Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Continuing on from Part 1 of this series on electric car & truck charging, here is Part 2.

More Power Required for Heavy-Duty Electric Truck Charging than for Cars

Fast charging heavy electric trucks is a much different proposition than fast charging electric cars. Car charging stations are typically equipped with chargers with power capacity from 50 to 150 kW, and ranging now up to 300 kW.

Kilowatts (kW) are units of electrical power.

Power = volts × amps = VA

Transformer ratings are often given in VA, or volt amps — another way of saying power.

Power × Time = Energy

That gives us kWh or kilowatt-hours, a familiar term to homeowners who look at their monthly electric bill.

A large amount of electric car charging is done at home or using publicly available Level 1 and Level 2 charging stations at relatively low power levels below 20 kW and from service voltage sources of 120V and 240V. For these systems, power levels are low, the charges are based on energy at a cost per kWh rate, and there are ordinarily no extra utility charges for power.

The situation is different for power users such as commercial users and fast charging stations.

Heavy truck fast charger stations use power in the MW range, much higher than home charging or car fast chargers.

Demand Charges

For the utility, an extra washer being turned on is so little power that it has little effect on grid operation. For fast charging cars, higher-powered chargers are used at levels of 50 kW and above. Sudden use of such high amounts of power, or to put it another way, large amounts of energy transferred in a short amount of time, can result in demand charges. Demand charges are charges based on peak power usage. The charges are given in units of cost per kW.

To understand why there are demand charges, we need to take a look at the power grid, and understand what happens in an electric vehicle DC fast charger station.

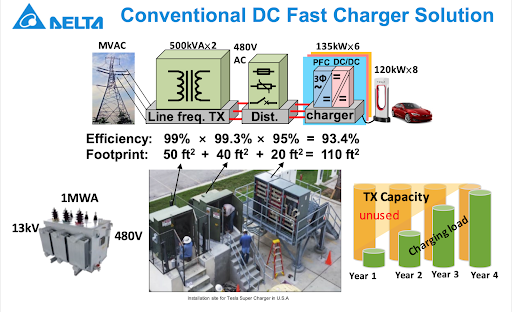

The diagram and discussion is for the US grid, but other areas follow similar patterns with different final voltages — and all the voltages are AC until the conversion to DC at the charging station. First, the transmission line voltages are at the 100kV level and are three phase. Substation transformers lower the level to distribution voltage levels, in this case 13kV. A 1MW or higher power transformer is used to lower the voltage to distribution levels. Some descriptions show medium voltage levels, and final distribution voltage levels may end up at 480V. This voltage level is common for commercial installations and in residential use. Those levels are lowered to 240V with two phases and 120V with a single phase by additional transformers.

In the illustration shown from US Department of Energy, the 1MWA transformer converts 13kV to 480V AC. The 480V AC is converted to a DC voltage, supplying DC power to six 135 kW chargers.

A typical DC fast charger station utilizes a large amount of power compared to residential use. Single DC fast charger power uses ten to twenty times more power than typical home use. A car fast charging station with six chargers uses even more. Car DC fast charging stations are right on the edge of higher powers that start to have significant demand charges from utilities.

Why Demand Charges?

Heavy demand from large commercial and industrial customers increases utility distribution requirements and costs. Larger transformers and distribution wiring and maintenance adds to costs and requires upgrading to higher rated equipment. Higher demand increases losses and creates heat, wearing equipment out faster. The impact of EV charging is not just energy, its power.

According to a Great Plains Institute white paper, looking at scenarios for car charging and increasing power beyond 150 kW makes it impossible for a car charging station operator to break even, except when utilities have no demand charges.

Heavy Truck Charging Challenges

While there are challenges to car DC fast charging at the 150 kW level, those are dwarfed by the problems facing heavy electric truck charging. A single long-range class 8 electric truck can have a battery pack from 500 kWh for 300 miles to 900 kWh for 500 miles. To charge such a pack in under an hour requires more than a MW.

To charge a group of heavy trucks at charging station could easily require 10 MW or more. This level of power will cause utilities to need to upgrade their equipment, and demand charges are certainly expected, if not outright direct costs for upgrades. Heavy electric trucks must compete with diesel tractors. Diesel fuel costs could be higher than electricity costs on a per kWh basis. A calculation of diesel costs versus electricity costs shows an advantage for heavy electric trucks, excluding demand charges.

Demand charges could raise the electricity costs. Those excess charges needed to be reduced for heavy electric trucks to compete. In addition, heavy-duty electric trucks are under pressure to get back into service quickly, necessitating fast charging in less than an hour.

It has been several years since Tesla announced the Semi, and made promises of under $200,000 prices for long-range tractors. Other makers offer vehicles at prices nearer $400,000, and it is unlikely the original Semi prices will stand. Long-haul trucks must maintain charging cost advantages versus diesel fuel costs to offset the higher costs of electric Semi tractors.

Reducing Heavy Truck Charging Costs — Fast Chargers with Storage

To reduce heavy electric truck charging costs, two factors must be met. One is the time it takes to get the depleted battery pack truck back in service, and the other is reducing the peak demand, thus the running costs. With this in mind, one method of reducing this high power demand is to use storage as a buffer from the grid. Storage can be charged at a lower power over longer periods than fast charging, and the peak power drawn from the grid can be reduced. Some truck chargers take this approach. This requires storage packs at a level near 1 MWh per charger for MWh battery packs charged in under an hour. Electrify America uses Tesla Megapacks for 300 kW charging stations for cars. Tesla uses Megapacks at its Megacharging stations as well — “we believe the automaker is likely testing the energy storage system as a solution to the extremely expensive demand charges that will come with operating a charging system such as a Megacharger. Demand charges are a higher rate that an electric utility charges when a user’s electricity needs a spike.”

Other heavy truck chargers simply do not fast charge. Instead, they charge at the lower power rates used for cars, values like 150 kW. With a 400 kW pack, they require as much as three hours of charging, a penalty in down time. Heavy electric trucks with multi-hour charging times are thus at a disadvantage.

Heavy Truck Pack Swapping

Another approach to reducing high-power demand is pack swap. Packs can be charged slowly and then mounted on vehicles. The Chinese government has fully supported electric trucks and has supported battery swapping for heavy duty trucks — 49.5% of electric trucks were swap capable in 2022.

Buses also do pack swapping in India and Korea.

Heavy-duty electric truck pack swapping has been done extensively in China for several years, and swap stations operate with automatic mechanisms.

CATL has developed a heavy-duty truck swap pack called QIJI. The 420 km Ningde–Kiamen trunk line includes four battery swap stations.

China has had a pilot heavy truck swapping program since 2021 and has government support for swapping. There are ICCT studies on heavy-duty truck programs in China broadly, including battery swapping, and there are some more targeted initial studies of Chinese electric heavy-duty trucks using pack swap.

Comparisons

How do the two heavy-duty truck charging methods compare? In a simple scenario for long-distance freight, fast charging stations or swapping stations are arranged at distances shorter than expected minimum ranges. Long-haul trucks could travel distances up to 250 to 450 miles depending on pack size. This represents on the order of four to eight hours of travel time, the former corresponding to a 500 kWh pack with 300 miles of range, and the latter corresponding to a 900 kWh pack with 500 miles of range. The distances between stations could be the same for both options. In a simple scenario with trucks along long-distance interstate routes, a fast charged fleet would need one battery pack per truck.

In this scenario, a swap fleet on a cross-country round-trip route would need one pack on a traveling truck and another at the swap station, charging during the interval between trucks arriving at stations. The time needed to charge the packs would lower the peak demand. If the pack was fast charged in an hour and it was a 1MWh pack, it would require a 1MW charger, at least, but if the same pack was charged in the time between required charges, it would only require one eighth as much power, putting it at about 120 kW, the level of power needed for car fast chargers. It’s a tenable situation, and you could swap packs in about five minutes or less.

Pack swaps would allow more time in transport. The cross-country route scenario would rotate vehicles back and forth along the route in both directions, always with one pack at the swap station and the other on the truck.

At initial use, there are two packs per truck, but those last the fleet twice as long. Battery packs have fixed cycle life, and capacity. Over time, in comparison, the number of packs used only depends on miles travelled, or to put it another way, total lifetime kWh use. Long-haul heavy trucks can wear out battery packs in as little as five years of continuous use.

All else equal, the pack size used is proportional to miles traveled, which is the same for both scenarios, except for one thing.

In the swap scenario, every pack operates in transport. Fast chargers require storage packs that do not operate in transport. In comparison, the slow charging swap scenario requires less batteries.

There are some additional considerations. A heavy truck fast charge network requiring storage has lower efficiency. In a fast charge network with storage, there is an 80% round-trip efficiency for charging the stationary storage, because the storage pack charges from the grid and then the truck pack is charged. That increases the energy cost. The lower-power chargers used in this scenario for swap would be cheaper than the higher-powered ones required for faster megacharging without storage. The faster swap also returns trucks to operation faster, and allows more truck operating time. Swap packs may also be able to charge more fully than fast charged packs, as fast charged packs must stop charging before the charging ramp slows, typically by 70% to 80% of full charge, to avoid significant additional charge time.

There are some differences related to the swap station lifting mechanisms and swap station building. Fast-charger networks with storage require more parking stalls per car because of their lengthier time and the need to park vehicles while waiting for charging, thus requiring more area. Swap stations typically have a small building housing the lifting mechanism, and several packs charging. This enclosure structure can be a pretty basic industrial building, big enough for one vehicle, slow chargers, and packs, with openings for entry and exit in a direct line. According to NIO, the space requirements for car swap stations are significantly lower than for fast-charging stations.

This would carry over for heavy-truck swapping stations.

Other Use Cases, an ICCT Example

In China, heavy truck swap stations may also use fast charging, and the primary motives for swap used for some heavy trucks can be different. There, the advantage of higher operating time is a significant factor. An ICCT paper outlines the use cases, looking at port electric drayage trucks and concrete mixers. Trucks may be sold without battery packs, and the batteries are then used under a Battery as as Service (BaaS) model. Under that model, fleets do not pay up front for battery costs, lowering the truck purchase price and making them more competitive with diesel tractors. The packs are used under a rental. This is an attractive option for smaller fleet operators, lowering capital expenditures.

The study showed comparisons between diesel, hydrogen, battery swap, and fast-charged electric heavy-duty truck total costs of ownership (TCO). The results for the study showed electric trucks having the lowest TCO, with battery swap TCO slightly lower than fast charge in one case. In the other case, swap and fast charging vehicle TCO were equal.

Summary

China is the world’s largest EV market, with about 50% of world market share for cars. For heavy trucks, the market share is even greater. Any global study of EVs must include the China market. The US is the smallest market, and Europe is the second largest, both trailing China by wide margins — and those margins are greatest for heavy duty trucks. Europe and the US have more recently instituted efforts to increase heavy electric truck operation, but they are not yet close to China’s.

For heavy-duty trucks, there are distinct advantages for swapping that are not as important for cars. The power levels for trucks are so much higher than demand charges, and utility costs require mitigation of peak power demand. Heavy truck fast chargers must use storage to reduce peak demand or face significant electric rate charges, reducing electric vehicle advantages relative to diesel competition. While adding storage mitigates peak power demand, it adds additional cost and reduced efficiency to the charger.

The slow-charged swapping scenario has battery efficiency and actually uses less battery packs overall, because all the packs are used in transport, and none are stationary. At the same time, costs are lowered because of higher efficiency with a shorter electrical path from grid to truck pack, and lower power chargers are used.

For cars, the situation is different. The peak power demand for fast chargers above 150 kW may encounter extra demand charge costs, increasing charging costs and making the economics more difficult for charging stations. In some cases, fast charging stations have used stationary storage to mitigate this. For electric car charging below 150 kW, stations may not require storage or experience significant demand charges. In that case, swapping is likely to be more expensive than charging. Still, in China at least, on holidays with large numbers of electric cars queuing at fast charging stations with long wait times of an hour and charge times an average of 50 minutes, many EV customers are opting for the convenience of EVs with battery swap. Three-minute swaps offer a significant convenience factor.

For electric cars at least, swapping is likely to be more affected by systems issues like standardization. As yet, no standards have emerged for swapping in the US and Europe, likely limiting its growth there.

For heavy trucks, the power levels are much higher and extra utility charges are so significant that direct fast charging in under an hour is prohibitive without storage. The extra costs involved in significant stationary storage are an additional burden.

In the scenario outlined here, slower pack charging could be used with intervals of several hours between swaps, instead of fast charging plus storage, lowering peak power utility charges.

The additional benefits of heavy truck swap include higher operating time, higher efficiency charging than fast chargers with storage, lower station costs without additional storage, and potentially better long-term pack life with slower charging.

In China, the situation for cars differs from heavy trucks, but the amount of highway pack swapping for cars is significant for cars compared to the largest fast charging car fleet.

For the rest of the world, a lack of government support and standardization in swapping represents an impediment to swap. As yet, beyond China, there does not seem to be widespread awareness of greater heavy truck charging power impacts and the advantages of swap.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy