Below are some of the most interesting things I came across this week. Click here to subscribe to our free weekly newsletter and get this post delivered to your inbox each Saturday morning.

STAT

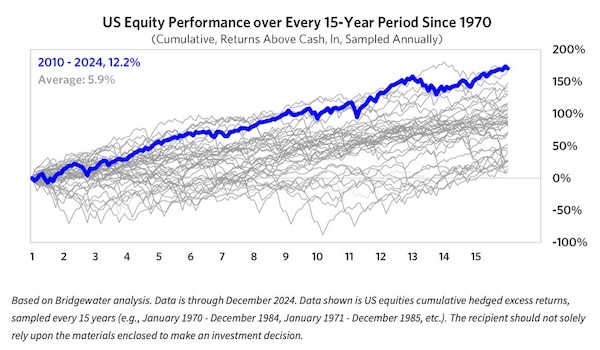

The current bull market has been extraordinary. As Bridgewater reports, “Out of any 15-year period to be invested in equities dating back to 1970, the one we’ve just lived through was the best. Stocks have been on a relentless tear, with any dips quickly fading into memory. Returns have been more than double the average.”

CHART

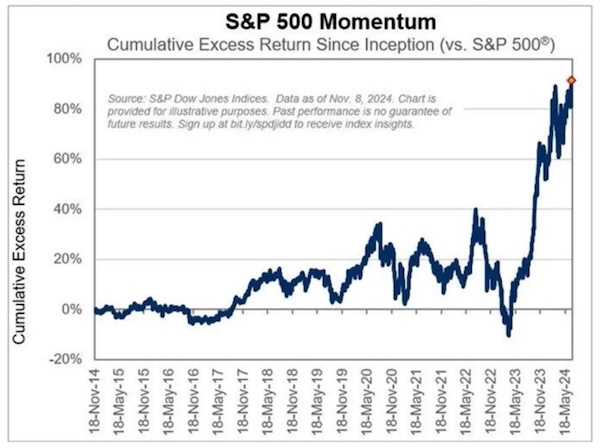

Over the past couple of years, gains have largely been driven by a FOMO-driven momentum chase. As Bill Smead writes, “It is the most all-encompassing momentum market of my 45 years in the investing business.”

LINK

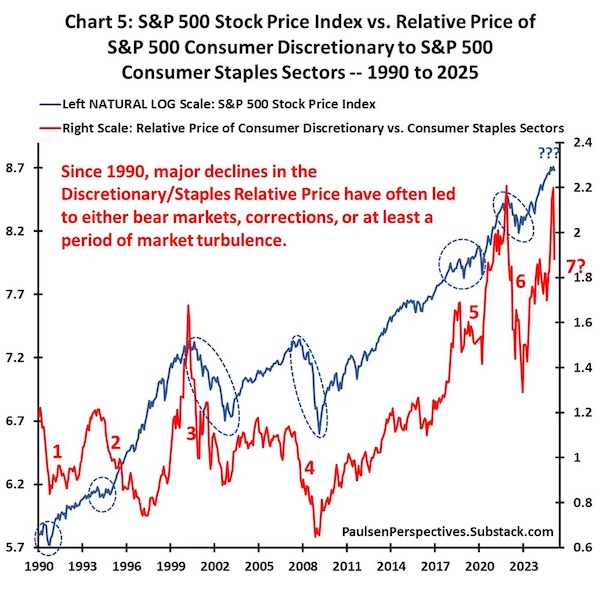

However, the inside of the stock market is starting to send a clear warning regarding the trend in the underlying economy. “Since 1990, we have never had as big of a decline as we have in the ratio of consumer discretionary to consumer staples stocks during the last month without a much larger pullback by the overall S&P 500 index,” writes Jim Paulsen.

CHART

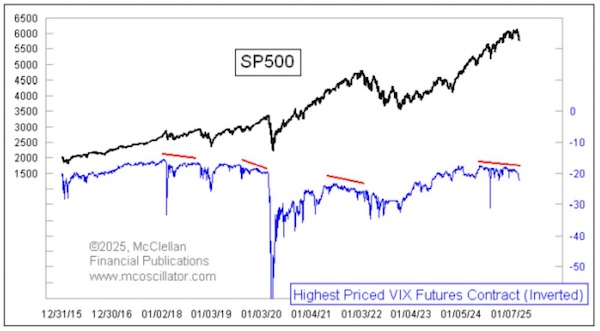

Investor risk appetites are also displaying an important change in trend. Tom McClellan writes, “…when there is a divergence between the SP500 and the price of the highest VIX futures contract, that is worth paying attention to. A divergence does not mean that a top has arrived, but it tells us that we may be building a much more significant price top than just an ordinary one.”

LINK

And after a record 15-year run, the U.S. stock market may be poised for a prolonged period of underwhelming performance. As Meir Statman writes, “There is a common belief that while U.S. stocks can inflict painful losses in the short term, they are sure to deliver gains if you hold them for 10 years. And if not in 10 years, definitely in 20 years. Unfortunately, this perception is a misperception.”

Courtesy of The Felder Report and originally published here.

********