Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

If you are following the EV revolution in China, you can be forgiven if you are confused. The latest headline from the Associated Press says, “China’s electric car sales grew in 2024 as sales of gasoline cars plunged.” The latest headline from CNBC says, “China’s electric car boom is expected to slow down in 2025.” Can they both be correct? Let’s take a look behind the headlines to see what’s what.

EV Sales Up 40 Percent In China

AP reports that sales of all types of electric vehicles — including plug-in hybrids and so-called extended-range hybrids — rose more than 40 percent in China last year, while sales of gasoline-powered automobiles plummeted according to Chinese industry data published January 13. A total of 31.4 million vehicles, including buses and trucks, were sold last year in China. That’s an increase of 4.5 percent compared to 2023. Growth in sales outpaced growth in production, which rose 3.7 percent. Exports of Chinese-made passenger cars rose almost 20 percent in 2024 to almost 5 million vehicles, which contributed to a large overall increase in China’s exports. The expansion of Chinese EV makers overseas has alarmed automakers in the US and Europe. The US enacted a 100 percent tariff on Chinese-made electric cars last year, and the European Union also imposed new tariffs on Chinese-made EVs, which it says benefited from unfair government subsidies.

In the home market, sales of passenger cars rose 13.6 percent in December, thanks to incentive programs such as rebates for trade-ins. Overall, passenger car sales in China rose 3.6 percent YOY to 22.6 million vehicles. Plug-in hybrids saw the most rapid growth in 2024. They appeal to drivers who are nervous about buying battery electric EVs. Sales of conventional gasoline and diesel powered vehicles in China were down 17 percent in 2026 — from 14 million to 11.6 million. Sales of cars with plugs accounted for just over half of all new car sales in China last year, which was up strongly from 38 percent the prior year and 35 percent two years ago.

Shrinking demand for conventional cars has dealt a harsh blow to foreign automakers such as Volkswagen and Nissan, who for years relied on strong sales in China to pump up their bottom lines. A drastic decrease in profits from China prompted a crisis for Volkswagen recently, as it struggled to keep the unions that represent its workers happy despite a significant decrease in production. Honda and Nissan recently announced plans to pursue a merger in part to meet the challenge of China’s rising EV makers.

Slower Growth Predicted

CNBC tells a “that was then, this is now story.” It reports that industry analysts at HSBC predict that China’s electric car market is headed for a sharp slowdown in 2025. From a 40 percent increase last year, they believe the increase in 2025 will be only half as much. BYD, whose sales grew 40 percent last year, is expected to realize only a 14 percent gain in 2025. Strong sales volumes have enabled “strugglers and stragglers” to hang on despite falling margins, Yuqian Ding, head of China autos research at HSBC, said in a report last week. She pointed out that only BYD, Tesla, and Li Auto made a profit in 2023. “In our view, this situation is unsustainable and we expect the pace of industry consolidation to accelerate rapidly,” Ding said.

Shenzhen-based laser display company Appotronics had no customers in the auto industry until it began making an in-car projector screen that began deliveries in China early last year. The company shipped more than 170,000 units last year. But in a sign of a changing market, the company said it expects no increase in shipments in 2025. CEO Li Yi told CNBC last week he did not expect the market to pick back up until 2026. “A lot of customers, the automakers, they’re not in a good financial state. They cut the R&D budget. That will definitely have a negative impact on this industry,” Li said.

Appotronics plans to bring a 4K-resolution projector to cars in China this year, along with a screen that has better contrast and privacy features, Li said. Over the longer term, the company intends to spend the next two to three years developing new, laser-based uses for car headlights. Li said the company is in talks with Tesla for a projector-type product in a next-generation vehicle, but could not say more because of a non-disclosure agreement.

As automakers piled into China’s fast growing electric car market, they began a price war near the end of 2023 in a bid to attract new customers. Smartphone company Xiaomi launched its SU7 electric sedan last year and priced it $4,000 less than Tesla’s Model 3, which has a shorter driving range. “When BYD and Tesla cut prices, most rivals have little choice but to follow suit. This has clearly squeezed the overall profit pool in the auto industry, especially now that EVs have all the momentum,” HSBC’s Ding said, noting that BYD has a net profit margin of only 5 percent, less than the low teens for top automakers that was considered normal when sales of conventional cars with gasoline and diesel engines were at their peak.

Because sales of battery electric and plug-in hybrid cars now account for more than 50 percent of the market, any increase in sales will likely slow to between 15 percent and 20 percent in 2025, according to a Fitch Bohua team of analysts headed by Wenyu Zhou. They expect so-called smart features will increasingly become a major point of competition. Automakers in China have increasingly turned to in-car entertainment features and driver assist technology as ways to make their vehicles stand out.

Tesla vs. BYD

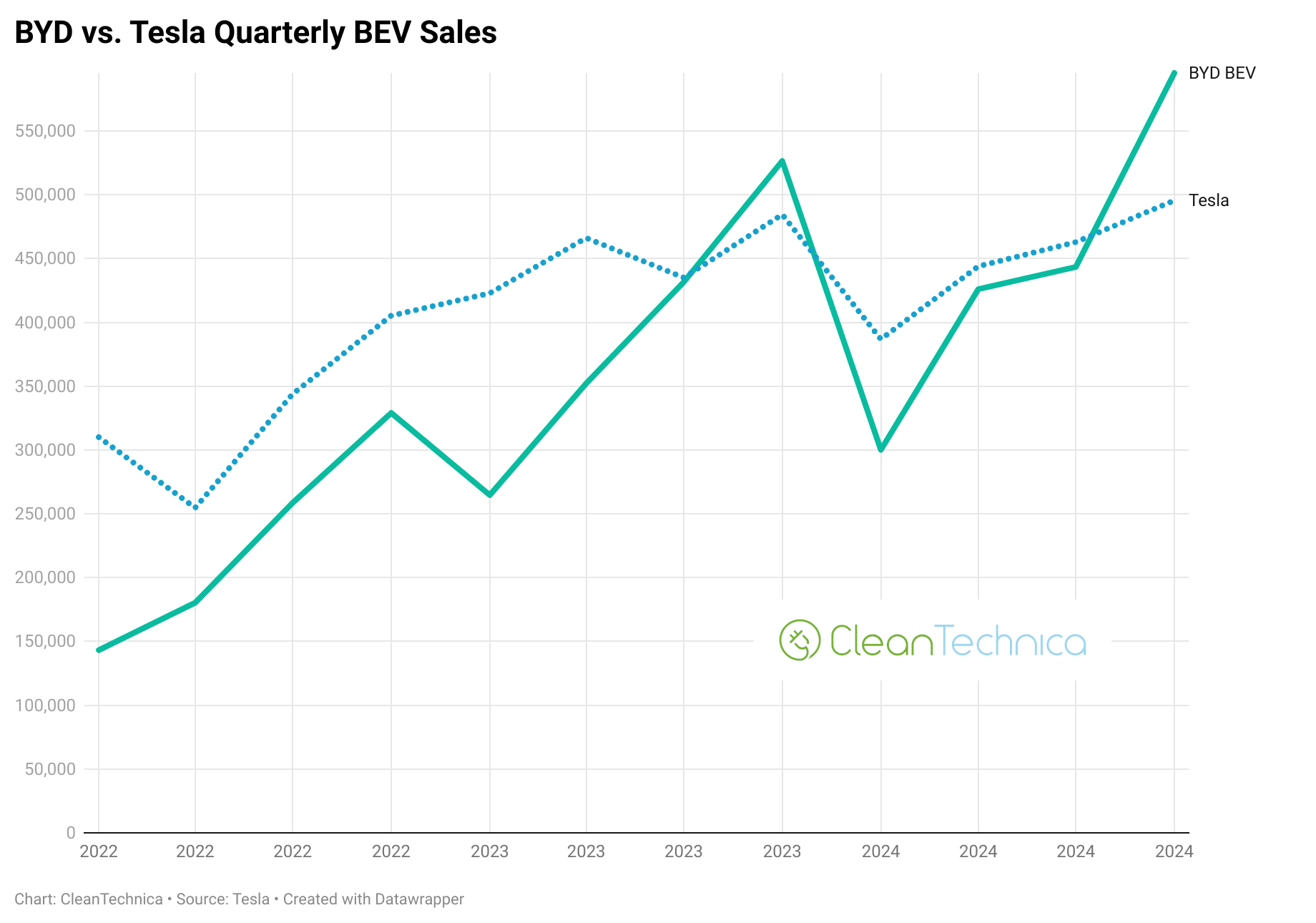

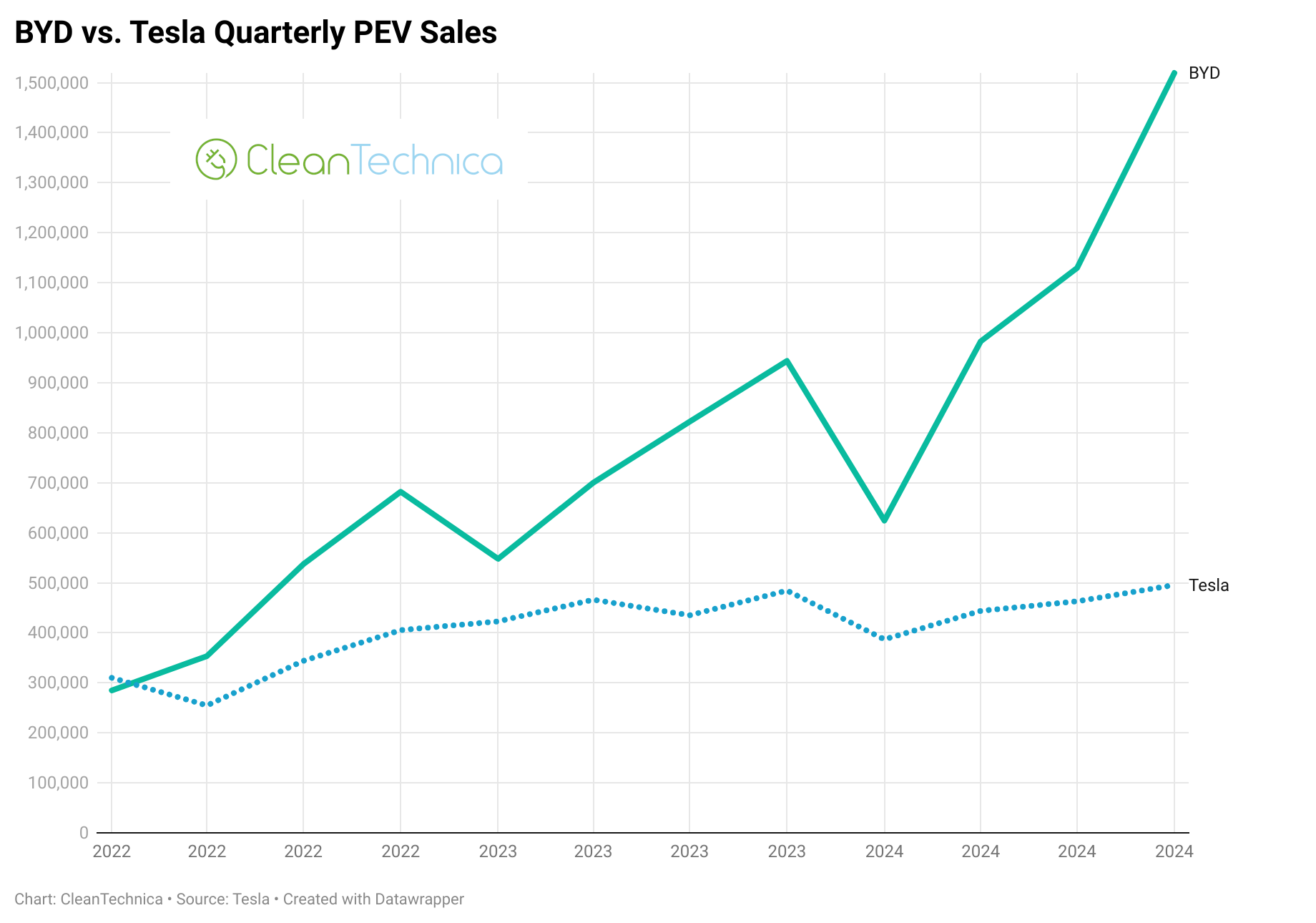

Industry watchers are focusing on the head to head battle for sales dominance between Tesla and BYD. The Chinese company sold 595,413 battery electric vehicles in the last three months of 2024, while Tesla delivered 495,570 battery electric vehicles during the same period. But here is an interesting note. When you add in plug-in hybrids, BYD is selling quite a few more cars in China than is Tesla. PHEV and EREV offerings in China are being well received by customers, but Tesla has no ability to manufacture those cars as it has never built any cars with engines and likely never will.

Chinese companies have practically invented the EREV category, which has few competitors in the world. BYD even offers models with more than 1300 miles of total range! Mercedes-Benz is enticing customers with the GLC 350e, a plug-in hybrid with 52 miles of battery-only range. Could there be any clearer indication of how far behind legacy automakers are when it comes to competing with Chinese car companies?

It is unlikely that the sales of EVs in China would continue to grow 40 percent a year. That pace is simply unsustainable. But the CNBC headline that says sales will plummet is misleading. The truth is electric cars are on their way to dominating new car sales in China. By the end of this decade, China could be rivaling Norway in terms of the percentage of new cars sold that are electric.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy