The governments of Canada, the United States, and many other nations are mandating a shift in vehicle technology: away from vehicles powered primarily by internal combustion engines, and toward vehicles powered primarily with electricity stored on board in batteries.

Canada’s government has established policies designed to push automakers to achieve the government’s goal of having 35 percent of all new medium- and heavy-duty vehicle sales be electric by 2030, rising to 100 percent of all new medium- and heavy-duty vehicle sales being electric by 2040.

The US has set a target requiring 50 percent of all new passenger cars and light trucks sold in 2030 be electric, or largely electric hybrid vehicles. These timelines are ambitious, calling for a major expansion of the prevalence of electric vehicles (EVs) in the major vehicle classes in a very short time—only 7 to 10 years.

Barring breakthrough developments in battery technology, this massive and rapid expansion of battery-electric vehicle production will require a correspondingly massive and rapid expansion of the mining and refining of the metals and rare earth elements critical to battery-electric vehicle technology.

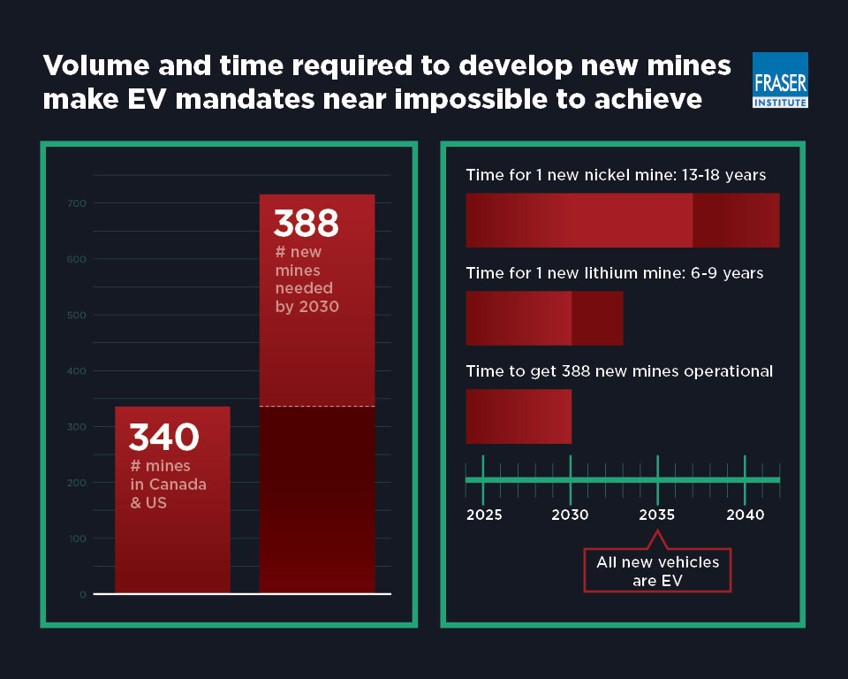

The International Energy Agency (IEA) suggests that to meet international EV adoption pledges, the world will need 50 new lithium mines by 2030, along with 60 new nickel mines, and 17 new cobalt mines. The materials needed for cathode production will require 50 more new mines, and anode materials another 40. The battery cells will require 90 new mines, and EVs themselves another 81. In total, this adds up to 388 new mines. For context, as of 2021, there were only 270 metal mines operating across the US, and only 70 in Canada. If Canada and the US wish to have internal supply chains for these vital EV metals, they have a lot of mines to establish in a very short period.

Historically, however, mining and refining facilities are both slow to develop and are highly uncertain endeavors plagued by regulatory uncertainty and by environmental and regulatory barriers. Lithium production timelines, for example, are approximately 6 to 9 years, while production timelines (from application to production) for nickel are approximately 13 to 18 years, according to the IEA.

The establishment of aggressive and short-term EV adoption goals sets up a potential conflict with metal and mineral production, which is historically characterized by long lead-times and long production timelines. The risk that mineral and mining production will fall short of projected demand is significant, and could greatly affect the success of various governments’ plans for EV transition.

Author:

Senior Fellow, Fraser Institute

More from this study

Share This: