Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Scope 1 emissions emerge directly from a company’s activity. Scope 2 emissions are related to operational electricity use. Scope 3 emissions are those produced by a company’s customers and supply chain — both upstream (before) and downstream (after) its own operations. They typically account for around 80% of a company’s carbon footprint. In some of the most polluting industries such as oil and gas, the number can be even higher.

Only 5% of US companies report their Scope 3 greenhouse gas (GHG) emissions.

New regulations and public awareness are prompting investors to concur with the London Stock Exchange Group (LSEG) that Scope 3 emissions are becoming “one of the most vexing problems in climate finance.” A gap in this data reporting is a major obstacle for investment firms that want to cut emissions out of their portfolio holdings.

It will take reconceptualizing Scope 3 so materiality is considered at a level of complexity per sector. With 15 proposed categories of Scope 3, the questions become:

- To which fully cycle materials should investors pay the most attention?

- What will be the cost of profits if companies are forced to address Scope 3 emissions?

The Nuances behind Scope 3 Emissions

Two-thirds of Scope 3 — half of total emissions — come from the use of products, so reducing Scope 3 emissions will primarily be achieved by changing products or by significantly altering demand dynamics.

The availability, quality, and reliability of Scope 3 data are a concern for many investors. That’s because it’s a lot more difficult to determine Score 3 emissions than Scope 1 or 2 emissions. In fact, there are a whole list of challenges for businesses to efficiently and correctly report and compute Scope 3 numbers. While more organizations than ever are reaching into their value chains to understand the full GHG impact of their operations, most companies miss obvious emissions reduction opportunities because these emissions can affect the profitability that results from the emissions.

As a result, data quality issues and gaps hinder investors’ ability to systematically evaluate Scope 3 emissions and integrate them into investment processes and reporting. Then again, many investment companies aren’t quite ready to stipulate that companies include Scope 3 in their climate reporting.

AXA IM is one such company. They say they’re committed to net zero. But they also realize at this point, “given the challenges of adapting complex value chains, including elements outside of a company’s control” up or down the value chain, “things can get a little murkier.” In sectors more tangentially reliant on fossil fuels, an authentically net zero Scope 3 emissions result would mean entirely phasing out current products or fully reengineering them.

AXA IM acknowledges to its investors:

“As responsible investors seek to align portfolios with their own climate ambitions and more broadly to the global push towards net zero, understanding that more nuanced side of the emissions calculation is becoming ever more important – and ever more possible.”

Bill McKibben reported yesterday that Chase Bank and Blackrock had decided to pull out of the Climate 100 alliance of businesses that were “at least nominally concerned with decarbonizing the earth.” They were joined by Boston’s State Street, which after Blackrock is the second-biggest asset manager on earth; the third biggest, Vanguard, had already left.

Yet these investment firms are only part of the picture. The private Soros Economic Development Fund invests along the life cycle of enterprises, and it has reduced the intensity of Scope 1 and Scope 2 financed emissions by roughly 53% since 2019. To obtain these results, it has restricted investment in fossil fuel intensive companies. It has turned to climate solutions by partnering with companies in high emitting sectors to accelerate their transition to clean energy. Still, limited available data means the Soros fund drop amounts to only about 13%. “Even though we look well on track to hit our emissions reduction targets, we still have a lot of work to do,” Hilary Irby, the firm’s head of impact strategy, told BNN Bloomberg.

FTSE Russell, an LSEG business, argues in a January, 2024 report that accounting for Scope 3 emissions is critical for investors to analyze transition risks associated with their investments. Moreover, they’re needed to comply with Net Zero commitments and evolving regulatory standards.

A broad consensus about full product life emissions is imperative for climate risk assessments. What does that look like, however, as a practical matter in portfolio analysis? It’s a complex equation to calculate all that’s involved in Scope 3 accounting: low disclosure rates, variable data quality, high volatility, and poor comparability are key variables, according to LSEG.

Interestingly, the US EPA states that an organization must report emissions from all relevant categories.

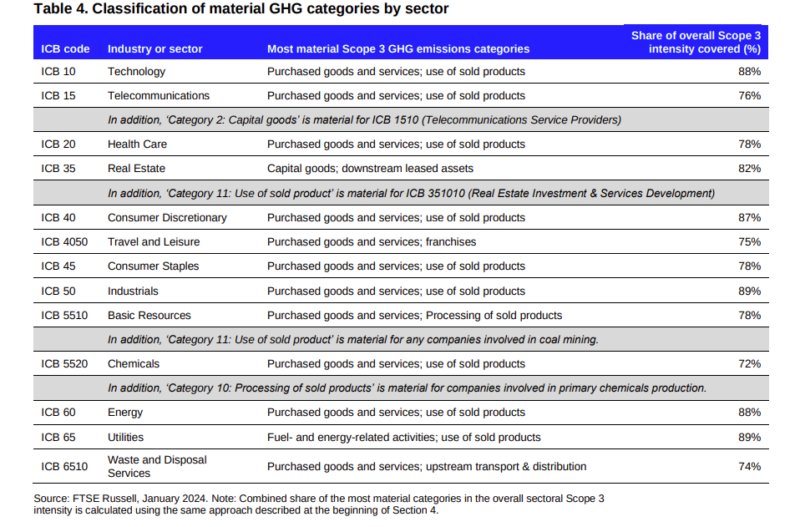

A mere 45% of the 4,000 medium to large sized publicly traded companies in the FTSE All-World Index disclose Scope 3 data, and less than half of those do so for the most material emissions categories in their sector. The research concludes that investors should focus on the two most material Scope 3 categories for an industry because those two categories will account for over three-quarters of the sector’s total Scope 3 emissions. Take the energy industry, for example: purchased goods and the use of sold products account for 88% of Scope 3 emissions intensity.

The main standard for measuring and reporting emissions comes from the Greenhouse Gas (GHG) Protocol. The standards were designed to provide a framework for businesses, governments, and other entities to measure and report their GHG emissions in ways that support their missions and goals. The Protocol’s Corporate Standard Training Webinar is an entry point for corporate GHG emissions accounting. Participants gain knowledge and skills in GHG accounting and reporting principles; business goals and inventory design; setting organizational and operational boundaries; tracking emissions over time; and, identifying, calculating, and reporting GHG emissions. With these parameters in mind, the organization may be able to influence its suppliers or choose which vendors to contract with based on their practices.

The Corporate Value Chain (Scope 3) Standard Online Course teaches business professionals how to account for emissions throughout their value chain via a convenient online learning platform. Building off the Corporate Standard, the Scope 3 Standard allows companies to account and report their full value chain impacts. Many companies are able to zoom in on the contexts that comprise their GHG emissions within their value chain, which makes understanding and managing these impacts so important. The course typically takes 8 – 20 hours total to complete.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.