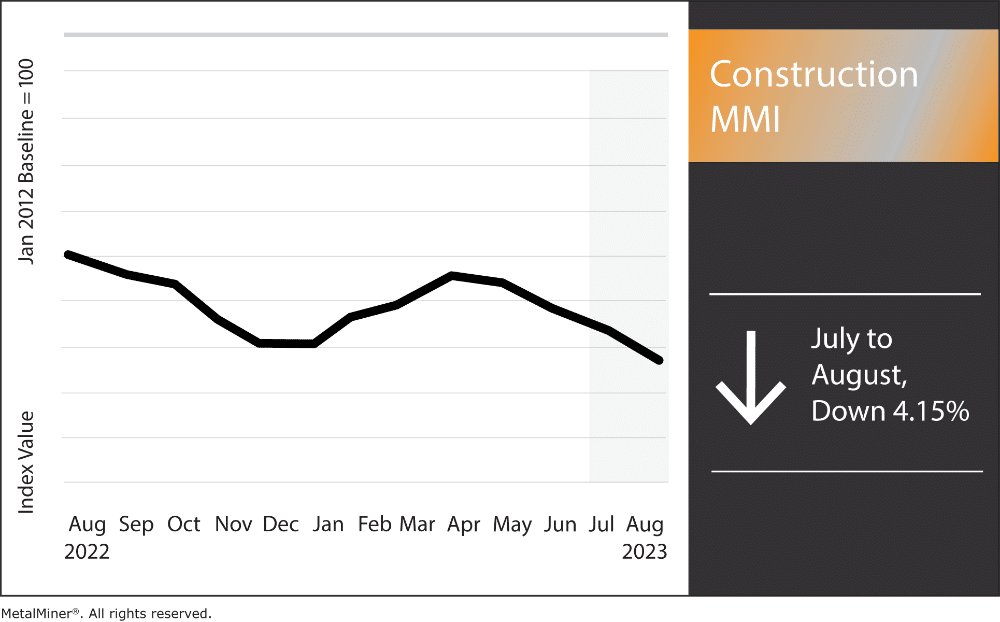

The Construction MMI (Monthly Metals Index) continues to experience pressure from both sides amid conflicting global construction news. For instance, U.S. scrap steel prices recently dropped due to more vehicles being manufactured (car manufacturing always produces ample scrap). However, Chinese steel product prices went up at the same time. Ultimately, metal markets witnessed more movement in the past few months, somewhat breaking out of their sideways trends. This significantly impacted the construction market. However, Chinese manufacturing also remains in a slump. This ultimately impacted the construction index more than anything else, as U.S. import orders from China were down significantly. In the end, the index declined 4.15%.

Stay on top of steel, aluminum, copper and other metal market shifts on a weekly basis. Opt-in to MetalMiner’s free weekly newsletter.

Chinese Manufacturing Still Down, Impacting Material Availability

China’s manufacturing sector continued its decline, particularly with regards to the U.S. Indeed, China witnessed no significant increase in its exports to the U.S. during 2022. Moreover, the imposition of tariffs and the escalation of international tensions over the past few years have only exacerbated this situation. Consequently, Chinese factories face mounting pressure to augment their revenue, necessitating that they surpass their previous levels of goods sold.

In other Chinese manufacturing news, the non-manufacturing Purchasing Managers’ Index (PMI) decelerated to 51.5 in July 2023. This marks the fourth consecutive monthly decrease. The country’s manufacturing sector also experienced a decline in its level of activity, while the lifting of zero-COVID restrictions resulted in a notable reduction in demand.

The Caixin/S&P Global manufacturing PMI for China dropped from 50.5 in June to 49.2 in July. This outcome fell short of analysts’ projections of 50.3 and marked the first contraction in the country’s activity in 15 months. The consequence of this immediately reverberated across global manufacturing, including in the U.S.

Factories in both the U.S. and Europe continue to grapple with high costs despite recent signs of cooling inflation within the U.S. Input costs have risen as a result, leading to disruptions in the supply chain. Consequently, factories in these regions continue to find it challenging to meet demands, creating a ripple effect on production worldwide.

Stay on top of how slumping Chinese demand is impacting metal prices and understand what direction metal market prices are heading in. Learn more about MetalMiner Insights.

Latest Construction News Shows Impact of Slumping Chinese Demand on U.S. Construction

China’s struggling economy might lead to additional drops in the cost of construction materials in the U.S. Indeed, if China continues to slow down its manufacturing activity, it could cause a decline in demand for construction materials across markets. This decline, in turn, might further impact U.S. construction projects.

Analysts anticipate that China will implement more stimulus measures to bolster its economy. However, these measures might not specifically focus on the construction sector. As reported by Reuters, they could attempt to boost sluggish consumer and private sector demand instead. Meanwhile, the shortage of highly skilled factory workers in China, brought on by the decline in international demand, could result in a more pervasive employment issue. Simultaneously, it could also affect the quality of those manufactured items originating from the country. Therefore, MetalMiner suggests that procurement managers do not source solely from China and instead attempt to diversify their supply network.

If you need comprehensive, monthly insight about steel, aluminum and other metal markets in order to avoid making costly sourcing errors, subscribe to MetalMiner’s Monthly Outlook report.

Construction News: Biggest Price Shifts in The Construction MMI

- Chinese steel rebar increased by 3.67%, bringing prices to $538.01 per metric ton.

- Chinese h-beam steel also went up in price. Month-on-month, prices rose by 4.02%, leaving prices at $520.12.

- Weekly Midwest bar fuel surcharges went up by 11.54%, bringing prices to $0.58 per mile.

- Finally, Chinese aluminum bar moved sideways, inching down 0.89% in prices. This brought prices to $2782.53 per metric ton.