The Aluminum Monthly Metals Index (MMI) rose 3.16% from September to October.

Aluminum prices continued to rise throughout September, with a 5.31% increase. By October 4, the uptrend found at least a short-term peak as the price of aluminum hit its highest level since June, followed by a modest decline.

Get weekly updates with expert-driven aluminum market insight, ensuring your company is well-informed and prepared to tackle any aluminum volatility. Opt into MetalMiner’s free weekly newsletter.

Aluminum Prices: Funds Pull Back After Port Strike

As with other base metals, the combined headwinds of September’s rate cut, China’s stimulus announcement and the since-resolved port strike boosted bullish sentiment for Aluminum during the month. Investment funds, whose large positions offer strong influence over price, built up long positions during September following a pullback after prices peaked in late May.

Data from the LME showed long bets from investment funds rose nearly 28% from September 6 to October 4. This support gave prices enough momentum to break above their late August high.

By mid-October, momentum appeared to slow. As the luster of September’s bullish headwinds wore off, funds began to pull back long positions, albeit slightly, once again. Meanwhile, the port strike was resolved after only three days, and had little impact on market conditions.

Meanwhile, China’s September stimulus package, while significant, was met with concern that it was too small to shift conditions meaningfully. Markets expected another large package to follow, but that did not occur. Instead, China outlined loose plans for more stimulus in an October 12 press conference, but neglected to inform markets of the size of forthcoming support. As a result, prices began to stagnate, slipping 0.61% during the first two weeks of Q4.

MetalMiner’s 2025 metal price outlook report just released! Get price forecasts, sourcing tips and primary price drivers for aluminum, steel, nickel, copper and more. Download a free sample report.

Market Oversupply Leads to Steep Discounts

Despite the recent rise in aluminum prices, market conditions in the U.S. offered no support. The Midwest Premium, a proxy for U.S. demand, remains sideways as of mid-October. Following a rebound in late September ahead of the port strike, the premium quickly retraced by October as disruption concerns faded.

Distributors showed little worry that even a protracted port strike would lead to shortages. Although it would have likely offered support to prices, the U.S. carried a significant supply glut by the end of Q3, enough to insulate the market from the loss of imports. By late September, oversupply led to reports of steep discounts on material, with pricing on fabs falling to pre-pandemic lows.

Demand conditions appeared to exacerbate bearish conditions, although oversupply remains the leading driver for domestic aluminum prices. One source characterized U.S. demand as “slow, but not crazy slow.”

Visually see where 2025 aluminum costs are projected to land with MetalMiner Insights’ comprehensive short and long-term price forecasts. Chat with us.

Alumina Prices Spike Following Disruptions

China, the world’s largest aluminum producer, has shown little interest in curtailing production levels. As of August, the International Aluminum Institute showed that Chinese output remained robust, with a 1.32% year-over-year rise. This is despite increased trade barriers from the West. However, Alumina supply disruptions could prove enough to place a cap on rising output.

Following a suspension of bauxite exports from Guinea, which accounts for roughly 70% of Chinese imports, alumina prices hit a new all-time high of $677 per metric ton on October 14.. Due to customs issues, Emirates Global Alumina announced a halt in bauxite imports from its Guinea Alumina Corporation. Output from the miner remained ongoing, which will likely mitigate the impact of the disruption.

While potentially short-lived, the timing of the suspension hit an already tight market. Australia, another leading supplier, faced other disruptions during the year, including Alcoa’s closure of its Kwinana refinery and the force majeure at Rio Tinto’s Queensland refineries.

Although it may help boost market sentiment, sky-high alumina prices do not necessarily mean aluminum prices will follow, as conditions at the bottom of the supply chain matter far less than conditions at the top. With the global market largely oversupplied, alumina disruptions may increase prices for primary producers, but appear unlikely to affect prices at the end-use level.

Biggest Aluminum Price Moves

- European commercial 1050 aluminum sheet prices witnessed the largest increase of the overall index, surging 17.07% to $3,680 per metric ton as of October 1.

- Chinese primary cash aluminum prices remained bullish, with a 5.85% increase to $2,904 per metric ton.

- Indian primary cash aluminum prices rose 4.85% to $2.84 per kilogram.

- The Korean 3003 aluminum coil premium over 1050 sheet fell 3.34% to $4.03 per kilogram.

- Korean commercial 1050 aluminum sheet prices fell 3.38% to $4.00 per kilogram.

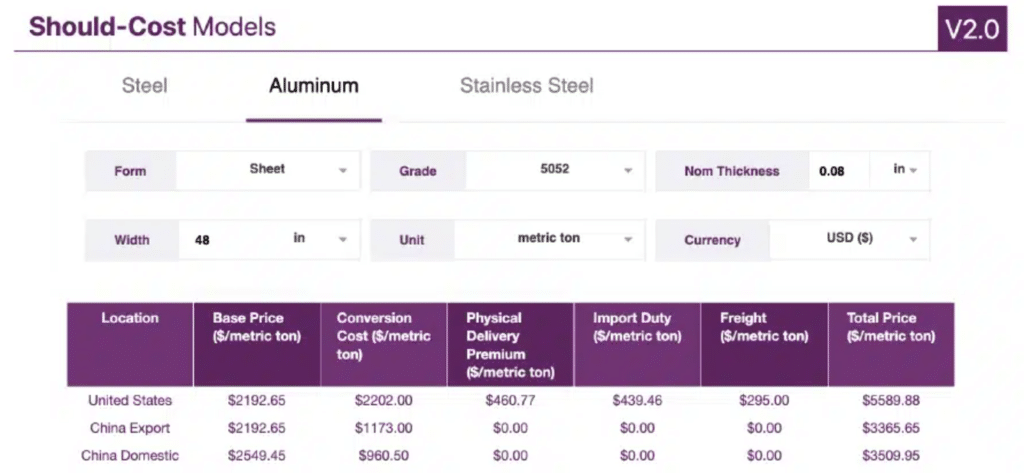

MetalMiner aluminum, steel and stainless should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore these models now.