Three articles crossed my screen recently suggested that Australia might be seeing reality around hydrogen. It’s not official policy or anything, but it’s a good sign that the hype bubble might be leaking or even deflating, which would be very good for Australia’s economy. But first, some context.

Australian Net Zero Projected export primary energy (Exajoules / year)

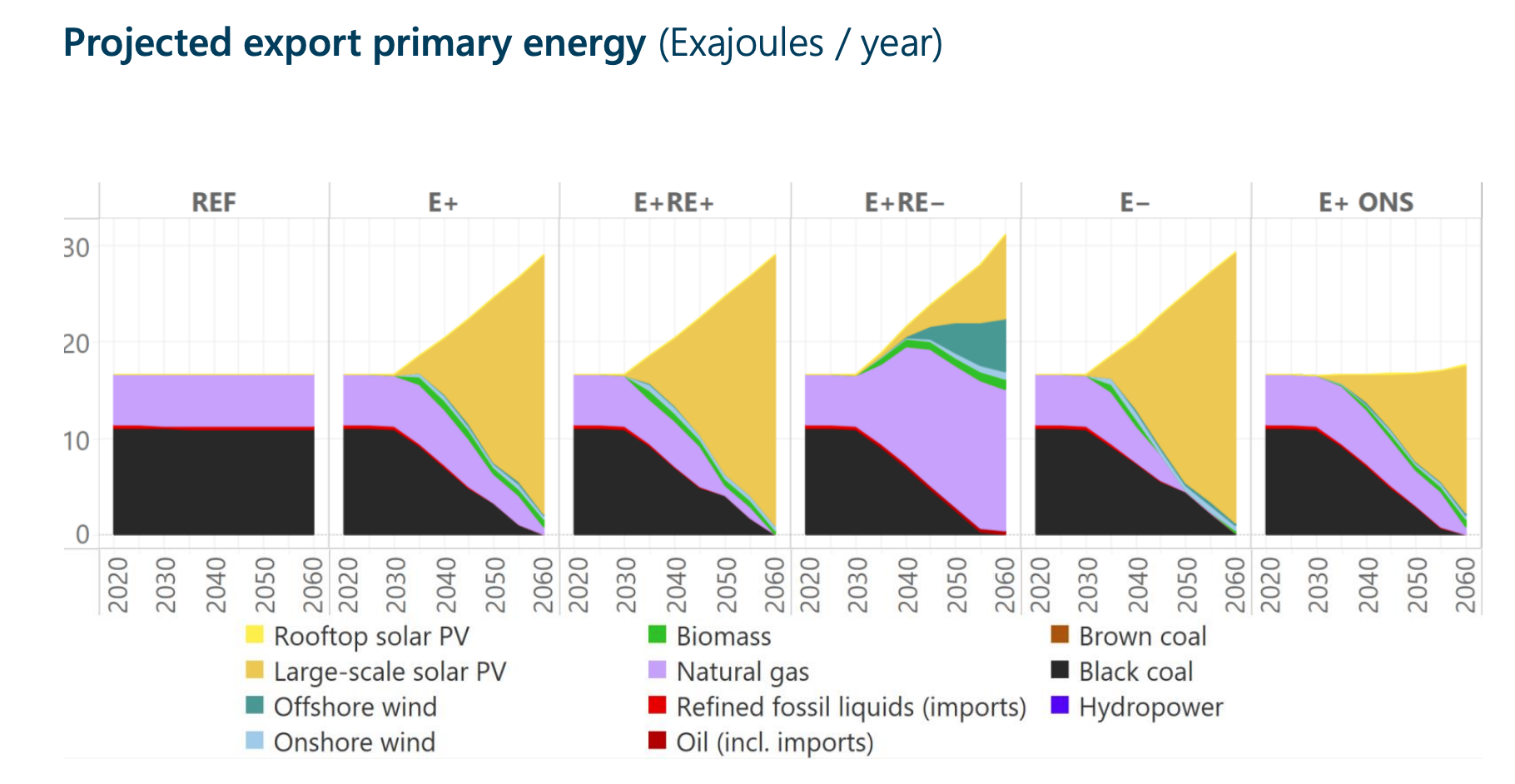

As I noted in my assessment of Australia’s 2023 Net Zero plan, which was heavy on hopium and light on reality, Australia currently exports four times as much primary energy as its entire economy consumes. 5-7% of its GDP is directly or indirectly related to fossil fuel extraction and mostly exports. As such, the world’s move away from fossil fuels is an existential crisis for a country that wants to grow its economy, not shrink it. The Net Zero plan’s strategy was mostly to double energy exports, but with green hydrogen instead of coal and gas.

Their big hope is that other countries like Japan will bankrupt their economies with ten times the cost for energy instead of building lots of renewables and HVDC interconnectors, which is pretty much the definition of a terrible basis for a strategy or economic plan. And that’s ten times the cost of liquid natural gas, already the most expensive form of imported energy at two to three times the cost of imported coal, as I noted in my piece on the cultural factors that lead to Japan over focusing on the slippery molecule.

The response in the 2019 hydrogen strategy, led by then-chief scientist Alan Finkel, was to focus on hydrogen for transportation, gas networks, heating, electricity systems, and export, along with a much smaller group of actually sensible use cases like green ammonia and green steel. Finkel is no intellectual or STEM slouch. While he’s a neuroscientist, his first degree was in electrical engineering. He built a Silicon Valley biotech firm, sold it, founded Cosmos magazine, went on to be CTO of an electric car charging firm, had accolades heaped upon him, and generally advised everyone all the time on everything scientific.

Which rather demands the question:

Why did Finkel and the team he led get the hydrogen strategy so wrong?

Obviously politics, economic terror, naked greed at the thought of being an energy superpower, and fossil fuel lobbying interfered with the basics of science and economics. Other countries proclaiming loudly that they were going to be importing green hydrogen and green ammonia for energy has been part of the hydrogen hopium bubble that’s been a global decarbonization problem for the last few years, and it was obviously present in Australia as well.

Clearly, Finkel didn’t do the science and math work himself, but let some underlings do the heavy intellectual lifting, with predictable results that either no underlings did, or they were ignored.

And then there’s Australia’s Fortescue Mining Group and its billionaire boss Andrew Forrest. They made no bones a few years ago that heavy mining trucks would be running on green hydrogen. Forrest spun up Fortescue Future Industries with a billion dollar war chest to manufacture green hydrogen for export, clearly being close to the middle of the Australian hydrogen hopium bubble with billions or trillions of dollar signs blinding him to reality. Nothing like having billions already to make wanting lots more billions an absolute necessity, it seems. He’s all over the US IRA’s hydrogen funding too, with projects initiated in the USA.

For a while, Forrest was making some sense about energy, getting into the excellent Sun Cable project which would run an HVDC cable past Indonesia to Singapore, feeding gigawatts of Australian solar into the high-energy economy of the Little Red Dot when they needed it, as well as linking into the obvious ASEAN hub. He was in partnership with another Australian billionaire, Mike Cannon-Brookes, and unsurprisingly, two huge personalities in the same room meant the room was too small for the both of them, especially when one of them is under the illusion that molecules for energy are going to continue to be a big deal.

That led to Sun Cable going into receivership temporarily, but there’s a tremendous amount of interest from numerous parties about picking up the pieces, assembling a better organization with less conflict around it, and getting it laying wire. Presumably Cannon-Brookes will be involved, but it’s unlikely Forrest will be.

As I’ve said a few times, HVDC is the new pipeline (and oil tanker and LNG ship). The future is massively more local-ish generation of power, and shipping the remaining electrons for energy, not molecules. The future is upgrading iron ore near the mine with green hydrogen, or more directly with electricity, not shipping bulks of coal and iron ore thousands of kilometers where they are combined in massive furnaces to make iron and then steel.

So that’s years of hydrogen hopium playing out across Australia’s political and economic landscape, with many of its leading figures leaning heavily on the pumps inflating the bubble. So what’s the good news? What leads me to say that the bubble is softening?

Well, they both have to do with Finkel and Forrest, the F-squared team that have been some of the most prominent figures lending credibility to the idea that the hydrogen hype bubble is actually a massive tectonic shift in energy globally and domestically.

Let’s start with Forrest, or rather Christiaan Heyning, Forrest’s head of decarbonization for Fortescue Mining Group. Remember how heavy mining trucks were going to be running on green hydrogen? Well, not according to Heyning at the Energy and Mines Australia Summit in Perth, Australia on June 14th. He told the conference that it was going to be batteries, for the simple and bleedingly obvious reason that using hydrogen would require triple the electricity, and hence a lot more generation, transmission, and other things with their own inefficiencies.

Is this anything that wasn’t bleedingly obvious in 2019? No, no it wasn’t. It was bleedingly obvious in 2015, and 2012 too.

Was Heyning alone in pointing out the bleedingly obvious? No, he was joined by John Mulcahy, principal adviser on surface mining and technology at Australia’s largest iron-ore miner, Rio Tinto. These are both huge global mining concerns, by the way. What did Mulcahy have to say to the assembled mining luminaries?

“The hydrogen cycle is about one-third as efficient, so our initial view is let’s drive it with batteries because of the higher efficiency, the lesser impact on infrastructure and distribution systems.”

Yup. Once again, stating the bleedingly obvious. Of course, Mulcahy held out the potential that hydrogen could be used if in the future it were delivered to the mine site the way diesel is today, ignoring the fact that it would take about 14 hydrogen semi tankers to deliver the same energy as a single truck of diesel. Clearly, he’s not doing the math on that one either, or maybe he’s required by contract to hold out a faint hope that hydrogen might one day be useful for energy.

When asked later, Fortescue Mining Group claimed that it is agnostic on heavy mining equipment energy, but as has been clear to me since I worked on a zero carbon hard rock mining proposal for Northern Ontario’s ring of fire a few years ago and on a northern Quebec mine’s wind turbine efforts, the answer is electrons, not molecules, and always will be.

So, Forrest’s firms are starting to do the math and get the obvious answers. Forrest remains bullish, but he’s in the billionaire oligarch bubble, where reality so often fears to tread. It will take a while for the memo to get to him, and if it does, it will likely be so softly worded and carefully expressed that he’ll ignore it.

Meanwhile, another mining giant, BHP, isn’t being coy about electric mining equipment being the future.

“Each year our Australian operations use roughly 1,500 mega litres of diesel in over 1,000 pieces of equipment,” said vice president of planning and technical minerals Australia Anna Wiley.

“Over half of this is used in our truck fleets. Electrification is the preferred pathway to eliminate this diesel. Part of the reason for this is energy efficiency.”

But what about Finkel? Among other things, he actually owns a Toyota Mirai, a clear sign of a deluded hydrogen optimist, or someone with a vested interest in hydrogen in some way, so a marketing requirement. Or, in his case, maybe just too much money. Well, remember that he was CTO of an EV charging firm for a while too, and so also has an electric car. Have the four years since he led the hydrogen strategy for Australia led to any changes in his perspective? Oh, yes.

He was recently on the Energy Insider’s podcast with Giles Parkinson and David Leitch. Finkel has a new book out, it seems, so is doing media rounds. As Parkinson notes in a summary article in The Driven, Finkel is clear on a few things.

Hydrogen for cars is dead. Finkel, having both electric and fuel cell vehicles, now knows intimately how trivial it is to get electrons and how much of a pain it is to get molecules. He has to drive 30 minutes to the nearest hydrogen refueling station, while his electric car is full in the mornings when he gets up. The assumption that refueling times are important is dead for him. It’s sunk in. And since it has, the assumption that his hydrogen strategy had about millions of fuel cell cars being on foreign roads is dead too. No hydrogen exports for the massive light vehicle demand segment. They’ll be electric vehicles all the way.

Finkel got the memo on heat pumps and induction stoves too. No hydrogen for home heating, so another segment of the hydrogen strategy where domestic and global demand will be non-existent. Another huge market for Australian hydrogen exports goes up in a puff of water vapor.

He hasn’t figured out that trucks and trains are all going to be electric yet. He holds out hope on that, despite all major geographies except North America electrifying rail at a tremendous rate. As I pointed out in my assessment of global rail earlier this year, India is around 85% and targeting 100% heavy rail electrification by 2025, with only tiny legacy tourism routes getting a double handful of hydrogen locomotives, mainly to avoid overhead wires blocking pretty views. China is remarkably not leading in this space, but trailing at a still significant and rapidly climbing 72% rail electrification. Europe is at 60% and climbing, and comparisons of hydrogen vs grid-tied or battery/grid-tied hybrid systems are showing the bleedingly obvious there as well, that hydrogen is three times as expensive.

On trucks, of course, I spent a couple of hours recently talking with David Cebon, the head of the Centre for Sustainable Road Freight and professor at Cambridge. I assessed the most recent conference’s proceedings not long ago to see what a global conference on road freight had to say about what would be the dominating decarbonization pathway for that ground transportation segment. The answer? Batteries, unsurprisingly.

Cebon is also a founding member of the Hydrogen Science Coalition, in large part because being a road freight expert and mechanical engineer, he dug deeply into the options and found the bleedingly obvious as well, wondered why it wasn’t bleedingly obvious to everyone else, and said so.

As he pointed out toward the end of our discussion when we got to hydrogen, he put together a major grant proposal in the past couple of years to do long term road tests with battery-electric and hydrogen freight trucks. That required that European manufacturers give him actual prices that they would charge him to buy both hydrogen and battery-electric trucks. The truck manufacturers, which don’t have Tesla’s vast economies of scale with batteries and electric motors, and which were mostly shoehorning battery and hydrogen drive trains into existing tractor frames, ponied up.

What numbers did he get? Diesel tractors are £100,000 to £150,000 (US$130,000 to US$190,000). Battery-electric tractors were quoted at £250,000 to £300,000 (US$320,000 to US$380,000), or two to three times the cost of diesel. Note that Tesla’s Semi is apparently selling for US$250,000, well under what European OEMs are quoting.

What’s hydrogen coming in at? £500,000 (US$635,000) per tractor, double the price of European electric tractors and 2.5 times that of the Tesla.

As Cebon noted, electric trucks get Wright’s Law advantages from light vehicles, while hydrogen trucks won’t. That means that they’ll get cheaper more slowly and as a result always be at least double the cost of a battery-electric truck.

And as the mining experts and Cebon point out, fueling a hydrogen truck will always require at least three times the electricity as just using the electricity more directly.

Two to three times the capital cost of a battery-electric truck. Three times the operational cost of a battery-electric truck at minimum. Exactly what fleet or private semi-tractor buyer is going to sign that check?

It’s pretty easy if you skim lightly across the pro-hydrogen news to think that hydrogen for trucks, rail, and the like is a thing, as opposed to a rounding error or a fantasy, especially if you are pre-disposed to the molecule.

So while Finkel holds out hydrogen hope for trucks and trains, once again he clearly hasn’t done the math and research himself. The people who have make it clear that all ground transportation globally is going to be grid-tied and battery-electric pretty rapidly. North American rail will lag, but as I pointed out in my assessment of the American Association of Railroads (AAR) anti-electrification screed, they are strategically aiming for trucks to eat their declining lunch. Why declining? Well, four million cars of coal a year and 70,000 cars of oil are going away.

Of course, the US trucking lobbying group recently sent Andrew Boyle, their first vice chair, to Congress, where he either lied through his teeth or was deeply misinformed about trucking electrification. Yes, American ground freight transportation lobbying groups are pushing back hard against climate and economic reality. But there’s a long backorder list for the Tesla Semi, and California is aiming for zero emission trucking in the relatively near term, so Boyle and his counterparts at the AAR are vying for the role of King Canute in an off-off-off-off-Broadway production of King Canute and the Seven Small-Minded Idiots, not realizing the roles that the director actually has in mind for them.

Finkel’s book, by the way, is Powering Up: Unleashing the Clean Energy Supply Chain, in which he apparently lays out how states can transform themselves from petrostates to electrostates. I haven’t read it, so probably shouldn’t comment, but given his misses on road and rail freight, I’m guessing it has some shortcomings.

So, some good news out of Oz on at least a weakening of pressure in the hydrogen hopium bubble. The head of decarbonization in Forrest’s organization is saying the same thing as his counterparts in Rio Tinto and BHP, both mining giants. They aren’t the heads of those organizations, but probably get face time with the CEOs at least a couple of times a year. Finkel is no longer Chief Scientist, but according to Wikipedia he’s currently Special Adviser to the Australian Government on Low Emissions Technologies and Chair of Australia’s Low Emissions Technology Investment Advisory Council. He’s in a position to influence policy.

Does this mean that Australia’s government and billionaires will stop snorting hydrogen fumes to make the dollar signs in their eyes spin faster? Unlikely. That will take another few years. Major economies like Japan will have to stop deluding themselves about powering their economies with hydrogen. And with that country just announcing $107.5 billion for the stuff, and the USA’s IRA subsidizing the molecule heavily through 2043 in the most extreme case, hydrogen hopium will be around for a while.

Thankfully we need a lot of the molecule to clean up the current carbon problem that is black and gray hydrogen, with their annual emissions in the scale of all aviation globally. As I guide investor and developer clients globally, ensure that any hydrogen projects you are involved in are either for industrial feedstocks, can be converted to industrial feedstocks without too much capital cost, or can have the wind, solar, and transmission decarbonize the grid if the hydrogen business case fails.

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Have a tip for CleanTechnica, want to advertise, or want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Former Tesla Battery Expert Leading Lyten Into New Lithium-Sulfur Battery Era — Podcast:

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …