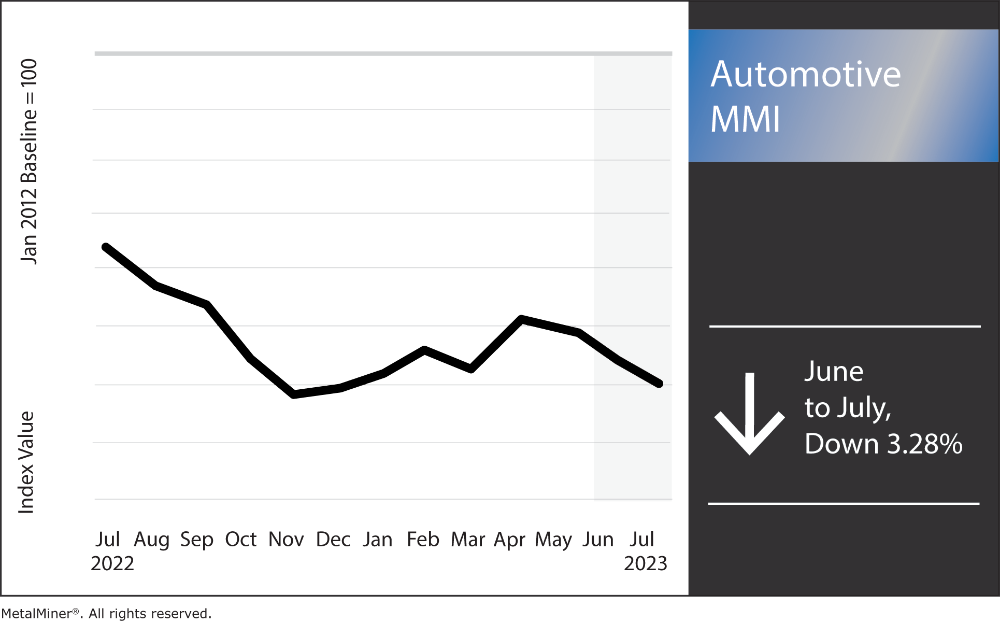

The Automotive MMI (Monthly Metals Index) continued its decline in June, this time falling by 3.28%. The aluminum and copper components of the index traded sideways. However, all other parts of the index dropped. Lead prices managed to trend more sideways in June than in May, but weak demand continues to impact lead and steel prices. Though U.S. car sales also trended higher in June, they weren’t enough to pull the automotive index upward.

Knowing when steel prices will rise again is key to saving money and generating ROI. Learn more about how MetalMiner Insights helps customers forecast metal price directions and save money.

U.S. Vehicle Demand Up

According to a recent Reuter’s report, new vehicle demand in the U.S. increased in June 2023.

This boost largely stemmed from improved supply and increased sales to fleet clients. However, pent-up demand for new vehicles was also a factor, as consumers who had postponed purchases due to the pandemic were now in the market for new vehicles. According to Thomas King, president of J.D. Power’s statistics and analytics division, the industry should continue to benefit from pent-up demand for new automobiles.

Analysts also predict the growth in demand for new cars will continue in the third and fourth quarters of 2023. According to AP News, auto sales increased 16.8% from April to June, reaching just over 4.1 million. Again, much of this buying stemmed from pent-up demand due to nearly two years of scarcity. And despite the predicted increase in demand, experts anticipated that new car costs will continue to increase as well. Indeed, the latest estimates predict that customers will spend $47.9 billion on new vehicles in 2022. This is an increase of more than $6 billion over June 2022 estimates. Moreover, Consumer Reports noted that the spike in new vehicle prices is also driving up the price of used automobiles, making purchasing more difficult.

Are you prepared for your annual steel contract negotiations? Stay informed on changing steel prices and be sure to check out these 5 best practices.

Fluctuating Steel Demand and Steel Prices

The steel demand outlook in the U.S. for the remainder of 2023 remains somewhat mixed. While some experts predict high demand, others warn of potential pitfalls while remaining decidedly bearish. Indeed, there are numerous examples to consider. Among the most notable are softer manufacturing activity, a shift in consumer spending from goods to services, a downturn from the recent housing boom, and a delayed rebound in the non-residential building industry.

In its most recent outlook, the World Steel Association expressed a somewhat optimistic view of U.S. steel demand for 2023. Specifically, the WSA stated that it did not expect market contraction due to positive momentum in the automotive sector, spending from the country’s new infrastructure law, and rising energy sector investment.

Steel sees extensive use in the global vehicle production business. However, the sector will face considerable issues if steel demand becomes too low and end users do not purchase as much as they regularly do.

Not sure why you should trust MetalMiner’s opinion about where steel prices are headed? Take a look at our track record.

Will Weak Steel Demand Hurt Automobile Manufacturing?

If steel demand falls too low, the car industry will have to confront a number of issues. For instance, many companies would have to replace their steel with alternative materials, necessitating considerable research and development investments.The industry would also need to identify new material sources, which would require substantial investments in supply chain management. Finally, the sector would have to find new markets for its products. Of course, doing so would require significant investments in marketing and sales.

Moreover, the automobile industry employs a considerable number of people. Therefore, any collapse in the industry would have a big impact on overall employment. The industry would need to invest in people’s abilities while also providing decent, sustainable work. To remain competitive, the sector would need to invest in new technologies and form collaborations with technological businesses.

MetalMiner’s monthly free MMI report gives monthly price trends for 10 different metal areas. Keep yourself updated on copper, stainless, aluminum, and steel prices. Sign up here.

Automotive MMI: Lead, Steel Prices, and Other Significant Price Shifts

- Shredded scrap steel saw the sharpest drop in price out of all of the components of the automotive index. Prices fell by 12%, leaving prices at $411 per short ton.

- Chinese lead trended sideways. Prices fell by a modest 1.3%, leaving prices at $2094.55 per metric ton.

- And lastly, Korean aluminum 5052 coil premium over 1050 moved up in price by 4.5%, which brought prices to $4.18 per kilogram.