Jonas Ranggård, Manager of Boliden Mines Electrification Program, says his whitepaper on the electrification of open-pit mining aims to equip miners with the right questions to help them in their transition, while providing a wake-up call to truck suppliers to focus “less on developing ad-hoc solutions that will never be cost competitive”. IM argues he has achieved both aims.

The major conclusion from his paper, supported with simulations from Olav Öhmark, Senior Development Engineer at Boliden, is that battery-electric vehicles utilising static charging would have more applications in the mining sector than the battery-trolley philosophy many are pushing. This is predicated on the fact that batteries should be cheap; in-cycle charging is not, as some would argue, a ‘no-go’; battery trucks need to offer more than productivity and payload alone; and truck battery capacity needs to increase.

Before getting into the reasons behind these, it is worth examining where Ranggård is coming from, both in terms of experience and the company he works for.

Ranggård is in the somewhat unique position of wearing electrification hats for both open-pit mining and public road transport, with Boliden using both at its operations. This is different to the majority of engineers in charge of open-pit electrification projects at mining companies.

Boliden is also not your average miner.

Its mines are powered by mainly renewable energy. It is also more forward-looking than most, already investing in recycling metals and producing low-carbon products to differentiate its offering. Its close ties to the Nordic technology space, renowned for its forward-thinking technology, also affords it special privileges.

These facts do not dilute Ranggård’s assertions on the future of mine electrification. Boliden has been proactive in testing out many of the technologies the sector has put forward as either ‘bridge’ solutions or those expected to help achieve net-zero status outright. For instance, at its two big open-pit mines in northern Sweden – Aitik and Kevitsa – Boliden has invested time and money on installing trolley assist lines and acquiring diesel-electric ultra-class trucks to run on them. Similarly, it has acquired battery-electric machines for on-road trucking and at its underground mines.

Ranggård’s views are based on real-world experience, not just theoretical calculations.

Battling battery expectations

“Batteries are cheap,” Ranggård says. “A rough guideline is that a throughput cost higher than $100/MWh is unacceptable” being the price level already seen in the public road trucking sector. According to Ranggård, OEMs from this sector are already offering lower prices for battery vehicles in the future based on expectations of battery volumes increasing and an awareness of the financials needed to compete.

These public road trucking OEMs are focusing on two battery chemistries – nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) – which, along with lithium titanate oxide (LTO), are also the ones most applicable to mining applications, according to Ranggård. LFP will overtake NMC in the upcoming years in terms of market share, while LTO, even with its lower energy density and increased expense, could be seen in vehicles and applications where range is not as important.

These battery chemistries need to be used optimally, with a lower depth of discharge (DoD) the order of the day. “Low DoDs can be achieved with two solutions: charge more often, or over-dimension the [battery] pack,” Ranggård says.

Getting past the battery cell level is where the pricing problem occurs, according to Ranggård, with mining OEMs trying to carry out “extremely complex development in-house”. This is a problem as the development cost is spread over a small number of consumers, leading to high prices.

The sector needs to look, again, at developments in public road trucking – trucks that are already being used in mining today in diesel-powered form – for a lead, Ranggård says.

“While their packs for battery versions now entering the market are more expensive than a typical car today (2-3x), they are still significantly cheaper than mining-specific packs,” he says.

The ‘ruggedisation’ argument mining OEMs will argue accounts for the difference does not hold up in Ranggård’s opinion. “We have conducted vibration measurements on common Volvo/Scania trucks used for underground hauling and compared them with vibrations on ultra-class trucks,” he said. “The vibrations or g-shocks are more or less the same.”

There is a need for some extra safety measures to be included – protection from falling rocks, for instance – but there is no justification for designing an entire pack from scratch, he argues.

This all harks back to Ranggård’s original assertion that batteries, at their core, should be “cheap” and that mining-specific suppliers will find it tough to compete in this market by developing bespoke battery solutions.

He looks East to China for an example: “What we will see in the future is mining OEMs being pressured by suppliers chasing, for example, Tesla and BYD on public roads and then using the same pack for construction/mining equipment…XCMG has, for example, recently communicated the commissioning of a massive battery pack plant with BYD: it will be extremely challenging for western mining vehicle suppliers to reach the same volumes and therefore prices as this.”

The reason for homing in on the battery price here is that most OEMs, according to Ranggård, offer battery-electric trucks without the battery and DC-DC converter at the same capital cost as a diesel-electric truck. This means the battery and supporting infrastructure need to be cost-competitive to stack up financially.

It is then the cost of energy throughput – a function of the battery cell price, the pack price and the lifespan with a limited state of charge window (cycles) – that needs to compete with the incumbent diesel price to make sense from an operating cost perspective.

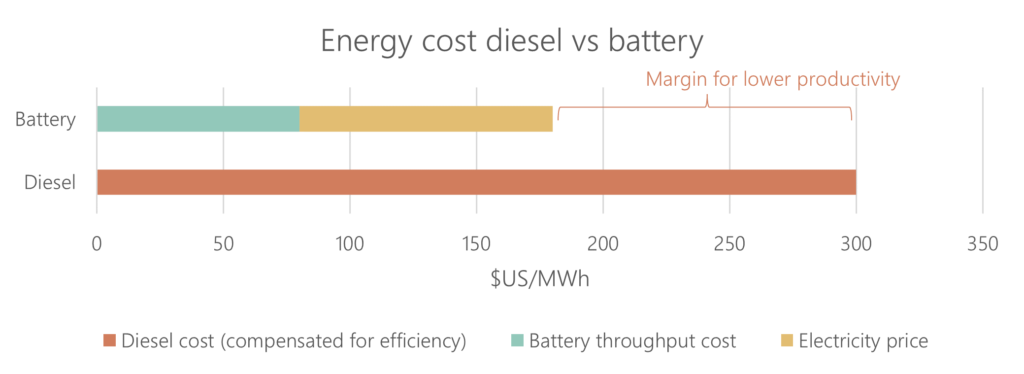

“For reference, diesel at $1/litre will cost roughly $300/MWh compensated for efficiency,” Ranggård says. “So, to be cost-competitive with diesel, the cost of energy throughput, plus electricity price, needs to be less than $300/MWh – preferably by some margin to pay for infrastructure and lower productivity (more trucks required due to charging).”

As a result, if batteries come down in price or their life cycle expands from the existing baseline, the financial benefits increase in step with an increase in the use of the battery trucks.

“Almost the entire business case of electrification is based on this saving,” Ranggård says. “But, if the electricity or batteries are too expensive, the opposite is true – electrify all you want, you’ll never get your money back.”

This links to the size of the battery pack chosen – the bigger, the better, according to Ranggård to allow for changes to the mine plan and the longest possible battery life. Here, miners need to ditch their payload obsession and focus more on operating costs, he argues.

“Looking at third-party pack solutions that are out there today, one should be able to fit roughly 1,000 kWh of LTO and 3,000-4,000 kWh of LFP on a 220-ton truck without too much reengineering of the truck, heavily dependent on the pack solution,” Ranggård says.

“Unfortunately, what we see is many (not all) mining OEMs aiming for less due to payload concerns, sub-optimal battery solutions and an unrealistic reliance on dynamic charging.”

This concern isn’t present in the public road trucking sector, according to Ranggård, with suppliers chasing range ahead of payload as they have cost-competitive battery solutions that make for a good business case even with reduced payloads.

“Also, as mentioned before, a bigger battery equals a longer battery lifespan (lower energy throughput cost) and higher charging power,” he added.

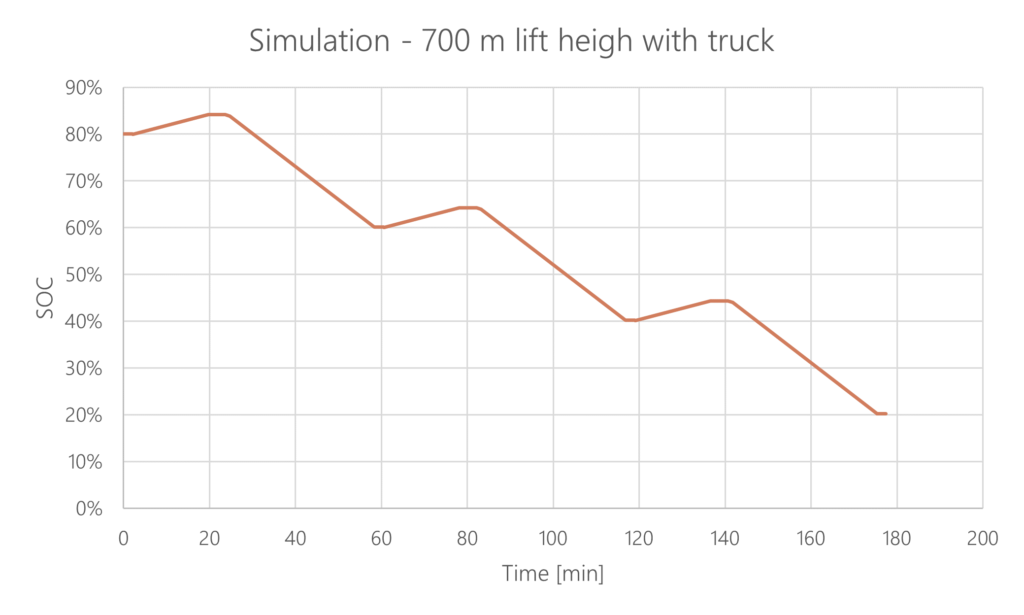

It is a public road battery truck operating in a mining application that Ranggård uses to back this opinion up, with a simulation that shows, even with a 700 m lift height, the truck – carrying 500-600 kWh of battery power – can drive continuously up and down carrying maximum payload without a charge for three hours. In this example, a truck with “proper” battery pricing can lower transport costs when pitted against the diesel equivalent even though the batteries are used to the absolute maximum. “What’s even more impressive is that this is not even the biggest available battery size for that model,” Ranggård adds.

If one were to use the same energy/payload ratio as this example, a 220-ton-capacity truck would have almost 6,000 kWh of battery power to call on.

Charging conundrums

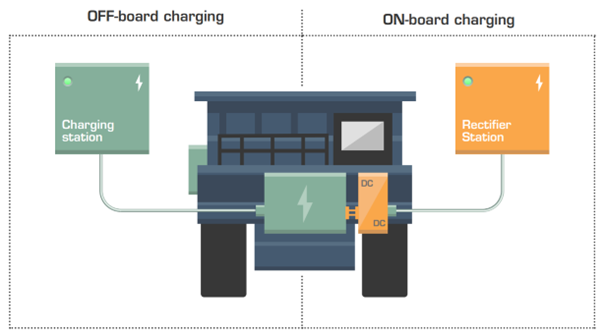

To the subject of charging this 220-ton-capacity truck and the question: should you leverage an on-board or off-board system?

Where on-board charging connects directly to the DC-link on the truck and transfers power through the on-board DC-DC converter – the solution used in a dynamic charging scenario – off-board charging sees the charging station connected directly to the battery (just like fast charging a car).

The former is less complex – requiring a transformer and a relatively cheap diode rectifier for the railway – but comes with the bottleneck of the DC-DC converter typically having a lower power rating than the pack can handle.

The latter, meanwhile, allows charging at higher speeds but counters that with more charging station complexity, higher battery usage and the fact there is no dynamic element to keep the vehicle moving while charging, Ranggård says.

“The common miner’s mindset is that standstill time is unacceptable, usually overlooking the fact that the operating expense savings from electrification are large enough to compensate for lower productivity/more trucks,” he explains.

More battery power is one avenue to consider in this scenario, as is minimising the connect and disconnect time associated with charging. The latter element can be achieved by putting the chargers inside the haul cycles.

The reason for Ranggård’s aversion to dynamic charging is the realities of achieving high availability of the system and the number of applications it would be suited for. By under-dimensioning a battery pack on-board a battery truck operating on a dynamic charging loop, one is leaving it susceptible to hitting a standstill should the infrastructure fail. At the same time, mines with a short ramp lifespan, narrow ramp, rock stability issues or that are near to blasting operations do not favour a dynamic charging setup.

“Dynamic charging can only be justified on steep uphill travel; on faster flat hauls, it makes far less sense as a dynamic solution costs basically the same regardless of the incline it is placed on,” he said. “Also, the truck travels much faster on flat hauls.”

Contrary to the belief that battery trolley operations are the most likely way to start electrifying mines, Ranggård sees dynamic charging solutions and battery trucks as two separate entities with far less synergies than believers assume.

Pit falls

Ranggård’s whitepaper provides enough real-life insights from Aitik and Kevitsa to back many of these assertions up (some of which are included here).

He also presents a baseline study for the Aitik Pushback – a 50 Mt/y operation with an uphill portion, long haul and flat haul as part of its cycle. It is this example that showcases the battery truck superiority on a net present value basis against battery trolley and diesel applications.

The next acid test will come when the company has its first battery truck on site operating in real conditions. All indications are this could be soon given Boliden recently signed an agreement with Komatsu to take the Power Agnostic 930E pre-production haulage truck to Aitik and the fact it has already received a prototype ABB Robot Automated Connection Device (ACD) to charge future battery-electric trucks at Aitik ready for connection testing in arctic conditions.

Even with this experience in tow, Ranggård’s advice and warnings will not receive the same reception all over the world.

“While electrification makes financial sense for some markets, it won’t for others for many years,” he said. In markets where diesel is cheap – either through government rebates, incentives, or a lack of carbon pricing applications – the business case will be non-existent even if the batteries were free.

“This might create space for some bridging solutions, such as battery/diesel hybrid trucks,” he says. “It would probably also continue to push for diesel-trolley (or alternatives) as they can be sold as productivity solutions.”

Unless something drastic occurs, this dynamic will mean miners miss their most ambitious targets to 2030, at the same time as truck OEMs realise they invested too much too early, according to Ranggård. “But, as this unfolds, it is important to remember that electrification will happen and will be profitable (for many). The problem was that the speed of the transition was overly optimistic.”

This could lead to cost-competitive battery truck volumes not arriving in the ultra-class category, opening up an opportunity to downsize operating fleets and enable them with AHS, even if it does mean selling ‘useful’ trucks on the second-hand market or for scrap.

With so many uncertainties in play, what do the OEMs do?

“The OEMs have two choices: go all in or buy technology from someone else,” Ranggård says. “The all-in approach is the high-risk, high-reward option. But it will take a lot of money and effort to compete with Chinese and public road manufacturers. The safer bet would probably be to create a standardised space and interface on the truck and be flexible on battery supplier. That would most likely achieve a better product at a lower cost and with a lower risk.

“One thing is certain: the obvious pitfall is doing something in between.”

Read the full report here