Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

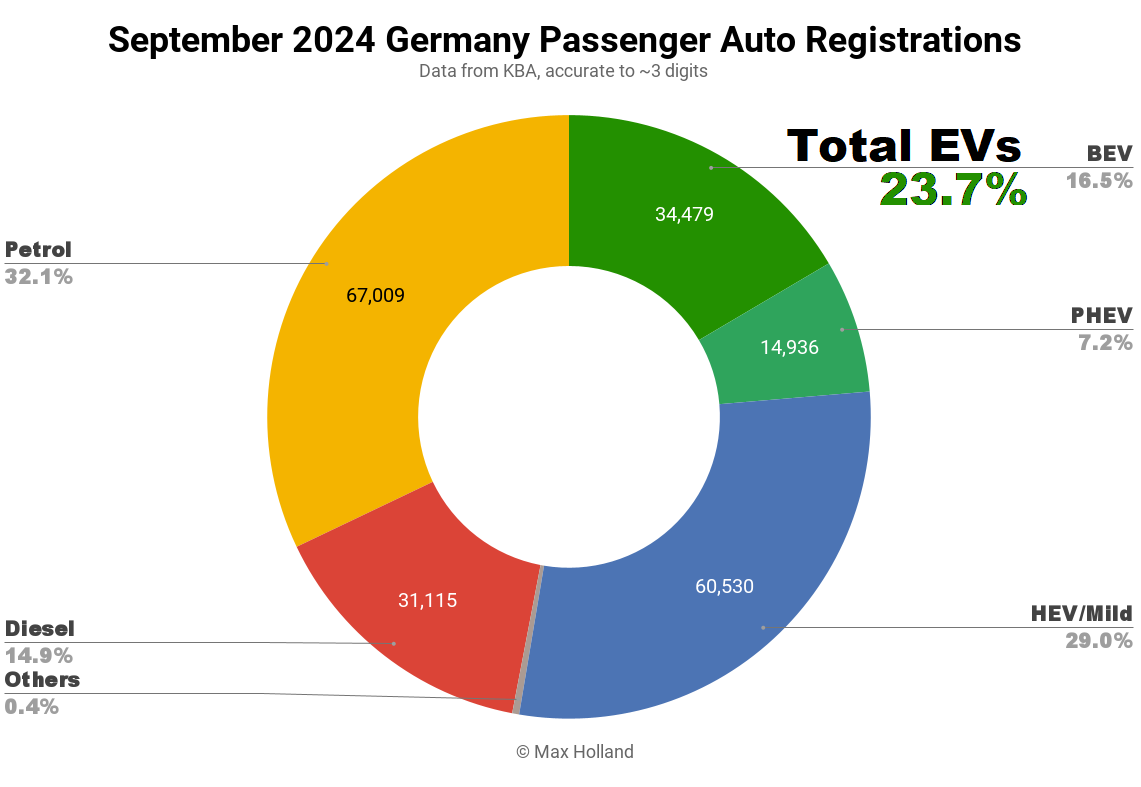

September saw plugin EVs at 23.7% share in Germany, up from 21.0% year on year. The low year-on-year baseline masks weakness — BEV share (and volume) 2 years ago was higher than now. September’s overall auto volume was 208,848 units, down 7% YoY and down around 14% from 2017–2019 seasonal norms (~245,000 units). The best selling BEV in September was the Skoda Enyaq.

September’s market data saw combined EVs at 23.7% share in Germany, with full electrics (BEVs) at 16.5% and plugin hybrids (PHEVs) at 7.2% share. These compare with YoY figures of 21.0% combined, 14.1% BEV and 6.9% PHEV.

In the last report we had noted that August 2023 provided a high baseline (due to a pull-forward), making the figures from August 2024 look weak by YoY comparison. We’re now at the other end of that blip, where the subsequent hangover in September 2023 provides a low baseline, making the September 2024 YoY comparison appear favourable. Unscrupulous commentators could make all kinds of claims about these trends without giving the underlying context (a common problem in contemporary media).

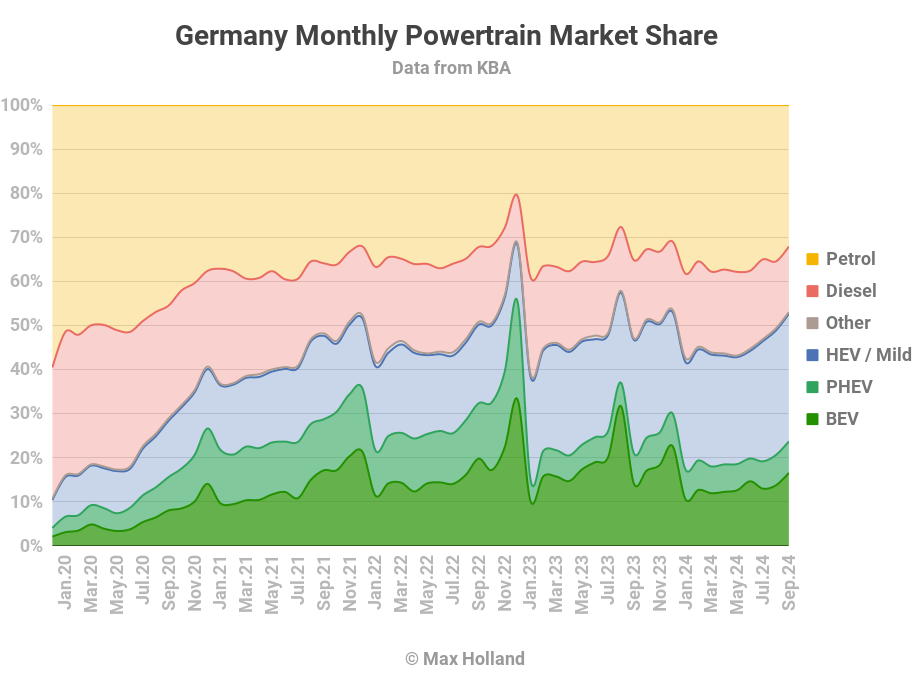

In fact, if we look at the powertrain evolution chart below, we can see that the pattern across 2024 year to date has seen very similar seasonal variation to the pattern in 2022 (and even to that in 2021). Disappointingly, though, compared to 2022, share for BEVs in 2024 has been roughly 2% lower each month so far. Meanwhile, PHEV share year to date (6.3%) is barely half what it was at this point in 2022 (11.5%).

The lack of BEV progress in Germany is due to a combination of factors. Prominent is the abrupt mid-December 2023 early cancellation of all purchase incentives. Next is the continued overpricing of BEVs by European legacy auto brands, with the same models actually increasing in price over the past couple of years, even whilst BEV powertrain costs have become less expensive. This has come even as automakers made record profits over the period, and paid these profits out to management and shareholders (rather than re-investing in the EV transition).

Meanwhile, the broader German economy has been weak over the past 18 months, with YoY GDP either flat or negative. Expensive items like BEVs obviously tend to become less attractive to consumers during a recession.

Consequently, combustion-only vehicle share has increased across 2024, compared to 2023. Year to date, petrol-only share stands at 36.4%, up YoY from 35.1%. Diesel stands at 17.9%, up from 17.5%.

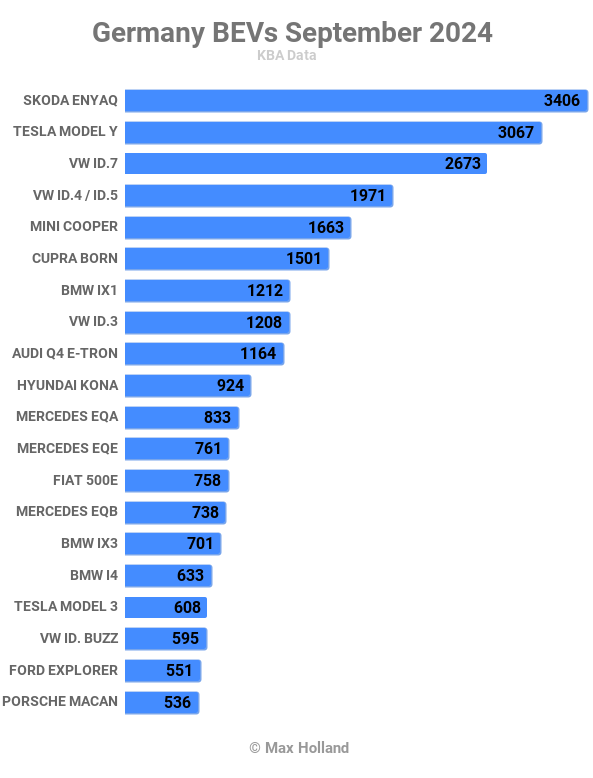

Best Selling BEV Models

The best selling BEV model in September was the Skoda Enyaq, with 3,406 units delivered, its highest ever monthly volume. In second place was the Tesla Model Y, with 3,067 units. In third was the Volkswagen ID.7, at 2,673 units (also a personal best), and its first entry into the top 3.

There were a few shufflings in the top 20. The Volkswagen ID.4/ID.5 recovered from a slow August back to habitual volumes, and the Hyundai Kona, BMW iX3, and Volkswagen ID.Buzz also improved compared to recent months. On the flip side, the Fiat 500e and BMW i4 had relatively slow months and dropped a few spots.

The most impressive performance from a recent newcomer goes to the new Porsche Macan, which registered 536 units in only its second month on sale. This is impressive volume for an expensive model (starting from €80,000).

Not to be outdone, the new Ford Explorer, which debuted in July, also saw decent volumes, 551 registrations in September. Meanwhile, the Cupra Tavascan, which debuted in August with 133 registrations, increased to 369 registrations in September (and the 27th spot). Finally, the Peugeot e-5008, which had seen an initial 7 units in August, upped its volume to 67 units (and the 55th rank) in September, and should climb further.

There were 3 debutant BEV models in September, all at modest volumes. The new Opel Frontera, with 24 units, shares its platform with Stellantis cousins, the new Citroen e-C3 and the forthcoming Fiat Grande Panda. Like the new Citroen (which has not yet launched in Germany), it has battery options up to 44 kWh (usable). Though, the Frontera is a larger vehicle at 4385 mm length (vs 4105 mm for the Citroen). It has a WLTP range of 305 km and can recharge 10% to 80% in a decent 32 minutes. Pricing of the Frontera in Germany is from €28,990, a good bit more than what’s expected for the Citroen e-C3 (from €23,990).

Next up was the MG Cyberster, which got an initial 14 deliveries. We summarised the Cyberster in the recent UK report. Its pricing in Germany is rumoured to be from €56,000 for the base model — though, only upper trims may be available initially. Surely, open-top tourers are a tradition of Mercedes-Benz? Let’s see if the launch of the MG Cyberster can encourage the home brand to compete with a BEV in this niche.

Finally, the new Xpeng G6 also saw its German debut in September, having been available in Norway and Sweden for a couple of months already. Its German debut saw a modest 6 units, but more will surely follow.

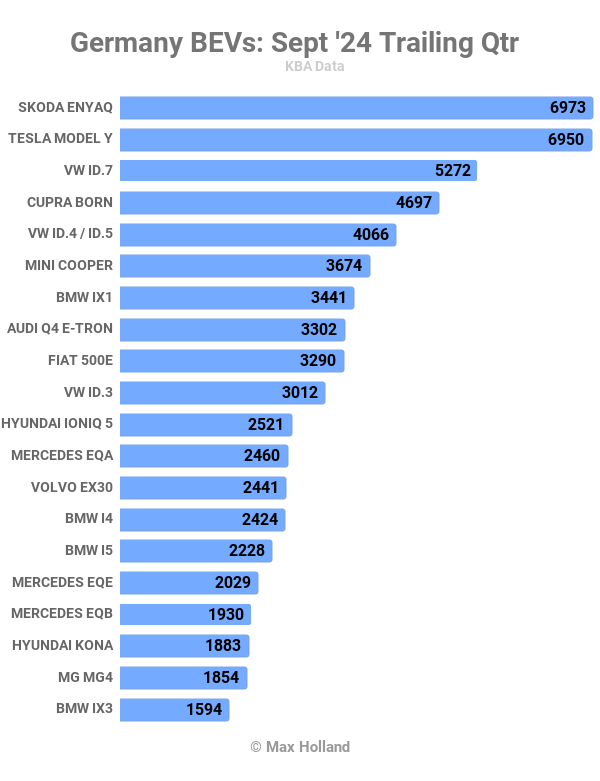

Let’s turn to the 3-month rankings:

Thanks to September’s strong volumes, the Skoda Enyaq has just squeezed past the Tesla Model Y to take the lead over the trailing three months, and the Q2 leaders, the Volkswagen ID.3 and MG4, have fallen down the rankings.

Thanks to September’s strong volumes, the Skoda Enyaq has just squeezed past the Tesla Model Y to take the lead over the trailing three months, and the Q2 leaders, the Volkswagen ID.3 and MG4, have fallen down the rankings.

The Volkswagen ID.7 took third place in Q3, a very impressive rise from its 19th place in Q2, with 3.5× the previous volume.

The refreshed and improved Mini Cooper also saw a strong climb, from 20th in Q2 to 6th in Q3, with volume up 2.5× over the period.

Let’s keep an eye out for the new Ford Explorer and the new Audi Q6 e-tron, currently in 26th and 28th, respectively, both of which will potentially enter the top 20 in time for next month’s chart.

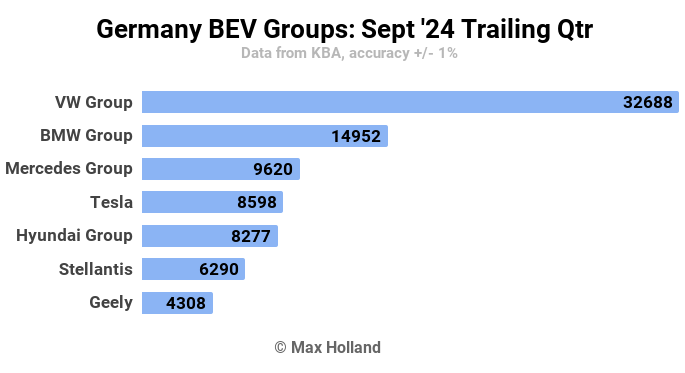

Given that Germany is Europe’s largest auto market, with more steady monthly allocation than other parts of Europe, let’s take a look at the manufacturing group rankings:

As usual, home favourite Volkswagen Group leads the rankings, with a substantial 35.7% share of the trailing 3-month BEV market. This is fairly stable over Q2’s 35.9% share.

BMW and Mercedes have swapped places compared to Q2, with BMW now taking second. Its share has increased strongly from 11.7% to 16.3% over the period, whilst Mercedes’ share dropped from 12.2% to 10.5%. Tesla remains in 4th place — though, with share (9.4%) slightly up compared to Q2 (8.0%).

Because of the protectionist tariffs, MG’s parent group, SAIC, dropped three spots from 5th to 8th (just off the chart), allowing HMG, Stellantis, and Geely each to advance one place. Toyota Group remains in a tantrum at the back of the pack, with just 0.5% share of the BEV market.

Outlook

As mentioned above, Germany’s economy remains weak, with the latest quarterly GDP data (2024 Q2) recording 0% annual growth. Official inflation has moderated to 1.6%, and ECB interest rates have reduced to 3.65%. Manufacturing PMI was very weak at 40.6 points in September, the weakest in over a year and — excepting COVID — close to the weakest seen since mid 2009.

What are your predictions about the future prospects of Germany’s EV transition? When (if ever) will the economy improve? Will the incoming “somewhat more affordable” BEVs be enough to get EV growth back on track? Please share your thoughts in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy

.png)