Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Last Updated on: 19th February 2025, 10:39 am

At a high-level industry conference in China this week, BYD founder and CEO Wang Chuanfu said Chinese new energy vehicles are three to five years ahead of the rest of the world and called for less restrictive trade policies to allow more people to experience them. Only with openness and innovation can the world experience how good Chinese products are and develop competitive products together, he said, according to a report by CnEVPost. Behind every one of the company’s technologies is innovation, green development, and the efforts of its large corps of engineers. “We have 110,000 engineers, which is BYD’s biggest asset,” Wang said.

New energy vehicles in China include plug-in hybrids, but it’s now more common for that country’s automakers to talk about these as extended-range EVs and they far exceed the battery-only range of most PHEVs from the US and Europe. BYD has some models that can drive more than 1,300 miles without stopping to recharge the battery or refill the gas tank. Those cars can drive hundreds of miles on battery power alone while most PHEVs from other countries can only manage 40 to 50 miles. The difference should be embarrassing to automakers outside of China.

His remarks were clearly aimed at the EU and the US, both of which have imposed significant tariffs in an effort to limit the sale of Chinese made cars in order to protect their domestic car companies. That actually is not how capitalism is supposed to work. In theory, better products that sell for less money should succeed in the marketplace, which will force others to either improve their products or go broke. The system can be quite cruel — just ask Kodak and Nokia — but it is touted as the best of all economic systems by those who worship Ayn Rand and Milton Friedman. Wang would argue that those tariff barriers should come down so more people can experience the goodness of his company’s products. Although, he might sing a different tune if the situation were reversed.

BYD’s dominance of the Chinese new car market was reflected in the latest sales numbers, which show that for the week ending February 16, 2025, new registrations for Nio were 1,900, Tesla 7,500, Xiaomi 6,900, and BYD 46,800. Nothing says dominance like outselling your nearest rival by more than 600 percent!

China Dominates Global EV Battery Supply Chain

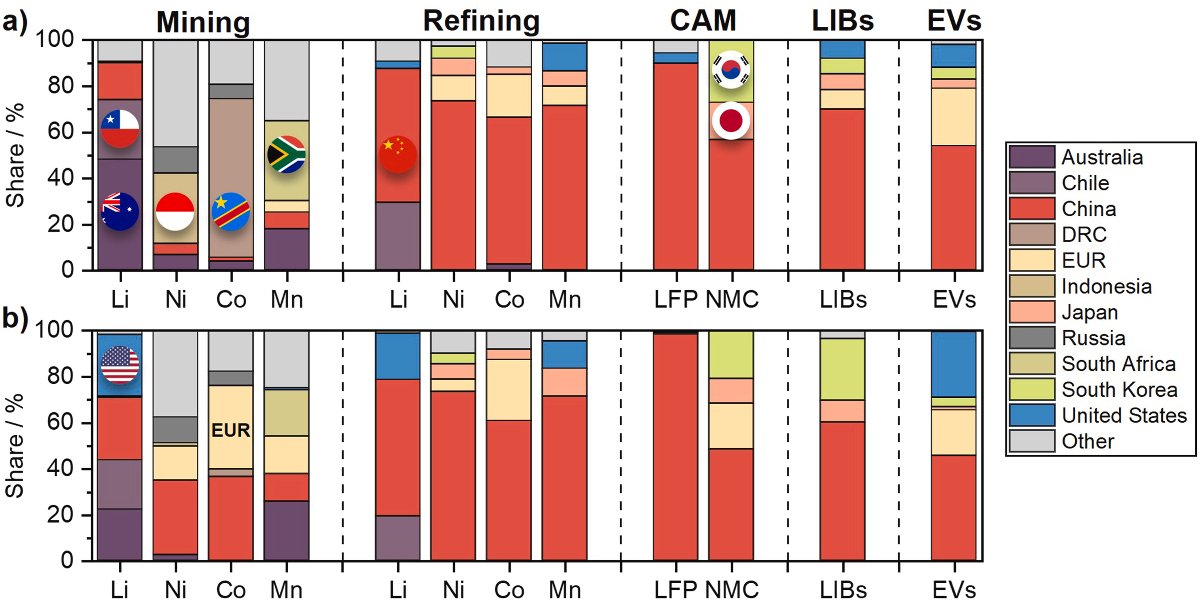

China may be facing resistance in some countries when it comes to selling cars with plugs, but it is by far the dominant player in the supply chain for them. Even so-called domestic cars rely heavily on components and materials sourced from Chinese companies. A team of researchers from Fraunhofer FFB and the German University of Münster have analysed the ownership structures and geopolitical dependencies along the supply chain for electric car batteries, and the results show China is clearly in the lead in those areas.

The researchers determined that China dominates the entire electric car value chain, from the extraction of raw materials to the production of batteries. Of the four raw materials analysed — lithium, nickel, cobalt, and manganese — only manganese is an exception. The refinement of the raw materials and the construction of the actual cells and batteries is dominated by China as well. CATL and BYD alone account for 55 percent of the global market share for installed battery capacity in electric cars.

Only a few countries, such as China, Australia, and the DRC, have the resources needed to produce the large quantities of battery materials needed for the expansion of electric mobility. These include China, Australia, and the Democratic Republic of the Congo. “Mineral raw materials are at the very beginning of the supply chain for battery cell production, and Europe is almost 100 per cent dependent on imports,” says Professor Simon Lux, Director of Fraunhofer FFB. “This dependency makes Europe vulnerable. Geopolitical tensions or export stops could lead to massive economic damage and losses running into billions.”

The research identifies Australia, Indonesia, and the Democratic Republic of the Congo as key regions for mining lithium, nickel and cobalt that are particularly affected by company takeovers. 74 percent of the world’s lithium comes from Australia and Chile, but Chinese (29 percent) and US companies (26 percent) hold the largest shares of production at 29 and 26 percent respectively. “These developments underline the global competition for critical raw materials and the strategic realignment of value chains,” says Lux. Europe controls almost no lithium supplies in other countries.

Although 30 percent of global nickel production takes place in Indonesia, Indonesian companies account for less than five percent of production. Chinese companies such as Tsingshan control 86 percent of the remaining production in Indonesia, meaning China has the greatest control over nickel production in combination with domestic production. For cobalt, the story is much the same. 68 percent of global production takes place in the DR Congo, but local companies control only five percent of the mines. China and Europe dominate production there, with each responsible for 47 percent of production in that country.

Australia has expanded its influence in manganese to a total of 25 percent by acquiring more than half of South African mining rights by two companies, South 32 and Jupiter Mines. South Africa is in second place with 20 percent, followed by Europe, which has a total share of 16 percent of global manganese production. These shares are spread across mines in Australia, Gabon, and Ukraine, which were acquired by Anglo American, Eramet, and ERG.

The researchers note that China has a particularly large lead in the LFP battery sector, where it produces the majority of lithium iron phosphate active materials, with a share of more than 98 percent. The conclusion is that this means Europe is entirely dependent on China for batteries that use LFP chemistry. They suggest possible levers for a secure and sovereign battery supply chain in Europe could be investments in expanding Europe’s own refinery capacities, promoting strategic raw material partnerships and strengthening the local circular economy.

In terms of methodology, the researchers from Fraunhofer FFB and the University of Münster say that the study is based on a comprehensive data analysis, in which the ownership structures along the global lithium-ion battery supply chain were analysed and compared with the geographical distribution of production shares. The purpose of the study was to “draw a holistic picture of the current power structures in the industry.”

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy