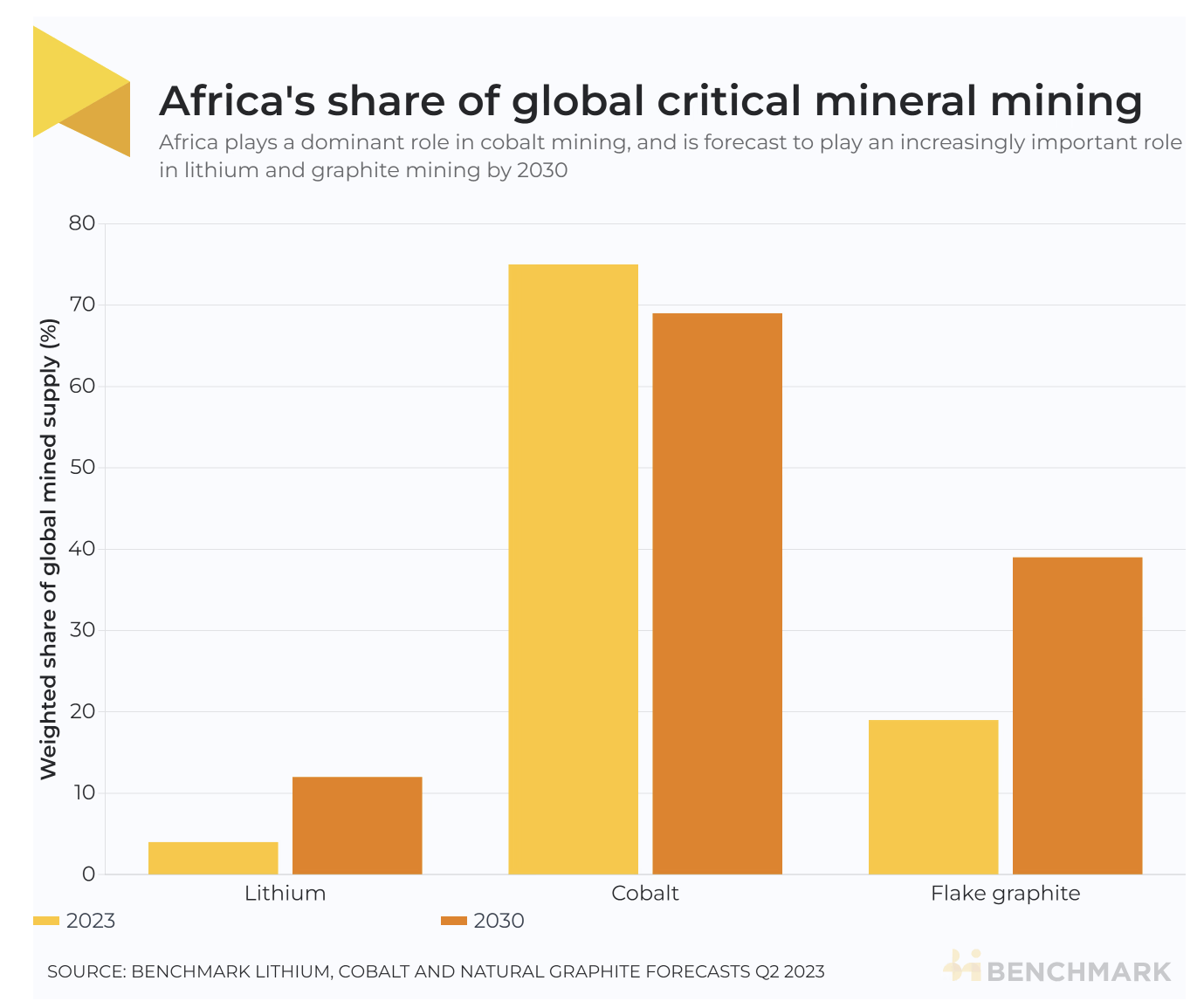

When we think of where lithium comes from, we think of South America (Chile specifically), Australia, and the US a bit — with processing in China, of course. We don’t think of Africa. However, Africa has resources, and the expectation is that the continent will be a much bigger source of lithium by 2030.

Lithium

Benchmark Mineral Intelligence, highly regarded in the field of tracking lithium production and forecasting its future, expects that “Africa’s mined lithium production output is set to increase more than ten-fold this decade.” That’s reported in Benchmark’s Lithium Forecast. With this boom in lithium extraction, Africa could climb to 12% of the world’s lithium supply in the coming decade. Benchmark expects growth from 4% in 2023 to 12% in 2033.

Most notable in the growth of this market, though, is not an African country at all. It’s China. “China has invested heavily across Africa to help secure access to its critical mineral deposits, potentially putting Western countries on the back foot when it comes to operating in the region.” And this is not a small market advantage at this point. It’s a very lopsided level of foreign investment. “A total of 83% of forecast lithium supply is set to come from projects with some form of Chinese involvement, according to Benchmark.”

Cobalt

Now, when you think of cobalt, you probably do think of Africa, and especially the Democratic Republic of the Congo. In fact, even many people who don’t follow the EV market know that cobalt often comes from there. Cobalt mining in the Democratic Republic of the Congo has gotten a lot of attention for not good things, particularly unsafe and inhumane child labor. While Benchmark expects Africa’s share of lithium to rise, however, it expects the continent’s share of the cobalt supply to decline a bit — probably because of these concerns about child labor and inhumane labor practices. Nonetheless, the continent will remain the main source of cobalt globally.

“Of the critical battery minerals, cobalt is the one which Africa captures the largest share of the upstream mining. Benchmark’s Cobalt Forecast shows that 75% of mined cobalt comes from the continent, with the vast majority of this coming from the DRC,” Benchmark writes. “Although Indonesian cobalt will eat into this market share, the region will maintain a strong 69% of the market in 2030.”

Flake Graphite

Then there’s the matter of graphite — flake graphite, to be specific. Similar to lithium, big growth is expected in this market on the African continent.

“Africa has rich flake graphite reserves, too, and is expected to grow production from 19% of global supply this year to 39% in 2030, according to Benchmark’s Natural Graphite Forecast. In graphite, unlike cobalt and lithium, non-Chinese companies are the dominant investors on the continent.”

Capturing More Value For Africa … Or Not

Benchmark notes that some African countries have initiated bans on some raw materials in order to force processing within their borders. However, it turns out that may violate international trade rules.

“Last month, Namibia banned the export of unprocessed lithium, cobalt, manganese, graphite and rare earth minerals,” and Zimbabwe passed similar legislation in December 2022. “This prohibition applies strictly to unprocessed critical minerals. Value should be added at least up to the concentrate, carbonate/hydroxide level,” said Andreas Simon, a spokesperson for Namibia’s Ministry of Mines and Energy.

“When you combine the export ban with domestic processing, you are really playing with fire,” Peter Leon, a partner and Global Africa chair at international law firm Herbert Smith Freehills, said at the London Indaba.

Benchmark compared this to a case with Indonesia and nickel ore (used to make steel). The case is sitting in limbo waiting for the World Trade Organization’s Appellate Board to become operational again — the EU won the case against Indonesia but then Indonesia appealed.

We’ll see what happens in all of these cases, but I think every party except China would be happy to see battery mineral processing become more diversified and have more of it done in African countries where the raw minerals are mined.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …