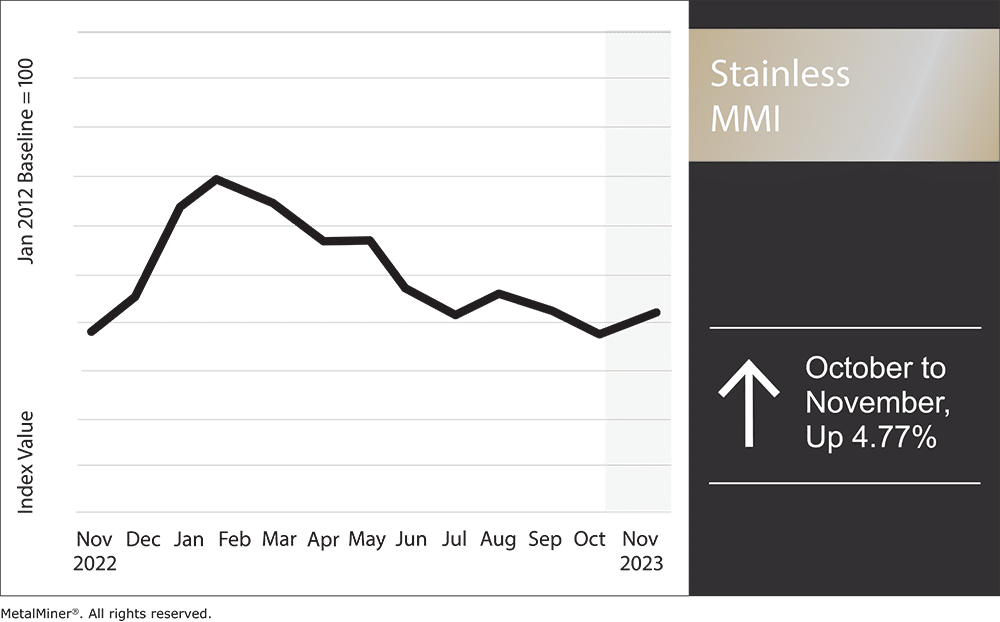

The nickel price index continued to decline during the month, dropping a total of 4.06%. While prices remain above their pre-squeeze historical average, they recently fell to their lowest level since October 2021 as they continue to slip below short-term support. All components declined during the month, which saw the Stainless Monthly Metals Index (MMI) fall 4.56% from October to November.

Crush the competition by getting access to weekly exclusive nickel market intel. Opt into MetalMiner’s free weekly newsletter.

Stainless Market Remains “Challenging”

The domestic stainless market continued to grapple with lower demand during the month. Compared to tight supply conditions seen in years past, no products currently stand in allocation, with mills reportedly willing to produce everything. Even 201, which offers lower profit margins, remains easy to source domestically.

Both North American Stainless (NAS) and Outokumpu encountered a slowdown during Q3. While Outokumpu noted a “solid performance in the Americas” relative to Europe, the Americas still saw a decrease in deliveries quarter-over-quarter. In terms of both markets, Outokumpu’s deliveries fell roughly 9%. This reflects an 11% decrease year-over-year.

Meanwhile, Acerinox, the parent company of NAS, noted that its quarterly results “in a challenging environment reflect the company’s resilience at low points in the cycle.” According to the company’s most recent quarterly report, both sales and melt shop production declined. In fact, stainless production saw a 9% quarterly decline, which reflects a 12% year-over-year drop. Stainless net sales also fell by 14% from Q2, a 36% drop from Q3 2022. Amid weak demand for stainless flat products, apparent U.S. consumption through August dropped by 27%. Over in Europe, consumption fell 26% through September.

The nickel price index may fluctuate, but we always know what you should pay for metals! MetalMiner’s should-cost models are the ultimate savings hack, showing you the “should-cost” price for gauge, width, polish, and finish adders. Explore what value they can add to your organization.

Producers Suggest Optimistic Outlook, but Risks Remain to Stainless Steel Prices

Both Outokumpu and Acernox noted certain positive shifts within the market. Despite being a historically slow period of the year, Outokumpu appeared optimistic about Q4. The producer estimated that improved European demand would see total stainless deliveries rise between 0-10% from Q3. This could receive significant aid from the implementation of the Carbon Border Adjustment Mechanism (CBAM), which will likely raise the cost of imports coming into the region.

Meanwhile, Acerinox noted that inventories in both the U.S. and Europe have “normalized,” which could translate to improved demand. Indeed, high inventories throughout the supply chain amid a bearish market caused mill lead times to shift historically short. Acerniox believes current inventory levels suggest the de-stocking process is “already completed in all markets.”

That said, there’s reason to question the optimism among stainless producers. While domestic inventories may have “normalized,” lead times have yet to show any meaningful recovery. Moreover, manufacturers and distributors will unlikely build out inventories further through the end of the year. This could extend longer amid the currently down market, which would offer no support to prices or demand.

Currently, service center Ryerson expects its own Q3 slowdown to continue through the remainder of the year, as high interest rates and free-falling nickel prices remain substantial risks for holding material. This could translate to inventory levels falling below average throughout the domestic supply chain as companies look to avoid losses amid bearish pricing.

Do you have a buying strategy based on current nickel price trends? MetalMiner’s Monthly Buying Outlook Report provides monthly price forecasts and purchasing strategies for 10 different metal types. Opt in and view a free sample copy.

Nickel Price Movements: Inventories Down Y-O-Y as Bears Await Rebuild

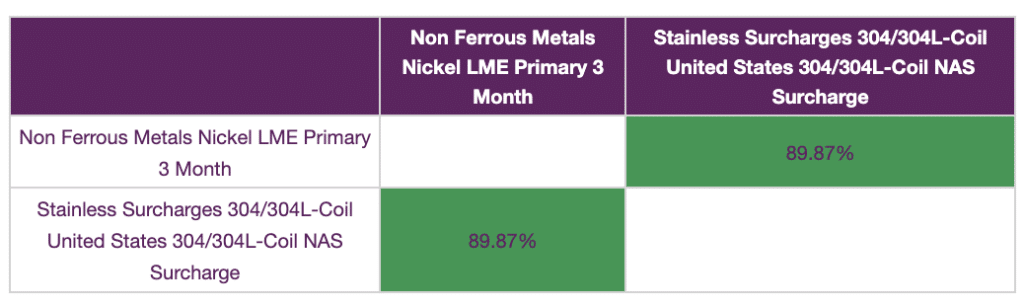

Among its components, the nickel price has the strongest influence over the stainless surcharge. Curiously, LME inventories remain down, having dropped over 27% from the start of the year. Still, falling prices suggest strong bearish momentum. Indeed, the stock decline appears even more significant when compared to 2021.

Although inventory levels across base metals have a negligible correlation with prices, markets nonetheless pay attention. Projections of higher supply – primarily from Indonesia – seem to underpin much of the current market bias. In fact, during LME week, one estimate suggested that Indonesia will account for 70% of global supply in just five years. This represents a major increase from its current level of roughly 55%.

While a supply boom has yet to hit the exchange, it has nonetheless translated to a rise in short positions. For its part, the LME aided the bearish outlook with expedited approvals of new companies for deliveries against its nickel contract. Most recently, that included the November 1 approval of GEM-NI1 nickel cathode produced by China’s Green Eco-Manufacture (Gem), which could add up to 10,000 tons per year of capacity. The move also fits into the LME’s larger strategy to stabilize its still-broken nickel contract and attract the market participants lost following the squeeze..

A falling nickel price will continue to pressure the surcharge for stainless steel. Absent any meaningful turnaround in demand, there remains little incentive for distributors and end users to build inventories further.

Read next: 5 Mistakes Buyers Can Make When Sourcing Stainless Steel

Biggest Nickel and Stainless Steel Price Moves

- Chinese ferrochrome lump prices inverted to the downside, falling 7.66% to $1,893 per metric ton as of November 1.

- Chinese primary nickel prices saw a 9.18% decrease to $19,471 per metric ton.

- The Allegheny Ludlum surcharge for 304/304L coil declined by 9.82% to $1.03 per pound.

- The Allegheny Ludlum surcharge for 316/316L coil dropped 10.3% to $1.62 per pound.

- Chinese ferromolybdenum lump prices saw the largest decline of the overall index, plunging 22.25% to $27,542 per metric ton.