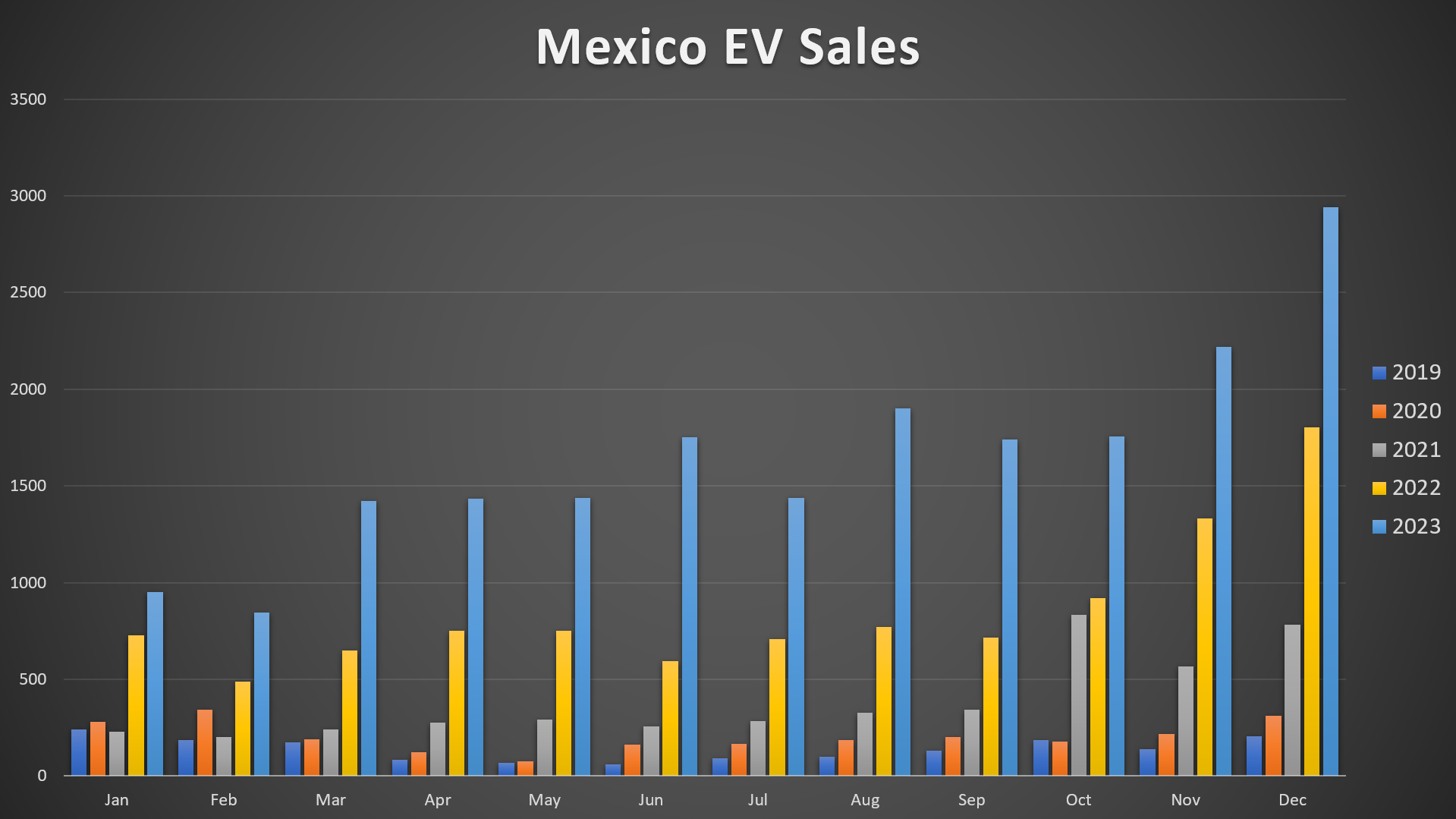

1,469,040 light and heavy vehicles were sold in Mexico in 2023. Of these, 19,487 were EVs (up 94% YoY), for only 1.3% EV market share. However, because sales ramped up substantially during the year, December 2023 closed at 2% (1.5% BEV), meaning the market is maturing very fast, with significant growth in only one year.

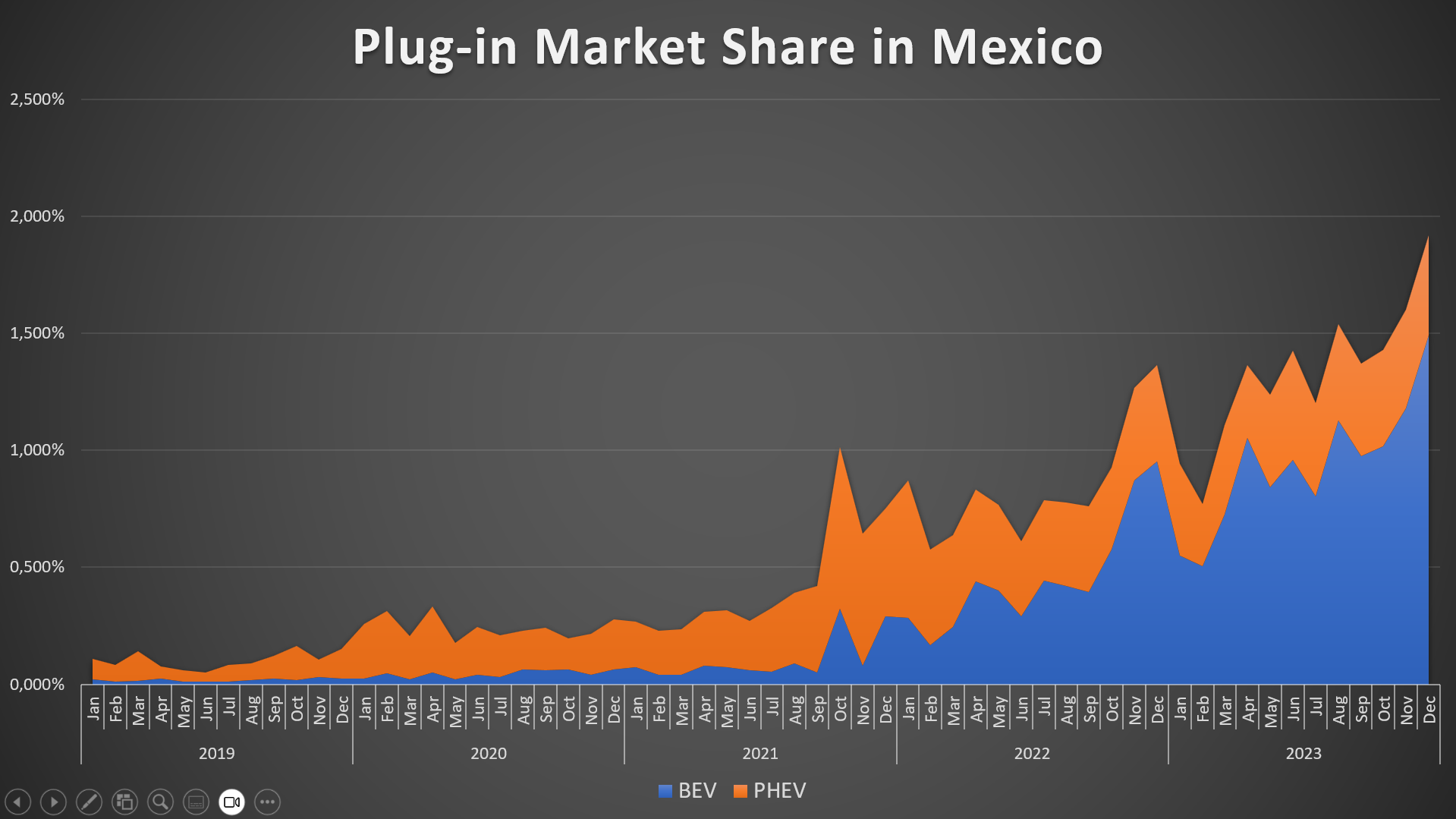

Market share has also grown consistently from 2021 onwards, reaching just shy of 2% in December 2023:

It’s worth noting that until October 2021, BEVs were practically unknown in the country, with nearly all EVs being PHEVs. However, the roles have reversed and BEVs are now responsible for most of the sales and the growth.

This is likely to be related with a development in Latin American markets that contradicts what’s happening in the US and to a lesser degree Europe: here (and I’d wager in most of the developing world) it’s BEVs that are cheaper, not PHEVs. PHEVs tend to be large SUVs or, at best, large sedans, well into the $30,000–$40,000 range for the most affordable options, while BEVs can be found in compact and sub-compact versions available for $20,000 or so, sometimes even a little bit less. PHEVs may have the advantage of longer range, but some people use their vehicles mainly as daily commuters, so the lower cost more than makes up for less range.

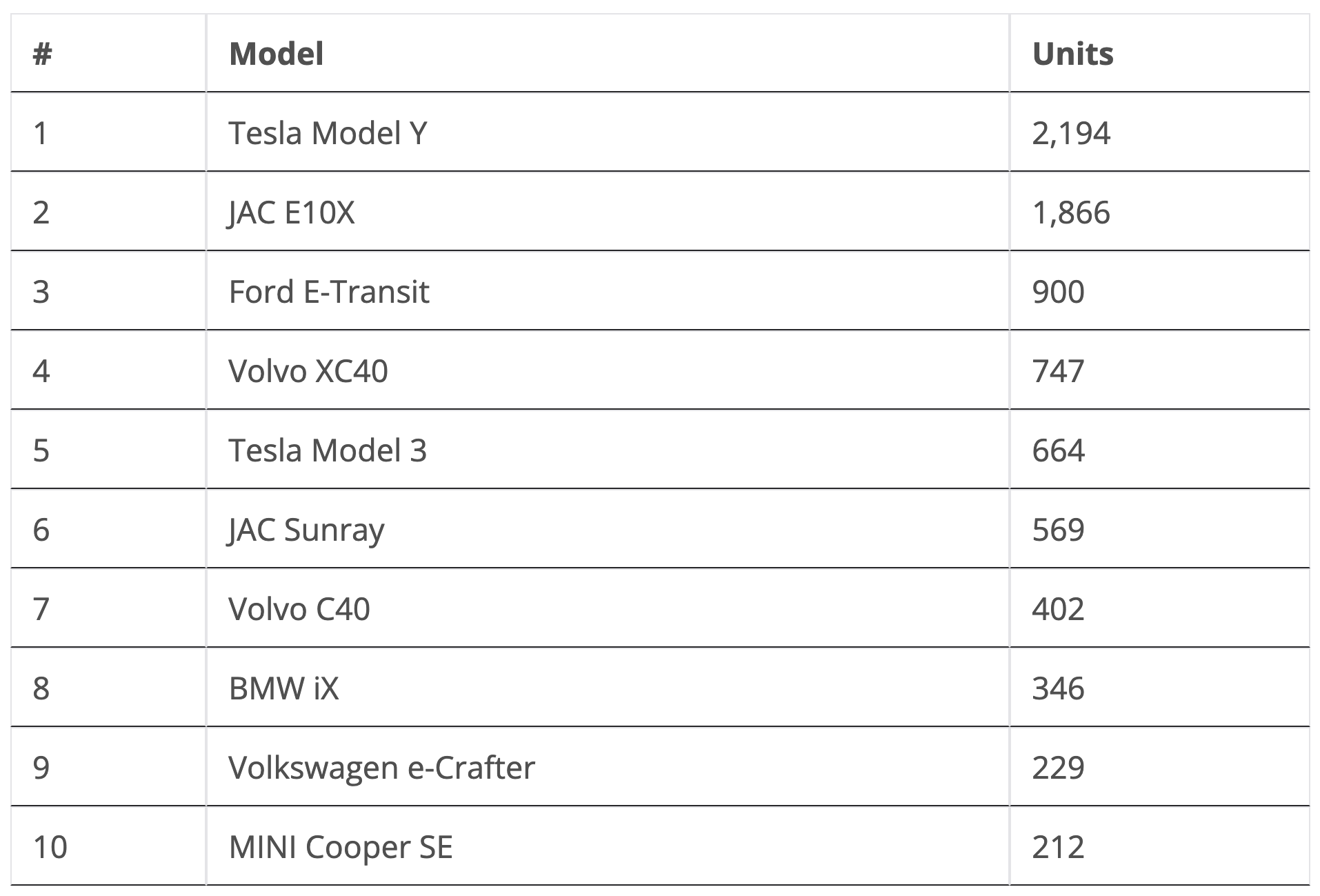

Unlike other markets, Mexico lacks a significant Chinese presence, and other than locally assembled cars from JAC (backed by billionaire Carlos Slim), there are no Chinese cars in the top 10 most-sold models!

Tesla’s presence in this market is significant, with the Model Y leading in sales. However, the runner-up JAC E10X is a force to be reckoned with, particularly after the significant price cut it received earlier this month. It seems JAC has managed to crack the code for entering the market earlier than any other Chinese brand, and it’s likely related to local assembly of the vehicles (and, eventually, local production). SEV and BYD are following suit.

A Ford vehicle, the E-Transit, gets the bronze — in a surprising appearance — followed by the Volvo XC40 and the Tesla Model 3.

What’s coming in 2024

Mexico is definitely going to be one of the most interesting markets in the region this 2024. Chinese EV makers are arriving in force, but — aside from JAC — local production isn’t likely to ramp up until 2025.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Meanwhile, GM and Ford have already made Mexico a cornerstone of their EV production projects, and GM in particular is supposed to start churning out Blazers and Equinox EVs in decent numbers this year. I said before that a $40,000 Equinox EV could do well in Latin American markets, and I still believe it, particularly as Chinese competition in Mexico remains relatively expensive: the smaller-sized JAC E-Sei4 with only a 55kWh battery stands at $45,000, for example.

Yet, it’s a fact that Chinese brands can and will compete on price. We already mentioned here at CleanTechnica that BYD just launched a price war in the city-car segment that was answered in kind by JAC and SEV. Similar developments could well happen in the CUV and SUV segments once new options arrive, and, in particular, once GM decides to offer its own EVs at reasonable prices … if it ever does.

I said at some point that EVs had to become cheaper if Latin American markets expected to ever surpass 10% EV market share. I stand by it, yet 2024 will clearly present lower prices than 2023 in some if not all segments, so the future looks bright. The E10X was already Mexico’s second most sold car before its 20% price discount in late February. Though, the BYD Dolphin Mini is bound to take significant market share in that segment. The question is: will it take it from JAC, or from ICEV competition? What do you guys think?

Oh, and remember that $45,000 JAC E-Sei4 I mentioned earlier? As of March 2024, it costs $27,500 in Costa Rica. That’s how low prices could go, if needed be.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.