Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

In recent months I’ve apparently taken on a sideline of assessing major total cost of ownership studies from reputable organizations, specifically looking at their usually weird assumptions around hydrogen. Now it’s the Potsdam Institute for Climate Impact Research‘s turn, although it’s not a TCO study in this case. They’ve released a meaty scenario analysis based on their institutional models and multiple scenarios, accounting for EU carbon pricing, Distinct roles of direct and indirect electrification in pathways to a renewables-dominated European energy system.

I’m pleased to say it’s better than most of the hydrogen-centric material I’ve reviewed recently, but this will be faint praise against bad company. The International Council on Clean Transportation’s trucking, maritime shipping, and aviation studies pertaining to hydrogen had completely obvious and embarrassing errors as well as many, many thumbs on the scale for hydrogen as they tried to force the square peg of the molecule into the round hole of the requirement. The German working group on freight trucking was better than that, but still had deeply unrealistic costs for manufacturing, importing, and distributing hydrogen, deeply underestimated battery-electric improvements, and assumed there would be hydrogen pipelines everywhere.

Neither managed to find that hydrogen for trucking was remotely economically competitive with battery-electric despite best efforts. In the ICCT’s case they initially made the false assertion that it would be very close by 2050, before they reran the model with one fewer thumb on the scale for hydrogen, instead making electricity for electrolysis at the truck stop vastly cheaper than what would be available for battery-electric trucks, they made the prices the same and changed all of their results and conclusions.

The Rocky Mountain Institute, now known as RMI, hired a long-time oil and gas industry economics PhD to run their hydrogen unit and unsurprisingly they published a lot of stuff making it seem as if there was a massive case for hydrogen in everything. With any luck, the Olympic-sized swimming pool of ice water I threw over their publications will aid them in making a course correction. In my doorstop of an article about their position — 14,000 words or so — I did provide a recommended strategy for them based on Richard Rumelt’s kernel of good strategy, so one can hope.

It’s worth mentioning in this vein that I’ve been in the reference group for a Swedish total cost of ownership study on European freight trucking decarbonization, an intelligent preemptive strategy by the lead author to avoid post-publication humiliation of the sort that the ICCT authors have had. And to be clear, I live by post-publication humiliation, so I know how excruciating it is to be both wrong and have someone else discover it before I do.

And so, to the Potsdam Institute. Like many of these organizations, I’ve probably read something from them without realizing I was doing so and had no idea an institute with almost 400 people affiliated with it per LinkedIn existed. Its head office is in the German state of Brandenburg, about 35 kilometers from Berlin. It’s basically a climate research organization founded in 1992 and funded by the German government and the state of Brandenburg. It’s not a fossil fuel shill organization. Its publications end up in peer-reviewed journals. So far, so good.

Potsdam Gets A Lot Of Stuff Right

Let’s talk about what they get right first. There’s a reasonable amount to like in this category.

They are among the few major groups who realize that direct use of hydrogen for energy vectors doesn’t make a lot of sense. In the discussion section they make this note about other, earlier European studies of a similar nature:

One notable difference is that their scenarios always see a significant role for direct hydrogen usage in fuel-cell vehicles, which is questionable given recent trends in BEV adoption and expected improvements in battery technology.

However, they also note:

several of those scenarios feature very low shares of hydrogen-based energy below 10% outside of our scenario range.

They suggest, but do not attempt to definitively assert, that the result may be due to more bioenergy or residual fossil fuels use. I suspect the former based on a few data points in the study.

Unlike other studies, this recently published piece — February 16th, 2024 — doesn’t see a role for hydrogen in ground vehicles except for a minor potential for trucking. Even there, they see that where batteries won’t suffice, low-carbon burnable liquid fuels will dominate. They lean on a 2022 publication by P. Plotz, Hydrogen technology is unlikely to play a major role in sustainable road transport, which actually understands that battery electrochemistry, energy density, and price points are improving rapidly, unlike many studies in the space.

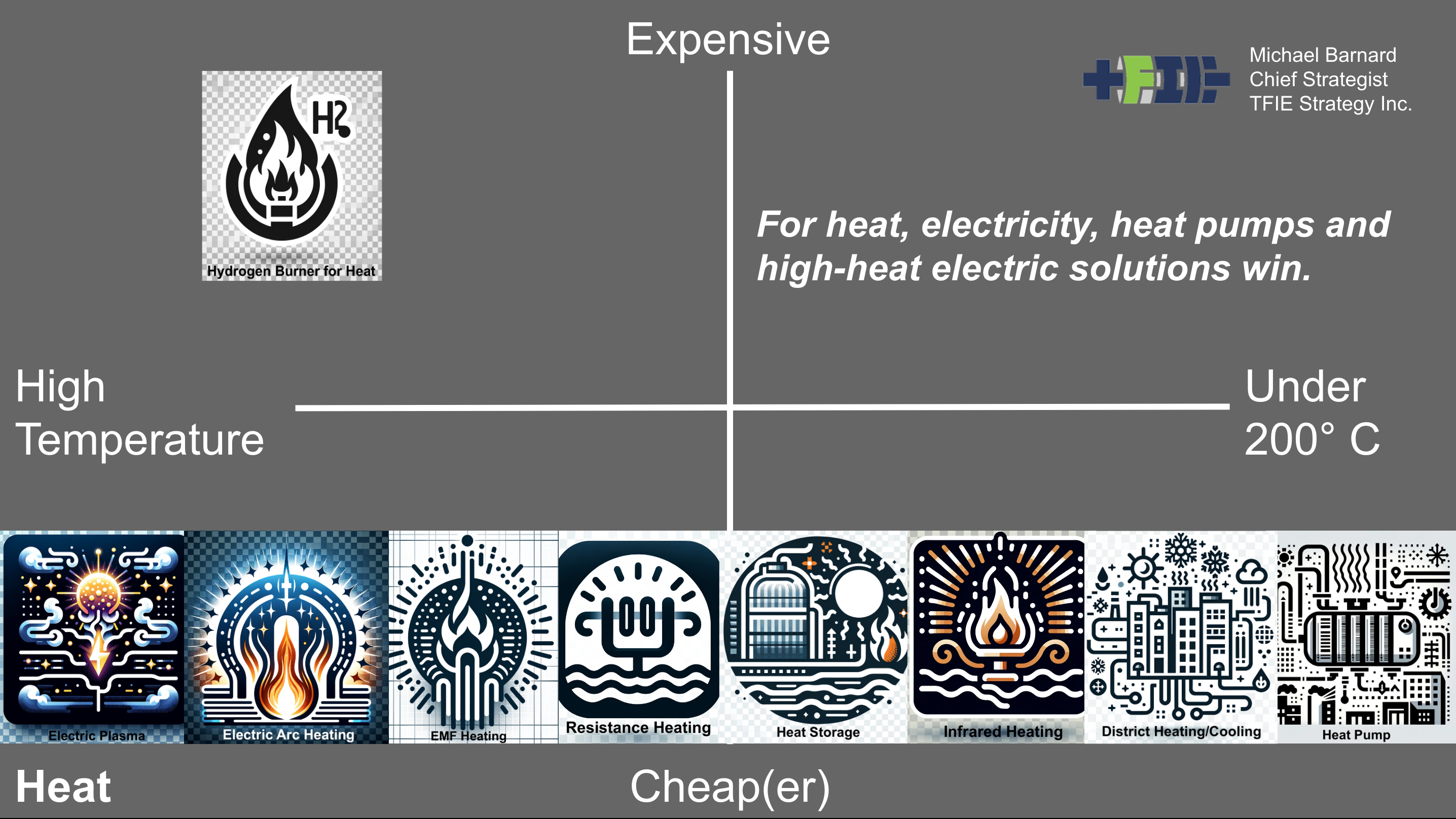

They also acknowledge that hydrogen has no place in heating residential or commercial buildings, indeed in providing any lower-temperature heat. This is a big step for European energy studies. Naturally they lean on Jan Rosenow’s ongoing meta-analyses of heat pump studies, in this case a 2022 one, Is heating homes with hydrogen all but a pipe dream? An evidence review. Rosenow’s most recent meta-analysis has 54 independent studies all saying exactly the same thing: hydrogen won’t be heating buildings or water.

That highlights something else the Institute and its authors get right. They aren’t in a bubble as the ICCT allowed or required its researchers to be, almost entirely referencing the reports of their fellow institute members.

They run assumptions with high, medium, and low carbon grid electricity and use that data to figure out EU emissions trading scheme carbon pricing impacts. That’s good, but it’s not clear if they use EU budgetary guidance for carbon pricing, the guidance that is much higher than current ETS prices and aligned with US and Canadian social cost of carbon prices. That’s what I’ve recommended the Swedish study use as it’s clearly the directed policy of the UE, although other organizations such as Standard & Poor have lower projections.

They focus electrolysis on industrial-scale facilities where power purchase agreements might reasonably lower the cost of electricity for hydrogen manufacturing, something that the ICCT thinks will happen at trucking stations. The assumption of centralized production having access to power purchase agreements at a lower price point is a more reasonable assumption, although the end results fall apart it seems.

And to round out the things they get right, they make it clear that electrifying everything that can be electrified is the right option. But they don’t have quite the right assumptions and don’t get to the actual end point.

EU scenarios show 42%–60% electricity and 9%–26% hydrogen-based energy share in 2050

9% to 26% hydrogen energy? What the heck is up with that? Anyone who has looked at the actual costs of running things off of electricity, plug-compatible biofuels and hydrogen or its derivatives in any detail will be scratching their heads at that.

Potsdam Gets Some Big Stuff Wrong

So what do they get wrong? I found a few things.

Like many of these studies, they seem to think that green hydrogen will be cheap. There’s a really odd set of basically unexplained graphs of energy prices across different solutions in the supplementary information data, Figure S3. The Potsdam Institute makes it clear that you don’t use their graphics without their permission, so I’ll suggest you look at page 21 of this document.

It shows energy prices in euros per MWh across buildings, industry, and transportation for electricity, gases, hydrogens, and liquids. Anyone who has read my assessments, but most especially this piece explicitly on the subject, will probably be thinking “wait a minute” at this point. MWh for hydrogen? Asserting a unit of energy for an industrial feedstock is leaping to the assumption that it will be an energy carrier. It’s like measuring clothes in MWh because they might be burned in municipal trash to energy systems.

And when I tell you that the graphs show that hydrogen and liquid synthetic fuels are roughly the same or even lower than the cost of electricity in many scenarios, alarm bells will be going off.

Hydrogen Will Be Multiples Of Potsdam’s Price

In the hydrogen dominant scenario, for example, hydrogen for transportation is half the price of electricity for transportation. There is no world that adheres to the laws of physics where this will occur.

Let’s tear this apart a bit. There are a small handful of reasons why this is unrealistic.

The first is that making hydrogen, storing, distributing, and using hydrogen is roughly a third as efficient as using electricity in a battery-electric vehicle. When that’s the case, how can hydrogen be the same or half the energy cost of electricity? There are no prices per kilogram to understand their assumptions.

Tracking back, the Institute has a model, LIMES-EU, which is a long-term electricity system model for Europe. On page 27 of the documentation, it shows fuel prices of €13.9 per gigajoule for hydrogen for dispatchable green hydrogen generation. A kilogram of hydrogen has a 120 megajoules, so a gigajoule of hydrogen is 8.3 kilograms. That means that the Institute thinks hydrogen will cost €1.67 per kilogram through 2050.

That’s a completely unsupportable figure. That’s down at the level of unabated gray and black hydrogen. There is no universe in which green hydrogen will be that cheap delivered to a generation unit. And to be clear, they are asserting green hydrogen as the greenhouse gas intensity they list for hydrogen in that table is zero.

They also have the REMIND model, the Regional Model of Investments and Development. Unfortunately, they’ve moved to what appears to be semi-automated documentation and finding out the cost of anything was beyond me. I’ve read a lot of systems documentation and written a lot too, and the complete lack of ability to find values for anything is problematic.

So back to the MWh. They clearly think that hydrogen will be cheap. How cheap is the hydrogen in this study? In the scenario for transportation, electricity is €200 to €230 per MWh or €0.20 to €0.23 per kWh, which is to close to the average European industrial electricity rates, which were €0.21 to €0.24 per kWh when I reviewed the ICCT study in November. This makes it clear that Table S3 is of prices of delivered energy, not at point of manufacturing or wholesale prices.

By contrast, hydrogen for transportation and building heat is priced as low as €0.11 per kWh delivered.

There are 33.33 kWh of energy in a kilogram of hydrogen. That implies that they are expecting hydrogen delivered to hydrogen refueling sites to have an all-in cost including manufacturing, storage, transmission, distribution, compression or liquification and profits for everyone in the supply chain of €3.70 per kilogram. These are the prices that the Institute is assuming end purchasers will pay. Wait until you see what they think industry and synthetic fuels manufacturers will be paying, subjects I cover later in this assessment.

A rule of thumb I use when assessing studies is checking whether they assert that delivered green hydrogen in the future will be cheaper than delivered gray hydrogen today. If it is, the study is flawed. Why? Because green hydrogen will be more expensive than gray hydrogen and if the base molecules are more expensive and everything else remains the same then the retail price will be higher. This isn’t remotely difficult to understand. As I’ve worked up against multiple manufacturing and distribution scenarios on multiple continents, hydrogen can be green, but it can’t be cheap. That reality is sinking in.

Recently Boston Consulting Group published on the reality, saying that the consensus manufacturing cost of €3 per kilogram green hydrogen wasn’t going to occur, but would be in the range of €5 to €8 per kilogram. As I noted at the time, that purported consensus was among STEM and economics illiterate fantasists, as anyone who did the cost workups with realistic capital and electricity costs inevitably found it was going to be in that range. Personally, the range I think is appropriate is €6 to €8 per kilogram for the vast majority of green hydrogen manufacturing.

So the Institute is saying that the delivered price of hydrogen for transportation and building heating will be about half the manufactured cost of hydrogen. That’s not remotely realistic. Distribution of hydrogen is one of its many Achilles heels, as is maintenance of refueling facilities.

Let’s go to a US DOE 2020 report, where the reality of the cost of distributing hydrogen is starting to sink in, although it doesn’t seem to be getting the attention it deserves.

For liquid tanker-based stations, delivery costs are calculated to be approximately $11/kg at 450 kg/day and projected to be roughly $8/kg at 1,000 kg/day stations. For tube-trailer gaseous stations, delivery costs are projected to be $9.50/kg and $8/kg at 450 kg/day and 1,000 kg/day stations, respectively (2016$).

The best case cost for delivering hydrogen is $8 per kilogram for high daily volumes of liquid hydrogen by truck. That excludes the manufacturing cost and the retail mark up at the end. And it excludes the 33% of energy required for liquification of the hydrogen.

That cost point is €7.40, which is to say the double the price that the Institute believes hydrogen will be sold at for transportation and building heating.

Even their worst cost scenarios for hydrogen are deeply unrealistic, equating to just over €8 per kilogram, which is to say they will be selling hydrogen at about the cost of manufacturing it, including storage, compression or liquification, distribution, refueling facility capital, and operating expenses and profits.

If manufacturers manage to get the cost of hydrogen down to €5 to manufacture, then they have to add the capital cost of liquification facilities and the 10-12 extra kWh of electricity costs per kilogram to liquify it, then add the €7.40 to that, then add the capital cost amortization and operational costs for the refueling station and then add profits for those involved in the value chain. There’s a reason why gray hydrogen at current refueling stations in Europe and North America is anywhere from €15 to €33 right now.

Hydrogen Refueling Is Expensive & Risky

While we’re on that subject, let’s talk about the capital and operating costs of hydrogen refueling stations. Once again, let’s look at the USA, where the costs of its stations are publicly available. As I worked out and published recently, once again in aid of the Swedish study I’m assisting with, California’s stations were out of service 20% more hours than they were pumping hydrogen in the first half of 2021. That period is the last six months where they were recording maintenance data, the highest volume period for demand and after six years of stations being in operation, so it should have reflected a period when lemons had been eliminated and maintenance optimized.

The stations averaged about $2.1 million to build and maintenance costs if they had been operating at full capacity — maintenance cost increases are linear with volume pumped per triangulating studies — would have been 30% of capital cost per year, not the 3% to 4% that total cost of ownership studies have been assuming. The most problematic components are the compressors, as they have to create pressures equivalent to 7 kilometers under the surface of the ocean for 700 bar systems and 3.5 kilometers deep for 350 bar systems.

This is one of the reasons why the very odd idea of radically expanding trucking liquid hydrogen to refueling stations has resurfaced, with Mercedes Benz Group — Daimler has been relegated to a sub-brand, which I’m sure has a story of its own — and Linde building a trial station in Germany recently. Mercedes is betting on creating liquid hydrogen in centralized facilities, pumping it into liquid hydrogen tanker trucks, driving to refueling stations, pumping the liquid hydrogen into liquid hydrogen tanks at the stations, then dispensing liquid hydrogen into semi tractor tanks.

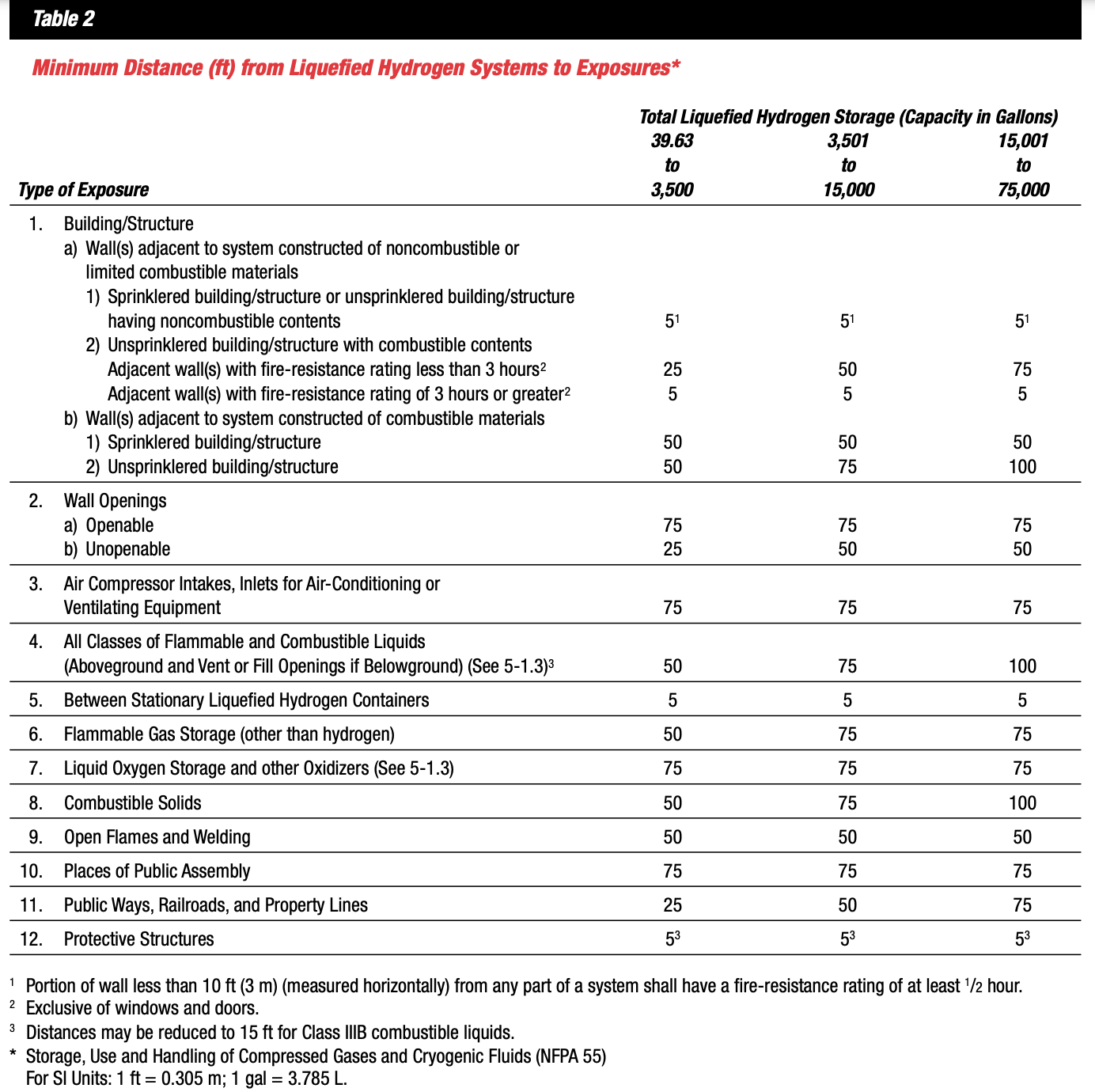

As a reminder, liquid hydrogen is a cryofluid that only exists at temperatures below 20° Kelvin or -253° Celsius. It’s an incredibly difficult substance to make and handle, which is why the space industry is moving away from it. Having innumerable trucks of the stuff on roads with distracted drivers and school buses is a recipe for disaster. Having refueling station employees or truck drivers pumping it is a recipe for disaster. NASA can’t make liquid hydrogen foolproof with a huge budget and devoted PhDs and engineers trained and certified in the stuff. They have to delay launches regularly due to these problems.

On NASA’s first try, on 29 August, lightning near the launch pad delayed work to fill the rocket’s fuel tanks. Then two hydrogen leaks appeared. Finally, a sensor indicated that one of the SLS’s four main engines was not chilled to the temperature necessary to receive fuel before lift-off.

In a collision which ruptured the tanks, first a stream of 20° above absolute zero liquid would pour onto the vehicles, freezing anyone exposed very badly, then would flash to an explosive gas and become an air fuel bomb destroying anyone left alive in the vicinity. While we truck liquid hydrogen around today, we do it rarely and only in situations where it’s absolutely critical to have hydrogen. It is literally the substance of last resort after everything else has been proven not to work.

This table from liquid hydrogen safety guidelines that the US DOE hosts is informative. Basically, keep stuff away from it. Keep people far away from it.

Mercedes and Linde assert that their liquid hydrogen station will cost less to build and operate than the current 700 bar compression stations used today, but that won’t make them remotely inexpensive or maintenance free.

No Broad Distribution Pipeline Grid For Hydrogen Will Exist

But hydrogen pipelines, you are thinking, that’s how hydrogen will be delivered. And that’s what the Institute thinks too, although there is no reason for them to think so. At best they have a scenario where hydrogen distribution pipelines are somewhat constrained instead of the realistic scenario where they won’t be present at all.

Why do I say that? Let’s start with where gas pipelines go today. That’s mostly to two places: buildings and electrical generation stations, per the EU’s Agency for the Cooperation of Energy Regulators.

The residential sector accounts for most EU gas demand (40%), followed by industry and gas use for power generation. Industry consumption has declined by 20% since 2000, whereas in the same period gas use for power generation has risen by 15%.

As noted above, the Institute accepts that hydrogen won’t be used for anything that a heat pump or electricity can be used for instead. That means the 40% of demand from the residential sector goes away, along with all commercial air and water heating use cases. Further, the 45% of heat in industry that’s below 200° Celsius also goes away with heat pumps and basic resistance heating. And, of course, gas generation declines radically over the coming decades, being turned on less and less frequently to fill in gaps not filled by storage, a 25% overbuild of renewables and transmission interconnects.

All pipelines in all urban areas are going to be decommissioned, isolation sub-network by isolation sub-network, something Utrecht is intelligently doing right now as I noted after asserting that this was the only strategy that avoided the utility death spiral for gas utilities.

There will be no broad distribution network for hydrogen because there will be no broad demand for it. Only major consumers will get bespoke pipelines and frankly those consumers have those pipelines today, roughly 1,600 kilometers of them in industrial areas for refineries and ammonia fertilizer plants. They lead from major steam reformation hydrogen manufacturing facilities to major demand centers.

This is, by the way, the same guidance I gave the Swedish study lead researcher. It remains to be seen whether it will pass muster, as many European stakeholders are stuck on the idea that hydrogen pipelines will be everywhere.

None of the hydrogen pipelines lead to or from ports, airports, or hydrogen refueling centers because the amounts of hydrogen are too small. And to be clear, the Institute agrees that pure hydrogen will be used very little but doesn’t have the courage to step through the implications to the end. As a result, all of their scenarios have pipelines.

But at least transmission pipelines will be built, one thinks. But the question is why?

Remember how cheap hydrogen was going to be for transportation? Well, the Institute thinks it will be half that price for industry, €60 per MWh or €2 per kilogram delivered.

That’s a third to a quarter of the likely best cost of manufacturing green hydrogen in Europe.

I did a best case cost workup for Quebec green hydrogen manufacturing recently using the very green, very firm, 24/7/365 availability, full amortized, dirt cheap hydroelectricity in that province. I used the cheapest alkaline electrolyzers available at 95% utilization. The power and energy costs of Quebec’s industrial electricity rates are €0.046 per kWh. Just manufacturing the hydrogen cost €2.44 per kilogram. That’s without doing anything at all with it, without moving it anywhere, and without any profits or cost of capital. That’s just electricity and amortizing the capital cost. That also required kicking all cryptocurrency miners off of the grid and providing their firmed electricity to the hydrogen plant, as Quebec’s current electricity generation is fully subscribed already and new supply is roughly double the cost.

The Institute can’t use alkaline electrolyzers of course because they are modeling 50% utilization to align with power purchase agreements for a mix of wind and solar. That means that they need PEM electrolyzers which are twice the capital cost. Also, it’s now apparent that the flexibility of PEM electrolyzers is more in the marketing than the reality, so all of the projections based on running them only when electricity is cheapest are in question.

You can’t halve utilization and substantially increase capital costs without increasing the cost substantially. European transmission and distribution charges alone for electricity are higher than Quebec’s industrial rates, something the ICCT did get right in one study, but which was subsequently ignored by later analysts.

Pipelines & Shipping Will Be Expensive

These economics hold true for pipelines from the North Sea to central Europe, a favored idea of people who don’t accept that HVDC and storage improvements are going to significantly reduce offshore wind curtailment and so hydrogen must be manufactured instead. I looked at a very bad DNV study last year, paid for by the European pipeline lobbyist association and run under their requirements by fossil fuel side DNV staffers, which found that in the best possible case in 2050, with lots of thumbs on the scale for hydrogen that don’t hold up to scrutiny, hydrogen would be available at the end of the transmission pipeline at €3.21 per kg in 2023 value currency.

That’s before it gets distributed, compressed, liquified, and pumped, so it’s the undelivered wholesale cost of hydrogen at best.

I’ve looked at most other hydrogen pipeline studies and they share similar problems, assuming that there’s some magical massive amount of hydrogen being manufactured or delivered to one end of the pipeline and that there’s a massive demand center effectively at the other end of the pipeline. Most recently I looked at the Oxford Institute for Energy Studies’ November 2023 report on the subject, and while it was better in some ways, it made the same mistakes again.

I’ve also looked at the cost of shipping hydrogen in liquid hydrogen tankers and it would be five times more expensive per unit of energy delivered than LNG and that’s with hydrogen electrolysis that’s even cheaper than the Institute’s, just the electrolyzer with no balance of plant. The reality is much higher.

I’ve also looked at pipelines for hydrogen and repurposing existing gas pipelines. The costs there are much higher as well.

This illusion of a massive grid of hydrogen pipelines bringing cheap green hydrogen everywhere in Europe is just that, an illusion. There is no single source of massive quantities of cheap, green hydrogen to fill any pipeline. There is no widespread demand for hydrogen to justify expensive pipelines being built. For that matter, demand is much more likely to fall for current hydrogen pipelines than rise, as refinery use is going to diminish rapidly with electrification of ground transportation and that’s a full third of current demand.

So, no pipelines. Much more expensive green hydrogen than the Institute assumes when you pull apart their math. Expensive distribution to end consumption points, either by truck or by bespoke point-to-point pipelines. 85% of hydrogen is consumed where it is manufactured today because it’s so expensive to distribute and that will be true in the future as well. Major industrial consumers will, as the Institute points out, be manufacturing hydrogen at point of demand with power purchase agreements that enable 50% utilization with electricity 75% of the industrial rates in Europe.

flexible electrolysis runs on about 3/4 average electricity prices at ½ capacity factor

What’s unclear is why the Institute thinks that this results in €2 per kilogram hydrogen. Remember that it takes about 55 kWh to manufacture a kilogram of hydrogen with balance of plant. Let’s ignore liquification for now. Three-quarters of the industrial rates in Europe is about €0.16 per kWh. Just the electricity will cost €8.80 per kilogram, ignoring all capital costs.

Their own assumptions make this clear, yet their results contradict the stated assumptions wildly.

Synthetic Fuels Will Be Much More Expensive

In this context, they then make the next mistake, which is assuming hydrogen-based synthetic fuels will be cheap as well. They agree that they will be more expensive than hydrogen, although the distribution will be vastly cheaper. Synthetic fuel prices listed are €150 to €250 averages across scenarios, which is to say 75% to 125% of electricity prices.

There is no universe in which this will be true. The only way this works is if green hydrogen is indeed dirt cheap and that’s not reality.

What is the reality? Well, you don’t have to take my word for it. The International Energy Agency recently published an e-fuels deep dive. They gave manufacturing synthetic fuels every possible advantage. They put a bespoke, integrated industrial facility in empty land in the high-wind, high-sun Midwest of the USA. They assumed custom-built, large wind and solar farms connected directly to the facility without utility costs for transmission, distribution, and administration. They assumed a massive biofuel facility in the industrial complex producing high-quality streams of cheap CO2 as another usually pricey feedstock for synthetic fuels. I wasn’t able to determine the cost of CO2 that the Institute chose, but the IEA study did cost sensitivity analysis with varying sources of CO2 from $30 to hundreds of dollars and it’s a big hitter.

This resulted in synthetic ammonia and methanol that in the best case was 4-6 times the cost of existing maritime and aviation fuels on a unit of energy basis. Meanwhile, biofuels were 2-2.5 times as expensive as existing fuels. That’s multiples of the Institute’s assumptions.

That’s what I found out in 2019 when I did a case study of Carbon Engineering, working up the real cost of the synthetic plug-compatible fuels that they were asserting that they would be manufacturing, giving them every possible benefit of the doubt, including the lowest end of CO2 capture. While CO2 is a big waste product, capturing it isn’t cheap, nor is distributing it. If you want tons of the stuff, it costs $100 per ton, and that’s fossil CO2.

The artificially very cheap hydrogen in the Institute’s study, something completely at odds with their own assumptions, leads to synthetic fuels being a big demand vector for green hydrogen as well, leading even in the electricity dominant scenarios.

But it won’t be, of course.

It’s worth pointing out another problem with the Institute’s representation. Back to the MWh as a unit of energy for electricity, hydrogen, and synthetic fuels. They just aren’t the same things, and the Institute makes that clear.

the production of electricity-based hydrogen and synthetic fuels involves conversion losses, and associated end-use technologies are less efficient (e.g., efficiency of combustion engines versus electric engines).

But that doesn’t show up in the MWh, where hydrogen and synthetic fuels are often shown as cheaper than electricity. What does it mean in reality?

For fuel cells in transportation or burning hydrogen or synthetic fuels in jet engines, a MWh is actually half a MWh with efficiency losses. In heating a MWh is about a MWh, but a MWh of electricity with heat pumps is actually 3 MWh. So what looks like a good deal in terms of energy use isn’t.

Industrial Heat Won’t Use Hydrogen Or Synfuels

Anything else? Yes, industrial heat.

High-temperature processes in other industrial sectors pose limits to electrification as the required technologies are highly uncertain. In the non-metallic minerals sector (cement, glass, and ceramics), electrification is limited and some hydrogen is used in cement kilns in the H2 scenarios.

That’s an odd thing to say. Especially when the source that they are relying on says something different. The CO2 reduction potential for the European industry via direct electrification of heat supply (power-to-heat) by Madeddu et al. gets it right. Among other things, they make it clear that glass and ceramics are highly electrified right now. It’s actually rare to see anyone bother with non-electric glass kilns.

The study is correct that currently some processes require usually carbon from fossil fuels, but that’s amenable to biomass and green hydrogen for reduction of steel. It’s been convenient to use fossil fuels for both heat and chemical feedstocks simply because they were dirt cheap.

As I noted when going through pretty much every pathway for hydrogen for energy recently, there is an embarrassment of riches of electrical heating sources from the lowest to highest temperatures. The only way that they won’t be applied in industry is if hydrogen or synthetic fuels are dirt cheap and as this assessment of the Institute’s study shows, that’s what they assumed for reasons which are completely non-evident.

What Should The Potsdam Institute Do?

Well, they should go back to their models, plug in realistic costs for green hydrogen manufacturing, transmission, distribution and pumping, then rerun the models.

Then they should retract this report as its conclusions are clearly wrong. They should publish an amended report that’s actually useful, which shows that hydrogen for the energy vectors that they suggest will be far too expensive and so won’t be used.

And they should start learning a lot more about industrial heat and biofuels, two areas they clearly have some challenges with. As I’ve noted many times, for transportation it’s grid-ties, batteries, and biofuels in merit order of total cost of ownership. Hydrogen and its derivatives are going to remain much more expensive.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.