London, 03 January 2024, (Oilandgaspress): – The United States exported 91.2 million metric tons of LNG last year, after the country’s primary export facility, Freeport LNG, resumed operations after an eight-month hiatus following a fire in June 2022. Meanwhile, EU countries were looking to reduce their reliance on Russian gas and compensate for Russia’s curtailment of pipeline gas into Europe.

Australia was the second-leading LNG exporter in 2023, while Qatar, the leading LNG exporter in 2022, reduced its exports by 1.9% in 2023, came in third, according to new data compiled and shared by Bloomberg Read full article

References are made to the announcements of the Company dated 28 August 2023 and 27 September 2023 (the “Announcements”) in relation to the entering into of the Acquisition Framework Agreement and the Formal Agreement by BE for the purpose of the Acquisition. Unless otherwise stated, capitalized terms used in this announcement shall have the same meanings as those defined in the Announcements.The Board is pleased to announce that as at 29 December 2023, all the conditions precedent of the Acquisition had been satisfied. The cash Consideration for the Acquisition, which is on the basis of RMB15.8 billion (equivalent to US$2.2 billion), is determined to be approximately RMB14.29 billion (equivalent to US$2.01 billion) upon the Closing after adjustment according to the actual amounts of cash, indebtedness and net working capital at the Closing. The financial information of the TargetGroup will be included in the consolidated financial statements of BE.By order of the Board BYD Company LimitedWang Chuan-fuChairmanShenzhen, PRC, 29 December 2023. As at the date of this announcement, the Board of Directors comprises Mr. Wang Chuan-fu being the executive Director, Mr. Lv Xiang-yang and Mr. Xia Zuo-quan being the non-executive Directors, and Mr. Cai Hong-ping, Mr. Zhang Min and Ms. Yu Ling being the independent non-executive Directors. Read full article

The oversea sales volume of New Energy Passenger Vehicle achieved 36,095 units of the Company for the month of December 2023.The installed capacity of NEV power battery and energy storage battery of the Company for the month of December 2023 was approximately17.746GWh. The cumulative installed capacity for the year 2023 was approximately 150.909 GWh. Read full article

Porsche development driver Lars Kern has outdone himself at the Nürburgring: driving a pre-series Taycan, he posted a lap time of 7:07.55 minutes on the Nordschleife. This official lap time is a whopping 26 seconds faster than he was on his last record drive, in a Taycan Turbo S Sport sedan equipped with the performance package back in August 2022. Read full article

The history of the electric car stretches back far longer than we might think.

The photos were snapped way back in 1922 and show a woman dressed in a large hat and gloves posing in a garage with an electric car.

The car in the photos is a Columbia Electric Victoria Phaeton – a type of electric vehicle first produced in 1905.

Bought new, a car like this would have cost $1,600 in 1908, or around $44,000 (£34,803) in modern terms. The car in the photos is a Columbia Electric Victoria Phaeton – a type of electric vehicle first produced in 1905.

According to an earlier brochure from Columbia Electric Vehicles, this car was so popular when it was first released that it completely sold out.

The brochure says that ‘during the 1905 season only one opinion was expressed regarding this carriage, namely, that it was the smartest, fastest most up-to-date, and the most reliable light electric carriage to be had.’

It boasted 24 battery cells, three forward gears as well as two in reverse, and could reach top speeds of up to 15 miles/hour (24km/h). 1890: William Morrison, a chemist from Iowa, creates the first electric car

1900: Electric vehicles account for a third of American car sales

1909: Oliver P. Fritchle creates a car which he claims can travel 100 miles on a single charge

1910: Chargers are widely available in peoples’ homes and in garages

1912: Production of electric cars peaks as the electric automobile starter is invented, leading to a decline in popularity Read full article

Hyundai Motor Group (the Group) held its 2024 New Year address today at Kia AutoLand Gwangmyeong, the first dedicated electric vehicle (EV) plant in Korea, looking forward to the year ahead and outlining the Group’s key areas of focus. Under the theme ‘Together, a Valuable Start,’ Hyundai Motor Group Executive Chair Euisun Chung and executives from the Group’s affiliates shared New Year’s messages and the Group’s future vision. In his New Year’s message, Executive Chair Euisun Chung highlighted, “Our mission this year will be ‘Consistency and Sustainability’ consistently strengthening our capabilities, which will allow us to scale any challenges and achieve sustainable progress.” Chung stressed that ‘consistent change’ and ‘sustainable growth’ are the key words for the Group’s success in the face of increasing global uncertainty and growing competition. Focusing on 2024 and beyond, Chung said, “I am excited about the series of innovations in electrification that will start here at AutoLand Gwangmyeong, the Group’s first EV-dedicated plant, and expand to Ulsan, the United States and beyond.

The Group will complete the redevelopment of the Kia AutoLand Gwangmyeong EV Plant in the second quarter of this year, which will produce the brand’s EV3, a compact EV, for domestic and international sales. Subsequently, Hyundai Motor Group Metaplant America (HMGMA), Kia’s AutoLand Hwaseong EV Plant, and the Hyundai Motor Ulsan EV Plant will be brought online sequentially to introduce innovative EVs to the global market, with an overall Group strategy to become a top three global EV manufacturer by 2030.

“Last November, I was conferred the Most Excellent Order of the British Empire as Honorary Commander (CBE) in recognition of my contributions to strengthening the cooperation and friendship between the UK and the Republic of Korea,” said Chung, adding, “It is the same Order that was bestowed upon the Founding Chairman Ju-yung Chung, who laid the foundation of the Hyundai-UK partnership in the 1970s.”

He expressed his deep gratitude to the Group’s members by saying, “This recognition is the result of the outstanding work and professionalism of all our employees, and I applaud all of you who fully deserve this honor.”

Executive Chair Chung added that he is particularly pleased that the Group’s ‘challenging spirit’ has been passed on like a timeless medal, originating with Founding Chairman Ju-yung Chung and continued by Honorary Chairman Mong-Koo Chung.

Referring to the Group’s ability to overcome numerous crises, Executive Chair Chung emphasized the importance of a healthy character for its companies.

He said, “Weakness will make you stumble but strength allows you to maintain your balance, defy the odds and come out stronger. A company should do the same by making continuous efforts to strengthen itself.”

“Oftentimes it is a painful process,” he added, “but it is absolutely necessary in order to succeed. Only when we, as a company, strengthen ourselves can we conquer our challenges and lay the foundation for sustainable growth.” Read full article

The start of the 2024 edition of the Dakar Rally is just a few days away, and the TOYOTA GAZOO Racing (TGR) Dakar Team has deployed near the starting bivouac at the northern Saudi Arabian city of Alula, where the race is due to kick off with a 28km-long Prologue on January 5th. All five of the team’s GR Hilux EVOs have been fully assembled on site, and will be undergoing a shakedown to confirm that all systems are working as expected, before the team concludes the required technical checks. The team will be represented by Lucas Moraes and Armand Monleon; as well as Seth Quintero and Dennis Zenz, both crews racing in Red Bull colours. Giniel de Villiers and Dennis Murphy will be racing in GR livery, as will their teammates Saood Variawa and Francois Cazalet; and Guy Botterill and Brett Cummings.

The five crews will be taking on the 12 stages of Dakar 2024, starting with the prologue on January 5th near Alula; and ending the final stage leading to the coastal city of Yanbu. The rest day will take place on January 13th in the Saudi capital of Riyadh. Read full article

Dragon Oil, an upstream exploration and production platform wholly owned by the Dubai Government, has launched crude oil production in Egypt and confirmed plans to drill 7 new wells in about two years. The Al Wasl field (North Safa), the company’s first oil discovery in Egypt, was put in on production at an initial rate of 3,000 barrels of crude oil per day, the company said in a statement on Tuesday. Discovered in 2021, the field represents one of the largest oil discoveries in the Gulf of Suez during the last two decades, with an oil reserve exceeding 95 million barrels. The company said it will intensify oil exploration and expansion in the Gulf of Suez by developing fields and repairing wells to boost crude output and expand further in the Egyptian market. Read More

Reference is made to the mandatory cash offer by BW Group Limited (the “Offeror”) to acquire all remaining shares in BW Energy Limited (“BW Energy or the “Company”) for a price of NOK 27.00 per share (the “Offer”), announced in the stock exchange announcement on 13 December 2023 and described in the offer document dated 13 December 2023 (the “Offer Document”).

The Offeror is a close associate to a primary insider in the Company (the primary insider is the chairman of the board of directors of the Company). The Offeror is therefore pursuant to the disclosure requirements in article 19 of the Regulation EU 596/2014 (the EU Market Abuse Regulation) and section 5-12 of the Norwegian Securities Trading Act required to disclose transactions made in securities in the Company. This includes disclosing acceptances received in the Offer on an ongoing basis.

Please see the attached notifications of trading for information on acceptances received by the Offeror.

Reference is also made to section 6.2.2 in the Offer Document. The Offeror has been made aware that the four references to the “nine months ended” in section 6.2.2 should be to the “three months ended” as the financial figures included in sections 6.2.2.1 and 6.2.2.3 of the Offer Document are for the third quarter and not for the first nine months of the year. Read More

Seatrium Limited has been awarded a contract by Shell Offshore Inc. (Shell) to construct and integrate the hull, topsides and living quarters of the Sparta semi-submersible Floating Production Unit (FPU). The contract includes the installation of Shell-furnished equipment and follows the Letter of Intent sealed by both parties on 28 August 2023. The Sparta FPU will be situated in the Garden Banks area of the US Gulf of Mexico, approximately 275 kilometres (171 miles) off the coast of Louisiana. It will feature a single topside bolstered by a four-column, semi-submersible floating hull and is designed to produce 90,000 barrels of oil equivalent per day (boe/d). Seatrium, a leading global provider of engineering solutions to the marine, offshore and energy sectors, is known for its industry-leading approach in assembling topsides safely and efficiently at ground level, which minimises work-at-height risks for workers. The two-level topside for Sparta will be integrated and lifted to the hull using Seatrium’s game-changing Goliath twin cranes capable of lifting up to 30,000 tonnes. Read More

Seatrium Limited announce that its wholly-owned subsidiary, Seatrium Financial Services Pte. Ltd. (SFS) has secured a S$500 million committed revolving credit loan facility (RCF) arranged by DBS Bank Limited, The Hongkong and Shanghai Banking Corporation Limited (HSBC) and Standard Chartered Bank (Singapore) Limited.

The RCF will provide additional funding and liquidity to Seatrium, increasing its financial flexibility. Seatrium acted as the guarantor for SFS and HSBC was the loan facility agent. Mr Paul Tan, Acting Group Finance Director, Seatrium said, “As part of the Group’s proactive capital management, the S$500 million committed revolver will support our business operations and other strategic business needs. Securing the revolving credit facility not only bears testament to Seatrium’s financial strength and business outlook, but also reflects the strong support from top financial institutions for the growth of the offshore, marine and energy industries in Singapore. We would like to express our appreciation to our relationship banks for their unwavering support and trust.”

Mr Lim Wee Seng, Group Head of Energy, Renewables and Infrastructure, Institutional Banking Group, DBS Bank, said, “DBS Bank is pleased to be part of this inaugural club loan to provide Seatrium with funding for strategic growth and new opportunities. As a leading financial institution in Asia, we are committed to helping companies compete on the global stage and strengthening Singapore’s position as a key hub for business.” Read More

Seatrium Limited announced that it has successfully delivered the Floating Production Storage and Offloading vessel (FPSO), FPSO Léopold Sédar Senghor, to MODEC Offshore Production Systems (Singapore) Pte Ltd (MODEC) with no lost time incidents. The FPSO will be acquired by Woodside Energy (Senegal) B.V., who as operator, is progressing the development of the Sangomar Field Development Phase 1 – Senegal’s first offshore oil development. Mr Marlin Khiew, Executive Vice President, Oil & Gas (Americas), Seatrium said, “We are pleased to support Woodside in contributing to Senegal’s oil and gas industry with a first FPSO for deployment in the Sangomar Field, delivering sustainable long-term economic and social benefits for Senegal. FPSO Léopold Sédar Senghor reinforces Seatrium’s standing as the world leader in the conversion, modification, and completion of FPSOs, and attests to our strong execution capabilities and versatility in undertaking a variety of projects as well as providing value-added services. It also marks our 20th major project for MODEC, building on the strong value creation and partnership that we have forged over decades of collaboration.” Seatrium’s scope of work include topsides integration, as well as support for the onshore commissioning of the FPSO. The Sangomar (formerly SNE) field is located 100 kilometres south of Dakar, Senegal’s capital. The FPSO will be moored in waters approximately 780 metres deep and is designed to produce 100,000 barrels of oil per day and will be able to store approximately 1.3 million barrels of crude oil. Read More

NIO Inc. announced that it is notifying holders of its 0.00% Convertible Senior Notes due 2026 (CUSIP No. 62914VAE6) (the “Notes”) that pursuant to the Indenture dated as of January 15, 2021 (the “Indenture”) relating to the Notes by and between the Company and The Deutsche Bank Trust Company Americas, as trustee, each holder has the right, at the option of such holder, to require the Company to repurchase all of such holder’s Notes or any portion thereof that is an integral multiple of US$1,000 principal amount for cash on February 1, 2024 (the “Repurchase Right”). The Repurchase Right expires at 5:00 p.m., New York City time, on Wednesday, January 31, 2024.

As required by rules of the United States Securities and Exchange Commission (the “SEC”), the Company will file a Tender Offer Statement on Schedule TO. In addition, documents specifying the terms, conditions and procedures for exercising the Repurchase Right will be available through the Depository Trust Company and the paying agent, which is The Deutsche Bank Trust Company Americas. None of the Company, its board of directors or its employees has made or is making any representation or recommendation to any holder as to whether to exercise or refrain from exercising the Repurchase Right.

The Repurchase Right entitles each holder of the Notes to require the Company to repurchase all of such holder’s Notes or any portion thereof that is an integral multiple of US$1,000 principal amount. The repurchase price for such Notes will be equal to 100% of the principal amount of the Notes to be repurchased, plus any accrued and unpaid additional interest, if any, to, but excluding, February 1, 2024, which is the date specified for repurchase in the Indenture (the “Repurchase Date”), subject to the terms and conditions of the Indenture and the Notes. Pursuant to the terms of the Indenture and the Notes, the Company will pay additional interest, if any, at its sole election as the sole remedy relating to certain failure by the Company to comply with its reporting obligations. Such failures have not occurred to date. As of January 2, 2024, there was US$301,448,000.00 in aggregate principal amount of the Notes outstanding. If all outstanding Notes are surrendered for repurchase through exercise of the Repurchase Right, the aggregate cash purchase price will be US$301,448,000.00.

The opportunity for holders of the Notes to exercise the Repurchase Right commences at 9:00 a.m., New York City time today, January 3, 2024, and will terminate at 5:00 p.m., New York City time, on Wednesday, January 31, 2024. In order to exercise the Repurchase Right, a holder must follow the transmittal procedures set forth in the Company’s Repurchase Right Notice to holders (the “Repurchase Right Notice”), which is available through the Depository Trust Company and The Deutsche Bank Trust Company Americas. Holders may withdraw any previously tendered Notes pursuant to the terms of the Repurchase Right at any time prior to 5:00 p.m., New York City time, on Wednesday, January 31, 2024, or as otherwise provided by applicable law. Read More

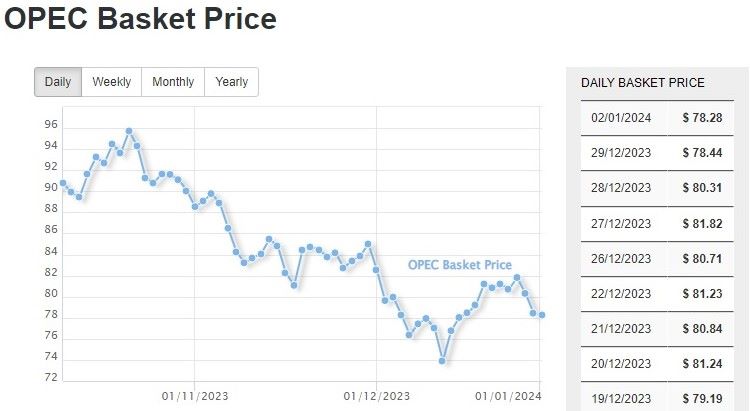

| Oil and Gas Blends | Units | Oil Price US$/bbl | Change |

| Crude Oil (WTI) | USD/bbl | $70.33 | Down |

| Crude Oil (Brent) | USD/bbl | $75.98 | Down |

| Bonny Light | USD/bbl | $77.15 | Down |

| Saharan Blend | USD/bbl | $76.52 | Down |

| Natural Gas | USD/MMBtu | $2.58 | Up |

| OPEC basket 02/01/24 | USD/bbl | $78.28 | Down |

During the period from December 27 to December 29, 2023, Eni acquired on the Euronext Milan no. 3,014,742 shares (equal to 0.09% of the share capital), at a weighted average price per share equal to 15.4053 euro, for a total consideration of 46,442,949.50 euro within the second tranche of the treasury shares program approved by the Shareholders’ Meeting on 10 May 2023, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, here below a synthesis of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read full article

U.S. U.S. +2 to 622 Canada -60 to 86

U.S. Rig Count is up 2 from last week to 622 with oil rigs up 2 to 500, gas rigs unchanged at 120 and miscellaneous rigs unchanged at 2.

Canada Rig Count is down 60 from last week to 86, with oil rigs down 54 to 27, and gas rigs down 6 to 59.

International Rig Count is up 16 rigs from last month to 978 with land rigs up 15 to 758, offshore rigs up 1 to 220.

| Region | Period | Rig Count | Change |

| U.S.A | 29 December 2023 | 622 | +2 |

| Canada | 29 December 2023 | 86 | -60 |

| International | November 2023 | 978 | +16 |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication [email protected]

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,