Aluminum prices remain entrenched within a sideways trend. Following a 2.78% month-over-month decline in February, prices retraced throughout the first three weeks of March to where they currently stand: 2.17% above their February close.

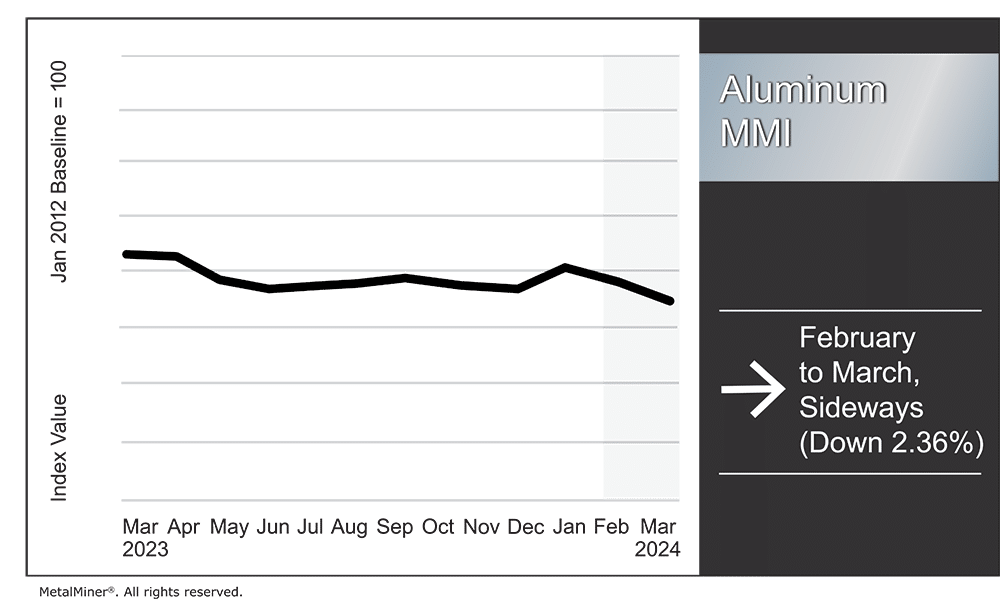

Overall, the Aluminum Monthly Metals Index (MMI) moved sideways, with a 2.36% decline from February to March.

AI vastly improves your organization’s chance of making stainless steel purchases which generate the most cost downs. Read why.

Will Aluminum Prices Echo the Copper Price Rally?

As Q1 nears its close, aluminum prices continue to show little momentum, further reflecting an uncertain market. However, prices saw a modest rally that brought them to a nearly 11-week high by March 18 as they seemingly followed copper prices upward. That said, there may be reason to question the most recent aluminum price increase.

Thus far, prices have yet to break out of their sideways trend. While trading near the top of their long-term range, prices stopped short of a more significant rise, which would be necessary to confirm a shift in trend. As base metals often travel in a pack, the most recent rise in copper and tin prices, both of which historically boast strong correlations to aluminum prices, potentially helped boost market sentiment in recent weeks.

However, 2023 saw the correlations between most base metal prices erode, as each market navigated its own unique challenges. While copper and tin markets faced supply threats, global aluminum output throughout 2023 appeared largely robust against muted demand conditions. Indeed, the year saw only the correlation between aluminum and zinc prices grow, as energy prices strongly impact both metals.

Investment Fund Positioning Reflects Different Outlooks on Aluminum Prices

Investment fund positioning offers a notable influence over metal markets due to the relative size of their positions. According to data from the LME’s Commitments of Traders Reports, comparing the spread between copper and aluminum revealed that funds showed differing biases by mid-March. For instance, copper appeared net long by the highest margin since February 2022. Meanwhile, aluminum funds remained net short, although the delta narrowed from where it stood in late 2023.

While influential, the bias among investment funds does not necessarily dictate market direction. However, the comparison between the copper and aluminum markets suggests that the most recent rally in copper prices was underpinned by stronger sentiment than aluminum, which may see aluminum prices peak in the short term.

For all base metals, the next moves by the Federal Reserve remain key. While the Fed unsurprisingly opted to keep rates flat in March amid sticky inflation, officials signaled their continued plans for three rate cuts this year. And though the timing of those cuts remains in the air, they will likely support metal prices like aluminum.

Visually see 2024 metal costs projections like the one above with MetalMiner Insights’ comprehensive short and long-term price forecasts. Chat with us.

The China Question

In the U.S., demand remains tepid at best, mainly due to the continued slide of the Midwest Premium. However, the outlook appears more cloudy in China as markets keep a close eye on supply and demand dynamics in the region.

Last month saw reports of a jump in the Main Japanese Port premium, a proxy for Asian aluminum demand. As China remains the leading consumer of aluminum, this could suggest improving demand conditions. Beyond that, aluminum supply from China started to slump during the first months of 2024. China’s Yunnan Province remains in its dry season, which extends from November through April. This typically stifles output due to the region’s reliance on hydropower.

According to data from the International Aluminum Institute, primary output in China remained strong despite the most recent dip. Thus far, the dry season still managed year-over-year growth as production levels averaged 2.64% higher compared to the 2022-2023 dry season.

This will likely leave Chinese aluminum demand as a leading driver for the market. Meanwhile, Chinese industrial production saw a 7% jump during the first two months of 2024. However, according to data from the National Bureau of Statistics, its overall economy continues to face headwinds that could derail its most recent progress.

Biggest Moves for Aluminum Prices

Don’t make aluminum sourcing and purchasing decisions based on chance. Get the full scope of 2024 metal price forecasts and sourcing strategies with MetalMiner’s Annual Metal’s outlook. Get a free sample of our recent March 2024 update.

- Korean commercial 1050 aluminum sheet prices edged lower with a 2.11% decline to $3.69 per kilogram.

- Korean 3003 coil premium over 1050 aluminum sheet prices also fell 2.11% to $3.73 per kilogram.

- Korean 5052 coil premium over 1050 aluminum sheet prices saw a 2.12% decline to $3.84 per kilogram.

- European commercial 1050 aluminum sheet prices dropped 2.24% to $3,149 per metric ton.

- European 5083 prices saw the largest decline of the overall index, with a 9.56% decrease to $4,628 per metric ton.