London, 13 March 2024, (Oilandgaspress): As a result of OPEC+ extending crude oil production cuts, U.S. Energy Information Administration (EIA) has reduced there forecast for global oil production growth in 2024. The lower growth contributes to significant global oil inventory declines in our forecast for the second quarter of 2024 (2Q24). Because of falling inventories, we now expect the Brent crude oil spot price will average $88 per barrel (b) in 2Q24, up $4/b from our February STEO, and we expect the Brent price will average $87/b this year. Natural gas prices. EIA expect the Henry Hub spot price to remain below $2.00 per million British thermal units (MMBtu) in 2Q24 as the winter heating season ends with natural gas inventories 37% above the five-year average. The Henry Hub spot price averaged $1.72/MMBtu in February (30% lower than in our February STEO), a record low adjusted for inflation. Low prices were partially driven by reduced natural gas consumption in the residential and commercial sectors this winter (November—March). Read More

State enterprise Enova is allocating 2bn Norwegian kroner (€175m) to the 75MW GoliatVIND floating offshore wind project at Hammerfest in Norway.

A total of seven players have submitted floating wind project proposals in the call for tenders and are currently being assessed by Enova.

GoliatVIND was ranked at the top of the competition. The scheme will install a floating offshore wind farm to deliver renewable electricity to the Hammerfest region via the Goliat platform in the Barents Sea. The Goliat platform is already electrified from shore.

GoliatVIND is owned and supported by three partners: Odfjell Oceanwind, Source Galileo and Kansai Electric Power Company.

The bidders in the competition had to commit to a submitted progress plan that requires commissioning of the project within five years, and Enova must be kept informed on an ongoing basis about the project’s progress and reporting for the payment of support.. Read More

RAM Trucks Europe announces it will again be alongside the MXGP World Championship as an official partner for the 2024 season. The collaboration, which began in Loket in 2022 and was first formalised for the past season, is now renewed, underlining the deep connection between the brand’s spirit and the world of sporting competition, with the FIM Motocross World Championship being one of its leading representatives.

Once again this season, therefore, RAM Trucks Europe will appear on the racetracks as the official partner of one of the most prestigious offroad Championships in the world, with the presence of RAM vehicles along the track and on the paddock, as well as sponsorship in all the materials related to the events’ organization. Also renewed is the sponsorship of the MXGP and MX2 qualifying sessions, which will keep being called RAM Qualifying Races, allowing the brand to play a leading role not only on race days, but for the entire duration of the weekend. In addition, for this edition, RAM Trucks Europe has introduced a special “RAM Award” related to Saturday’s qualifying races, exclusively dedicated to the MXGP category: at the end of the season, the MXGP rider who won the most RAM Qualifying races will win an exclusive six-month driving experience with RAM Trucks Europe. The partnership will start from the first round of the 2024 season, scheduled for this weekend, 9 and 10 March, at the Villa La Angostura circuit in Patagonia – Argentina. . Read full article

FIA confirmed Stellantis Motorsport’s commitment to clear and consistent environmental management across all of its activities, awarding the group a three-star rating. This is the highest level possible within the sustainability accreditation programme, which is aimed at supporting world motorsport stakeholders in measuring and improving their environmental performance. This award comes after the FIA three-star accreditation was obtained in 2021 by Maserati MSG Racing and in 2023 by DS PENSKE whilst competing in the ABB FIA Formula E World Championship, as well as the FIA WEC and ACO “Low Carbon Impact Award” attributed to Team Peugeot TotalEnergies and the “DMSB Sustainability Award” bestowed by the German National Federation on the Opel ADAC e-Rally Cup. It provides yet further confirmation that Stellantis Motorsport is spearheading the Stellantis group’s Dare Forward programme, which seeks to reduce greenhouse gas emissions by 50% between now and 2030. The FIA highlighted in particular the implementation and roll out of a roadmap aimed at reducing the use of greenhouse gases, and managing energy consumption and lighting more effectively. Stellantis Motorsport has no intention of resting on its laurels, however, and is already looking ahead to the next audit. Read full article

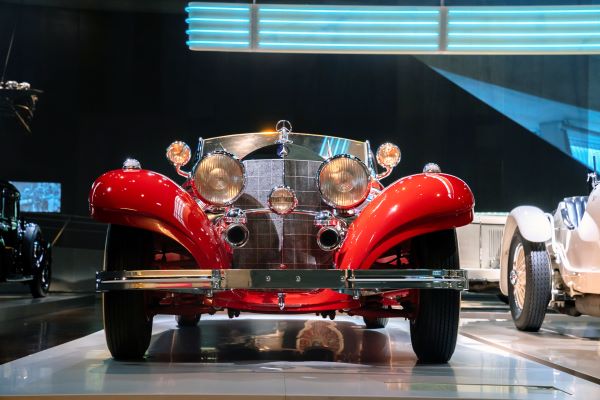

The 500 K Special Roadster is a superstar at the Mercedes-Benz Museum. What makes it so fascinating? It is an extraordinary automotive sculpture, whose elegance radiates effortlessly from the 1930s to the present day. This is where the best technology, highly elegant styling and a luxurious interior come together. Anyone approaching this bright red vehicle is mesmerised by its grandeur.

Highly exclusive: The Mercedes-Benz 500 K made its debut at the International Motor Show (IAMA) in Berlin from 8 to 18 March 1934 – 90 years ago. The luxury car was on display as a spectacular “autobahn courier”. The Special Roadster with recessed radiator was added to the model range in October 1934, as the eighth and most expensive body variant: its price was 28,000 reichsmarks. An exorbitant amount, for which you could easily buy a detached house in a prime location at the time.

Illustrious clientele: Celebrities from the worlds of culture, entertainment, business and politics purchased the 500 K – and at the same time enhanced their reputation with this vehicle. Presenting itself on the red carpet? One of the luxury car’s favourite pastimes.

The best of the best: The great effort that went into building the Special Roadster still amazes us today. Starting with the design. The bodywork with the large, elegantly curved wings and long bonnet was designed by stylist Friedrich Geiger. Today he would be called a designer. It gave the car the flair of the “Roaring Twenties”, which are still famous for their exuberance. Read full article

The Japanese government’s Strategic Energy Plan sets the path for energy policy in Japan. It is formulated at least once every three years by the Ministry of Energy, Trade and Industry (“METI”). The 6th Strategic Energy Plan was approved by the Japanese Cabinet in October 2021. Its projections include targets for both 2030 and 2050..This projects a significant increase in the energy mix being generated from renewable energy, which means there will need to be a rapid scaling of Japanese renewables to achieve these targets. Wind power currently accounts for 0.9% of the energy mix in Japan. For wind to, as projected, meet 5% of the energy mix in Japan by 2030, there will consequently need to be a large number of new wind projects. To reinforce all of this, the government has also set a target to generate 30 – 45 GWs of offshore wind generated power by 2040.

Looking further into the future, the 6th Strategic Plan also sets a target of carbon neutrality by 2050, with the government looking to continue rapid growth in renewable energy (including solar, wind and geothermal) as well as baseload nuclear energy.¹

JAPANESE OFFSHORE WIND MARKET

Given this background, it is not surprising that the Japanese government, and corporate investors, are engaging with the Japanese renewables market. This interest has included recent M&A in the energy sector including ENEOS’ purchase of Japan Renewable Energy for approximately JPY200bn (US$1.4bn) and NTT Anode Energy and JERA jointly purchasing Green Power Investment for approximately JPY300bn (US$2bn). In addition, Infroneer Holdings, a Japanese infrastructure company, recently purchased Japan Wind Development from Bain Capital for JPY200bn (US$1.4bn)².

As part of this renewables expansion, the offshore wind market in Japan represents an area of key interest. This is due to, amongst other things: Read full article

Nissan’s results, published in Japanese accounting standards, for the third quarter of fiscal year 2023/2024 (October 1st to December 31st, 2023), after IFRS restatements, will have a negative contribution to Renault Group’s fourth quarter 2023 net income estimated at -€440 million[1].

Therefore, Nissan’s contribution to Renault Group Full Year 2023 results amounted to €797 million. Read full article

On February 8, 2024, partners from Software République’s innovation ecosystem (Orange, Renault Group, STMicroelectronics and Thales) will meet for the industrial launch of the Mobilize PowerBox charging station at the site of the new production line at the Symbiose electronics plant in Beaupréau-en-Mauges (Maine-et-Loire, France). The initial production capacity is 65,000 units/year. The Mobilize PowerBox charging station will soon be marketed in the Renault network for all electric vehicles of Renault Group brands.

Mobilize PowerBox: a charging station made in France by LACROIX

LACROIX, an expert in the design and manufacture of connected equipment and solutions, is equipping its Symbiose plant with a new production line for the manufacture of the Mobilize PowerBox terminal. LACROIX has the capacity to produce, initially, 65,000 units/year thanks to its automated and digitalized Industry 4.0 strategy. In the event of larger volumes, the production line can be adapted or even duplicated to meet the growing expectations of the market. Symbiose is the group’s 4.0 plant, inaugurated in September 2022, located in Beaupréau-en-Mauges in Maine-et-Loire. It is part of the group’s desire to contribute to the relocation of the electronics sector in France. In addition, the plant benefits from a network of local suppliers to reduce the carbon impact of the supply chain.Mobilize PowerBox is a charging solution that adapts to all electrical installations, single-phase or three-phase. It can be installed both indoors and outdoors, on a wall or on a stand. At home, its use is integrated into the electrical ecosystem of the house. It benefits from a dynamic energy management system that allows the charging power to be modulated by adapting to the available power thereby avoiding any power outages in the house. Read full article

U.S. Environmental Protection Agency is announcing a rule to amend standards for facilities that use open burning and open detonation (OB/OD) to treat waste explosives such as munitions, fireworks, flares or airbag propellants. If finalized, the rule would strengthen existing regulatory requirements to use safe and available alternative technologies to treat waste explosives and provide new technical standards for open burning and open detonation designed to better protect communities and military families from pollution. EPA also proposed a framework for permitting mobile treatment units aimed to expand potential treatment options for waste explosives and reduce the use of open burning and open detonation.

“Open burning and open detonation of waste explosives like fireworks or munitions can have serious environmental and public health impacts, oftentimes in communities already overburdened by pollution,” said EPA Administrator Michael S. Regan. “In close coordination with federal, state and local partners, EPA’s proposal will work to better protect local communities from environmental and health harm while ensuring facilities are supported in the transition to new alternative technologies that safely manage explosive wastes.” Explosive wastes include a range of items, including munitions, propellants, fireworks, and flares and are often treated by OB/OD because historically, other safe modes of treatment have not been available. However, as described in 2019 reports by EPA and the National Academies of Sciences, Engineering, and Medicine, alternative technologies are now available to safely treat certain waste explosives. Read full article

The UK car market is set to undergo a radical change by 2028 according to the latest Cox Automotive new and used car market forecast. A dramatic decline in new diesel cars and a reduction in petrol registrations will have a profound impact on the used market.

The forecast – which includes fuel-type breakdowns for the first time – indicates that in the period 2024-27, EV share of registrations will grow 160% vs 2020-23 volumes to 2.3 million units or 28% of sales. Hybrid will represent 25% of registrations, with two million units sold. This growth comes at a significant cost for diesel and petrol derivatives. Diesel share over the four years will shrink to just 3%, with 62k units registered in 2027, while petrol, with 3.5 million registrations over the four years, will fall 12% to just a 35% share by 2028.This change comes on the back of a new car market that contracted by almost a third in the four years between January 2020 and December 2023, when compared to the equivalent period 2016-19, a loss of 3.1 million cars. The composition of the UK car parc has also changed. In 2016, EV claimed just 0.4% share and hybrid took 3%. By 2019, this had risen to 1.6% and 6%, respectively, and by the end of 2023, their share had each shot up to 17% and 20%.

The opposite can be said for petrol and diesel. In the period 2016-19, ICE cars made up 95% of new car registrations. That number fell to 71% in the period 2020-23, a loss of 4.6 million cars. The ICE decline accelerated throughout this period, dropping from an 83% market share in 2020 to 64% in 2023. Cox Automotive forecasts a further drop of 35% between now and the end of 2027, meaning just 784,000 new ICE vehicles will hit the road in 2027 versus the 1.2 million recorded in 2023.

Diesel has experienced the most dramatic decline, from a 38% share in 2016-19, to 13% in 2020-23. By 2023, diesel vehicles – including mild-hybrid variants – represented just 8% of new registrations. Cox Automotive predicts that this share will have declined to 3% by 2028, a loss of a further 488,000 vehicles over four years, in addition to the 2.9 million lost since 2020.

At 57% in 2016- 19 vs 58% in 2020-23, petrol volumes have remained steady. Still, Cox Automotive foresees a decline over the next four-years, with its share of all registrations dropping to 51% by the end of this year and 35% by 2028. This equates to a loss of 2.3 million petrol-powered vehicles aged 0-8 years from the used market by the end of 2027. Read full article

Neste has completed its organizational change process, announced on 1 November 2023. Neste informed that it will merge its three renewable business units into one Renewable Products business unit as well as restructure its functions to better support business-driven ways of working.

With the simplified organizational structure and operational model, Neste secures the execution of its growth strategy with improved cost-efficiency and strengthens its long-term competitiveness. The planned organizational changes were expected to lead to a reduction of approximately 400 job roles globally. In Finland, following thorough change consultations, the number of job roles to be reduced has been confirmed at about 320. In addition, it is estimated that 70 job roles will be reduced globally. Neste offers its employees support in adapting to the situation in different ways.

The restructuring is expected to result in total annual cost savings of approximately EUR 50 million. Neste communicated on its Capital Markets Day in June 2023 that it is targeting over MEUR 350 value creation with its Neste Excellence program by the end of 2026, compared to the year 2022 acting as the new base year. The organizational changes and a more streamlined development portfolio are concrete steps in the program. . Read More

Spectrum Markets, the pan-European trading venue for securities, has published its SERIX sentiment data for European retail investors for February, revealing increasingly bullish trading behaviour linked to natural gas.

Since mid-January, the price of natural gas has experienced a decline, although there has been considerable volatility. After peaking in 2022 at around $10, the price has since been falling in 2023 and has rarely exceeded $2.

Spectrum Markets made instruments on natural gas available in March 2023, in response to investor demand, and it has seen bullish SERIX sentiment for all but one of the months since then, reaching 119 points in February 2024.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

Market opinion; “There are several reasons why the natural gas price has fallen since the beginning of the year. Among the factors are the attempts to diversify energy sources as a means of reducing emissions, as well as a decreasing domestic demand and high inventories resulting from a mild winter, coupled with a high production volume”, says Michael Hall, Head of Distribution at Spectrum Markets. “However, from a European perspective there is a different view on this: Investors are noting a stable demand for LNG gas deliveries and observing increasing LNG shipments from the United States to European ports due to Europe’s efforts to reduce dependence on Russian natural gas supplies. According to the Council of the European Union, the EU is already the largest LNG importer in the world. The ongoing conflict has prompted EU member states to further develop their LNG infrastructure and import capacity. That is why retail investors have tried to capitalise on the currently low price and took a long position on natural gas”, adds Michael Hall. . Read More

The nomination committee in Equinor ASA recommends that the company’s corporate assembly elects Mikael Karlsson as new member to Equinor ASA’s board of directors. The board in Equinor ASA has consisted of 10 members after Michael Lewis left the board in March 2023. It has been desired to increase to 11 members. The nomination committee recommends Mikael Karlsson as new shareholder elected member of the board of directors.

Karlsson is partner and Vice Chairman of Actis Capital, a leading global investor in sustainable infrastructure. In the period 2021-2023 he was Chief Investment Officer in Actis, in 2012 he became partner in Actis and had the role as Head of Energy and Infrastructure from 2015-2021. From 2009-2015 he was CEO in Globeleq, an Actis portfolio company. Karlsson held several roles in ABB Energy Ventures before he came to Actis.

Karlsson has a Master in Business Administration from the University of Massachusetts in USA and a Master of Science in Industrial Engineering and Management from Linköping Institute of Technology in Sweden. The election to Equinor’s board of directors takes place in the company’s corporate assembly meeting Wednesday 20 March 2024. It is proposed that the election enters into effect from 1 April 2024 and is effective until the ordinary election of shareholder-elected members to the board of directors in June 2025. Read More

Mitsubishi Heavy Industries, Ltd. (MHI) has concluded a license agreement with Kellogg Brown & Root, Ltd. (KBR, Ltd.), an operating company of the first-tier American engineering firm KBR, Inc., to provide CO2 capture technology for a low carbon hydrogen production plant being established in Cheshire in northwest England. The project, Hydrogen Production Plant 2 (HPP2), will be constructed at the Stanlow Manufacturing Complex, which hosts one of the UK’s leading refineries. The project owner is EET Hydrogen, the leading player in low carbon hydrogen production projects in the UK. KBR, Ltd. will provide hydrogen production process technology and the front-end engineering design (“FEED”)..Under the agreement, MHI will license its “Advanced KM CDR Process™”, CO2 capture technology developed in collaboration with the Kansai Electric Power Co., Inc., and also provide the process design package (PDP) for the new post combustion CO2 capture plant. HPP2 will have an annual hydrogen production capacity of nearly 230,000 tons, which is expected to be the UK’s largest-scale low carbon hydrogen plants when it begins operation. HPP2 is a key pillar of the HyNet carbon capture, utilization and storage (CCUS) cluster. The captured CO2 will be permanently sequestered into depleted gas fields under the sea in Liverpool Bay.

The UK Government’s Department for Energy Security and Net Zero (DESNZ) has selected two initial clusters – HyNet (where EET Hydrogen is leading the critical hydrogen production projects) and East Coast. HPP2 augments the Hydrogen Production Plant 1 (HPP1) scheduled for construction as part of the large-scale low carbon hydrogen plant infrastructure planned by EET Hydrogen in the HyNet cluster. Read More

Mitsubishi Heavy Industries Thermal Systems, Ltd., a part of Mitsubishi Heavy Industries (MHI) Group, will launch 31 new models of residential-use air-conditioners for the Japanese market for 2024. The new models in five series will be released starting April 1. The 2024 lineup comprises nine models in the Company’s top-of-the-line S Series, featuring outstanding energy efficiency, functions for comfort and cleanliness, and a high Annual Performance Factor (APF), four models in the SK Series with enhanced heating capacity for use in cold regions, six models in the high-performance R Series incorporating an automatic filter cleaning function, seven models in the standard T Series, and five models in the TWF Series of T Series models with smartphone control functionality included as standard. Together these new models provide comfortable living spaces for diverse lifestyles. Read More

The total assets of Saudi Arabia’s Public Investment Fund (PIF) have surged by $163.6 billion to $940.26 billion, Sovereign Wealth Fund Institute said in its latest update.

The growth in PIF’s assets is attributed to Saudi Arabia’s transfer of an 8% stake in oil giant Aramco to the fund’s portfolio companies. The fund rose one rank to become the fifth-largest globally.

The stake was estimated at $163.6 billion, according to Aramco’s market capitalisation, LSEG data showed.

PIF directly owns a 4% stake in Aramco, which was transferred in 2022, and an additional 4% indirectly, which was transferred last year to its wholly-owned unit Sanabil Investments.

The top four SWFs globally are Norway Government Pension Fund Global ($1.65 trillion), China Investment Corporation ($1.35 trillion), SAFE Investment Company ($1.09 trillion) and Abu Dhabi Investment Authority ($993 billion). Following the latest transfer, the state holds 82.186% of Aramco. Read More

Abu Dhabi’s Advanced Technology Research Council (ATRC), a UAE-based advanced technology research body, and the South Korea-based Seoul Robotics, an industrial autonomous driving company, are exploring a partnership for joint research and development (R&D) in the field.

The discussions focused on sharing insights into the current state and the outlook of the industrial autonomous driving market, with emphasis on potential collaboration opportunities across R&D, according to a statement from Seoul Robotics.

Of the areas highlighted was autonomous robotics, including Seoul Robotics’ proprietary industrial autonomous driving software, the Level 5 Control Tower (LV5 software), which is being considered for potential application in the automotive logistics sector within the Middle Eastern market.. Read More

| Oil and Gas Blends | Units | Oil Price US$/bbl | Change |

| Crude Oil (WTI) | USD/bbl | $78.55 | Up |

| Crude Oil (Brent) | USD/bbl | $82.91 | Up |

| Bonny Light | USD/bbl | $85.45 | Up |

| Saharan Blend | USD/bbl | $83.74 | Down |

| Natural Gas | USD/MMBtu | $1.69 | Down |

| Murban Crude | USD/bbl | $83.57 | Up |

| OPEC basket 12/03/24 | USD/bbl | $82.61 | Down |

OPEC announced it took note of the International Energy Agency (IEA) reaffirming the significance of oil security to energy transitions in its most recent commentary: ‘A strong focus on oil security will be critical throughout the clean energy transition’.

At OPEC, we are encouraged by this message and the reference to the continuing importance of oil to the world. The IEA says in its commentary: “An enduring focus on oil security is a consequence of the continued need for oil to fuel cars, trucks, ships and aircraft, as well as to produce the petrochemicals necessary to manufacture countless everyday items”.

These messages have been strongly voiced by OPEC for many years, and we will continue to reiterate that energy security, energy affordability and reducing emissions need to go hand-in-hand, as we look to an all-energies, all-technologies and all-peoples approach to energy transitions.

The IEA’s commentary also underlines a number of other critical points.

It notes that “investment uncertainty raises the risk of a supply-demand imbalance” and talks of how this can leave “oil companies facing difficult and commercially risky decisions.” This is true, but it is important to stress that the IEA’s talk of the need for no new oil and natural gas fields in its net zero pathway has contributed significantly to this uncertainty, which has the potential to lead to major energy chaos, not the desired energy security.

It highlights that oil supply security is threatened by an array of additional factors, such as geopolitics, extreme weather events and cyber-attacks. It is important to stress that these factors have the potential to affect all energies, as well as all economic sectors. The oil sector is not isolated in this regard.

It also references “the emerging security dimensions of clean energy transitions, such as critical mineral supplies.” Critical mineral supply chains will also come under pressure in the IEA’s net zero pathway, given that the IEA says a typical electric vehicle needs six times the mineral inputs of a conventional car.

It is incumbent on all industry stakeholders to focus on and contribute to oil security, in all facets, given the immense benefits that oil, and the petroleum products derived from it, continue to provide to people and nations across the world.

OPEC has consistently reaffirmed its commitment to oil market stability and security of supply, including through its Members holding spare capacity at their own cost in case of any unforeseen global oil supply disruptions. We have also underscored how underinvestment in the industry could imperil that security. The stakes are high. This warrants clear and consistent messaging from all energy stakeholders on how vital oil and energy security is for the health of the global economy and the welfare of billions around the world. . Read full article

Baker Hughes Rig Count: U.S. -7 to 622 Canada -6 to 225

U.S. Rig Count is down 7 from last week to 622 with oil rigs down 2 to 504, gas rigs down 4 to 115 and miscellaneous rigs down 1 to 3.

Canada Rig Count is down 6 from last week to 225, with oil rigs down 3 to 141, and gas rigs down 3 to 84.

International Rig Count is down 7 rigs from last month to 958 with land rigs down 5 to 735, offshore rigs down 2 to 223.

The Worldwide Rig Count for February was 1,813, up 30 from the 1,784 counted in January 2024, and down 108, from the 1,921 counted in February 2023.

| Region | Period | Rig Count | Change |

| U.S.A | 08 March 2024 | 622 | -7 |

| Canada | 08 March 2024 | 225 | -6 |

| International | February 2024 | 958. | – 7 |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication [email protected]

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,

Subscribe to Oil, Gas, Energy News Release Service