Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

As the federal government pours billions into hydrogen production to lower greenhouse gas emissions, critics worry water shortages in the Southwest could worsen.

Armed with bright green shovels, executives from the Australian mining giant Fortescue broke ground in May on a green hydrogen plant outside of Buckeye, Arizona, in an area the city calls the “Sustainable Valley.”

But this wind- and solar-powered plant in the Sonoran Desert will make hydrogen trucking fuel from a groundwater source that experts say is not sustainable. The 11,000 metric tons of hydrogen per year that the project plans to produce will require at least 26 million gallons — and use between 32 to 45 million gallons total if the additional water needed for purification and cooling is included, according to water usage estimates by the Argonne National Laboratory.

If the water needed to produce and operate the wind and solar power is included, and if the leftover water from all these processes is not pumped back into the surface or groundwater source, the plant could consume up to 319 million gallons, according to water withdrawal estimates published in the journal Renewable Energy. In either case, it will remove even more water from an aquifer that has been declining by 3 feet per year, mainly due to irrigation for alfalfa and other crops. A well just over a mile from the plant site has fallen 170 feet since 2000.

Compared to irrigation, the water supply needed by Fortescue “is not a lot,” said Sarah Porter, director of Arizona State University’s Kyl Center for Water Policy. “But if hydrogen is the next big thing … then it is important for the state to come up with policies, to have a policy discussion and certainly give consideration to whether we should require sustainable water supplies.”

Fortescue said in a statement it was committed to reducing water use but declined to say exactly how much the plant would consume.

“We are conducting a detailed hydrogeological assessment to more fully understand the aquifer and how to protect it and preserve water in this area,” the company said. “We are developing design efficiencies to limit overall water use, and we are seeking alternative water sources like wastewater to reduce groundwater use.”

The water use of Fortescue and other hydrogen projects, including a 3,650-ton plant in nearby Casa Grande, raises a potential issue with the green hydrogen buildout encouraged by tax breaks and direct funding under President Joe Biden’s two major climate laws — the Inflation Reduction Act and the Bipartisan Infrastructure Law.

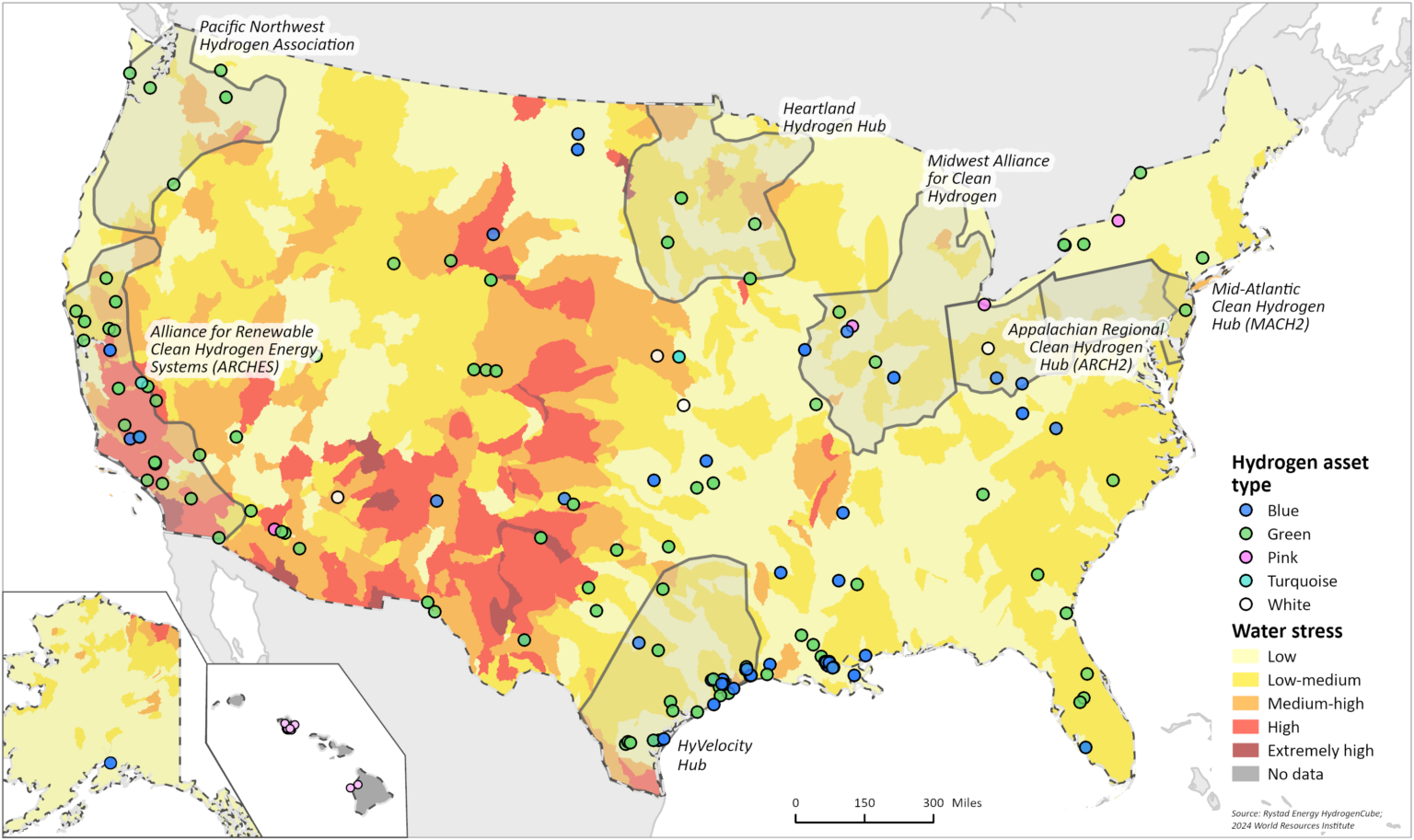

Out of 18 approved hydrogen production projects that will require significant freshwater, four are in areas of high or extremely high water stress, including the Buckeye-area plant, according to the World Resources Institute’s Water Risk Atlas. That designation compares water demand to available groundwater or surface water supply. While these 18 projects are already under construction or have a final investment decision, many other projects are being developed in water-stressed areas.

The seven regional hydrogen hubs selected by the Department of Energy for funding each of between $750 million and $1.2 billion include proposed projects in areas of high or extremely high water stress. Worldwide, most green hydrogen projects are located in water-stressed regions such as the Middle East.

Population growth and warmer temperatures will make the situation worse. By 2040, 39% of global hydrogen production will be in areas of high water stress, up from 35% today, according to the International Renewable Energy Agency.

The total water use of hydrogen “is not the big deal,” said Jack Brouwer, an engineering professor at University of California-Irvine. “The water challenge is that where we have good primary energy from wind and solar, we do not have good water (supply) necessarily.”

Hydrogen: A zero emissions fuel

When combined with oxygen in a fuel cell to generate electricity, hydrogen emits only water vapor. It can also be burned in an engine or turbine, although that can emit harmful nitrogen oxides. As part of its net-zero goal, the U.S. government is jump-starting hydrogen production to power sectors that can’t feasibly run on batteries or electricity, like long-distance trucking, shipping and air travel, or those that require high heat or chemical reactions, like steel, cement and fertilizer production.

Power plants may also need to burn hydrogen during lulls in solar and wind generation, it says. The Bipartisan Infrastructure Law set aside $9.5 billion for clean hydrogen, and the Inflation Reduction Act established the 45V tax credit of up to $3 per kilogram of clean hydrogen produced.

“Clean hydrogen is the Swiss Army Knife of zero-carbon solutions because it can do just about everything,” said Energy Secretary Jennifer Granholm, announcing the hubs alongside Biden at a Philadelphia shipping terminal.

Most of roughly 10 million metric tons of hydrogen produced annually in the United States is “gray” hydrogen made by combining natural gas with steam, which releases carbon dioxide. Putting chemical scrubbers on the plant’s smokestack can capture 80-90% of these CO2 emissions, resulting in “blue” hydrogen.

A truly net-zero fuel, however, can be made by splitting water into hydrogen and oxygen with clean electricity, a process called electrolysis. That’s known as “green” hydrogen if the electricity comes from solar or wind and “pink” hydrogen if from nuclear.

While activists and researchers have questioned whether the blue hydrogen supported by the hubs initiative and 45V will actually reduce emissions, green hydrogen has its own drawback with water. In the current fossil-fuel dominated electricity grid, it would take more than 100 gallons of H2O to make enough green hydrogen to drive 100 miles, compared to about 25 gallons for gasoline and about 10 for diesel, the Argonne National Laboratory estimates.

However, extracting fossil fuels as well as cooling coal- and gas-fired power plants guzzles tens of billions of gallons of freshwater each year. If U.S. hydrogen production reached a middle-of-the-road scenario for a “deeply decarbonized” future in 2050, it would consume 15% of the freshwater required by the entire U.S. energy system in 2014 while producing about 10% of total energy.

“Traditional energy projects also use water as well, so it’s not like a new area for the energy industry to think about,” said Minh Khoi Le, head of hydrogen research at Rystad Energy, an independent energy intelligence company.

Hydrogen projects in ‘megadrought’ areas

The question is where that green hydrogen production will be consuming water. Four of the private green hydrogen projects as well as the ARCHES hydrogen hub, which has been awarded up to $1.2 billion by the Department of Energy, are located in the southwestern United States. This region has the most sunshine for cheap solar energy to power the electrolysis, and it’s also near California, where limits on emissions from transportation fuels have spurred interest in hydrogen for trucking.

But parts of the Southwest remain in the worst megadrought in 1,200 years despite a bout of rainfall this winter; the Great Basin has lost trillions of gallons of groundwater, and the vital Colorado River is drying up. A 2019 study found that counties in southern and central California, southern Arizona and southern Nevada would experience water scarcity of more than 10 billion liters per day in 2040 based on projected hydrogen production.

California has made one of the biggest bets on green hydrogen. The ARCHES hydrogen hub plans to produce 17 million metric tons of hydrogen per year by 2045, which could consume up to 70 billion gallons for electrolysis — and up to 494 billion gallons for the whole life cycle if leftover water isn’t returned to its source.

That’s equivalent to the average yearly water use of up to 4.8 million Californians, although still only about 4% of the state’s total water use.

The Department of Energy told Floodlight that in water-stressed areas it only selected hubs that “have developed or are developing methods to minimize water consumption.”

ARCHES is set to include 37 projects in central and southern California, some of them in areas of extremely high water stress. For instance, Energy Resources is planning to produce 21,000 metric tons of hydrogen per year in Lancaster in Los Angeles County, which is located in the Mojave Desert and has had to restrict watering in recent years due to drought. The entire solar-powered project will consume 97 million gallons of water per year, said Element Resources CFO Avery Barnebey.

“Historically, the site has been used for agriculture — alfalfa, carrots and similar — and has used substantially more water than we will for hydrogen,” Barnebey said.

Separately, Los Angeles is converting its largest power plant to burn green hydrogen rather than natural gas and plans to convert three others as well to provide electricity in times of reduced solar and wind output. The nonprofit Food and Water Watch has estimated that the hydrogen to run that first plant would suck up 122 million gallons of water a year by 2045.

The Los Angeles Department of Water and Power told Floodlight “that number is no longer applicable,” and it is preparing “refinements to our hydrogen usage estimates.”

“We plan to partner with entities like ARCHES for responsible hydrogen production from non-potable, recycled water sources,” it said.

SoCalGas is developing what it says will be the nation’s largest hydrogen pipeline network from central California to Los Angeles. Producing the hydrogen to be transported in the pipelines would take up to 5.5 billion gallons of water per year, according to the company.

Food and Water Watch has opposed California’s hydrogen expansion as the “fossil fuel industry’s latest scam,” which it says would tap scarce water reserves, worsening the state’s water crisis.

“There are already families in the Central Valley who, when they turn on the tap, no water comes out because their wells have just gone completely dry,” said Food and Water Watch Los Angeles organizer Andrea Vega. “The same could happen in other parts of California.”

Making hydrogen with less fresh water

There are ways, however, to shrink green hydrogen’s water footprint, starting with returning the purification and cooling water to the source. Building more renewable energy will also reduce water use. Green hydrogen made with energy from only wind turbines, which require far less water than other major power sources including solar panels, would consume about 18 gallons of water to fuel a car for 100 miles — less than gasoline produced in the current energy grid.

In addition, at least two green hydrogen projects are relying almost entirely on treated wastewater, although this is more expensive than groundwater. Plug Power is even building a wastewater treatment plant to hand over to the city of Mendota, California, as part of its 11,000-ton green hydrogen plant there.

Finally, several companies are developing pilot projects to produce green hydrogen with desalinated seawater. But desalination requires additional energy and discharges salty brine that could potentially harm marine ecosystems in some areas. In Corpus Christi, Texas, proposed plants to desalinate water for industry including hydrogen production have sparked accusations of environmental racism and protests with slogans like “don’t kill our bay.”

Companies and governments in arid places like California will eventually need to invest more in power lines or water pipelines to connect sunny areas to water resources for green hydrogen production, said UC-Irvine’s Brouwer, who is also part of the ARCHES leadership team.

“We run a wire from the good solar to where the water is,” he said. “We could also do the reverse, run a pipe from where the water is to where the good solar is.”

Floodlight is a nonprofit newsroom that investigates the powerful interests stalling climate action. Louisiana Illuminator is part of States Newsroom, a nonprofit news network supported by grants and a coalition of donors as a 501c(3) public charity.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy