- Trudeau government jacking up carbon taxes across the country

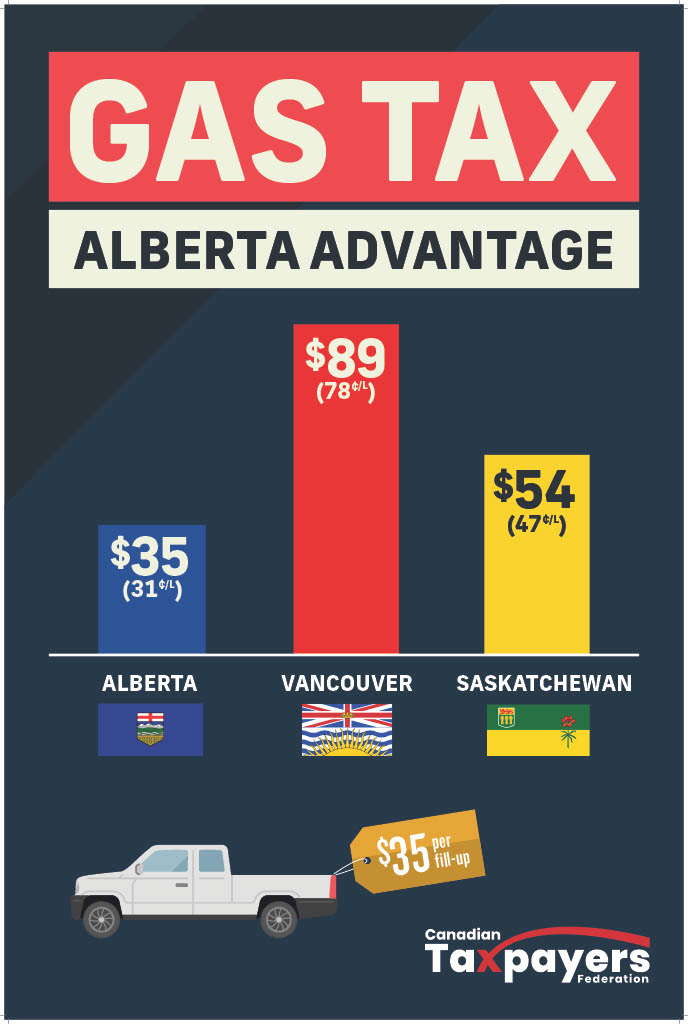

- Albertans save $53 per fill up compared to Vancouver

CALGARY, AB: The Canadian Taxpayers Federation released its 25th annual Gas Tax Honesty Report to shine a light on all the hidden taxes that make fueling up more expensive.

Albertans pay 31 cents in taxes per litre of gasoline, the lowest gas tax rate in Canada.

“Albertans are saving big money by not having any provincial fuel taxes, but Prime Minister Justin Trudeau is set on cranking up his carbon taxes every year from now until 2030,” said Kris Sims, Alberta Director of the Canadian Taxpayers Federation, at a Calgary press conference. “Trudeau wants to make Vancouver’s gas prices standard across the country.”

Filling up a light duty pickup truck in Calgary costs about $35 extra in gasoline taxes. That same fill-up in Vancouver costs about $88 in taxes. The $53 price difference between the two cities is caused by B.C.’s excise tax, B.C.’s second carbon tax and Vancouver’s transit tax.

The CTF’s Gas Tax Honesty Report reveals how much and how many taxes Canadians pay at the fuel pumps, something governments aren’t usually eager to share.

In Alberta a litre of gasoline carries these taxes:

- 14.3 cents first federal carbon tax

- 10 cents federal excise tax

- 6.7 cents federal sales taxTotal: 31 cents per litre

Alberta Premier Danielle Smith has fully suspended the provincial fuel tax, saving drivers 13 cents per litre of gasoline and diesel. But gas tax bills are set to increase every year until 2030 with the Trudeau government’s carbon tax hikes.

“It’s extremely tone deaf for the federal government to keep hiking carbon taxes when Canadians can barely afford to fuel up their cars now,” said Franco Terrazzano, CTF Federal Director at the press conference. “Canadians need relief and that means politicians must scrap their federal carbon taxes that don’t help the environment.”

You can find the CTF’s 2023 Gas Tax Honesty Report HERE.

-30-

Graphics provided by the CTF are free to use and share.

For more information & interviews call:

Kris Sims, Alberta Director of the Canadian Taxpayers Federation

Phone or text: 604-997-1798

Email: [email protected] | Twitter: @kris_sims

The CTF is Canada’s leading non-partisan citizens’ advocacy group fighting for lower taxes, less waste and accountable government. Founded in 1990, the CTF has more than 235,000 supporters and seven offices across Canada.

The CTF is funded by free-will contributions that do not get tax receipts.

Share This: