Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A closer look at the best-selling PEV automotive groups — edition 4 of 4

This is the fourth and final edition of a series looking at the top selling OEMs in terms of plugin vehicle sales. To check out the other ones, please click here, here, and here.

In this last edition, we have a look at the top top players in the EV game — BYD, Tesla, and Geely.

For more information on these OEMs and others, do not forget to check out our monthly reports on the global top 20 auto brands.

BYD

BYD Auto Co., Ltd, as it is officially known, is a Chinese automotive group based in Shenzhen, and part of the larger BYD conglomerate that makes seemingly everything that moves (cars, trucks, buses, forklifts, monorails, etc.) as well as batteries, solar PV systems, handsets, semiconductors, components, and … I might be forgetting something.

BYD Auto was established in 2003 when BYD bought the small Xi’an Qinchuan car brand, which at the time was making a small hatchback based on the Suzuki Alto.

Despite these humble beginnings, BYD is one of the EV pioneers, uninterruptedly making plugins since 2008 when it launched the F3 DM, a plugin hybrid sedan that would still be considered modern today, looking just at its EV specs — a 16 kWh LFP battery allowed it 60 km of electric range, and it had a solar panel on the roof….

(Those are the synergies when a PV/battery company buys a car company.)

In 2009, it launched its first BEV, the e6, which also had ahead-of-its-time specs (61 kWh LFP battery, AC fast charging), picking up the interest of Volkswagen Group, which considered a partnership with BYD and even prepared an MoU. Unfortunately for the German OEM, that fell through during the due diligence phase.

BYD jumped to EV glory in 2015, winning its first global EV manufacturer title in 2015 thanks to the success of the BYD Qin and BYD Tang.

2016 saw BYD repeat the title, a feat it would again repeat in the following year, but more importantly, in November 2016, BYD hired Wolfgang Egger, one of the best car designers of the time. He had been responsible for the best Alfa Romeo designs of the modern era, besides the coolest SEATs ever, and also designed a couple of Audis and Lamborghinis on the way….

This move was made in order to add the missing ingredient in the BYD recipe, because while its plugin specs were top notch, their designs simply didn’t look as cool as as Tesla’s….

With the reduction of subsidies in China during 2018 and 2019, the brand suffered, losing the global manufacturer title to Tesla.

The brand started to turn the tide in 2020 with a new platform and new battery technology (Blade battery). That, added to the first full Egger design, resulted in the impressive Han flagship sedan, which can be considered the first contemporary BYD.

In 2021, the renewal of BYD ensued, with the reveal of the Dolphin and Yuan Plus, as well as a more serious take on export markets.

But BYD had to wait until 2022 for its recovery to mature and bear fruit. That year, the Shenzhen company took full control of Denza, which previously had been a joint venture with Mercedes, and launched another hit model, the Denza D9 MPV. That helped the OEM to gain relevance in the most expensive (and profitable) parts of the market.

2022 was also the year that saw BYD return to the top of the EV game, and the BYD Song won a silver medal in the global model ranking, a first for the OEM.

The following year confirmed BYD as the leader of the EV game, repeating gold in the manufacturer race and silver in the model race, thanks again to the BYD Song.

On top of this, it expanded its lineup upwards, launching the upmarket brands Yangwang and Fangchengbao, but also downwards, launching the Seagull city car.

In 2024, the growth strategy continued, with a production output of 4.3 million units, allowing it to be the #1 EV maker in the world for the 3rd year in a row. The Shenzhen automaker now appears on the overall best selling OEM podium, all powertrains included, next to behemoths like Toyota for the VW Group.

Currently, BYD is the owner of the following passenger car brands:

- BYD — Mainstream brand, with PHEV and BEV lineups;

- Denza — Premium brand, with PHEV and BEV lineups;

- Fangchengbao — Premium brand, specialized in off-road oriented SUVs and sports cars, with BEV and PHEV models;

- Yangwang — Luxury brand, with PHEV and BEV lineups;

Besides this, the brand has a commercial vehicles division, making LCVs, pickup trucks, buses, and trucks.

Looking at individual models, the OEM has a long and balanced lineup, with the top sellers being the BYD Song, the BYD Qin Plus, and the rising star BYD Seagull.

When it comes to exports, they still represent a relatively small slice of global EV sales. Only 10% of all of the OEM’s plugin sales come from overseas markets.

Expect this number to grow significantly in the coming years, becoming BYD’s next growth engine motor (the OEM’s demand ceiling in China must be close by now). The OEM is now looking to surpass Toyota and become the world’s biggest automotive group.

Geely

Zhejiang Geely Holding Group Co., Ltd. (ZGH), also known as Geely, is probably the biggest unknown automotive conglomerate, although many of its brands have worldwide recognition, like Volvo and Lotus.

With a relatively short history, having been started in 1986, the Hangzhou-based conglomerate was founded by Li Shufu and is the second largest privately owned company in the local automotive business.

Starting to make cars only in 1997, previously it made motorcycles and refrigerator parts. In fewer than 30 years, it has grown to make 3.3 million vehicles globally, 1.5 million of them being plugins.

The OEM has a complex business structure, which I will try to explain here.

(Note: while doing this, I also discovered stuff I wasn’t aware of, enough to change the OEM’s name in my articles from Geely–Volvo to just Geely. Geely Auto, like Volvo, is a division of Geely Holding.)

Geely is divided into six divisions:

- Geely Automobile Holdings — which includes the subsidiaries Geely Auto Group and Zeekr Intelligent Technology — mainstream brand Geely, the Malaysian Proton (a 50% JV between Geely and the local DRB-HICOM corporation), and off-road specialist Radar develop their activities within Geely Auto Group while the Premium brand Zeekr and semi-premium Lynk & Co do the same within Zeekr Intelligent Technology;

- Volvo Car Group — it includes the premium Volvo Cars and Polestar brands;

- Lotus Group — Geely has 51% of the group, and includes the luxury and sports car maker Lotus Cars and Lotus Technology, an engineering consulting company;

- Geely Qizheng NEV — Livan budget-minded brand;

- Smart Automobile — Smart semi-premium brand, a 50% JV with Mercedes;

- London Electric Vehicle Company — LEVC brand, famous for the London Taxi cabs;

- Geely NEV Commercial Vehicles Group — Division specialized in different commercial vehicles, with the brands Farizon, Hanma, Ou Ling, Green Intelligent Link, and Oneworld Technology.

Along with this complex network of brands, Geely still has 45% share in Jidu Auto, a JV with Baidu, which is a tech-heavy premium brand. Further, Geely participations include a 10% stake in the Mercedes-Benz Group, a 17% stake in Aston Martin, a 34% stake in Renault Korea, a 45% stake in the engine maker Horse (a JV between Geely, Renault, and Saudi Aramco), and an undetermined stake in Zhido, a manufacturer of city EVs.

(And looking ahead, I wouldn’t be surprised if Geely bought a stake in Renault. Just sayin’…)

Finally, Geely still has a motorcycle division. It owns, among others, the Italian brand Benelli.

Looking at the sales breakdown between the OEM’s brands, the biggest seller is the namesake brand, Geely, with 36% of sales, followed by Volvo, with 23%.

Despite not having such a wide number of models as BYD, the Geely brand does have a large choice of models, with the best seller being the small Panda Mini, with 25% of the brand’s sales and 9% of the OEM’s total sales.

Despite being a China-based OEM, because it is a multinational conglomerate, export markets have significant weight on the total tally of EV sales. Those markets represent 29% of total PEV sales of the Geely OEM, which is the highest share among China-based automotive groups.

This is explained with the fact that most of Volvo and Polestar sales (but not Smart sales) are made outside China, where they have most of their factories and operations. It’s the same story for Lotus and LEVC, but the volumes of these two hardly move the needle.

Tesla

This is the most successful and famous of all the EV startups. It was founded in 2003 by Martin Eberhard and Marc Tarpenning. The next year, Elon Musk and JB Straubel joined the company, and in 2008, its first model, the Roadster, a six-figure sports car, was launched.

Building on the lessons learned with its first model, in 2012, Tesla launched its first volume model, the Model S.

Building on the success of the Model S, in 2015, the make began the production of the Model X crossover, but the real lever to propel the brand into profitability was the mass market Model 3, launched in 2017.

And while the Model 3 allowed Tesla to be profitable, it was the 2020 Model Y that made it filthy rich and the envy of the competition. In 2023, the Model Y became the first electric vehicle to win the global best seller trophy, all powertrains included.

Interestingly, it was only in 2018 that Tesla won its first global manufacturer best seller title, after four runner-up spots (2009, 2010, 2015, and 2016). It then won it for four years in a row, until 2022, when BYD retook the trophy, relegating the US company to 2nd place since.

Looking at the current models, it is no surprise that the Model Y is responsible for most of the heavy lifting, delivering 64% of global volume sales. It is well ahead of the Model 3, which has 30% of the company’s autonomotive sales. The remaining 6% of sales is distributed among the remaining three models — the Model S, X, and Cybertruck.

The Chinese market is its largest, with roughly 36% of sales being made there, closely followed by its domestic one (the USA), with 33%.

The 3rd and 4th largest markets are small by comparison, with Canada and the UK representing just 3% of sales, each.

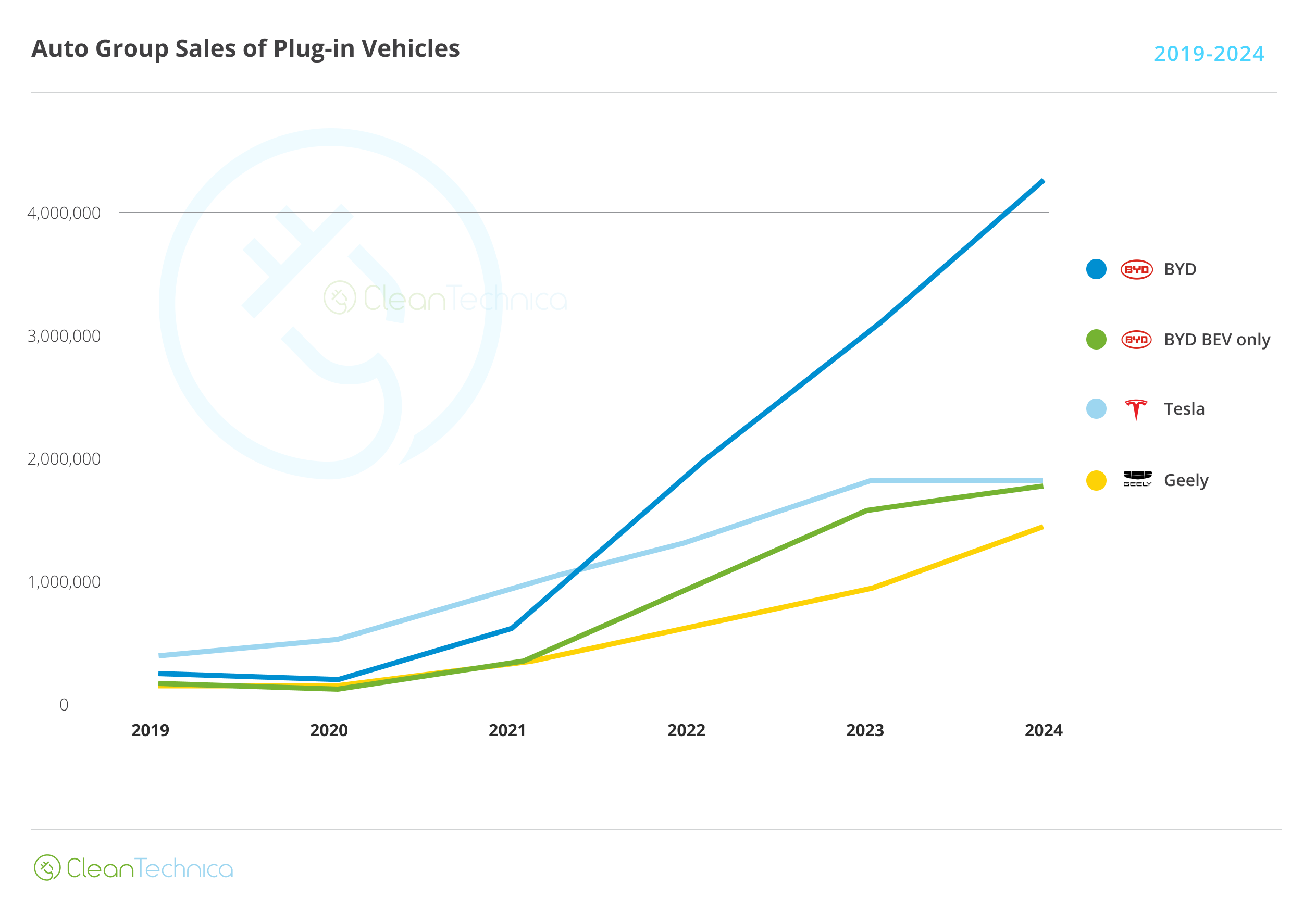

Looking at the sales of each OEM, one line stands apart from everything else — the irresistible rise of BYD since 2021. It’s like comparing an F-16 airplane to a WWI aircraft….

True, most of it is due to PHEVs, but still … just look at it. This is not a company that will be happy by staying at 4.5 million units. This is going to the top! (Toyota, take notice.)

I could see BYD becoming the biggest automotive group before the end of the decade. It will have to handle the natural demand limits of its domestic market, after all — it is already #1 there, so there shouldn’t be much more room for growth — and the USA market should stay off-limits in the foreseeable future. Export markets will also be harder to crack than its domestic one, but even so, there are already success stories, like Brazil, where it went from virtually nothing in 2022 to 18,000 units in 2023 and now to over 76,000 units in 2024!

And while at smaller volumes, there are other markets that could follow Brazil’s route where BYD is experiencing exponential growth, like Indonesia and Mexico.

Granted, looking just at its BEV lineup, growth isn’t as impressive, but nevertheless, it was enough to recover a 500,000-unit deficit compared to Tesla, in 2021, and get it to almost zero in just three years, with 2025 poised to be the year that BYD surpasses Tesla only looking at BEVs.

As for Geely, this past year has seen a step up in the growth rate, and while it doesn’t (yet) compare to BYD’s almost vertical line, it has allowed the Chinese OEM to recover significant ground on a stagnating Tesla. Considering the growth prospects of Geely in 2025, not only through an amazing number of new models coming in, distributed across all of its brands, but also from expansion of some its brands into new markets, we can safely assume that the Chinese OEM will probably surpass Tesla this year.

Even if that doesn’t happen in 2025, then it surely will in the following year, because the growth dynamics are so different that one cannot see how can it go differently.

And on top of that … Geely has a trump card up its sleeve, called acquisitions.

While BYD and Tesla base their business plans on organic growth — after all, because of their specific corporate cultures, they are allergic to incorporating other companies into their ranks — Geely benefits from a more traditional approach to its business, resulting in a more multicultural environment. On top of Geely’s Chinese operations, the company also has Malaysian, Swedish, German, and British companies in its ranks, so it won’t be such a big deal if it buys a couple more legacy companies….

… Something that could become more likely if the Carmageddon that some predict does become a reality. Geely could end up buying several troubled companies below market value.

The ones that Geely already has a stake in are prime candidates — Aston Martin could be a good companion to Lotus, as a sort of next-level luxury, resurrecting Lagonda along the way and making this last one a sort of Bentley/Rolls-Royce rival.

Renault would be a great filler in Geely’s European lineup, as the mainstream brand below all the current premium and semi-premium brands that the OEM already has. It would bring the added bonus of budget-minded Dacia having access to the scale savings of the Geely galaxy, thus increasing its profitability.

And as for Mercedes…. Well, who wouldn’t want to get Mercedes, right? It’s like Manchester United of football/soccer, or the LA Lakers in the NBA — sure, it might be going through some tough times, but the sheer branding power alone makes it a compelling business case.

Finally … Tesla.

It is painful for me to see Tesla’s flat line at the end of the graph, but frankly it doesn’t come as a surprise, considering the following factors:

- Old lineup — In 2024, the average age of the Tesla lineup was 6.4 years, which is already a lot by regular automotive standards, but especially so when we talk about the EV industry, where innovation happens much faster. I had written this already a year ago, but I’ll say it again: the Model S should have been in the middle of its second generation by now, it’s a similar story for the Model X, and the Model 3 is already a 7.5 year old car that should have been preparing to retire, as a new generation should have been landing soon. Basically, 3 out of the 5 Tesla models are officially old.

- Natural demand limits — Since 2021, the Tesla Model 3 has been selling between 450,000 and 550,000 units per year, which means that it already hit its natural demand limits. This means that it won’t routinely sell much more than it already has. Same story for the Model Y — with sales in 2023 and 2024 hovering at around 1.2 million units, do not expect 2025 to be much different. After all, it is already at the top of the global best sellers list, all powertrains included, and that’s where the market’s natural demand limits start to bite. True, the facelift will help things along, but I would be surprised if they could get to 1.4 million units by the end of 2025. 1.3 million units would already be an awesome result.

- Cybertruck — While I wouldn’t call it a flop (after all, it has beaten the Ford F-150 Lightning and other electric trucks to be named the best selling electric pickup truck of 2024), the truth is that it wasn’t the disruptive force on the market that many expected. I mean, 38,000 units sold last year is a respectable number, but in the previous year, 2023, the Ford F-150 Lightning had sold 29,000 units…. So it’s not much of an improvement, is it? And in a 1.8 million unit company like Tesla, it barely moved the needle. So, because export markets won’t be a major source of volume (as the Cybertruck is simply too big and expensive for most of them), even if the Cybertruck gets up to 60,000 units in 2025, it won’t improve Tesla’s output in a significant way.

- Little to no new models in the pipeline — While BYD and Geely have literally dozens of new models landing in the coming months, Tesla has … rumors. Yes, a new, cheaper and more compact crossover is said to start production this year, but even if production of its compact crossover starts in, say, June (and that alone is a big IF), considering Tesla’s history of production ramp-ups, it will take at least half a year to have it being made in significant volumes. So, while it might help Tesla’s output in 2026, for 2025, its impact will be limited. As such, expect Tesla in 2025 to stay at around 2 million units, at best.

- Branding issues (excluding Elon Musk) — One of the strong points that Tesla had in its early years was that it was associated with innovative and tech-heavy cool cars … that just happened to be electric. A few years ago, it was the “X factor” brand, the vehicle that many aspired to buy instead of your run-of-the-mill BMW, Audi, or Mercedes. But, now, because of the brand’s ubiquity (Cybertruck excepted), and because the brand hasn’t launched new generations of their models, they are becoming part of the road furniture — blending in instead of standing out. This leaves space for others to take over the early adopters market, to the profit of other EV startups in North America and the new Chinese players in China and elsewhere.

- Branding issues (Elon Musk) — And now the elephant in the room…. Yeah, Elon Musk. Once the poster boy of the EV industry, and even inspiration for action heroes, since the start of the Covid pandemic, things have changed tremendously, especially since he moved Tesla’s HQ to Texas in 2021. Now, in 2025, quoting Wikipedia: “Musk has been described as an American oligarch due to his extensive influence over public discourse, social media, industry, politics, and government policy. His influence in the second presidency of Donald Trump led some to call him the ‘actual president-elect’, ‘shadow president’ or ‘co-president’.”

Now, does this affects Tesla’s sales potential? For sure, especially in specific export markets where Elon is trying to influence local politics and in Tesla’s biggest US market, California. By how much? No idea, but as he becomes more identified in export markets with the upcoming US presidency, the icky factor will become more apparent.

- Politics and Tesla stock — The fact that the Tesla stock price jumped immediately after the US elections says a lot about how TSLA has become a meme stock.

Not only does associating Elon Musk with an unpopular US president risk hurting Tesla’s demand in export markets, but the risk associated with removing the $7,500 incentive from the USA EV market will impact Tesla far more than it will affect the company’s ICE-based competitors, as their ICE vehicle divisions will keep running business as usual and turning profits while Tesla will see its demand drop in its domestic market.

Another factor to have in mind is the possibility of a fallout between Trump and Musk. It has happened before, in the first Trump presidency, and it could happen again. It could be because of something trivial, or something with deep repercussions. One thing is certain: Musk has enemies within the MAGA movement, and while Trump is siding with Musk for now, between money and voters, you never know how things will go in the next spat. And if the newly elected president turns on Musk … you can imagine what happens next.

On top of this, there is China. If there is a trade war between the USA and China, guess who could be one of the first victims? Yep, Tesla. With roughly half of Tesla’s production being in Shanghai, imagine if the Chinese government confiscates Tesla’s facilities in the country. There goes half of the company….

All these risks could outweigh any possible profit that Tesla can take from a Trump presidency, so why the jump in valuation? Because Meme.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy