It’s been 3 years since Tesla rocked the industry with shockingly low solar prices, and a lot has changed in the market. I’m beginning a quest to get solar on 4 homes, and documenting it here.

The Challenge Of Shopping For Solar

I’m shopping for solar for 4 different homes right now.

- My wife and I have a townhouse in Tampa. I didn’t buy solar before for 3 reasons. First, I wanted to live in the house a year and make sure the roof was good before I changed anything. Second, my homeowners association was against it and I didn’t feel like fighting them (I realize they can’t stop me from installing solar, but they could make my life miserable). Third, I was getting my electricity for about 8 cents a kWh (it was especially low since there was a 2 cent a kWh reduction due to Covid-19 for a short period of time) and that makes the payback (even for aggressively priced solar) not so great. The price for electricity in Tampa has approximately doubled to 16 cents a kWh.

- My daughter in Colorado just built a house and wants to get solar on it to save money. She doesn’t have any issues, so this will probably be the first one to be ordered in the next month or two.

- My daughter in Tampa just bought a house and wants to get solar to help the environment. She has shade issues and we have to check the quality of her roof, so those issues will be have to be dealt. It doesn’t make sense to me to put solar on a roof that will have be to replaced soon because that adds a lot to the costs. And it doesn’t make sense to replace the roof 5 years early if it is still good. I don’t think Tesla’s Solar Roof is quite ready for primetime (although I’m all for the product once they get all the problems worked out).

- My sister in Raleigh has a home and is interested in buying solar to save money and help the environment. She doesn’t like the things Elon says on Twitter, so she might be biased against Tesla Energy.

The Fine Print In All Solar Sales Pitches That Nobody Warns You About

In every presentation, the salesperson calculates your savings, and to do that, they have to make an assumption on the rate of price increase your utility will charge every year over the next 25 years. In two recent presentations, the rates of increase predicted for Colorado for the next 25 years were 5% in one case and 5.5% in another. This was justified as the rate prices had increased historically. That sounds a bit high, and with a background in finance, I knew this one variable had a huge impact on the business case of installing solar. Increasing the rate of increase a few points could allow a solar company to double their prices and greatly increase their profits, yet still show good savings, whether or not this was a valid assumption.

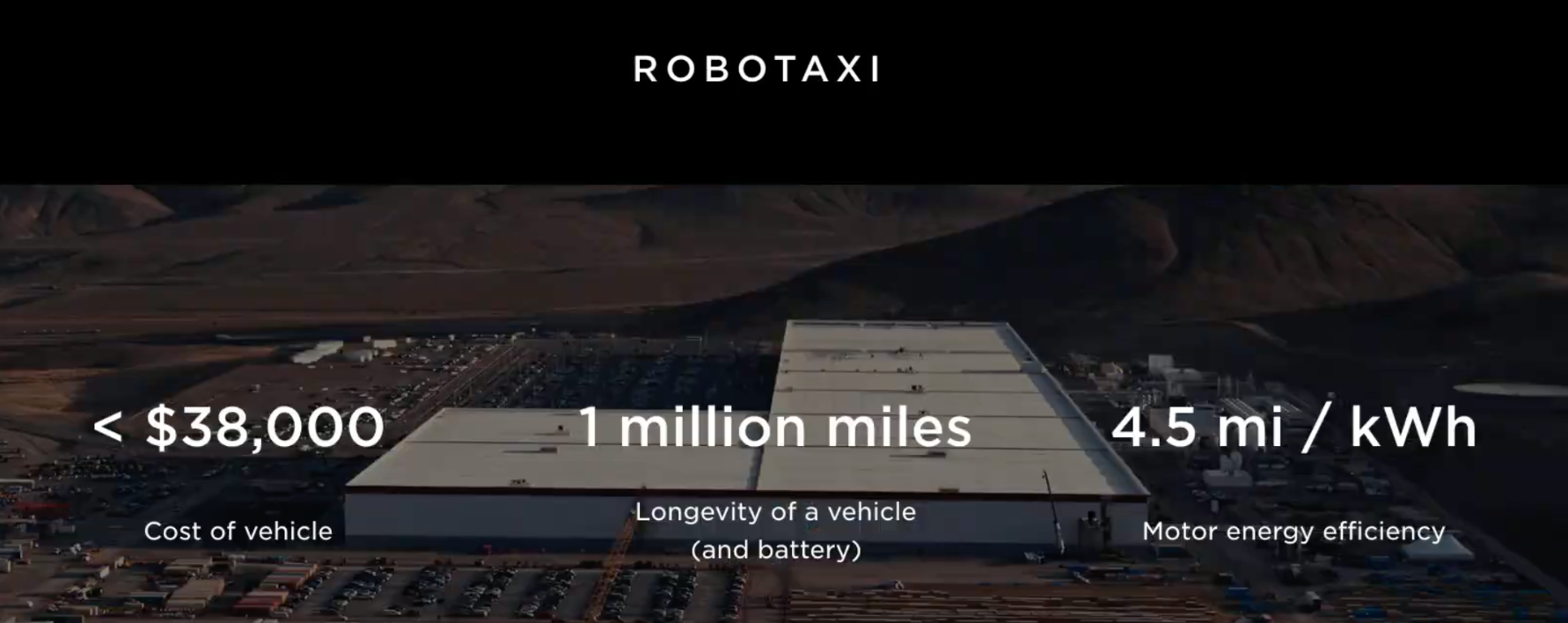

Image credit: eia.gov

Doing my own research, I found the US Energy Information Administration (EIA) has been tracking this for years, and although there is some variation, the rates have been flat when adjusting for inflation for the last 10 years. Looking at prices for a longer period of time, the price of electricity has gone up 1.61% a year over 110 years versus a general inflation rate of 3.16%. So electricity prices have risen about half as fast as general inflation over the long term. That does seem to be mainly because from 1913 to 1950, electricity prices plummeted as the technology advanced (Wright’s law). Since 1990, electricity rates have gone about the same as inflation as the industry has become more politically powerful and rates in many places are set by boards that are populated by individuals that might be influenced by political donations. Tesla uses an assumption of 2% increase in electricity rates for the next 25 years, which seems like a better assumption than 5%. Although rates have increased quickly over the last 3 years, I don’t think utilities will be able to get significant increases in the future for the following reasons:

- Utilities used high fuel prices to justify the increases. Natural gas prices have retreated, and next time they rise (they always seem to rise every few years), most of the grid will be powered by wind and solar, so it won’t have a large effect.

- Utilities know they can’t raise rates much more or they will just accelerate the move to solar by homeowners.

- Political opposition will grow if rates continue to rise.

Shopping For Denver Solar

I noticed that the local quotes were much higher than Tesla solar quotes (and also could only be obtained with a visit, whereas Tesla offers quotes online), but I also noticed that the installers offered lower interest rate financing. I thought, “That is odd. How can these small installers get better loan rates that one of the largest companies in the world?” The answer is they pay a huge “dealer fee” or “finance charge” of 25% to 50% to lower the interest rate, as described in this article. I’m sure this is to simplify the decision, but I prefer to know the real prices and rates and make my own decisions on how to finance the product. Tesla used to have national pricing at $1.50 a kWh (after a 30% tax credit), but it appears to have raised that to $2 in some markets (like Colorado) and kept it at $1.50 kWh in other markets (like Florida). North Carolina was about halfway between those prices at $1.70 a kWh.

All the examples in the rest of this article are in the Denver area. I’ll include Florida and North Carolina quotes in a future article.

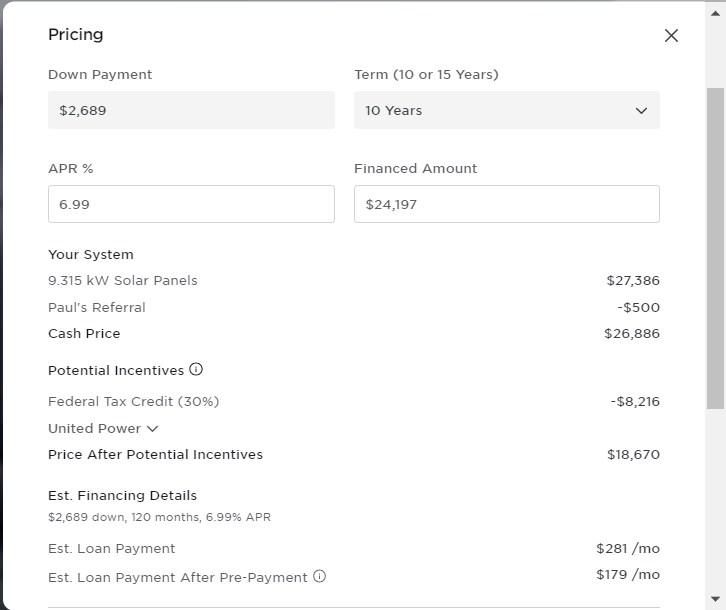

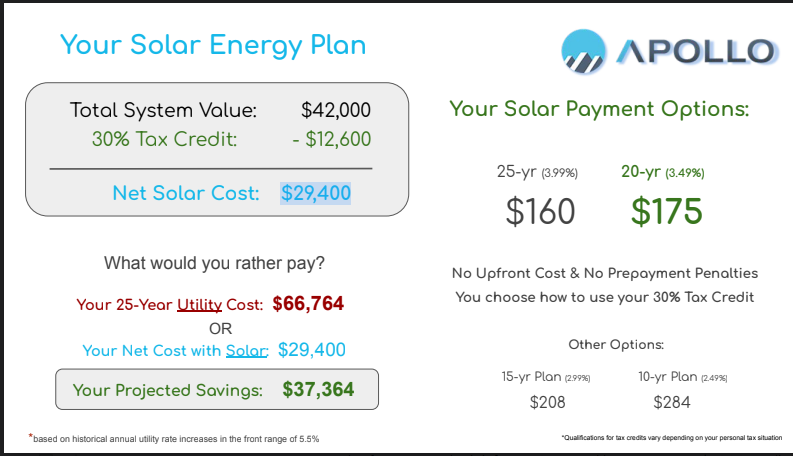

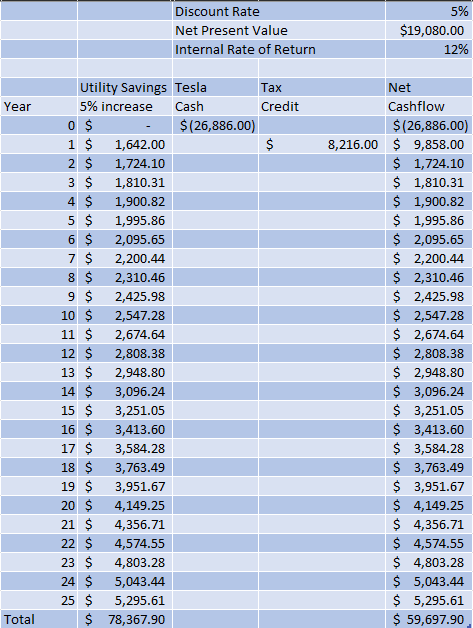

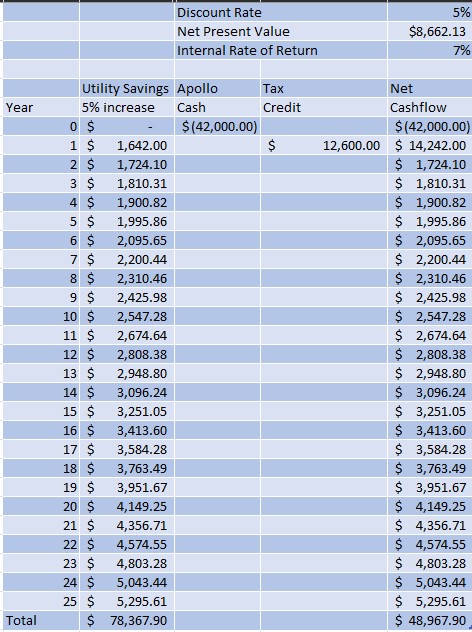

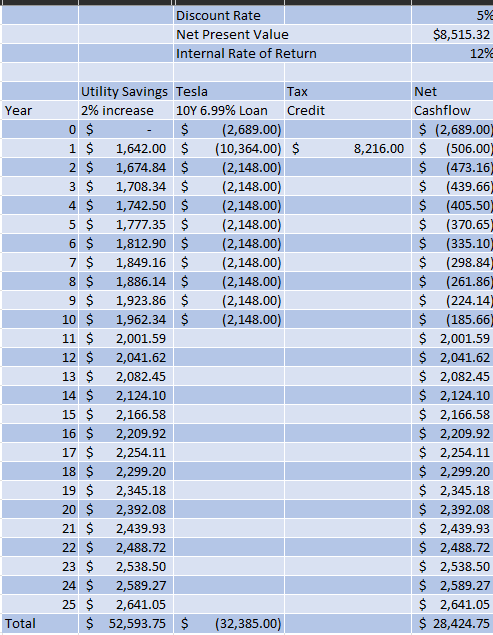

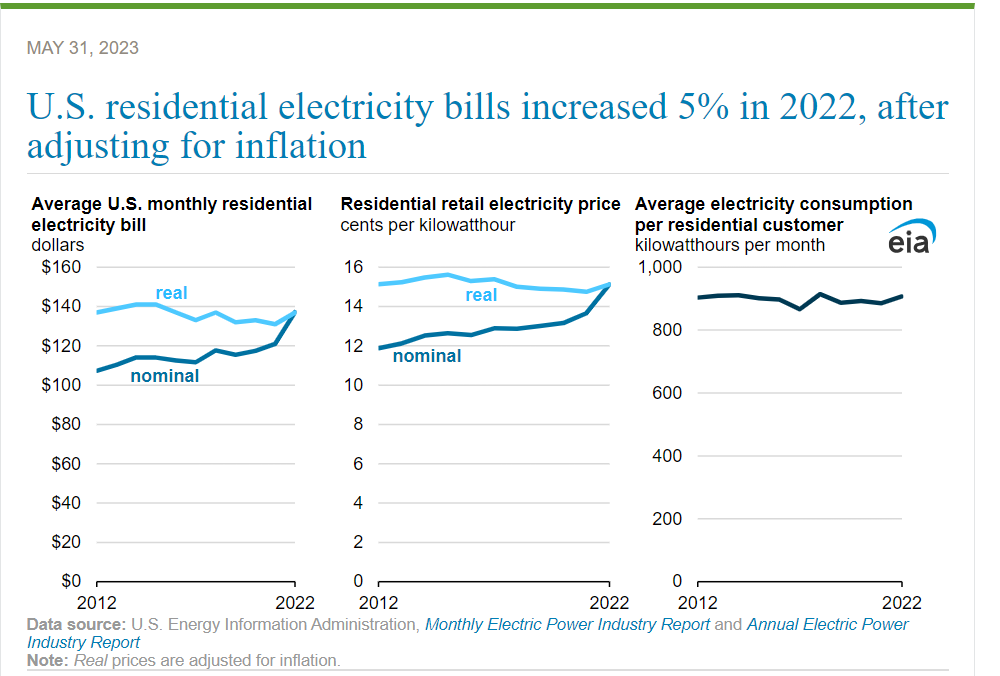

Paying Cash Assuming Annual 5% Utility Price Increases (Unlikely Utility Increases IMHO)

In this example, you can see the ~$12,000 cheaper quote of Tesla makes it the better financial decision for a person who has the money to invest in solar. The 12% rate of return for Tesla is better than the 7% rate for the local installer.

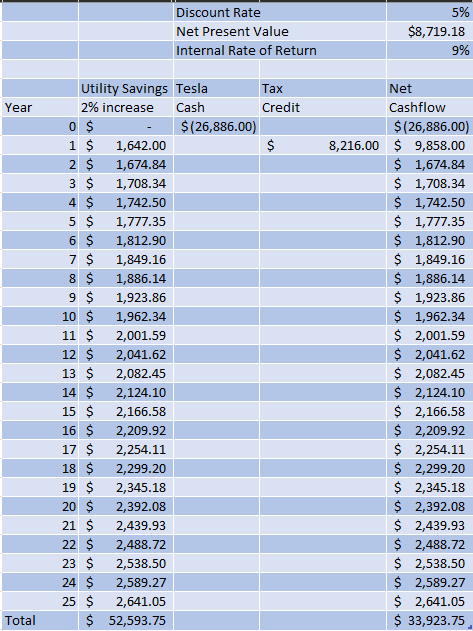

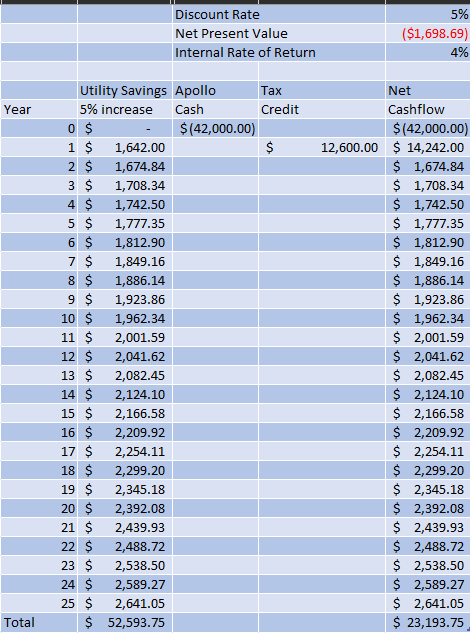

Paying Cash Assuming Annual 2% Utility Price Increases (Most Likely Utility Increases IMHO)

In this example, you can see the ~$12,000 cheaper quote of Tesla makes it the better financial decision for a person who has the money to invest in solar. The 9% rate of return for Tesla is better than the 4% rate for the local installer. Looking at the net present value of the investment with a 5% discount rate, the local installer turns negative, since the 4% rate of return is less than the discount rate. This scenario also doesn’t give a very good result if we have a few outages. When you have an outage, you end up making payments to both the solar company and the utility company.

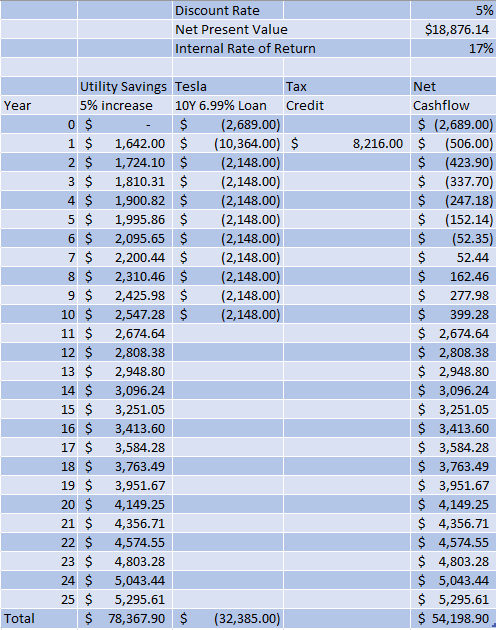

Getting A Loan To Greatly Reduce Impact To Your Budget In The Early Years Assuming Annual 5% Utility Price Increases (Unlikely Utility Increases IMHO)

In this example, you can see the ~$12,000 cheaper quote of Tesla makes it the better financial decision looking at the net present value, but the local installer’s offer of no down payment (versus Tesla Solar’s insistence on a minimum 10% down payment) means the local installer offers a higher rate of return. This is due to two factors. The very low investment (for just a few years the loan payment is slightly higher than the utility savings) in combination with the low interest rate on the loan.

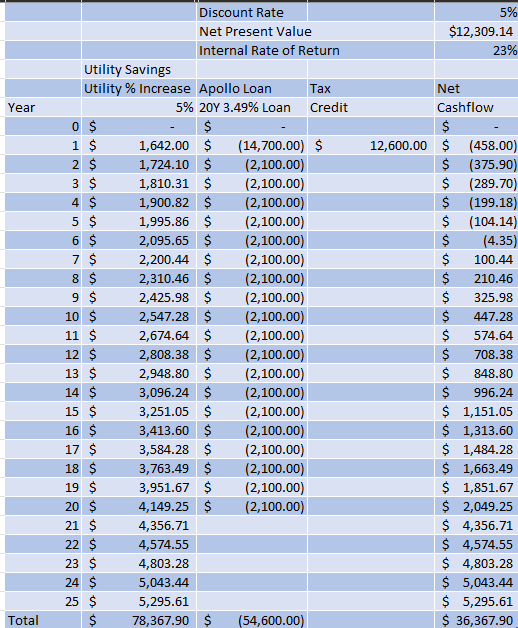

Getting A Loan To Greatly Reduce Impact To Your Budget In The Early Years Assuming Annual 2% Utility Price Increases (Most Likely Utility Increases IMHO)

In this example, you can see the ~$12,000 cheaper quote of Tesla more than makes up for the better local financing when looking at the net present value and internal rate of return. The differences are not huge. Going wtih Tesla will require a down payment that isn’t required with the local installer. The financials are close enough that you could go either way based on other factors (discussed below) or personal preference.

After Installation Support

It is pretty clear that Tesla is the best option from a purchase standpoint. Its prices are up to 50% less expensive than the other quotes I received, and it is a far more financially secure company than the other firms installing solar. Its panel warranty of 25 years is similar to the other products, while its 10-year warranty on the rest of the system was a little shorter than some others that offered 25 year warranties on everything (but one wonders if the companies will be around more than 10 years to honor the warranties).

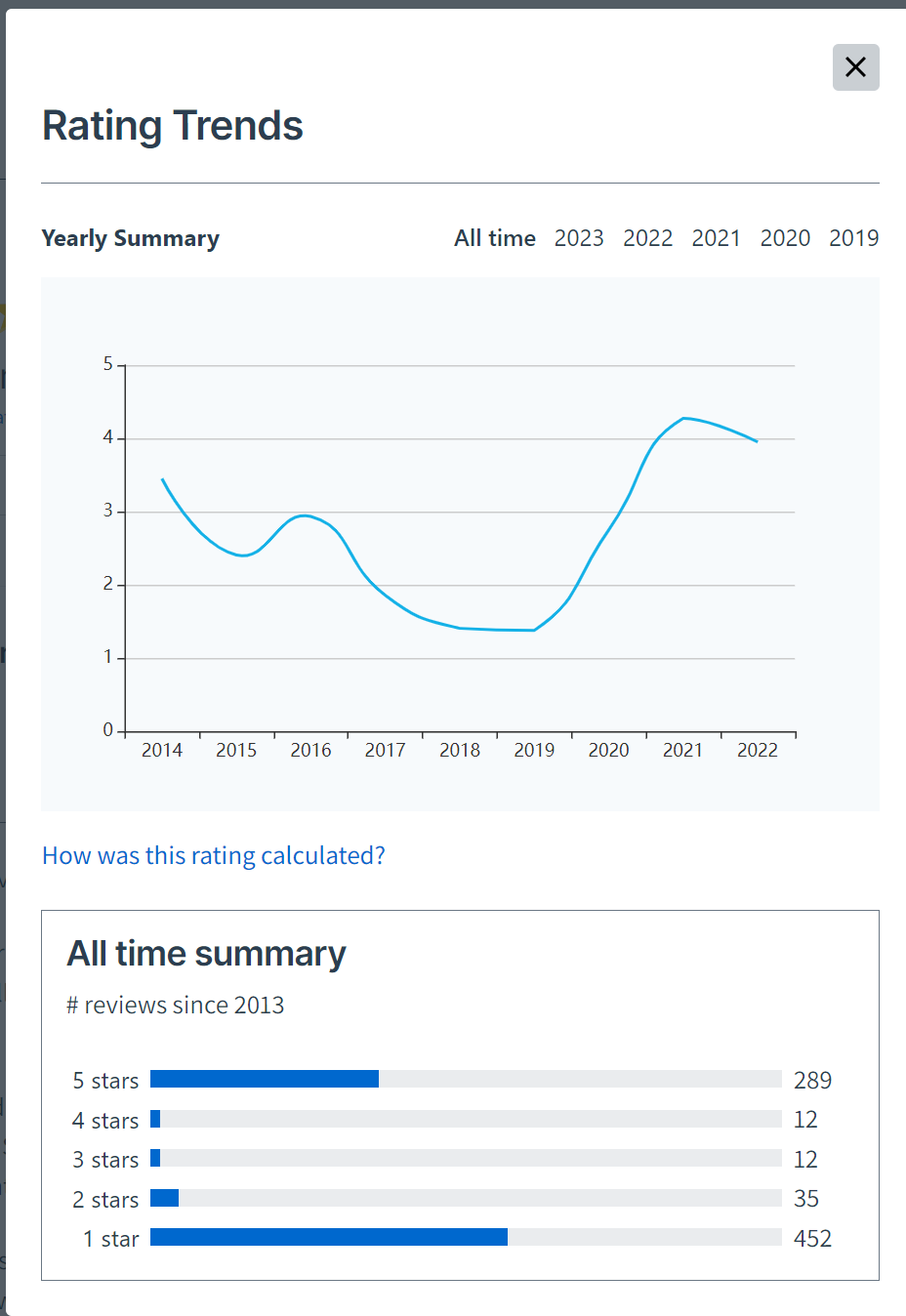

The local companies claim Tesla doesn’t have as good of service as they do. Is there any truth to that claim? I’ve checked with 3 people who have installed Tesla solar panels and they said it went fine. But I realize that is way too small a sample to be valid. I found this expert review by Solar Reviews that seems to do a good job of explaining Tesla Energy image problems.

“Prior to September 2020, Tesla had a reviews score on our site of less than 2 out of 5. However, since then, there has been a strong influx of positive reviews for the company and their overall reviews score has improved substantially. Almost all of these reviews have been from customers who had recently purchased a system, so it remains unclear if Tesla has only improved their sales and installation process, or whether their overall customer service to older customers has improved, as well.”

So, it appears Tesla is doing much better at the install, but the jury is still out as to whether it will be good for long-term support. Although some of the work of Tesla Energy is national (like its website), it does have local people in the major markets who you can talk to, and the service centers in major markets have people you could visit if you needed to speak to someone in person. That being said, I know from dealing with Tesla for car service that it is sometimes hard to get a hold of Tesla, since the company attempts to automate so much of its processes.

Image Credit: Solar Reviews

As you can see, Tesla really has a lot of 1-star reviews from the time when SolarCity (what Tesla Energy was called in the past) leased a lot of systems. Reading the 1-star reviews, the biggest complaint was the homeowner was trying to sell their home and Tesla had a lien on the home to secure its leased solar panels, and Tesla was slowing up closings because it needed to review the credit of the buyers of the property. Tesla doesn’t do those secured leases anymore, and this seems to be less troublesome. Solar prices have gone down so much in relation to the price of homes that, usually, there is plenty of equity in a home sale to pay off any solar loan. For example, 10 years ago, you might have $50,000 in solar panels on a $200,000 home. Now, you might have $30,000 in solar panels on a $600,000 home. In this hypothetical example, the solar panels used to be 25% of the price of the home, and now they are 5%.

Conclusion

My daughter hasn’t made her final decision on which way to go. I should mention she got several other local quotes that were higher than Apollo and no better quality in my opinion. There are definitely some bad solar deals out there. It’s clear to me that Tesla is the best choice if you want to pay cash, and going with a local installer is the best choice if you want a $0-down option (which Tesla doesn’t offer). Even though the rates of return on solar appear to be less than a high-flying stock investment promises, it has 3 advantages over stock investments:

- It should have lower risks. Although a few things can go wrong with solar, a lot more things can go wrong with stocks.

- You know you are doing your part to reduce your carbon footprint and not waiting for someone else to do it for you.

- As battery prices continue to go down, you are setting yourself up to become independent and maybe even join a program where you can sell power back to the grid when it needs it the most!

If you want to take advantage of my Tesla referral link to $500 off Tesla Solar: https://ts.la/paul92237.

Disclosure: I am a shareholder in Tesla [TSLA], BYD [BYDDY], Nio [NIO], XPeng [XPEV], Hertz [HTZ], and several ARK ETFs. But I offer no investment advice of any sort here.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …