Metals and miners are taking a breather after explosive gains. More upside is expected before the next cycle low, which is due in June.

Metals and miners are taking a breather after explosive gains. More upside is expected before the next cycle low, which is due in June.

Last Friday’s price action was wild, with gold swinging $100 and silver $2.00 in a 4-hour window. As the bull market matures, I expect the swings to get even bigger.

The Bitcoin halving has arrived, prices must hold critical support near $60,000 to prevent a larger ‘profit-taking’ breakdown.

Interest Payments

Interest payments (represented by the red line) on U.S. debt have surpassed the Defense Budget (black line) and are now on par with Medicare (green line). If this trend continues, debt payments could potentially exceed those of Social Security later this decade.

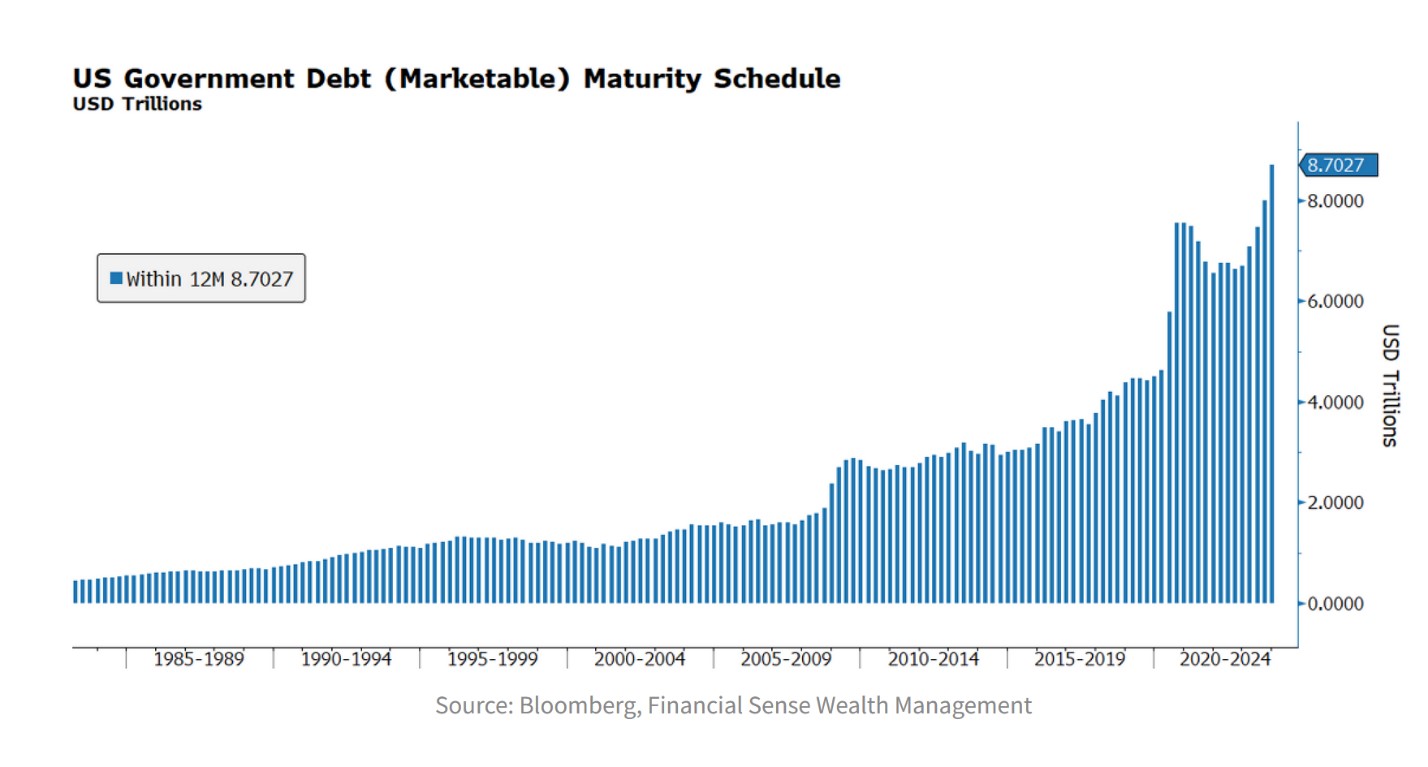

Debt Maturity

Interest payments could increase further as $8.7 trillion (25% of all debt) must be refinanced over the next 12 months at much higher interest rates. The unsustainable debt picture is one of the primary drivers pushing gold higher.

The Gold Cycle Indicator finished at 287.

GOLD- Gold is maintaining upward momentum, and I expect prices to make a higher high (above $2448) before rolling over into the next cycle low that is due in June.

SILVER- The current pattern in silver suggests a running consolidation, which could lead to an upward breakout. A successful breach above $30.00 might trigger significant upside.

PLATINUM- Platinum is back testing the $950 level before the next crack at $1000.

GDX- Miners completed a swing low after testing support near $32.50. Once this correction is over, I expect a breakout to a fresh high.

GDXJ- Juniors completed a swing low after testing support near $40.00. Once this correction is over, I expect a breakout to fresh highs.

SILJ- Silver juniors completed a swing low after testing support near $10.60. Once this correction is over, we should see fresh highs.

S&P 500- The stock market got ahead of itself concerning Fed rate cut expectations, and there are few fundamental reasons for prices to continue higher. Consequently, the high set in March (5264) could be significant. A sustained breakdown below 4600 would establish a renewed bear phase.

BITCOIN- The Bitcoin halving event is tomorrow; mining rewards will be cut in half. That means electricity costs will surge to between $12,000 and $14,000 to make one Bitcoin.

Receiving 50% less income every four years is a poor business model that will lead to consolidation. Eventually, there will be just a handful of miners, making the network less secure and prone to attack. If the Bitcoin network is compromised (hacked), it will instantly lose credibility, and the price could plummet.

Progressive closes below $60,000 would promote a retest of $50,000 and lower if prices fail to hold the 200-day MA.

Conclusion

The gold bull market is in full swing, and sub-$2000 prices may be forever in the past. Gold miners remain cheap and have a lot of potential. Silver looks like it wants to rip to the upside.

AG Thorson is a registered CMT and an expert in technical analysis. For daily market updates, consider subscribing www.GoldPredict.com.

*******