Euro Manganese Inc. [TSX-V and ASX: EMN; OTCQX: EUMNF; Frankfurt: E06] (the “Company”) is pleased to announce that it has signed definitive agreements with OMRF (BK) LLC (“Orion”), which is managed by the Orion Resource Partners Group, for US$100 million in non-dilutive financing (the “Funding Package”) to advance the development of the Chvaletice Manganese Project (the “Project”) in the Czech Republic.

Highlights

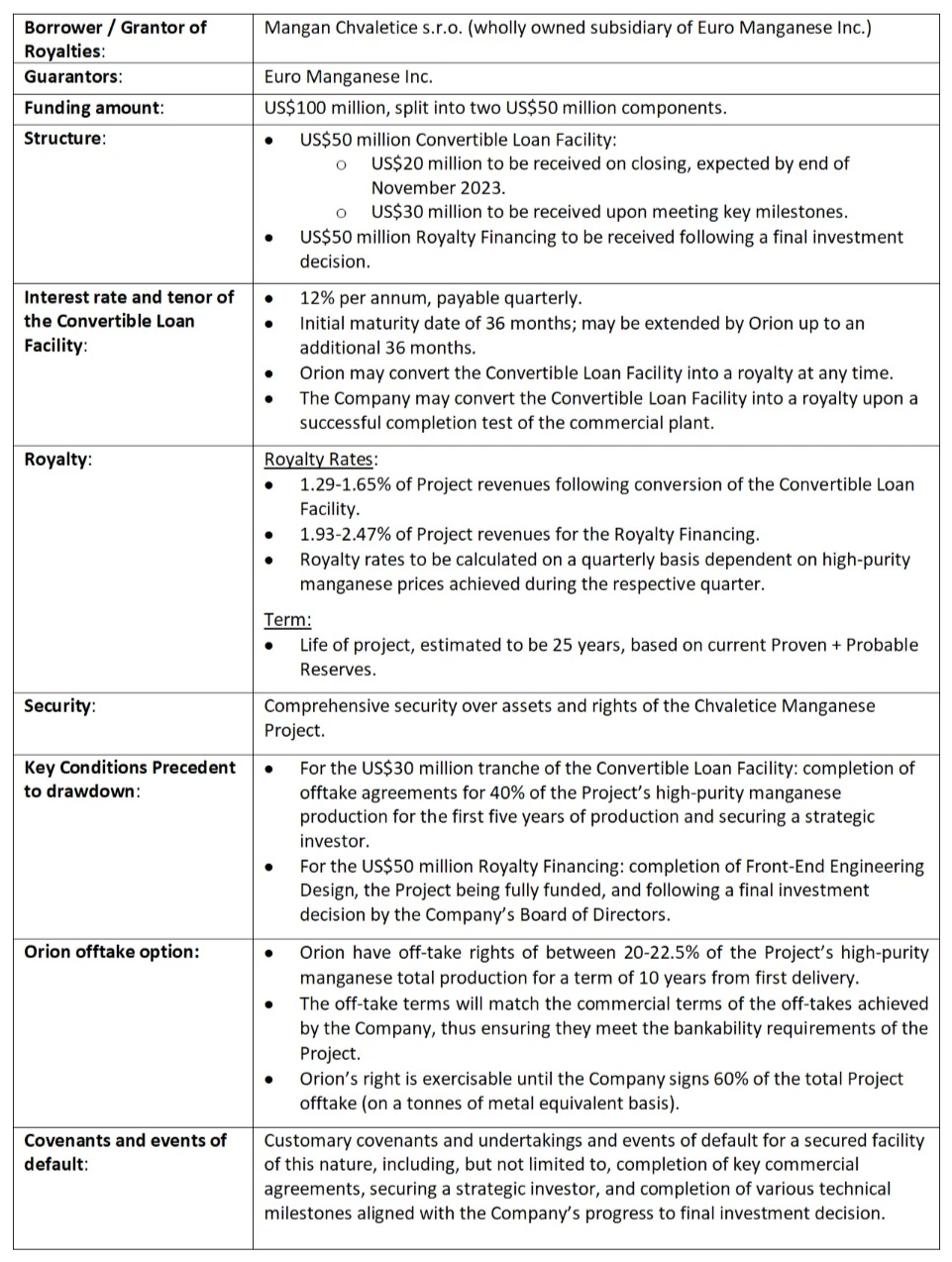

- The US$100 million Funding is split into two US$50 million components:

- A US$50 million loan facility, convertible into a 1.29-1.65% royalty on Project revenues (the “Convertible Loan Facility”), with US$20 million to be received upon closing and an additional US$30 million received upon meeting milestones that have been developed together with Orion to match Euro Manganese’s plans on a Final Investment Decision (“FID”); and

- Receipt of US$50 million in exchange for a 1.93-2.47% royalty on Project revenues following FID (the “Royalty Financing”) by the Company’s Board of Directors and other conditions precedents typical for this type of financing.

- The royalties in both agreements have an embedded sliding scale mechanism. The royalties will be calculated on a quarterly basis and the sliding scale rate is dependent on the high-purity manganese products prices achieved during the respective quarter. As the realised price increases from a lower price forecast to a higher price forecast, the royalty rates decrease from the higher royalty rate down to the lower royalty rate.

- All aspects of the Funding Package were structured to meet Project finance bankability requirements. Both the Convertible Loan Facility and the Royalty Financing sit alongside, and reduce, the project finance debt and equity required for the full Project financing.

- Closing is expected prior to month end and proceeds from the Funding Package will fund development activities related to the advancement of the Project, including G&A expenses related to the Project, which, as the only manganese resource in the European Union, is of strategic importance to domestic electric vehicle battery supply chains and the energy transition.

- In connection with the Funding Package, Orion have an off-take option of between 20-22.5% of the Project’s high-purity manganese total production for a term of 10 years from first delivery, matching the commercial terms of the Company’s sales.

Dr. Matthew James, President & CEO of Euro Manganese, commented:

“This is a transformative transaction for Euro Manganese, providing a Funding Package that facilitates the best possible pathway to a final investment decision and representing a collaboration between Euro Manganese, Orion, and Stifel. The non-dilutive, tranche structure minimises cost of funds and reduces future project financing requirements. This further validates the robust nature of the Chvaletice Project and our Team’s ability to deliver this strategic battery raw material project for Europe to the highest of standards.”

Stifel Nicolaus Europe Limited (“Stifel”) is acting as financial advisor to the Company and Norton Rose Fulbright LLP is acting as legal counsel to the Company. In connection with the Funding Package, the Company has agreed to pay a cash placement fee equal to 2.5%, due and payable to Stifel on the date of closing of each portion of the Convertible Loan Facility, and on the closing of the Royalty Financing.

About Euro Manganese

Euro Manganese is a battery materials company focused on becoming a leading producer of high-purity manganese for the electric vehicle industry. The Company is advancing development of the Chvaletice Manganese Project in the Czech Republic and exploring an early-stage opportunity to produce battery-grade manganese products in Bécancour, Québec.

The Chvaletice Project is a unique waste-to-value recycling and remediation opportunity involving reprocessing old tailings from a decommissioned mine. It is also the only sizable resource of manganese in the European Union, strategically positioning the Company to provide battery supply chains with critical raw materials to support the global shift to a circular, low-carbon economy.

Euro Manganese is dual listed on the TSXV and the ASX and is also traded on the OTCQX.

About Orion Resource Partners Group

The Orion Resource Partners Group is an $8.2 billion global asset management firm that specializes in institutional investment strategies in precious and energy transition metals and minerals. Headquartered in NYC and with offices in Denver, London, and Sydney, The Orion Resource Partners Group includes a team of 80 professionals with backgrounds in metals finance, physical metals logistics and sales, and in-house technical professionals responsible for risk assessment and portfolio management.

Authorized for release by the CEO of Euro Manganese Inc.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) or the ASX accepts responsibility for the adequacy or accuracy of this release.

Inquiries

Dr. Matthew James

President & CEO

[email protected]

Louise Burgess

Senior Director, Investor Relations & Communications

[email protected]

+1 (604) 312-7546

Company Address

#709 -700 West Pender Street

Vancouver, British Columbia, Canada, V6C 1G8

Table 1 – Summary of Key Terms of US$100 million Orion Funding Package

Forward-Looking Statements

Certain statements in this news release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of the Company, its Chvaletice Project, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

Such forward-looking information or statements include, but are not limited to, statements regarding the Company’s intentions regarding the development and advancement of the Chvaletice Project , the closing of the first tranche of the Convertible Loan Facility and related US$20 million draw down, closing of the second tranche of the Convertible Loan Facility and related US$30 million draw down, conversion of the loan into a royalty, the rates of the respective royalties that may be granted, the Company’s ability to meet the conditions precedent required to trigger funding obligations or sale of the royalty, the Company’s ability to advance the Project if it receives some or all of the Funding Package, the Company’s ability to satisfy the conditions precedent and make a final investment decision in order to complete the sale of the US$50 million royalty and the Company’s ability to meet Project finance bankability requirements and secure additional project finance debt and equity required to fund the full development of the Project.

Readers are cautioned not to place undue reliance on forward-looking information or statements. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company.

All forward-looking statements are made based on the Company’s current beliefs including various assumptions made by the Company and information currently available to the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: risks and uncertainties related to the ability to obtain, amend, or maintain necessary licenses, or permits; risks related to acquisition of surface rights; risks related to granting security; securing sufficient offtake agreements; the availability of acceptable financing for developing and advancing the Chvaletice Project and for continued operations; the availability and reliability of equipment, facilities, and suppliers necessary to complete development; the ability to develop adequate processing capacity with expected production rates; timing to start of production and total costs of production; the presence of and continuity of manganese at the Chvaletice Project at estimated grades; the potential for unknown or unexpected events to cause contractual conditions to not be satisfied; developments in EV (Electric Vehicles) battery markets and chemistries; and risks related to fluctuations in currency exchange rates, changes in laws or regulations; and regulation by various governmental agencies. For a further discussion of risks relevant to the Company, see “Risk Factors” in the Company’s annual information form for the year ended September 30, 2022, available on the Company’s SEDAR+ profile at www.sedarplus.ca.

Although the forward-looking statements contained in this news release are based upon what management of the Company believes are reasonable assumptions, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the Company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.