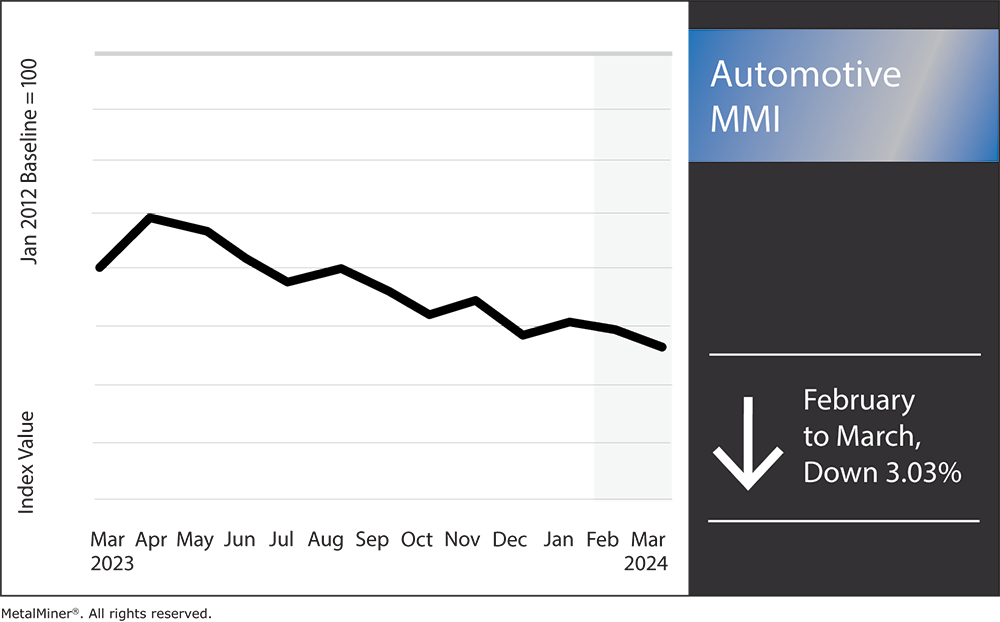

Month-over-month, the Automotive MMI (Monthly Metals Index) dropped by 3.03%. While the automotive market continued to improve overall, bearish pressure on certain steel prices like hot-dipped galvanized steel, ultimately forced the index down. Experts anticipate this bearish pressure to continue impacting both steel prices and automotive manufacturing in the short term. Despite this, the automotive market, in general, witnessed a welcome rebound in sales after a quiet beginning to the year.

Get valuable market trends, price alerts, and commodity news, supporting your business in mitigating the impact of increasing metal prices. Register for MetalMiner’s weekly newsletter.

February’s Rebound in Auto Sales

The U.S. auto sector experienced a slight uptick in sales in February. After a sluggish start to the year, sales of new cars increased significantly. Notably, Ford saw a 10.5% increase in sales, mainly driven by the desire for SUVs and hybrids. Meanwhile, various forecasts and analyses by S&P Global Mobility, Cox Automotive, and J.D. Power-GlobalData also indicated a positive trend in U.S. auto sales.

S&P Global Mobility predicted that February 2024 would see a modest uptick in U.S. car sales. This included a light vehicle sales volume of 15.9 million units, up 3% from the prior year. Such an optimistic assessment suggests a bright future for U.S. automotive manufacturing as both the domestic market and consumer demand seem to be growing.

According to Cox Automotive’s projections, the seasonally adjusted annual sales rate (SAAR) for new cars will grow from January to February and reach around 15.4 million units. This, combined with the rising sales, further supports a favorable trend for 2024.

Microchip Shortages Still Affecting Automotive Manufacturing

Despite this short-term uptick in the consumer end of the automotive industry, things on the automotive manufacturing end still face an ongoing problem that could counter sale increases: microchip shortages. Even with advancements, the problem of chip scarcity remains far from resolved, leading to continuous disturbances in the global automobile industry.

Forecasts for 2024 indicate that the number of new cars on the market will rise, getting closer to pre-pandemic levels and perhaps approaching three million units. This recovery shows that the sector continues to head in the right direction. However, this could contrast sharply with potential low supplies during this era of chip scarcity.

IDC, a market research group, predicts that chip scarcity could continue to worsen in 2024. This forecast is consistent with the industry’s assumption of a minimum 20% rise in revenue for the semiconductor sector. Despite attempts to address supply chain difficulties, there is still difficulty certifying capacity for usage in the automotive industry. This suggests that chip shortages could linger throughout 2024 and beyond.

Stay updated on news impacting raw materials for automobile manufacturing with MetalMiner’s MMI report.

Raw Materials for Microchips Scarce

The automotive sector saw a huge impact due to the ongoing problems with locating raw materials for car microchips. Indeed, numerous issues interfering with the supply chain and production processes have led to a scarcity of these vital materials. Meanwhile, the growing complexity of modern automobiles only worsens the impact of this scarcity, as most new vehicles require an ever-growing number of semiconductor chips.

The typical automobile now boasts around 1,400–1,500 chips, and some can have up to 3,000. This heightened demand, in conjunction with obstacles in the supply chain and disturbances in acquiring raw materials, continues to contribute to a growing disparity with the availability of raw materials. This enormous economic value at stake only emphasizes how critical it is to overcome the current chip scarcity and avoid major disruptions that might affect the automobile industry.

Meanwhile, the semiconductor industry and the automotive sector continue to devise ways to lessen the effects of these shortages and guarantee a more reliable supply chain going forward.

Automotive Manufacturing: Noteworthy Price Shifts

Steel prices and automotive manufacturing remain closely linked. Check if your service center is providing you with price transparency for your steel spend.

- Chinese lead moved sideways, dropping 2.61%. This left prices at $2,194.69 per metric ton

- Korean aluminum 5052 coil premium over 1050 also moved sideways, falling 2.12%. Prices at month’s start sat at $3.84 per kilogram

- Finally, hot-dipped galvanized steel experienced the largest month-over-month decline. Priced dropped 10.61% to $1238 per short ton