London, 19 February 2024, (Oilandgaspress): -US Federal Energy Regulatory Commission (FERC) on Feb. 15 approved two projects to increase US natural gas exports.FERC granted Tellurian Inc. a 3-year extension to put its 27.6-million tonne/year (tpy) Driftwood LNG plant on the Calcasieu River, south of Lake Charles, La., in service. FERC also approved the Saguaro Connector pipeline — proposed by Oneok — that would run about 500 miles and transport 2.8 billion cubic feet of gas per day from Texas to the coast of Mexico.

Alpine A290: the future full-electric hot hatch sport car, continues testing in Sweden near the Arctic Circle The A290 has been fine-tuning its low grip characteristics since the start of the year, in the most extreme weather conditions with temperatures that can drop below -30°C. Alpine’s technical teams test the prototypes on tracks and open roads in these conditions to ensure excellence across the board.

All the technical parameters are subject to full-scale tests to guarantee the required performance levels are achieved. As with every Alpine, particular attention is given to dynamic performance on the A290. Engine responsiveness, brio, driving precision and agility are all given the utmost attention to deliver a driving experience that extends to extreme conditions. A wide range of equipment is also being tested, including heating, the quality of defogging and defrosting, and ESC (Electronic Stability Control) on snow. None of these points can be reproduced in a technical centre and can only be validated in extremely cold conditions. For its first official outing, the A290 sported Alpine’s original camouflage, the ‘A-Arrow’ logo on the roof and the Alpine Blue colour scheme. The prototype was presented for the first time with its definitive bodywork and validated dimensions: length 3,990 mm, width 1,820 mm, height 1,520 mm, wheelbase 2,530 mm. The A290 also unveiled an exclusive Alpine sport steering wheel in Nappa leather, with a flattened surface and a centre point, reminiscent of motorsport that is so much a part of the brand’s DNA. It includes three essential functions borrowed from Alpine’s Formula 1 steering wheels: OV (Overtake), RCH (Recharge) and Drive modes with one-touch access. Read full article

Chemship today commissioned its first ship with wind assisted ship propulsion. This makes the MT Chemical Challenger the first chemical tanker in the world to be equipped with sustainable wind technology. The ship will serve on shipping company Chemship’s Trans-Atlantic route between the East Coast of the United States and the Mediterranean.

This week four 16-metre-high aluminium wind sails were installed on board the 134-metre long vessel. The VentoFoils from Econowind create a direct wind surface of 180 m2. Smart vacuum technology quintuples the force of the wind, creating a gross wind surface of 900 m2. This is equivalent to an imaginary sail of 30 by 30 metres. Chemship expects to achieve an average CO2 reduction of 10% with these turbo sails.

Leading the way in sustainability

Chemship has a relatively young fleet with an average ship age of seven years. With wind assisted ship propulsion, CEO Niels Grotz sees shipping returning to its roots: “As an avid sailor, I know the power of the wind. We will now harness this sustainable and free energy source on MT Chemical Challenger. Despite the fact that shipping already has the lowest carbon footprint of all transport modes, we can use wind to make our existing fleet even more sustainable. With the VentoFoils, we will use less fuel and thus reduce CO2 emissions. For this vessel, we anticipate an annual CO2 reduction of 850 tonnes. This is equivalent to the yearly CO2 emissions of over 500 passenger cars.”

ETS CO2 pricing

The emergence of wind-assisted sailing coincides exactly with the introduction of the European Emissions Trading System for the shipping industry. Since 1 January, shipowners have been paying for the emissions associated with transporting goods by sea to and from European ports. Niels explains: “Our customers increasingly demand CO2 reports. The better our ships perform, the higher the rating from our customers. Fewer emissions are not only beneficial for the environment, you will also notice it directly in your wallet.”

Business as usual

The wind sails fit well within the existing configuration of Chemship’s tankers. Operations Director Michiel Marelis explains the choice of wind propulsion: “Shipping is evolution: one step at a time. Chemship was looking for a solution that would not interfere with normal operations. These wind sails were easy to install without adding reinforcements to the ship. They are lightweight, have a small deck ‘footprint’ and do not obstruct the crew’s line of sight. At the push of a button, they can fold or set the sails as needed. Above wind force seven, the sails fold automatically, which is much safer. Now it is learning by doing. With positive results, we will also equip the next vessel with VentoFoils.”

Sustainability strategy

Wind propulsion is part of a larger sustainability plan, as Michiel explains: “The beauty of these turbo sails is that you can show it to customers. They immediately capture everyone’s imagination. We hope this will inspire others to choose wind assisted propulsion too. We also focus on less visible aspects such as improved lubricating oils and a coating that enables the ship to glide through the water more efficiently. Cumulatively, this leads to fuel savings of over 15%. This all goes hand in hand with a CO2 reduction. Chemship remains committed to making the fleet more sustainable.” . Read full article

Mitsubishi Heavy Industries, Ltd. (MHI) received an “A-minus” rating in the Climate Change Report 2023 published by CDP (headquartered in London, U.K.), a non-profit organization that maintains a global environmental information disclosure system. This A-minus is the CDP’s second-highest rating and is one rank up from the B ranking MHI received in the previous year.

CDP scoring and collected environmental data are publicly available on CDP’s platform and widely referenced by institutional investors and companies. MHI believes this improved rating will enable it to draw broad attention to its progress in addressing climate change in its business activities.

Every year since 2002, CDP sends letters to companies on behalf of investors asking those companies to disclose data on their environmental impacts. In 2023, 746 financial institutions (with more than US$136 trillion in invested assets) requested responses to a CDP-prepared questionnaire, and more than 15,000 companies worldwide were asked to provide environmental information.

CDP’s climate change questionnaire is comprehensive in content. It asks companies to provide not only climate change-related environmental data but also assessments of their governance structures as well as of opportunities and risks. Additionally, because the questionnaire’s content is the same worldwide, it provides stakeholders with a tool for comparing the efforts undertaken by different companies. . Read full article

On 1 February Jumbo Offshore and Sea Horizon Offshore Marine Services signed a memorandum of understanding (MoU). With this agreement, Sea Horizon Offshore becomes the representative of Jumbo Offshore in the Middle East region.

Increased regional support

Sea Horizon Offshore, with its broad network of local partners, will represent Jumbo Offshore to potential clients in the United Arab Emirates (UAE), Qatar, and Saudi Arabia. Sea Horizon Offshore’s scope will also include commercial representation, supporting operations and providing project management on behalf of Jumbo Offshore during project execution in the region.

Accelerating efficiency

The MoU paves the way for Jumbo Offshore to provide increased support to the considerable offshore expansion planned in the area over the coming years. Sea Horizon Offshore CEO Danial Kaabi explains.

“Through this MoU, we will provide the Middle East region with greater access to safe, high quality transport and installation (T&I) solutions. Jumbo Offshore represents considerable added value to regional operators. Currently, much of the transport and installation work carried out in the region is performed using a combination of barge and lifting vessel. Jumbo Offshore’s vessels are ideally suited to perform the entire T&I scope from a single platform, offering a significant boost to efficiency.”

The Jumbo Offshore fleet, which includes the Jumbo J-class vessels with a 1,800 t lifting capability, will support the regional offshore development with topside construction, light flex-lay, mooring installation and module installation, amongst other things. Read full article

Jumbo Offshore has recently been awarded a contract by Yunnneg Wind Power Co., Ltd. (YWPC) for the removal of monopiles at the Yunlin Offshore Wind Farm. The contract award represents an expansion of the company’s existing scope, which has involved transport and installation of the project’s transition pieces.

Under the amendment, some monopiles, which were installed during an earlier project phase, are to be removed approximately 3m below mean seabed level. To undertake this scope, Jumbo Offshore will mobilise the DP2 Heavy Lift Crane Vessel Fairplayer.

The vessel will be outfitted with an underwater abrasive cutting and lifting tool as well as an ROV. With these, the Fairplayer will remove the monopiles in several sections. These will then be lifted into the vessel’s 1,400m2 cargo hold for transportation to a local Taiwanese port, where the vessel will offload the monopile sections to the quayside.

Milad Sheikhi, Head of Sales and Business Development at Jumbo Offshore said, “We have been active on the Yunlin OWF project since 2021, carrying out transport and installation of transition pieces and will continue to perform this role in 2024. Being awarded this additional scope shows trust in our performance, project management, engineering and installation capabilities, for which are very grateful to our client.”

Brian Boutkan, Manager Commerce at Jumbo Offshore, added, “We are very proud to have been awarded this additional scope of work on the Yunlin OWF project. We see this as a confirmation that Jumbo’s values bring real benefit to our clients. With our client-centric approach, we aim to cooperate with our customers as a partner in all that we do, in order to offer a reliable service that inspires confidence.”

The Yunlin Offshore Wind Farm is developed by Yunneng Wind Power Co., Ltd., a joint project company involving Skybporn Renewables, TotalEnergies, Electricity Generating Public Company (EGCO) and Sojitz Corporation. Located in the Taiwan Strait between 8 to 17km off Taiwan’s west coast, the 82km2 offshore wind farm will comprise 80 wind turbine generators installed at water depths of between 8 and 35m. Once completed, the 640 MW project will be one of the largest offshore wind farms in Taiwan, producing enough clean energy to serve the energy needs of more than 600,000 Taiwanese households. Read full article

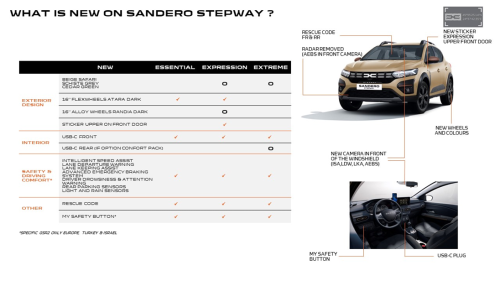

The success story continues for flagship models Sandero, Sandero Stepway, Jogger and Logan

The 4 models are taking advantage of the mandatory switch to GSR II regulatory equipment to bring their customers a little novelty and comfort by upgrading the design and product content.Sandero, leading retail sales since 2017 and N°2 in European sales across all channels in 2023, 3 million units sold since 2008.

Sandero Stepway accounts for two-thirds of the Sandero mix.

Jogger has surpassed 100,000 units sold and leads C-segment (excluding SUV) retail sales in Europe. The HYBRID 140 version accounts for a quarter of the mix.

Logan, 3rd best-selling vehicle in Morocco and 1st in Romania.

GSR II: GLOBAL SAFETY REGULATION II

The latest Global Safety Regulation outlines new vehicle safety requirements in the European Union. The GSR II covers rules designed to improve road safety for all, and that includes pedestrians and cyclists.

As part of changes in the GSR II, certain safety equipment becomes mandatory as of July, 2024.

The entire Dacia range will be compliant with the new regulation. Orders for the Sandero, Sandero Stepway, Jogger, and Logan models are scheduled to open in April 2024 (depending on country).

CHANGES TO PRODUCT DESIGN AND CONTENT

2024 models feature product upgrades, some of which will make vehicles GSR II compliant. Read full article

.Demand for new heavy goods vehicles (HGVs) grew for the second year running with UK registrations up 13.5% in 2023, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Some 46,227 new trucks of all types, sizes and technologies were put on the road last year, representing the best annual total since 20191 as more businesses invested in their fleets.The bulk of new HGVs were rigid trucks, up 14.7% to 24,439 units – more than half (52.9%) of the market – while demand for articulated trucks was also strong, rising 12.2% to 21,788 units.

More specifically, the most popular truck body type continues to be tractors, typically used for the largest delivery trucks, up 12.4% to represent some 46.4% of the market. Demand for box vans – typically used for chilled and fragile goods distribution in urban areas – rose 19.2%, while uptake of curtain-sided trucks and refuse vehicles increased by 37.4% and 14.4% respectively. Tipper registrations declined, however, down -9.2% compared with a strong 2022. Read full article

.Britain’s new bus, coach and minibus market is growing back after three challenging years, with 4,932 new units registered in 2023, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The performance represents a 44.6% increase on 2022 levels as passenger confidence continues to return, although uptake remains -16.0% below 2019 levels.1 The market was driven by strong investment in single and double-decker buses, with registrations up 52.5% and 173.6% respectively. Minibuses also recorded strong growth, rising 18.3% over the year as fleets across the UK invested in new passenger transport assets.:Buses are also at the vanguard of Britain’s net zero journey, with electric or hydrogen vehicles accounting for a phenomenal 45.1% of new single and double decker bus registrations – almost treble the new car market share.2 With 1,159 ZEV buses of all types entering service last year, the UK is Europe’s biggest ZEV bus market by volume.3

Uptake has been supported by Zero Emission Bus Regional Area (ZEBRA) funding, originally awarded in 2022, with finance eventually trickling through during last year. With 58 expressions of interest filed for the second round of funding at the end of 2023, ensuring rapid approval and allocation of cash will be essential to help more regions roll out affordable, zero emission mass mobility more quickly – vital for achieving the UK’s net zero goals. Given that any new funding needs to be invested by January 2025, there is no time to lose. Read full article

Vestas has completed the sale of its 12,5 percent shares in Lake Turkana Wind Power Limited (LTWP) in Kenya. The shares have been acquired by the Climate Finance Partnership (CFP), which is managed by BlackRock, after CFP in March 2023 announced its intention to acquire the shares held by Vestas Eastern Africa Ltd. The purchase price remains undisclosed.

With its 310 MW, the LTWP wind farm remains the largest in Africa to date. Vestas has been a shareholder in LTWP since 2014 from development and construction until power generation. The project was connected to the national Kenyan grid in 2018. Today, 365 Vestas turbines create electricity for 1,2 million Kenyan homes which counts for app. 14 percent of the overall electricity demand in Kenya. Vestas will continue to service the turbines, each with a capacity of 850 kilowatts.

In addition to generating power, the LTWP project has ensured that local communities benefit from the project, including in terms of stronger road infrastructure and job creation. The divestment follows Vestas strategy of developing wind farms without being a long term owner. The sale is the result of a sales process run by Vestas in cooperation with Finnish Fund for Industrial Cooperation Ltd. (Finnfund) and the Danish Investment Fund for Developing Countries (IFU), who have also sold their respective shares in LTWP to CFP. The transaction will have negligible impact on Vestas earnings or outlook.. Read More

.Global Energy Storage Group (GES), a leading provider of innovative energy storage solutions, is delighted to announce the successful sale by its subsidiary, GPS Innova Singapore Pte. Ltd., of 100% of the issued share capital of SRS Middle East FZE to Paragon Capital Pvt Ltd, a prominent investment firm specialising in the energy sector. SRS is a terminal comprising of 178.6 thousand cubic metres of storage capacity for petroleum products and petrochemicals. GES began developing the terminal on the then-greenfield site in 2018, and it was commissioned in 2020. SRS Middle East FZE, a subsidiary of GPS Innova Singapore Pte. Ltd., has been a significant player in the energy storage industry, offering innovative solutions and services to clients in the Middle East region.

The sale of SRS Middle East FZE aligns with GES’s strategic focus on optimising its focus on its core business operations to facilitate the energy transition, particularly through cryogenic storage of gases such as LNG, LPG, ammonia and hydrogen.

The transaction reflects GES’s commitment to enhancing shareholder value and further strengthening its position as a leader in the global energy storage industry.

Peter Vucins, CEO of GES said: “Having built the terminal from scratch, we have once again proven our world-leading capability to develop strategic assets on greenfield sites.” “We are pleased to have concluded this sale to Paragon Capital and are confident that they will do a great job as the new owners. I want to thank the SRS team for a great performance over the last six years since the terminal construction began, most notably in relation to our excellent HSE track record and awareness.” The Hamriyah Terminal, located strategically in the heart of the UAE, has been a vital asset for Global Energy Storage, offering state-of-the-art facilities for the storage and distribution of energy products. Under Paragon Capital’s ownership, the terminal is poised to further enhance its capabilities and continue serving as a key hub in the region’s energy infrastructure. The terminal, which commenced construction in 2018, was completed in the summer of 2020 and boasts a capacity of 178,640 cubic meters. Susmit Gupta, Managing Director of Paragon Capital said: “We are delighted to have completed the acquisition of this state-of-the-art storage terminal in UAE which is run by an excellent team. We strongly believe that UAE will be a leading force in the energy sector, and this asset aligns very well with our strategy and investment thesis” Read More

In pursuit of meeting the targets of 20% (unconditional) and 47% (conditional) greenhouse gas emission reduction as contained in the Nationally Determined Contribution under the Paris Accord signed by the President Bola Ahmed Tinubu administration, the NNPC Ltd/TotalEnergies Joint Venture has achieved zero routine gas flare in all its assets. This feat was announced on Thursday during an inspection tour of OML 100 in South-eastern Niger Delta, off Port Harcourt, by a joint team of NNPC Ltd and TotalEnergies to ascertain the success of the OML Flare Reduction Project launched in December 2023.

The NNPC Ltd/TotalEnergies Joint Venture, which is the concession holder of four leases, had hitherto achieved zero routine flaring across OML 99 (2006), OML 102 (2014), and OML 58 (2016), leaving OML 100 as the only lease with routine flaring going on. The significance of this achievement is that the last routine flare volume of about 12MMscf/d (twelve million standard cubic feet per day) of gas has now been eliminated giving rise to a greenhouse gas emissions reduction of about 341KtCO₂e/yr. The achievement is an outcome of a programme introduced by the NNPC Ltd to galvanize action towards achieving the zero routine flare by 2030 across its portfolio of assets. It is also a testament to NNPC Ltd’s prioritization of sustainability anchored on the ‘first R’ of its 5R Strategy (Reduce, Replace, Renew, Re-plant, Repurpose), as it strives to reduce its carbon footprint. Work is ongoing across all other assets within NNPC Ltd’s Upstream Directorate to ensure that all assets achieve zero routine flaring by 2030 or earlier.. Read More

| Oil and Gas Blends | Units | Oil Price US$/bbl | Change |

| Crude Oil (WTI) | USD/bbl | $78.82 | Up |

| Crude Oil (Brent) | USD/bbl | $82.92 | Up |

| Bonny Light | USD/bbl | $85.93 | Up |

| Saharan Blend | USD/bbl | $85.15 | Up |

| Natural Gas | USD/MMBtu | $1.55 | Down |

| OPEC basket 16/02/24 | USD/bbl | $82.63 | Up |

Baker Hughes Rig Count: U.S. -2 to 621 Canada +2 to 234

U.S. Rig Count is down 2 from last week to 621 with oil rigs down 2 to 497, gas rigs unchanged at 121 and miscellaneous rigs unchanged at 3.

Canada Rig Count is up 2 from last week to 234, with oil rigs up 3 to 144, and gas rigs down 1 to 90.

International Rig Count is up 10 rigs from last month to 965 with land rigs up 5 to 740, offshore rigs up 5 to 225. International Rig Count is up 64 rigs from last year’s count of 901, with land rigs up 65, offshore rigs down 1.

The Worldwide Rig Count for January was 1,784, up 45 from the 1,739 counted in December 2023, and down 115, from the 1,899 counted in January 2023.

| Region | Period | Rig Count | Change |

| U.S.A | 16 February 2024 | 621 | -2 |

| Canada | 16 February 2024 | 234 | +2 |

| International | January 2024 | 965 | +10 |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication [email protected]

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,

Subscribe to Oil, Gas, Energy News Release Service