Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Sodium ion batteries have one advantage over the batteries used to power most electric cars today. They don’t contain lithium. While the world is going crazy searching for new sources of lithium that is not processed in China, sodium is cheap and available virtually anywhere on the planet. Lower cost batteries should be just what the doctor ordered to make less expensive electric cars possible.

Every rose has its thorns, however. Today, sodium ion batteries have roughly half the energy density of lithium ion batteries. That means shorter range, which is the opposite of what most people want in their electric cars. However, there are many markets in which people are more than happy to have lower range, especially if the price is right.

China is one such market where low priced, no frills cars are welcome. One of its most popular electric cars is the Wuling Mini, which is built by a joint venture between state owned SAIC and GM. There is even a way to get one for under $3,000, if the buyer elects to lease the battery rather than purchase it. No self respecting American driver would ever consider one of those cars for use in the US — how would you tow a camper or a ski boat with one? — but for people who just need to drive a few miles around town, it may be the perfect vehicle.

JMEV Sodium Ion Battery Powered Car

As 2024 approaches, two Chinese automakers have announced they will have electric cars powered by sodium ion batteries for sale in the new year. According to CnEvPost, JMEV, an EV brand owned by Jiangling Motors Group, will offer a version of its EV3 fitted with sodium ion batteries from Farasis Energy next year. The first of those cars rolled of the assembly line on December 28, 2023.

The current EV3 uses lithium batteries and has a 31 kWh battery pack and a range of 301 km, using the very optimistic CLTC standard. The sodium battery pack will be rated at 21.4 kWh and will have a range of 251 km. List price will be 58,800 RMB ($8,306), which is about $500 less than the EV3. Is that enough of a difference to make up for the loss of about 50 km of range? For some, the answer will be yes.

The sodium ion batteries from Farasis Energy have energy densities in the range of 140-160 Wh/kg, and the battery cells have passed tests including pin-prick, overcharging, and extrusion, according to the company. It says it will launch its second generation sodium ion battery with an energy density of 160-180 Wh/kg later in 2024. By 2026, it expects its sodium ion battery products will have an energy density of 180-200 Wh/kg.

JAC Sodium Ion Powered Car

Also at the end of December, Anhui Jianghuai Automobile Group Corporation (JAC) announced it has begun production of an electric car powered by cylindrical sodium ion batteries from Hina Battery. It will be priced at 72,900 RMB ($10,600).

Figuring out who owns what in China is a full time job. Volkswagen has a 75 percent stake in (and management control of) JAC and owns 50 percent of JAC’s parent company, Anhui Jianghuai Automobile Group Holdings (JAG). The Chinese government owns the other half of JAG, according to Engadget.

JAC launched its new brand — Yiwei — on April 12 and made the brand’s first model, the Yiwei 3, available on June 16. That car was powered by a lithium ion battery but a sodium ion powered variant was promised for later in the year. But that apparently is not the car that went into production this month. According to Car News China, the Yiwei EV is a re-branded version of the Sehol E10X hatchback announced earlier this year. And who or what is Sehol? CNC has the answer.

“Sehol is a brand under JAC, founded in 2020. The brand was originally called SOL and was owned by a joint venture between JAC and Volkswagen. Later, VW bought a majority stake in the joint venture and used it for building Volkswagen-branded cars on its own MEB platform. The joint venture was renamed from JAC Volkswagen to Volkswagen Anhui. That meant there was no use for the SOL brand anymore. JAC took it over and renamed it Sehol. The Chinese name, 思皓 (Sihao), remains the same.”

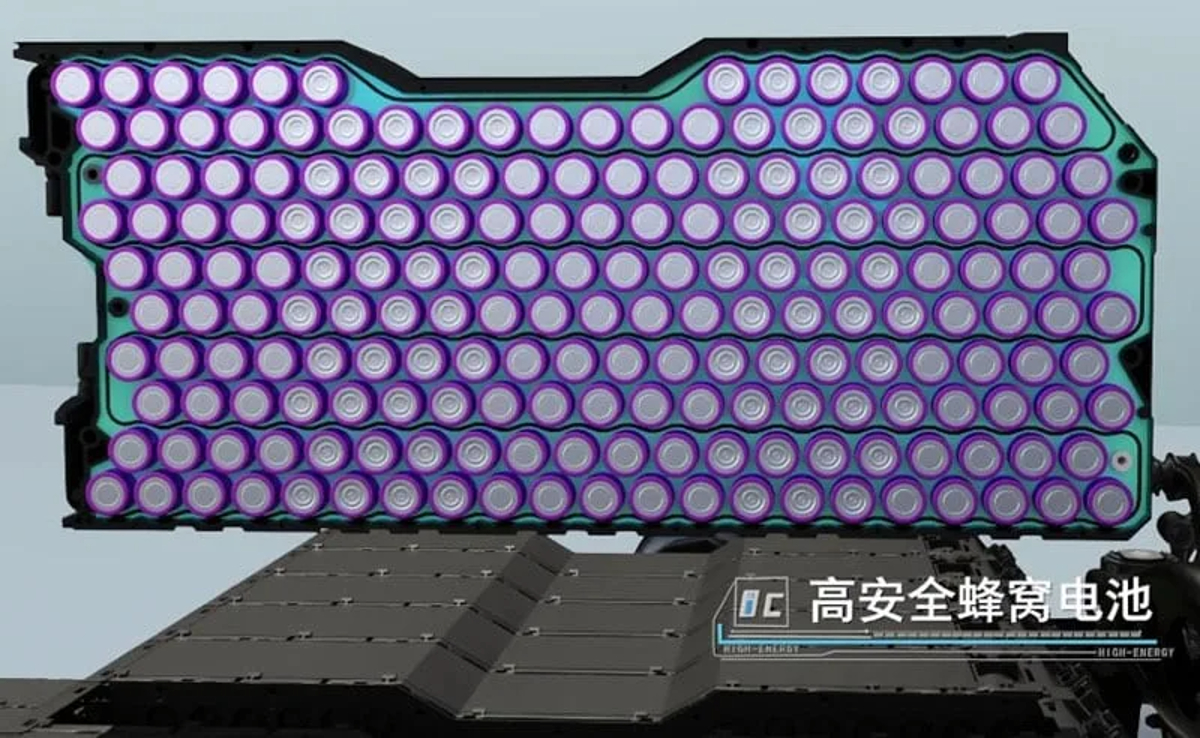

This car is said to have a 252 km (157 miles) range from its 25 kWh battery that uses Hina NaCR 32140 battery cells. Energy density is reported to be 120 Wh/kg and 3C to 4C charging is possible. JAC assembles the batteries in the company’s modular UE (Unitized Encapsulation) honeycomb structure, similar to CATL’s cell-to-pack arrangement and BYD’s Blade battery — a layout that can provide for greater stability and performance.

When JAC revealed the Yiwei brand in May, it said it would drop the Sehol label and rebrand all its vehicles to either JAC or Yiwei. JAC hasn’t yet said whether the Yiwei-branded sodium battery powered model will keep the E10X moniker.

The Takeaway

What’s all the hoopla about sodium ion batteries anyway? Lithium ion batteries are getting better (and cheaper) all the time. Lithium prices have fallen back to earth after hitting stratospheric levels at this time last year. Why bother with something new and different?

One reason is that sodium ion batteries have proven to be less affected by cold temperatures — a persistent issue with lithium ion batteries. And while some may snicker up their sleeves about batteries that have a wimpy 120 Wh/kg energy density, remember that not so long ago, LEDs where so dim they could barely be seen in a dark room and people wondered what in the world they would ever be good for. Now they illuminate our homes and businesses while using a small fraction of the electricity needed to light an old fashioned incandescent light bulb. Today they are so bright they are used as headlights for our vehicles.

Then there is the supply chain issue. China has the world’s supply of battery grade lithium in a hammerlock and is not shy about using its near monopoly to its advantage. Companies in other parts of the world are desperate to find a work around that will let them defeat China’s near total control of the lithium supply chain.

Just last month, Northvolt announced it has developed a sodium battery that completely eliminates reliance on most of the components that go into a traditional lithium ion battery — not only lithium but also cobalt, nickel, manganese, but also the graphite needed for the anode. China controls nearly 98% of all the battery grade graphite available today. To paraphrase Fox Mulder of X Files fame, “Sodium will set you free.”

Supply chains are becoming a dominant concern in manufacturing today. Previously, if you needed something, you would order it from wherever it was cheapest and it would be delivered by container ship to your door. Today, shipping in the Red Sea is being disrupted by pirates and a massive drought in Panama means there is not enough water in the Panama Canal to float all the container ships that want to use it if they are fully loaded.

Supply chain issues are enough to make production managers tear their hair out. Sodium batteries offer the prospect of using abundant, locally sourced materials that are available virtually everywhere. That, more than anything else, is what is driving the push to create sodium ion batteries. CATL said two years ago it had developed one that has 160 Wh/kg of energy density. It has been very quiet about sodium batteries since then.

Expect improvements in energy density for sodium batteries on a regular basis. Once they get to 200 Wh/kg reliably, they may well become the default choice to power most of the electric cars the world needs to make the EV revolution a success.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.