Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

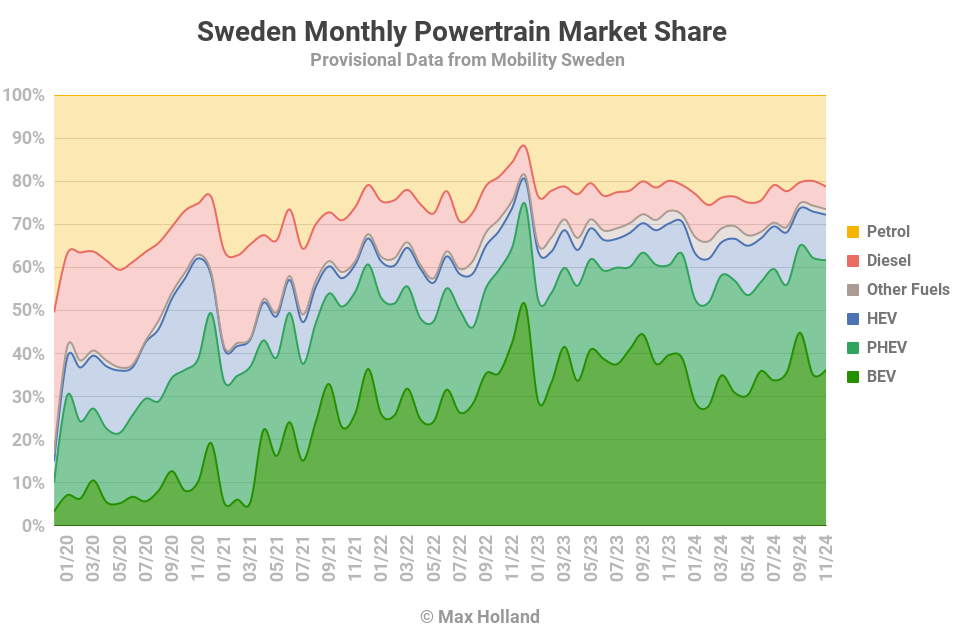

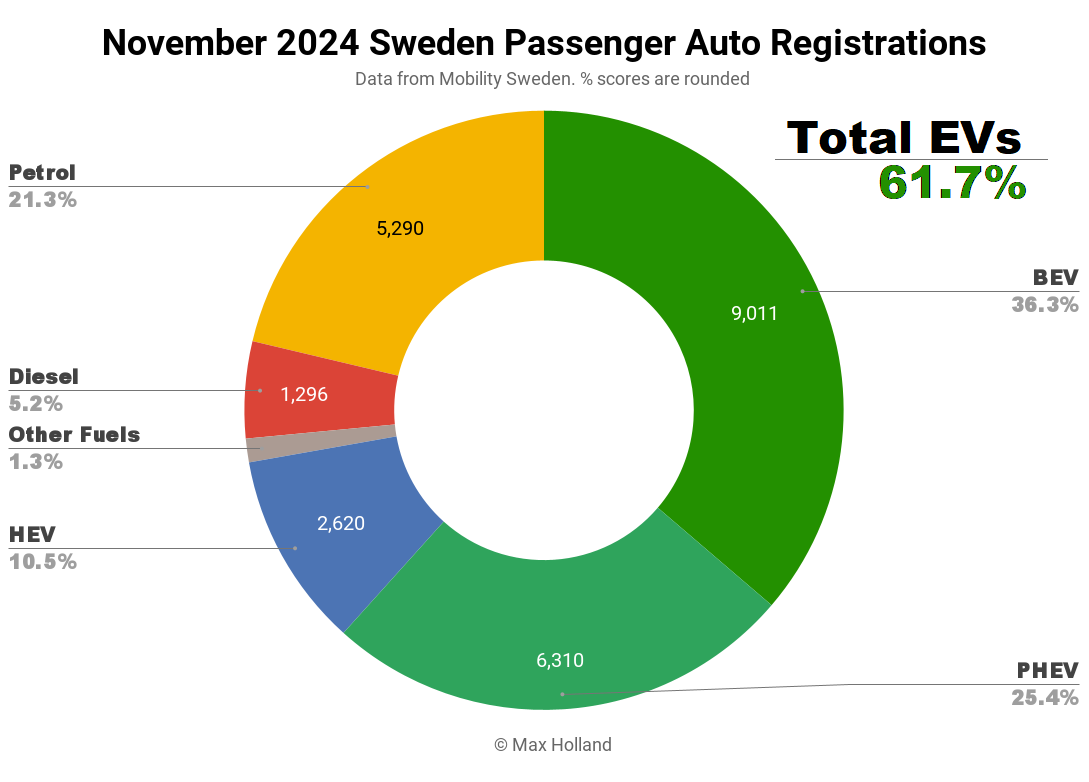

November’s auto sales saw plugin EVs at 61.7% share in Sweden, up slightly YoY from 60.6% in November 2023. BEV share fell back YoY, while PHEV share increased. Overall auto volume was 24,844 units, down some 2% YoY. The Tesla Model Y was again the best selling BEV.

November’s sales totals showed combined plugin EVs at 61.7% share in Sweden, with full electrics (BEVs) at 36.3% and plugin hybrids (PHEVs) at 25.4%. These figures compare YoY against 60.6% combined, 39.7% BEV and 20.9% PHEV.

We can see that BEV share is yet again down YoY, to 36.5% from 39.7%. While the overall auto market dropped in YoY volume by 2%, BEVs underperformed, dropping 11%. The YoY fall was mostly due to the tariffs on made-in-China models, with MG’s sales down more than 80% (and by ~360 units) and BYD also down by over 80% (and over 260 units). These two brands (making some of the best value BEVs available) account for half of the “missing” BEV units YoY (thanks EU protectionism)!

Hyundai Motor Group models were also down YoY, as were BMW Group models, but by a much lesser degree (YoY percentage drop) than MG and BYD.

Despite BEVs’ volume drop, PHEVs stepped up to help overall plugin sales maintain modest YoY growth. The new generation of PHEVs have an all-electric range of typically 50 miles (80 km) or more, easily able to cover the daily commuting needs of the vast majority of Swedish drivers on electricity alone. The Volvo XC60 and S/V60 are the two PHEV bestsellers (the XC60 alone accounting for 25% of all PHEV sales), each with ~19 kWh batteries and over 50 miles of electric range (WLTP).

Eight of the top 10 best selling PHEV models (4 Volvos, 2 BMWs, a VW, and a Mercedes) have ~19 kWh batteries and around 50+ miles of electric range (WLTP). All in all, 50+ mile PHEVs now account for around 85% of all PHEVs sold in Sweden, by unit volume. We are a long way from the PHEV technology of a few years ago, when some models had 6 to 8 kWh batteries and struggled to cover 20 miles in EV mode.

Diesel-only autos continue to lose share, seeing 5.2% in November, from 7.0% in November 2023, and sales volume fell 27% to 1,296 units.

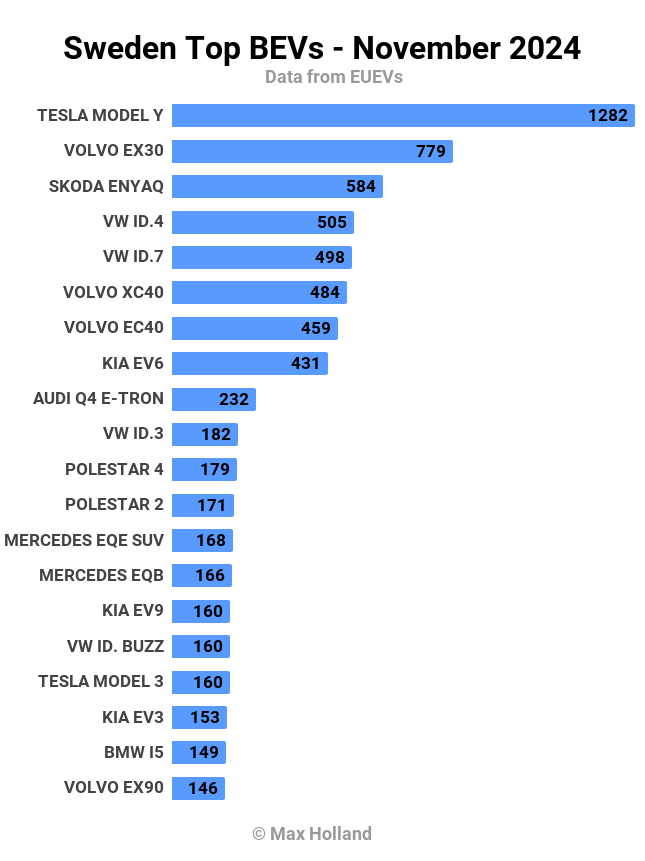

Popular BEV Models

The best selling BEV model in November was the Tesla Model Y, with 1,282 units moved, keeping the top spot for seven consecutive months!

The runner up was the Volvo EX30, with 779 units sold, and the Skoda Enyaq took third position, with 584 units.

Last month’s runner up, the Volkswagen ID.7, has stepped back to 5th spot, with volume falling back from 779 units to 498 units. This is a reminder that smaller markets like Sweden often don’t get consistent volume allocation, even from large “local” brands like Volkswagen.

The new premium mid-large SUV cousins, the Porsche Macan and Audi Q6 e-tron, both saw their sales take a dip in November, down from October’s high point, and both were left just outside the top 20 as a result. Nonetheless, there are likely further highs to come for these models in the near future.

Conversely, the new Volvo EX90 saw its first strong volume month, with 149 units delivered in November. It has just squeezed into the top 20 as a result. Will the local brand prove more popular than the Porsche and Audi over time? I expect so, but we will need more time to see the proof.

The Kia EV3 saw its first solitary unit delivered in October, but stepped up to 153 units in November, immediately putting it inside the top 20, in 18th spot. We can expect it to quickly enter the top 10 in the coming months. October’s other apparent debutant, the new Citroen e-C3, was in fact just passing by as it turns out, as it didn’t have any deliveries in November. Expect it to get going in proper volume in 2025.

There weren’t any significant new BEV model debuts in November. Stellantis gave the Citroen Ami microcar another rebadging, now as the Opel Rocks-e. Though, Sweden is hardly the optimal climate for this kind of vehicle. At the opposite end of the pricing scale, Geely launched its first 4-door sports sedan BEV, the Emeya. This also won’t be a high-volume model, being priced from SEK 1,313,480 (€114,000) and up. Each of these new BEV models saw just one initial unit registered in November.

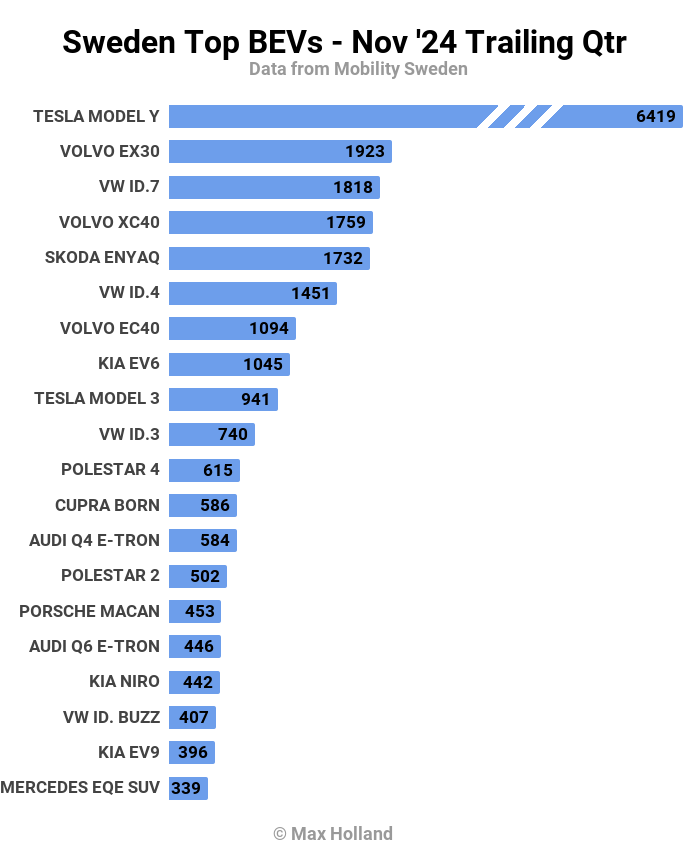

Let’s turn to the 3-month rankings:

After three strong months of sales, the Tesla Model Y is still far out in front, with more volume than the next 3 models combined. Its relative strength has actually increased compared to 3 months ago (June to August).

With several decent monthly results, the Volkswagen ID.7 has now climbed up to third spot, from 9th in the prior period. Will it sustain this success? Have Swedes rediscovered the utility of touring-wagons? Let’s wait and see.

Since seeing its first customer deliveries in July, the Polestar 4 has been on a strong climb (especially given the premium pricing), steadily rising to 11th spot in November. Will it maintain these volumes, or is Polestar still fulfilling backorders? We will have to wait a bit longer to find out — it has still only delivered 713 customer units to date.

Likewise, the Porsche Macan has rapidly climbed to 15th spot, and the Q6 e-tron to 16th. As noted above, November saw both models take a breathing-space — we need more time to see where their demand levels settle over the long term.

Let’s keep an eye out for the Volvo EX90, and for the Kia EV3, both of which are trending to enter the top 20 by the end of January.

Outlook

The Swedish economy has been lacklustre for the past few quarters, but is in slightly better health now than it was a year ago when growth was negative — Q3 2024 saw GDP up 0.7% YoY. Interest rates have recently come down to 2.75%, from 4% a year ago. Consumer confidence is back over 100 points at 102, its highest since late 2021. Manufacturing PMI is also trending positive, with 53.8 points in November.

All of this might point to BEV sales ceasing their negative slide over the coming months. Though, large-item spending is still seeing consumer caution, and BEVs are still overpriced relative to where they should be. Legacy European auto manufacturers, and their friends in the legacy media, are lobbying European politicians to loosen the emissions tightening planned for 2025 and subsequent years, so we will have to see how this plays out.

What are your thoughts on Sweden’s transition to EVs? Will 2025 see a turnaround to positive growth once more? Please share your thoughts in the comments section below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy